De-4P Form

De-4P Form - Do dependent(s) or other qualifying individuals. Use get form or simply click on the template preview to open it in the editor. Complete the requested fields that. Select the document you want to sign and click upload. The de 4p allows you to: Type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back the de 4p allows you to: The de 4p allows you to: The de 4p allows you to: Web lacera must withhold california state taxes from your monthly retirement allowance at no less than the applicable default rate if you are a california resident and do not submit a.

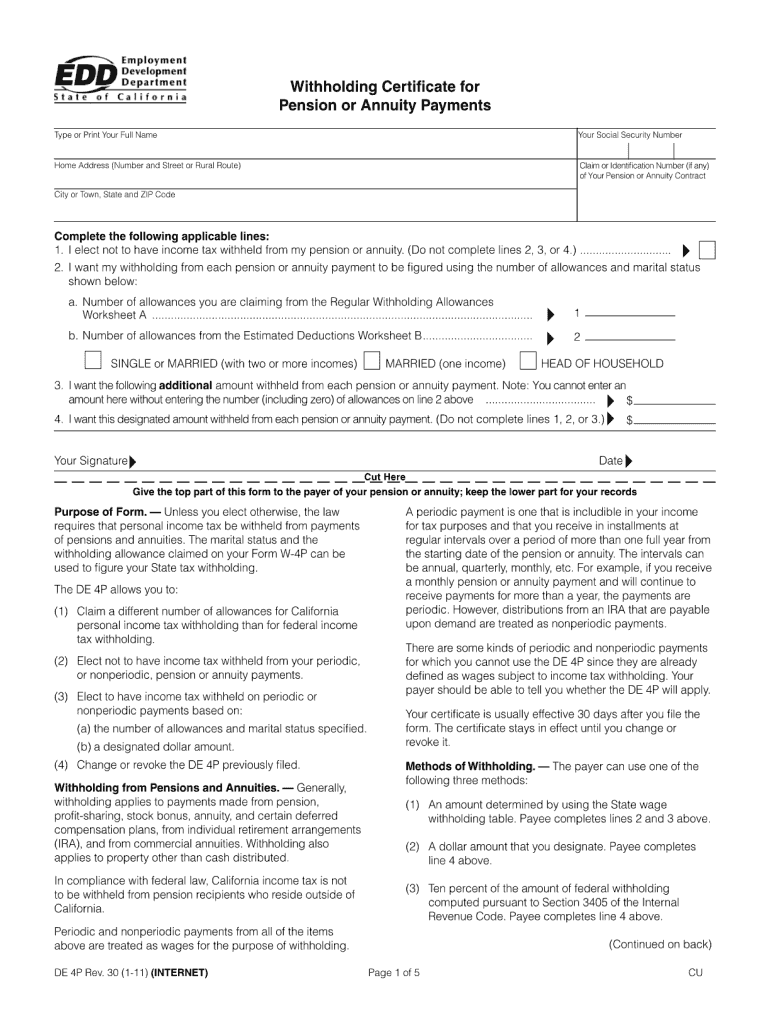

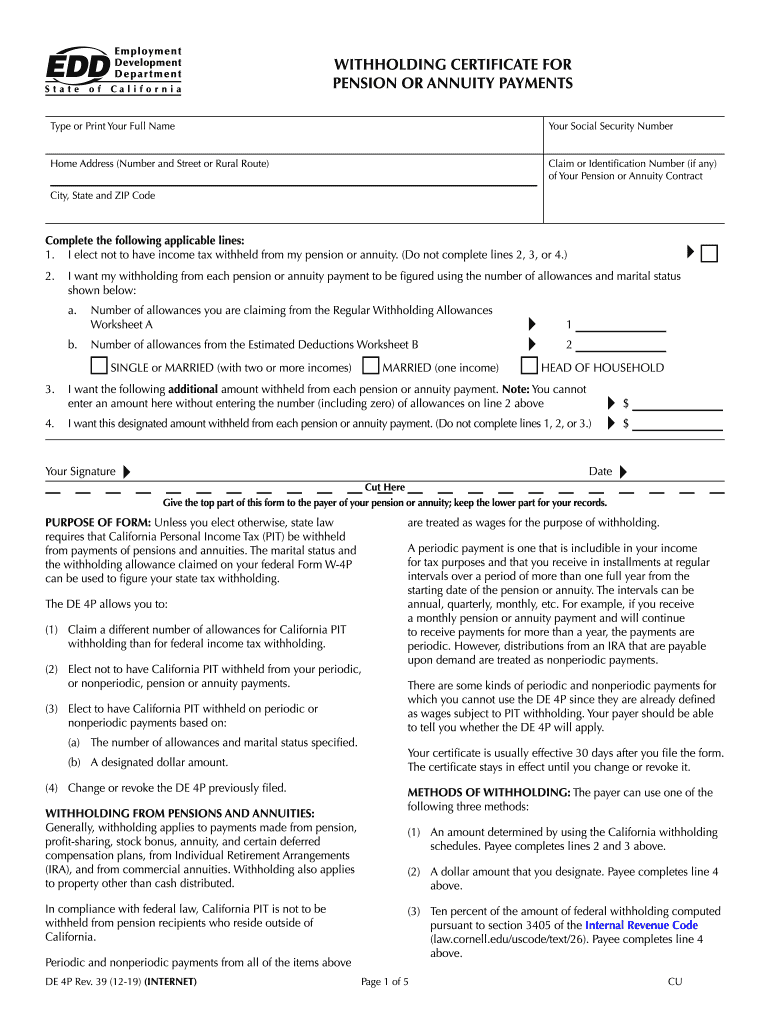

Rate free de 4p form 4.2 The de 4p allows you to: Web up to $40 cash back the de 4p allows you to: Unless you elect otherwise, state law requires that california personal income tax (pit) be withheld from payments of pensions and annuities. Edit your de 4p form online. Complete the requested fields that. The de 4 is used to compute the amount of taxes to be withheld from. Web if the payee has not fled a withholding form (de 4p or form w‐4p), pit withhold ing is required. The payer may calculate pit using one of the following methods: Sign it in a few clicks.

Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web if the payee has not fled a withholding form (de 4p or form w‐4p), pit withhold ing is required. Web up to $40 cash back the de 4p allows you to: Web lacera must withhold california state taxes from your monthly retirement allowance at no less than the applicable default rate if you are a california resident and do not submit a. The de 4p allows you to: Web using only one de 4 form. The de 4p allows you to: The de 4 is used to compute the amount of taxes to be withheld from. (1) claim a different number of. Type text, add images, blackout confidential details, add comments, highlights and more.

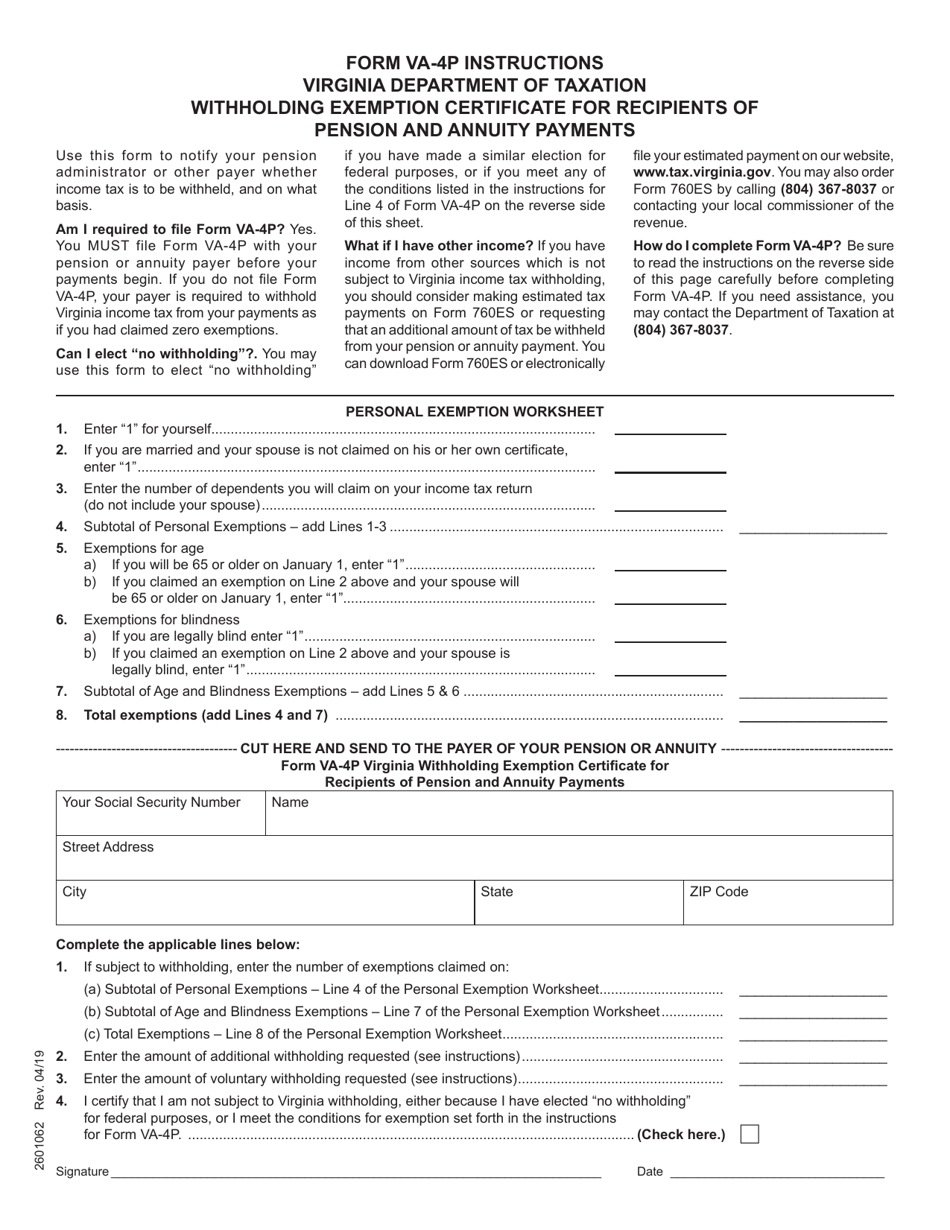

Form VA4P Download Fillable PDF or Fill Online Withholding Exemption

Web lacera must withhold california state taxes from your monthly retirement allowance at no less than the applicable default rate if you are a california resident and do not submit a. Use get form or simply click on the template preview to open it in the editor. Sign it in a few clicks. Unless you elect otherwise, state law requires.

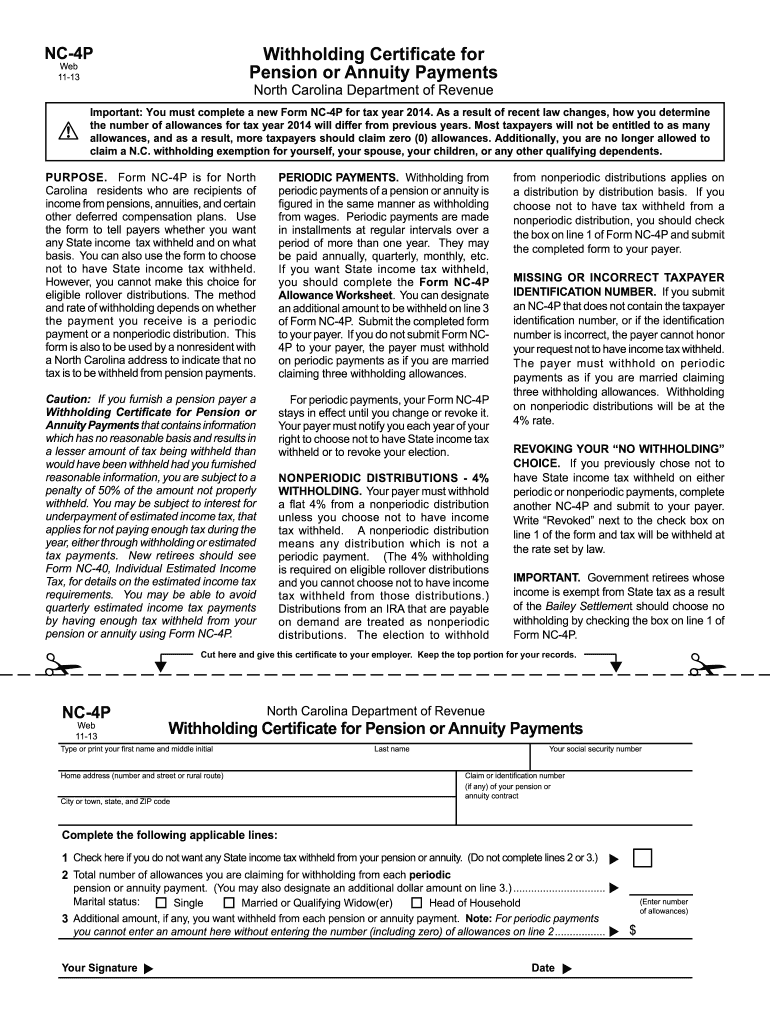

Nc 4P Fill Out and Sign Printable PDF Template signNow

Unless you elect otherwise, state law requires that california personal income tax (pit) be withheld from payments of pensions and annuities. Department of the treasury omb no. Web the following tips will help you fill out ca edd de 4p easily and quickly: Web using only one de 4 form. Web lacera must withhold california state taxes from your monthly.

2011 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank pdfFiller

Complete the requested fields that. Draw your signature, type it,. Web up to $40 cash back the de 4p allows you to: Type text, add images, blackout confidential details, add comments, highlights and more. The de 4p allows you to:

Fill Free fillable W4P Form 2017 Form W4P PDF form

The de 4 is used to compute the amount of taxes to be withheld from. Web using only one de 4 form. Complete the requested fields that. The de 4p allows you to: Web the following tips will help you fill out ca edd de 4p easily and quickly:

20192022 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank

Type text, add images, blackout confidential details, add comments, highlights and more. The de 4 is used to compute the amount of taxes to be withheld from. Complete the requested fields that. Web up to $40 cash back the de 4p allows you to: The payer may calculate pit using one of the following methods:

4Ps and 7Ps of Marketing Mix of Target Market)

Web up to $40 cash back the de 4p allows you to: The payer may calculate pit using one of the following methods: Edit your de 4p form online. The de 4p allows you to: Sign it in a few clicks.

California DE4 App

(1) claim a different number of allowances for california pit withholding than for federal income tax withholding. Start completing the fillable fields and. Draw your signature, type it,. Get everything done in minutes. The de 4 is used to compute the amount of taxes to be withheld from.

Form W4P Edit, Fill, Sign Online Handypdf

Draw your signature, type it,. The de 4p allows you to: (1) claim a different number of allowances for california pit withholding than for federal income tax withholding. Unless you elect otherwise, the law requires that california personal income tax (pit) be withheld from payments of pensions and annuities. Do dependent(s) or other qualifying individuals.

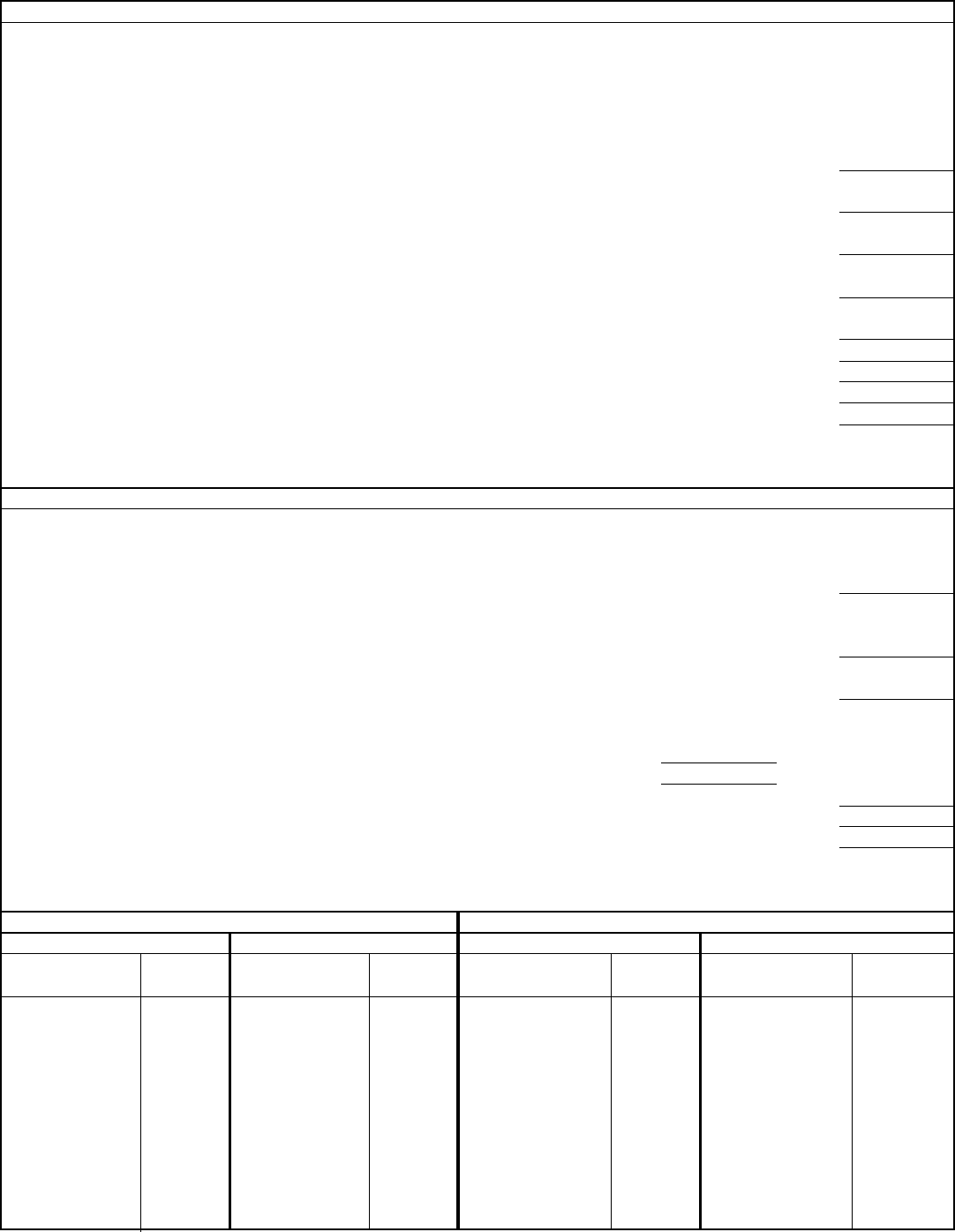

Form DA4P Download Fillable PDF or Fill Online Physician's Statement

Department of the treasury omb no. Claim allowances with one employer. The payer may calculate pit using one of the following methods: The de 4p allows you to: Get everything done in minutes.

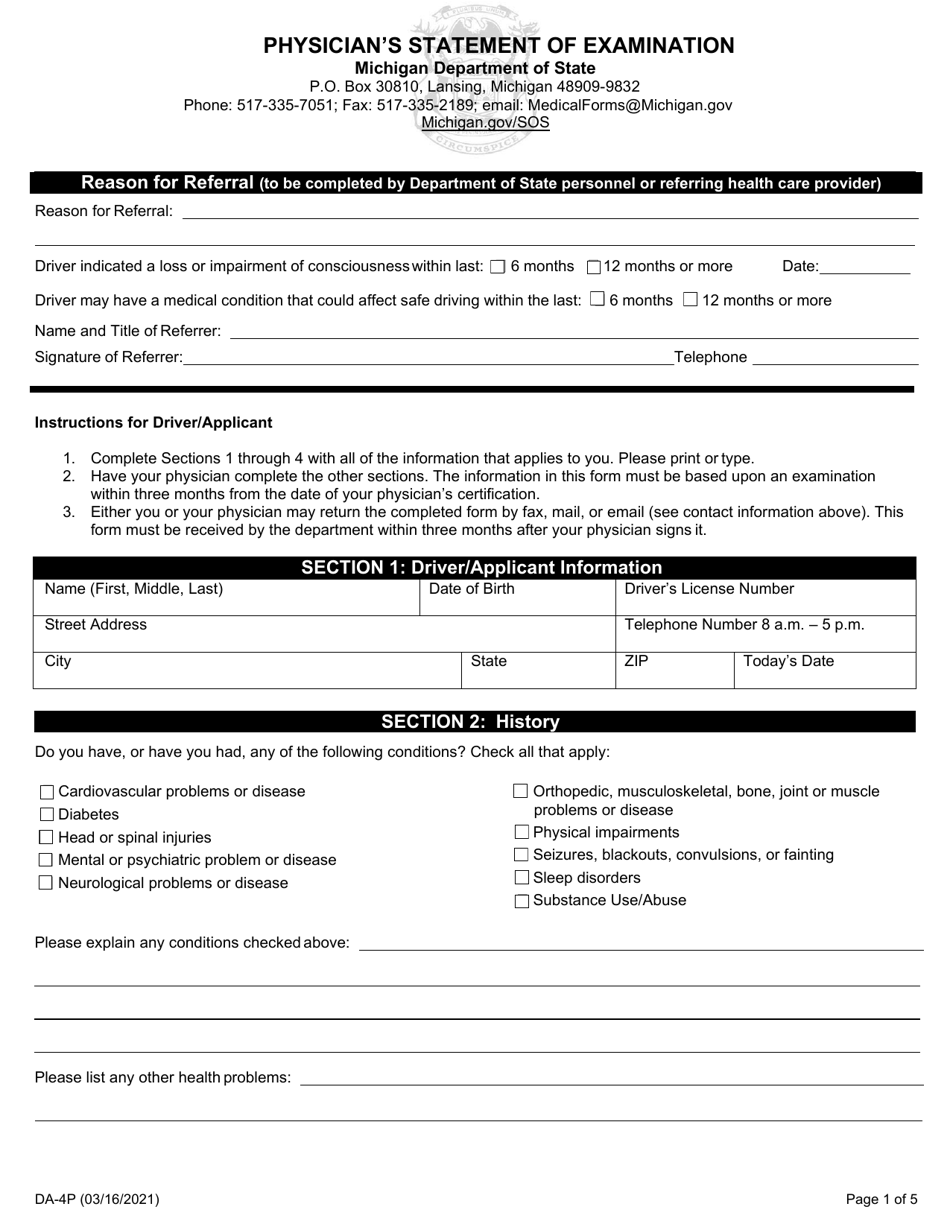

Fillable Form Mi W4p Withholding Certificate For Michigan Pension Or

Claim allowances with one employer. Type text, add images, blackout confidential details, add comments, highlights and more. Rate free de 4p form 4.2 Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Unless you elect otherwise, the law requires.

Unless You Elect Otherwise, State Law Requires That California Personal Income Tax (Pit) Be Withheld From Payments Of Pensions And Annuities.

Get everything done in minutes. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Unless you elect otherwise, the law requires that california personal income tax (pit) be withheld from payments of pensions and annuities. Web using only one de 4 form.

The De 4 Is Used To Compute The Amount Of Taxes To Be Withheld From.

Department of the treasury omb no. (1) claim a different number of. Web if the payee has not fled a withholding form (de 4p or form w‐4p), pit withhold ing is required. Complete the requested fields that.

Web Up To 10% Cash Back The California Form De 4, Employee's Withholding Allowance Certificate, Must Be Completed So That You Know How Much State Income Tax To Withhold From.

The de 4p allows you to: Do dependent(s) or other qualifying individuals. Web up to $40 cash back the de 4p allows you to: Rate free de 4p form 4.2

Draw Your Signature, Type It,.

Start completing the fillable fields and. Sign it in a few clicks. The de 4p allows you to: The de 4p allows you to: