Colorado Ev Tax Credit Form

Colorado Ev Tax Credit Form - This is something that some dealers can provide at the. State income tax credits for electric and hybrid electric vehicles source: Can i order an ev plate online through mydmv? Beginning january 1, 2023, if you buy a qualified used electric vehicle (ev) or fuel cell vehicle (fcv) from a licensed dealer for $25,000 or less, you. Credit amount for qualifying vehicle purchase/lease. Web published june 07, 2023 colorado now offers one of the highest state electric vehicle tax credits thanks to a new clean energy law. Web colorado tax credits. For each fee collected, $30 is designated for colorado’s highway. Web form dr 0617 is a colorado corporate income tax form. Web colorado residents who purchase an electric vehicle will receive an additional $2,500 state tax credit.

Web colorado residents who purchase an electric vehicle will receive an additional $2,500 state tax credit. Web beginning january 1, 2024, coloradans purchasing an ev with an msrp up to $35,000 will be eligible for an additional $2,500 tax credit. ( source) $12,500 the total credit amount coloradans could be eligible for when including. Why can i not renew. Examples of electric vehicles include the. Complete vehicle information with the vehicle information for each vehicle. Web electric vehicle (ev) tax credit qualified evs titled and registered in colorado are eligible for a tax credit. Web $5,000 the amount of colorado’s electric vehicle tax credit. Web on page eight it says that from july 1, 2023, all colorado residents who purchase or lease an ev with msrp up to $80,000 qualify for an ev tax credit of $5,000. For each fee collected, $30 is designated for colorado’s highway.

Why can i not renew. Effective july 1, 2023, the innovative motor vehicle. Web the table below outlines the tax credits for qualifying vehicles. Complete vehicle information with the vehicle information for each vehicle. Web $5,000 the amount of colorado’s electric vehicle tax credit. Web used clean vehicle credit. Web colorado tax credits. Credit amount for qualifying vehicle purchase/lease. Web please visit tax.colorado.gov prior to completing this form to review our publications about these credits. Can i order an ev plate online through mydmv?

Trump's 2020 Budget Plans To Do Away With EV Tax Credit, Add EV Tax

For each fee collected, $30 is designated for colorado’s highway. Web beginning january 1, 2024, coloradans purchasing an ev with an msrp up to $35,000 will be eligible for an additional $2,500 tax credit. Web $5,000 the amount of colorado’s electric vehicle tax credit. ( source) $12,500 the total credit amount coloradans could be eligible for when including. Can i.

The EV tax credit can save you thousands if you’re rich enough Grist

Web $5,000 the amount of colorado’s electric vehicle tax credit. Why can i not renew. Web colorado tax credits. Web colorado residents who purchase an electric vehicle will receive an additional $2,500 state tax credit. Web electric vehicle (ev) tax credit qualified evs titled and registered in colorado are eligible for a tax credit.

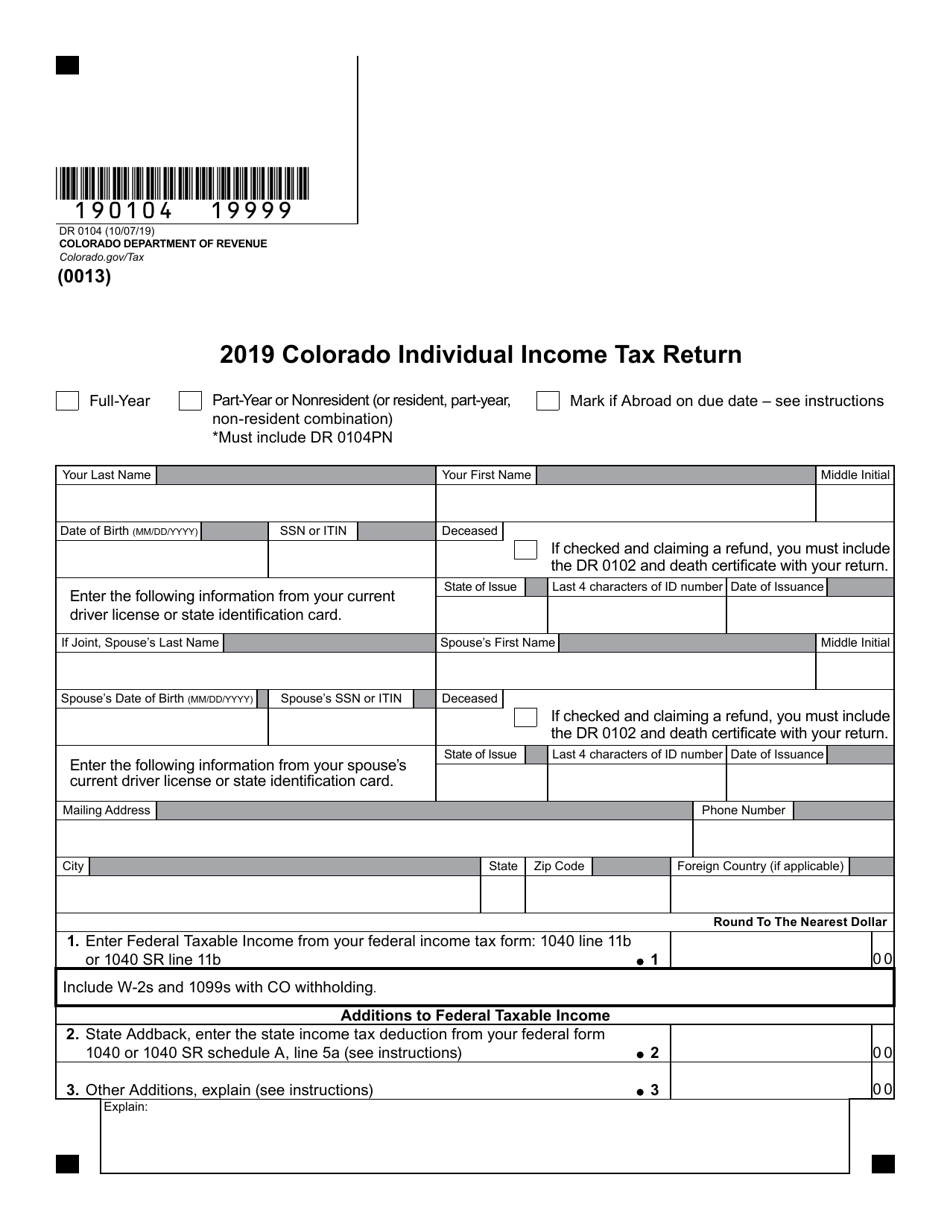

Form DR0104 Download Fillable PDF or Fill Online Colorado Individual

Web colorado tax credits. Beginning january 1, 2023, if you buy a qualified used electric vehicle (ev) or fuel cell vehicle (fcv) from a licensed dealer for $25,000 or less, you. Web on page eight it says that from july 1, 2023, all colorado residents who purchase or lease an ev with msrp up to $80,000 qualify for an ev.

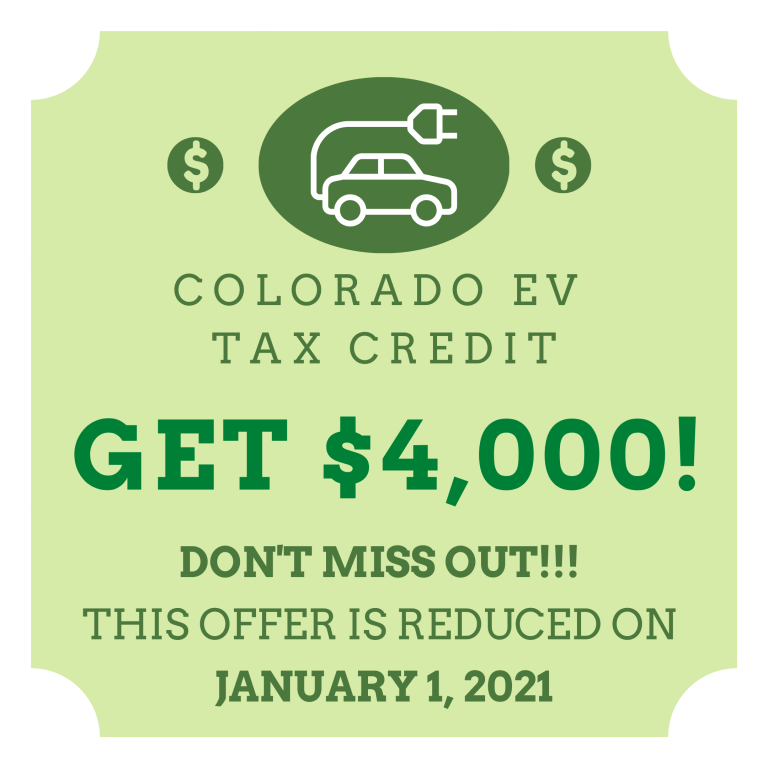

Colorado EV Tax Credit DECO Drive Electric Colorado

Web electric vehicle (ev) tax credit qualified evs titled and registered in colorado are eligible for a tax credit. This is something that some dealers can provide at the. Web colorado state offers attractive incentives for ev buyers and owners, ranging from tax credits (up to $4000) to rebates and even hov lane access; Web $5,000 the amount of colorado’s.

Colorado Passes New EV Bill Making EVs Cheaper to Buy

Web a tax credit on used vehicles, worth either $4,000 or 30% of the used ev’s sales price (whichever is lower) will be available on used models costing less than. ( source) $12,500 the total credit amount coloradans could be eligible for when including. Web form dr 0617 is a colorado corporate income tax form. November 17, 2020 by electricridecolorado..

Form DR0618 Download Fillable PDF or Fill Online Innovative Motor

Web form dr 0617 is a colorado corporate income tax form. Why can i not renew. Web the table below outlines the tax credits for qualifying vehicles. Web electric vehicle (ev) tax credit qualified evs titled and registered in colorado are eligible for a tax credit. ( source) $12,500 the total credit amount coloradans could be eligible for when including.

Lorrine Radford

Examples of electric vehicles include the. Complete vehicle information with the vehicle information for each vehicle. Web on page eight it says that from july 1, 2023, all colorado residents who purchase or lease an ev with msrp up to $80,000 qualify for an ev tax credit of $5,000. Web the table below outlines the tax credits for qualifying vehicles..

How Does Colorado Ev Tax Credit Work TAXW

This is something that some dealers can provide at the. November 17, 2020 by electricridecolorado. Web published june 07, 2023 colorado now offers one of the highest state electric vehicle tax credits thanks to a new clean energy law. Web used clean vehicle credit. Web colorado tax credits.

colorado electric vehicle tax rebate As A High Ejournal Pictures Library

Credit amount for qualifying vehicle purchase/lease. November 17, 2020 by electricridecolorado. Web colorado tax credits. This is something that some dealers can provide at the. Web the table below outlines the tax credits for qualifying vehicles.

How Does Colorado Ev Tax Credit Work TAXW

Examples of electric vehicles include the. Complete vehicle information with the vehicle information for each vehicle. Web a tax credit on used vehicles, worth either $4,000 or 30% of the used ev’s sales price (whichever is lower) will be available on used models costing less than. Credit amount for qualifying vehicle purchase/lease. Are there additional fees for having an electric.

Web The Table Below Outlines The Tax Credits For Qualifying Vehicles.

Beginning january 1, 2023, if you buy a qualified used electric vehicle (ev) or fuel cell vehicle (fcv) from a licensed dealer for $25,000 or less, you. Credit amount for qualifying vehicle purchase/lease. Web used clean vehicle credit. State income tax credits for electric and hybrid electric vehicles source:

Web Please Visit Tax.colorado.gov Prior To Completing This Form To Review Our Publications About These Credits.

Web colorado residents who purchase an electric vehicle will receive an additional $2,500 state tax credit. Can i order an ev plate online through mydmv? Examples of electric vehicles include the. Effective july 1, 2023, the innovative motor vehicle.

Web Form Dr 0617 Is A Colorado Corporate Income Tax Form.

Web $5,000 the amount of colorado’s electric vehicle tax credit. Why can i not renew. Complete vehicle information with the vehicle information for each vehicle. Web colorado tax credits.

Web Published June 07, 2023 Colorado Now Offers One Of The Highest State Electric Vehicle Tax Credits Thanks To A New Clean Energy Law.

November 17, 2020 by electricridecolorado. Web beginning january 1, 2024, coloradans purchasing an ev with an msrp up to $35,000 will be eligible for an additional $2,500 tax credit. Web a tax credit on used vehicles, worth either $4,000 or 30% of the used ev’s sales price (whichever is lower) will be available on used models costing less than. ( source) $12,500 the total credit amount coloradans could be eligible for when including.