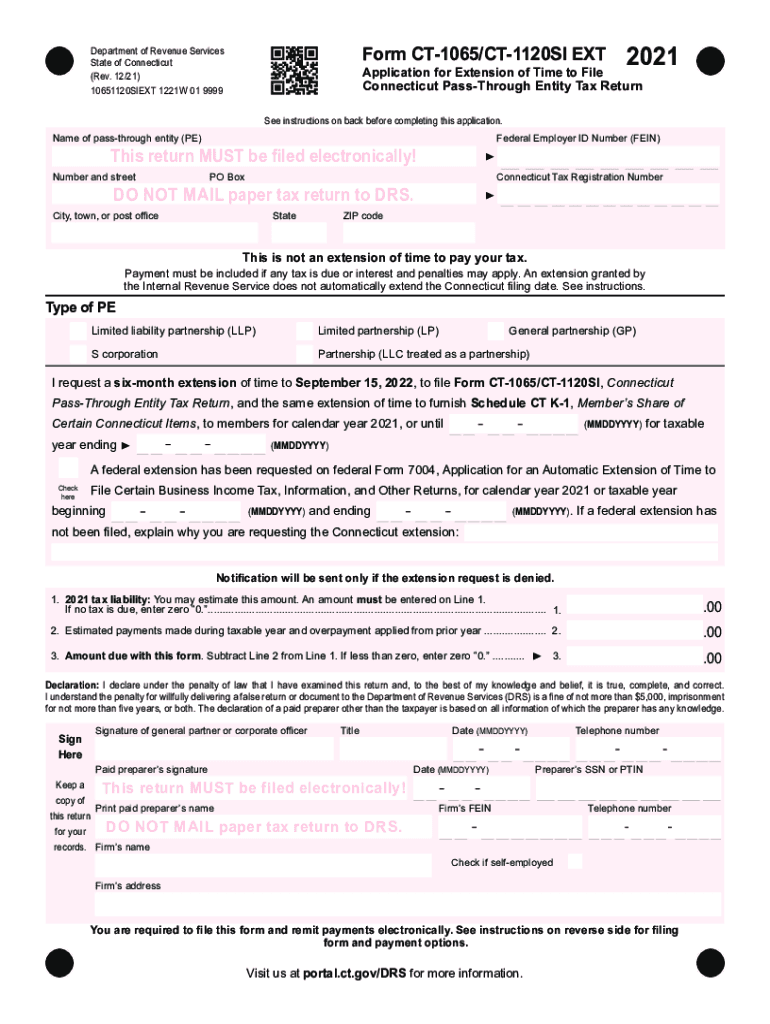

Ct Form 1065 Instructions 2021

Ct Form 1065 Instructions 2021 - For instructions and the latest information. Web beginning with the 2018 tax year, passthrough entities in the state of connecticut are now liable for an income tax in the state of connecticut levied directly on. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. 01/21) complete this form in blue or black ink only. Yes/ done no/ n/a 901) determine if health plan(s) and/or reimbursement arrangements are compliant with the affordable care act (aca). Web form 1065 long checklist. For a fiscal year or a short tax year, fill in the tax year. Web this booklet instructions contains: Department of the treasury internal revenue service.

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Under the families first coronavirus response act (ffcra), as. • delivers assistance to our citizens. Web beginning with the 2018 tax year, passthrough entities in the state of connecticut are now liable for an income tax in the state of connecticut levied directly on. Web form 1065 long checklist. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. 01/21) complete this form in blue or black ink only. For instructions and the latest information. 02/20) 10651120si 1219w 01 9999 2019. Department of the treasury internal revenue service.

Web form 1065 long checklist. 2022 member's share of certain connecticut items:. Department of the treasury internal revenue service. After logging into the tsc, select the make payment only option and choose a tax type from the drop down box. Web instructions this booklet contains information and instructions about the following forms: For instructions and the latest information. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. • delivers assistance to our citizens. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web beginning with the 2018 tax year, passthrough entities in the state of connecticut are now liable for an income tax in the state of connecticut levied directly on.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

01/21) complete this form in blue or black ink only. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Department of the treasury internal revenue service. For instructions and the latest information. 2022 member's share of certain connecticut items:.

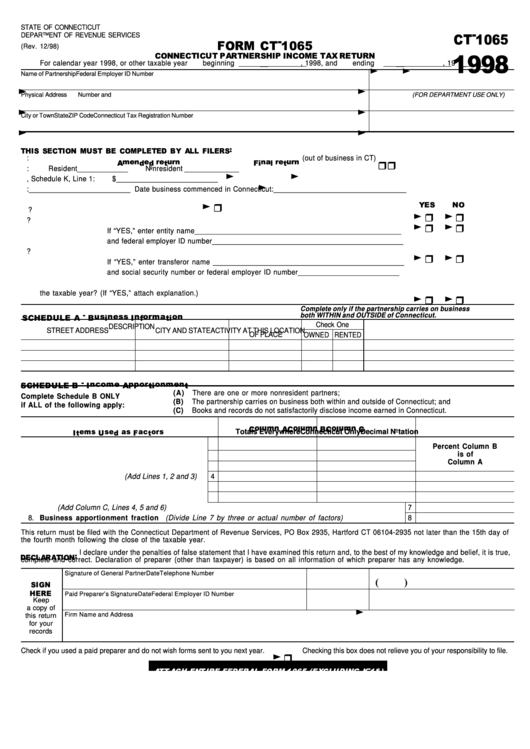

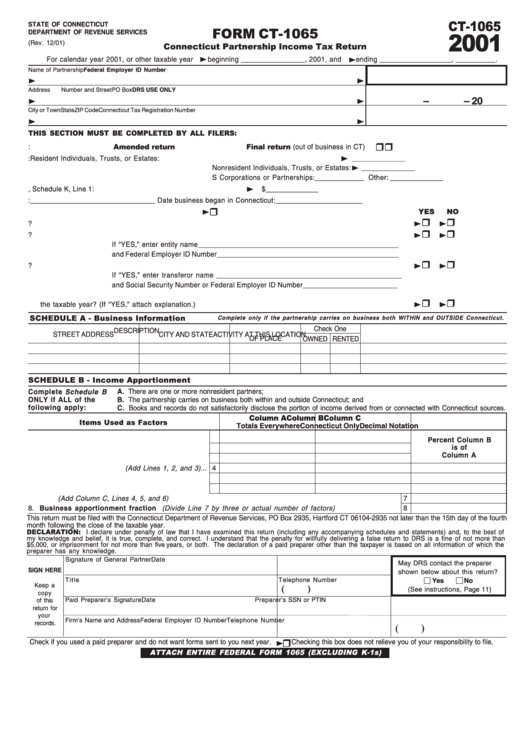

Fillable Form Ct1065 Connecticut Partnership Tax Return

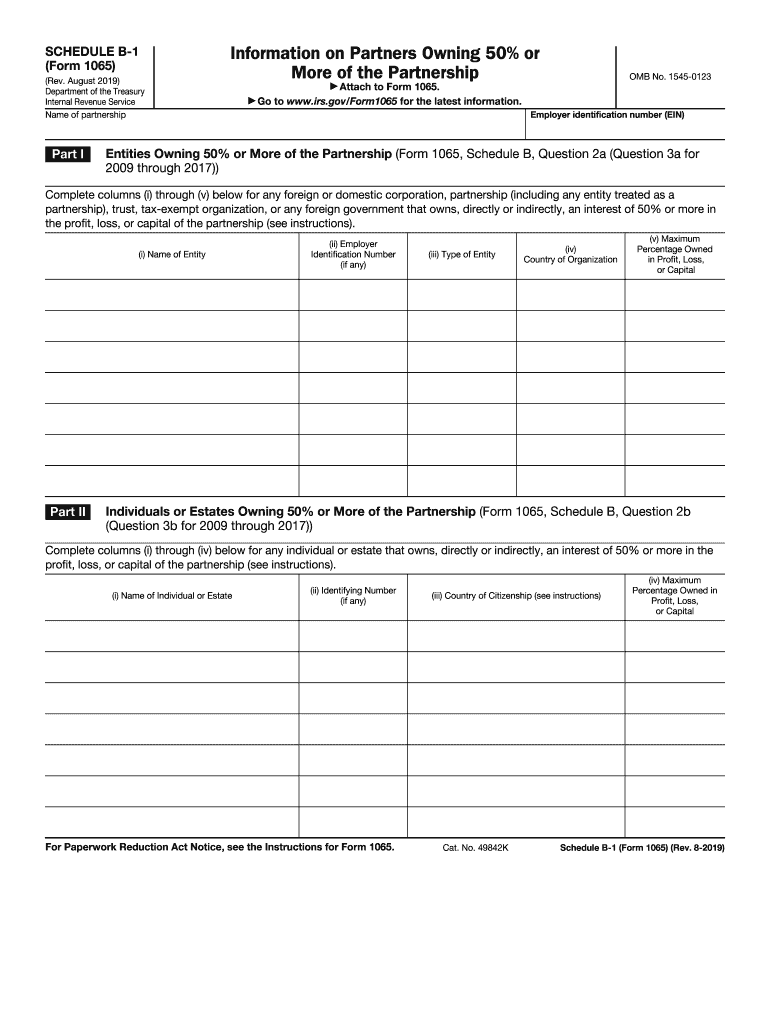

Department of the treasury internal revenue service. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web partnership c’s form 1065, it must answer “yes” to question 2a (question 3a for 2009 through 2017) of schedule b. Yes/ done no/ n/a 901) determine if health.

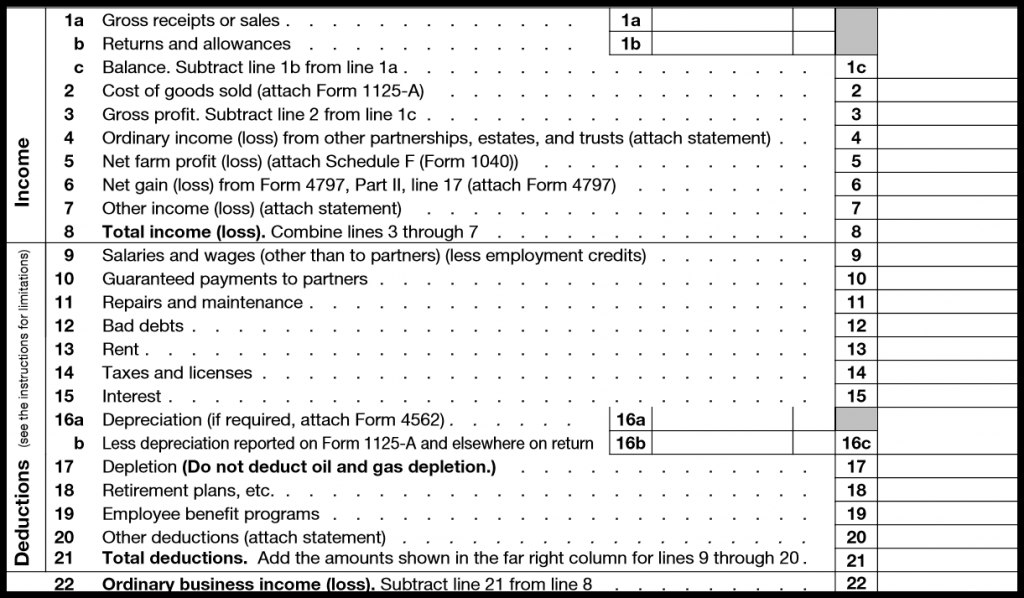

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Web form 1065 long checklist. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Yes/ done no/ n/a 901) determine if health plan(s) and/or reimbursement arrangements are compliant with the affordable care act (aca). For instructions and the latest information. Web instructions this booklet contains information and instructions about.

2017 Federal Tax Forms Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal revenue service. Web partnership c’s form 1065, it must answer “yes” to question 2a (question 3a for 2009 through 2017) of schedule b. • delivers assistance to our citizens. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web form 1065 long checklist.

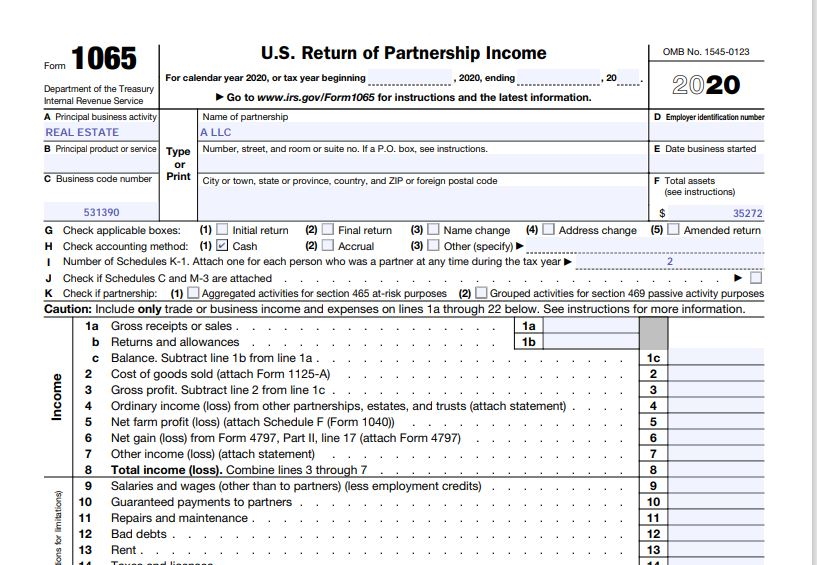

How to Complete 2020 Form 1065 Nina's Soap

Yes/ done no/ n/a 901) determine if health plan(s) and/or reimbursement arrangements are compliant with the affordable care act (aca). Web beginning with the 2018 tax year, passthrough entities in the state of connecticut are now liable for an income tax in the state of connecticut levied directly on. For instructions and the latest information. 2022 member's share of certain.

Irs Form 1065 K 1 Instructions Universal Network

Under the families first coronavirus response act (ffcra), as. Web to make a direct tax payment. Web beginning with the 2018 tax year, passthrough entities in the state of connecticut are now liable for an income tax in the state of connecticut levied directly on. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for.

Ct 1065 Instructions 2021 Fill Out and Sign Printable PDF Template

Department of the treasury internal revenue service. 2022 member's share of certain connecticut items:. Web form 1065 long checklist. Web partnership c’s form 1065, it must answer “yes” to question 2a (question 3a for 2009 through 2017) of schedule b. For a fiscal year or a short tax year, fill in the tax year.

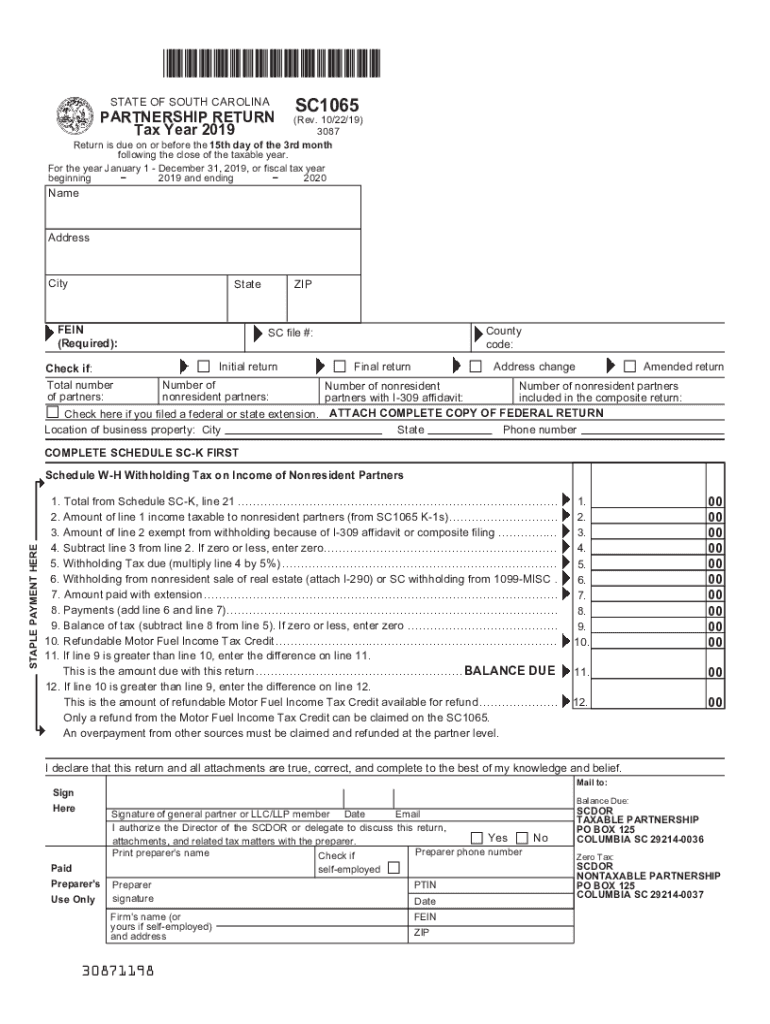

20192021 Form SC DoR SC1065 Fill Online, Printable, Fillable, Blank

Web instructions this booklet contains information and instructions about the following forms: Web partnership c’s form 1065, it must answer “yes” to question 2a (question 3a for 2009 through 2017) of schedule b. Department of the treasury internal revenue service. After logging into the tsc, select the make payment only option and choose a tax type from the drop down.

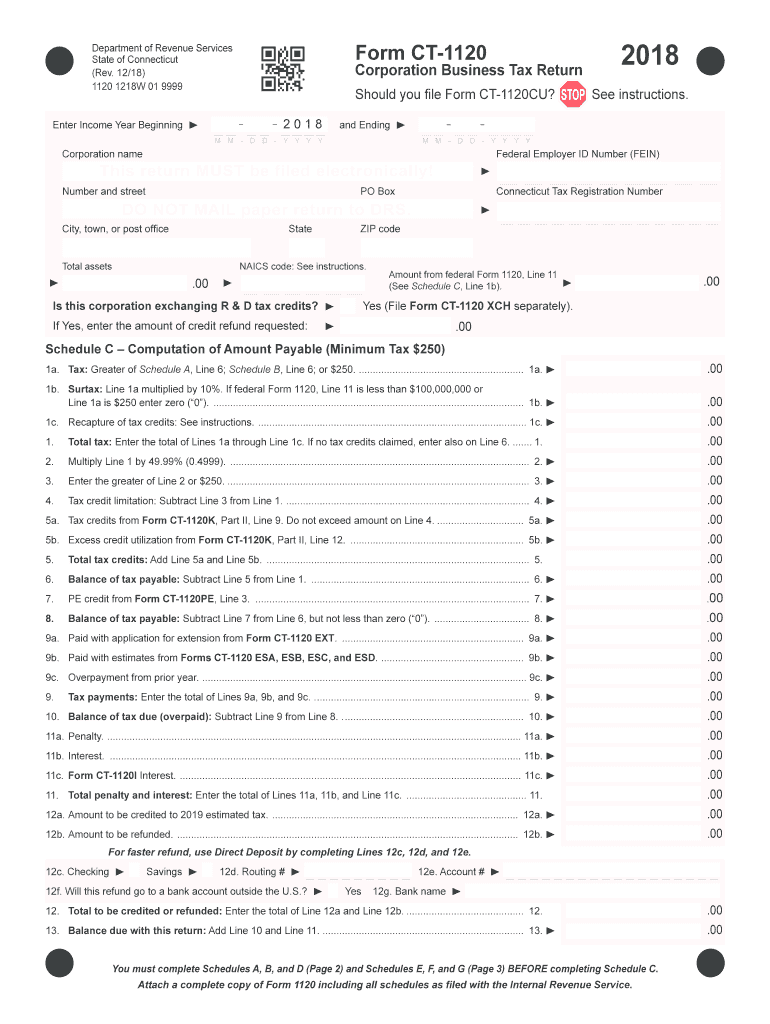

CT DRS CT1120 2018 Fill out Tax Template Online US Legal Forms

Web instructions this booklet contains information and instructions about the following forms: • delivers assistance to our citizens. For a fiscal year or a short tax year, fill in the tax year. Yes/ done no/ n/a 901) determine if health plan(s) and/or reimbursement arrangements are compliant with the affordable care act (aca). Web this booklet instructions contains:

Department Of The Treasury Internal Revenue Service.

Web instructions this booklet contains information and instructions about the following forms: Web form 1065 long checklist. Web this booklet instructions contains: 2022 member's share of certain connecticut items:.

02/20) 10651120Si 1219W 01 9999 2019.

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web partnership c’s form 1065, it must answer “yes” to question 2a (question 3a for 2009 through 2017) of schedule b. Under the families first coronavirus response act (ffcra), as.

Web To Make A Direct Tax Payment.

For a fiscal year or a short tax year, fill in the tax year. For instructions and the latest information. Web beginning with the 2018 tax year, passthrough entities in the state of connecticut are now liable for an income tax in the state of connecticut levied directly on. After logging into the tsc, select the make payment only option and choose a tax type from the drop down box.

Yes/ Done No/ N/A 901) Determine If Health Plan(S) And/Or Reimbursement Arrangements Are Compliant With The Affordable Care Act (Aca).

• delivers assistance to our citizens. 01/21) complete this form in blue or black ink only.