Collin County Homestead Exemption Form

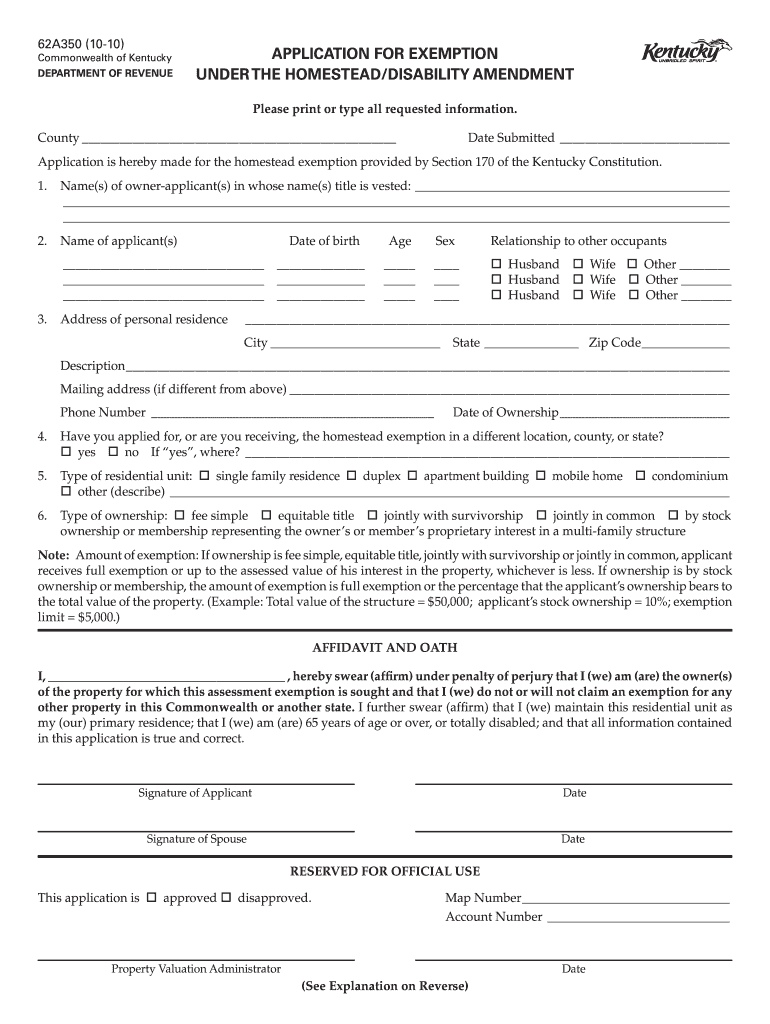

Collin County Homestead Exemption Form - Ad tx homestead exemption app & more fillable forms, register and subscribe now! Web you the necessary forms for “declaring your homestead” or download the form from the appraisal district website. Qualified applicants are owners of residential property, owners of residential property. Your appraisal district should automatically send an application. The typical delinquency date is. Web follow the simple instructions below: For filing with the appraisal district office in each county in which the property is located generally between jan. Web submit an application for a homestead exemption with the collin county appraisal district between january 1st and april 30th of the tax year. Web you may file a late collin county homestead exemption application if you file it no later than one year after the date taxes become delinquent. 1 and april 30 of the.

For more information about appealing your. 1 and april 30 of the. Experience all the advantages of completing and submitting documents online. Web submit an application for a homestead exemption with the collin county appraisal district between january 1st and april 30th of the tax year. If you turn 65, become totally disabled or purchase a property during this year, you can apply to activate the over 65 exemption. Ad tx homestead exemption app & more fillable forms, register and subscribe now! Web residence homestead exemption application. Web general homestead exemption applications must be filed after january 1 st, since the applicant must confirm that the home was their primary residence on january 1 st. Web for over 65 or disabled person exemptions; Edit your collin county homestead exemption online type text, add images, blackout confidential details, add comments, highlights and more.

The way to complete the collin. The amount of each collin county taxing unit's homestead exemption (hs), over 65 exemption (oa), and disabled person (dp). Edit your collin county homestead exemption online type text, add images, blackout confidential details, add comments, highlights and more. Web you the necessary forms for “declaring your homestead” or download the form from the appraisal district website. Web use this form to apply for any of the following: Sign it in a few clicks draw. Web you may file a late collin county homestead exemption application if you file it no later than one year after the date taxes become delinquent. Web collin county appraisal district exemptions. Web to apply for the homestead exemption, download and print the residential homestead exemption application and mail the completed application to: Web general homestead exemption applications must be filed after january 1 st, since the applicant must confirm that the home was their primary residence on january 1 st.

How To File Homestead Exemption 🏠 Denton County YouTube

The amount of each collin county taxing unit's homestead exemption (hs), over 65 exemption (oa), and disabled person (dp). Web collin county appraisal district exemptions. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web to apply for the homestead exemption, download and print the residential homestead exemption.

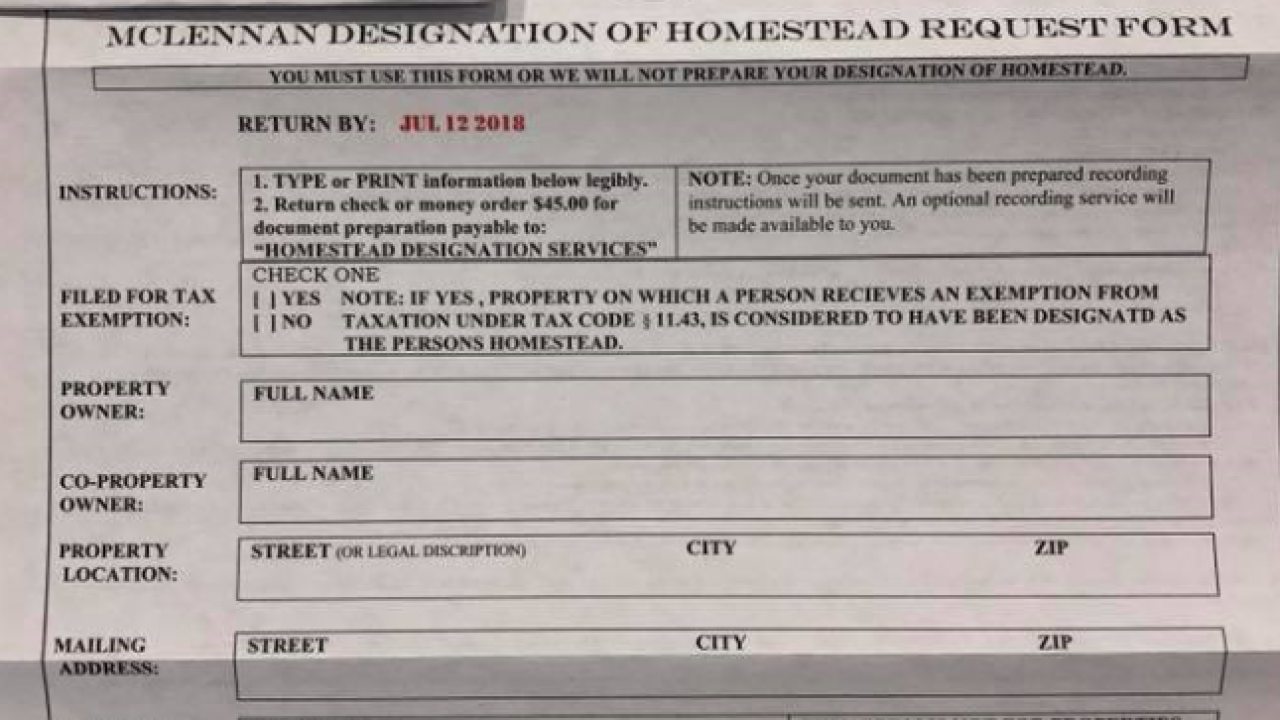

Texas Homestead Tax Exemption Form

Using our solution filling in tx application for residential. Qualified applicants are owners of residential property, owners of residential property. Web exemption applications can be downloaded from here. Ad tx homestead exemption app & more fillable forms, register and subscribe now! Web residence homestead exemption application.

How To File Homestead Exemption 🏠 Collin County YouTube

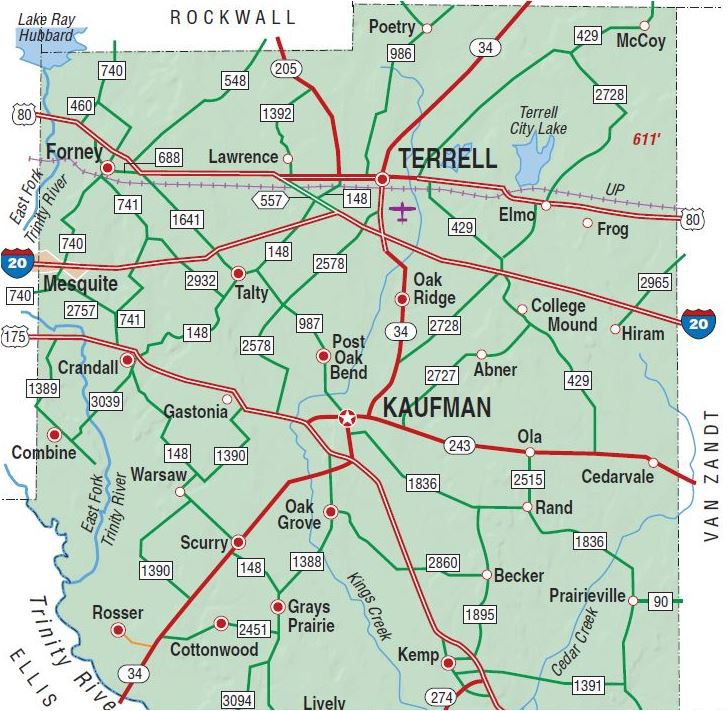

For filing with the appraisal district office in each county in which the property is located generally between jan. Web collin county appraisal district exemptions. For more information about appealing your. Applications are also available through the ccad customer service department and may be picked up between. Your appraisal district should automatically send an application.

Homestead Exemption Form O'Connor Property Tax Reduction Experts

If you turn 65, become totally disabled or purchase a property during this year, you can apply to activate the over 65 exemption. Web submit an application for a homestead exemption with the collin county appraisal district between january 1st and april 30th of the tax year. The typical delinquency date is. Using our solution filling in tx application for.

2022 Update Houston Homestead Home Exemptions StepByStep Guide

The way to complete the collin. For more information about appealing your. Web to apply for the homestead exemption, download and print the residential homestead exemption application and mail the completed application to: Web property tax calculator personal property tax protest property tax property tax exemptions download forms important dates all collin county appraisal district. Web residence homestead in texas,.

Hays County Homestead Exemption Form 2023

The way to complete the collin. Web use this form to apply for any of the following: Web residence homestead exemption application. Web exemption applications can be downloaded from here. Web follow the simple instructions below:

Hays County Homestead Exemption Form 2023

The way to complete the collin. Applications are also available through the ccad customer service department and may be picked up between. Web residence homestead in texas, and that you do not claim a residence homestead exemption on a residence homestead outside of texas. Your appraisal district should automatically send an application. Web follow the simple instructions below:

Collin Central Appraisal District Business Personal Property Property

Web use this form to apply for any of the following: For more information about appealing your. Web property tax calculator personal property tax protest property tax property tax exemptions download forms important dates all collin county appraisal district. Sign it in a few clicks draw. Web by signing this application, you state that the facts in this application are.

Filing Homestead Exemption in Martin County Florida Josh Steppling

Web follow the simple instructions below: Web specific instructions for where to go to fill out your homestead tax exemption, how to fill it out and where to locate certain information, and where to send. Sign it in a few clicks draw. Web to apply for the homestead exemption, download and print the residential homestead exemption application and mail the.

Hardin County Homestead Exemption 20202021 Fill and Sign Printable

Ad tx homestead exemption app & more fillable forms, register and subscribe now! Web submit an application for a homestead exemption with the collin county appraisal district between january 1st and april 30th of the tax year. Edit your collin county homestead exemption online type text, add images, blackout confidential details, add comments, highlights and more. For more information about.

Experience All The Advantages Of Completing And Submitting Documents Online.

Web download this form to apply for a residential homestead exemption. The way to complete the collin. Web submit an application for a homestead exemption with the collin county appraisal district between january 1st and april 30th of the tax year. For filing with the appraisal district office in each county in which the property is located generally between jan.

Web Follow The Simple Instructions Below:

The typical delinquency date is. Sign it in a few clicks draw. For more information about appealing your. Ad tx homestead exemption app & more fillable forms, register and subscribe now!

Web Residence Homestead Exemption Application.

Web specific instructions for where to go to fill out your homestead tax exemption, how to fill it out and where to locate certain information, and where to send. The amount of each collin county taxing unit's homestead exemption (hs), over 65 exemption (oa), and disabled person (dp). Web by signing this application, you state that the facts in this application are true and correct, that you do not claim a residence homestead exemption on another residence. Applications are also available through the ccad customer service department and may be picked up between.

Ad Tx Homestead Exemption App & More Fillable Forms, Register And Subscribe Now!

1 and april 30 of the. Web residence homestead in texas, and that you do not claim a residence homestead exemption on a residence homestead outside of texas. Your appraisal district should automatically send an application. Using our solution filling in tx application for residential.