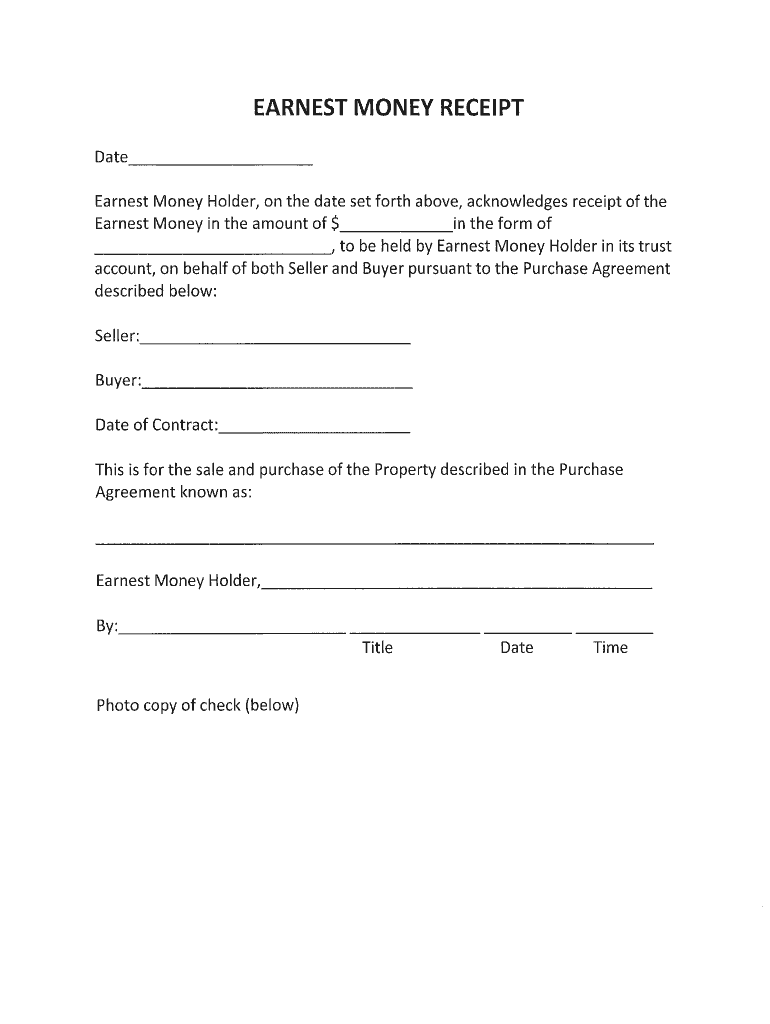

Earnest Money Deposit Form

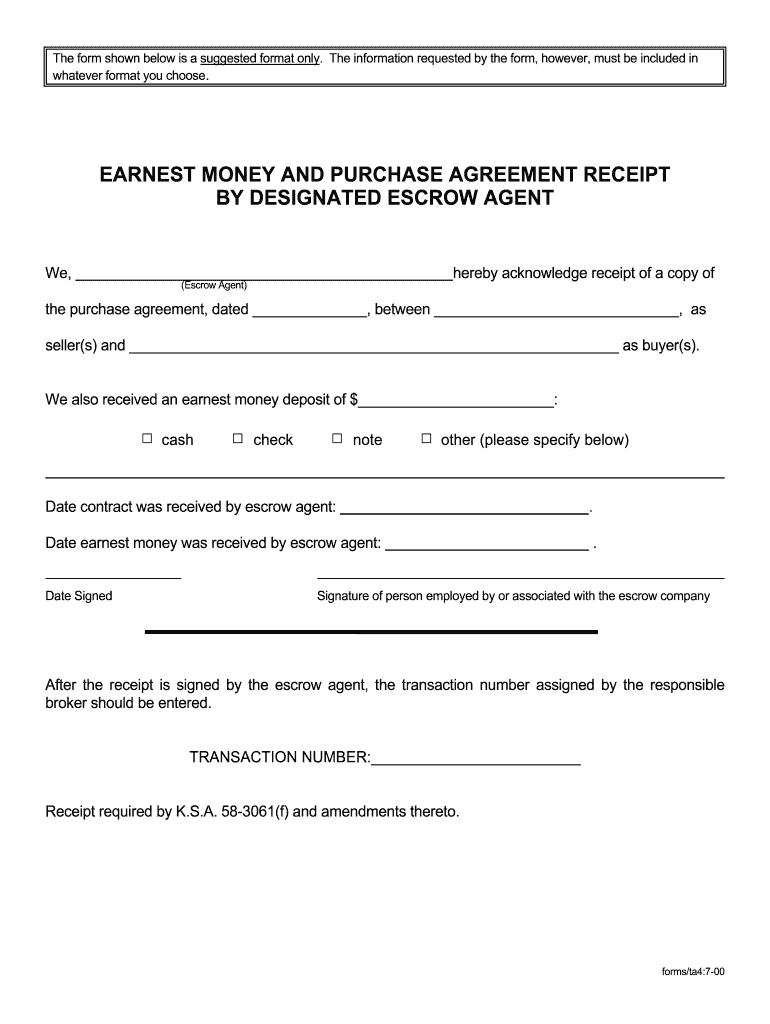

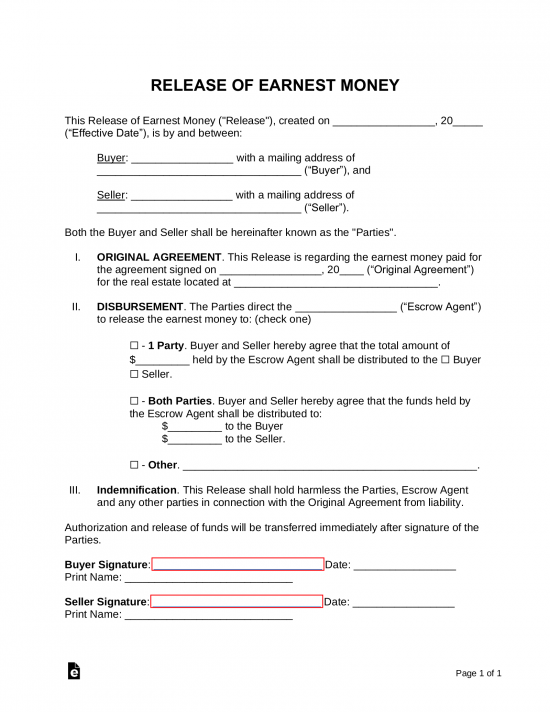

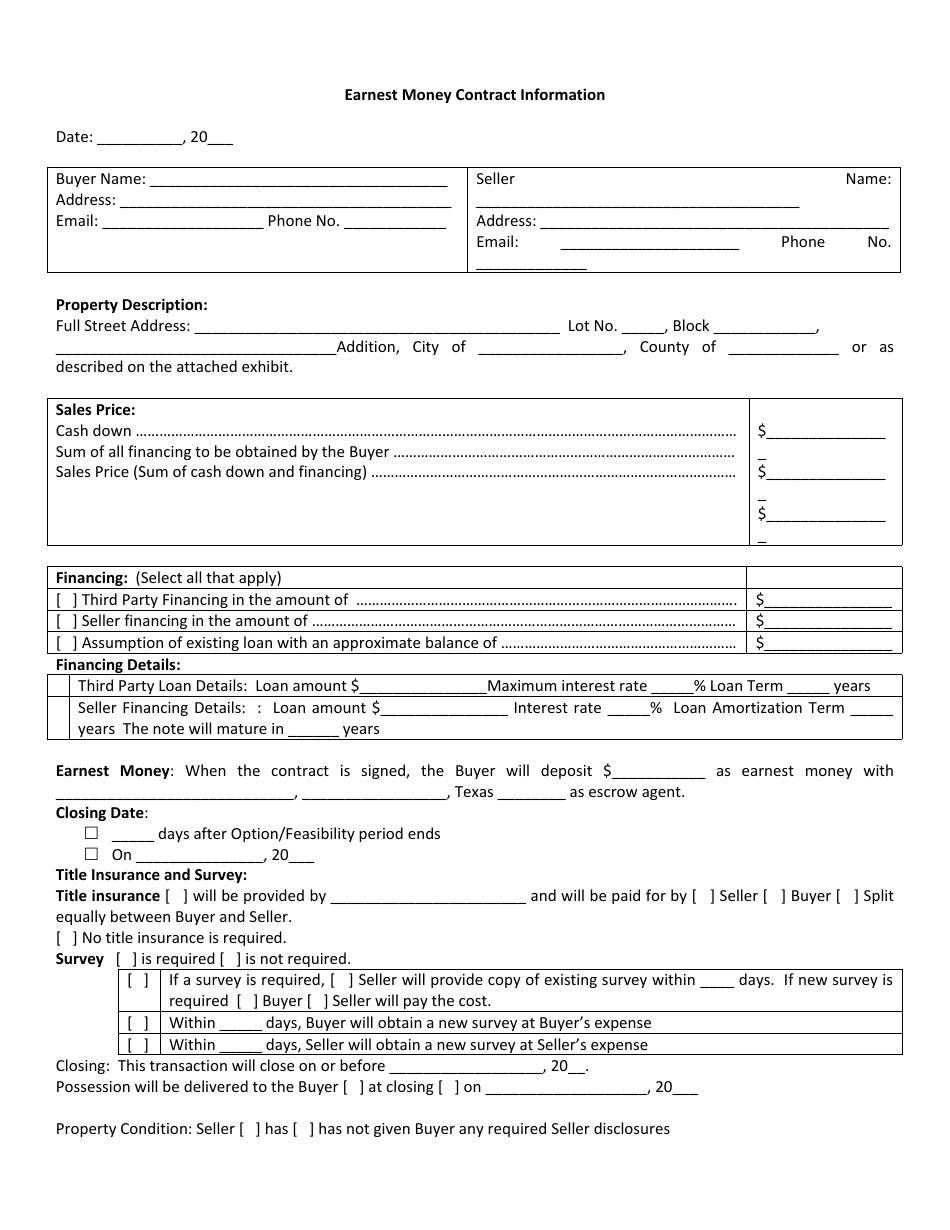

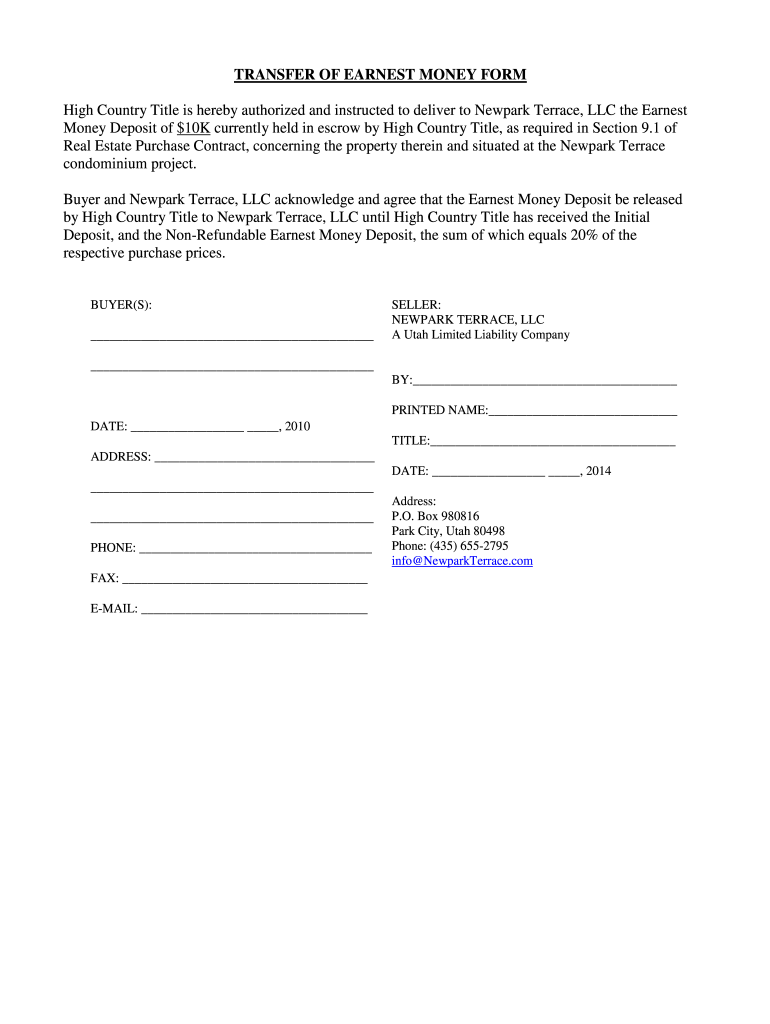

Earnest Money Deposit Form - Web go to the expenses tab, then enter the accounts on the original bill. Earnest money will be returned if buyer’s mortgage falls through. The deposit slip is given to the buyer after funds have been received. For example, a $300,000 home will require an earnest money deposit between $3,000 to $9,000. For example, if the buyer entered into an agreement to purchase property contingent on an inspection being conducted, and the roof is found to leak, the. Earnest money will be returned if undisclosed problems on property are discovered through inspection. An earnest money deposit receipt is given to a buyer of real estate after entering into a purchase agreement with a seller. Check the deposit that matches the vendor check amount. The earnest money should be made payable to a reputable third party such as an established real estate brokerage, legal firm, escrow company, or title. A release of earnest money form is a waiver signed by both the buyer and seller before an earnest money deposit towards a property may be released.

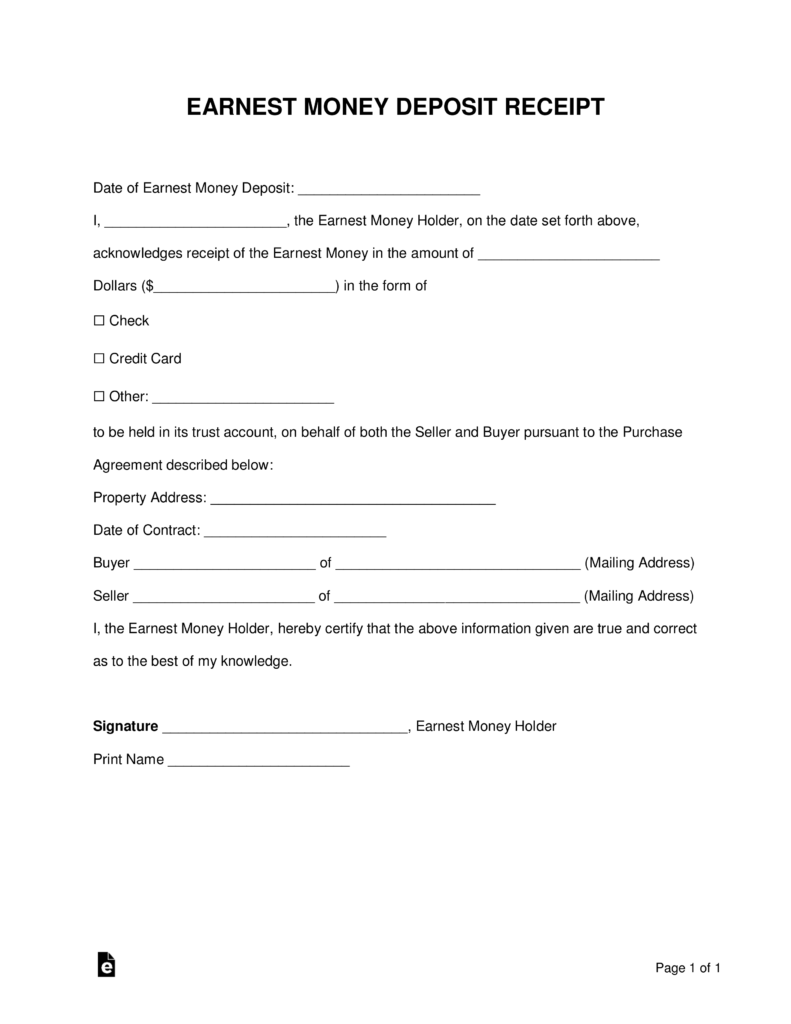

Web earnest money deposits are usually 1% to 3% of a home’s purchase price. Your real estate agent may recommend a different percentage depending on local practices and current market conditions. Web the following contingencies shall apply to the earnest money deposit: Web the earnest money shall only be deposited after landlord and tenant buyer and seller have signed this agreement. For example, if the buyer entered into an agreement to purchase property contingent on an inspection being conducted, and the roof is found to leak, the. (check any applicable contingencies) earnest money will be returned in the event of an unaccepted offer. Web updated october 31, 2022 an earnest money deposit receipt is supplied to a buyer who has expressed interest in a piece of property by providing a monetary deposit in a show of good faith. A release of earnest money form is a waiver signed by both the buyer and seller before an earnest money deposit towards a property may be released. For example, a $300,000 home will require an earnest money deposit between $3,000 to $9,000. This earnest money will become part of the purchase price of the property and will be applied to any applicable down payments and.

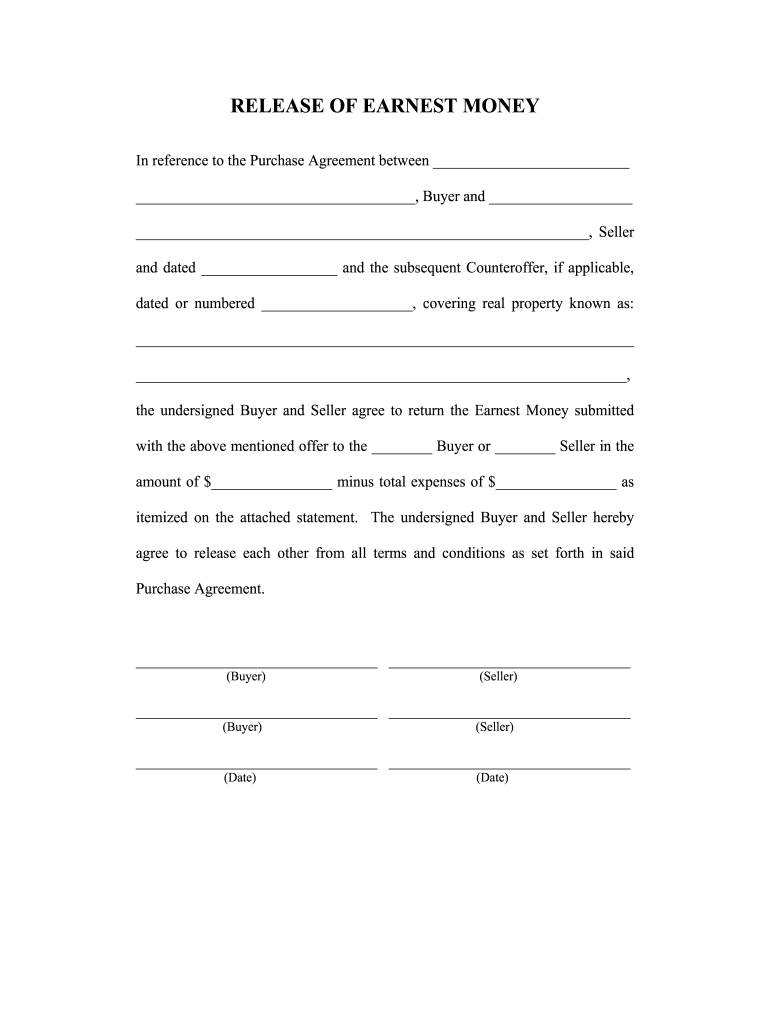

Web go to the expenses tab, then enter the accounts on the original bill. A release of earnest money form is a waiver signed by both the buyer and seller before an earnest money deposit towards a property may be released. Web key takeaways earnest money is a good faith deposit, which the buyer pays to the seller as a security against the property they want to buy. This earnest money will become part of the purchase price of the property and will be applied to any applicable down payments and. Web updated october 31, 2022 an earnest money deposit receipt is supplied to a buyer who has expressed interest in a piece of property by providing a monetary deposit in a show of good faith. Web updated october 31, 2022. Web the earnest money shall only be deposited after landlord and tenant buyer and seller have signed this agreement. Lastly, link the deposit to the bill credit: Acceptable payment methods include personal check, certified check and wire transfer. Web paying earnest money deposit.

Earnest Money Deposit Form Five Things You Won’t Miss Out If You Attend

Web go to the expenses tab, then enter the accounts on the original bill. For example, if the buyer entered into an agreement to purchase property contingent on an inspection being conducted, and the roof is found to leak, the. Web the earnest money shall only be deposited after landlord and tenant buyer and seller have signed this agreement. Earnest.

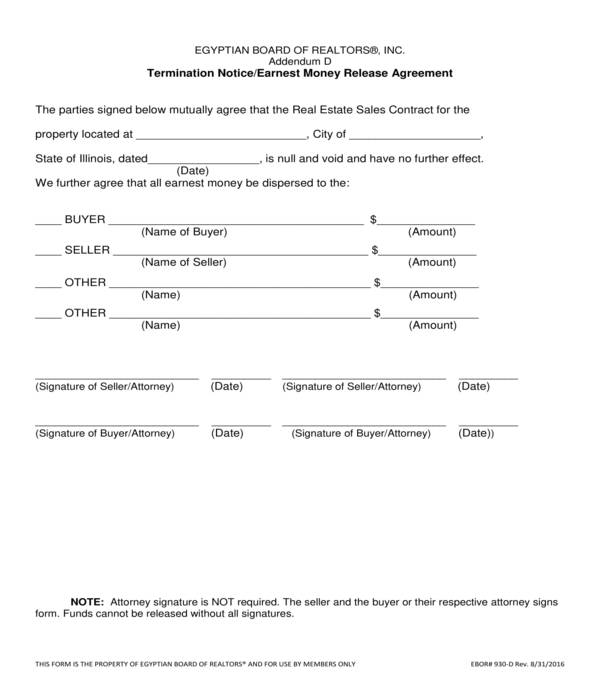

Release Of Earnest Money Deposit Form

(check any applicable contingencies) earnest money will be returned in the event of an unaccepted offer. Check the deposit that matches the vendor check amount. It assures the seller that the buyer is serious about the purchase. An earnest money deposit receipt is given to a buyer of real estate after entering into a purchase agreement with a seller. Web.

Free Release of Earnest Money Form PDF Word eForms

Your real estate agent may recommend a different percentage depending on local practices and current market conditions. Web key takeaways earnest money is a good faith deposit, which the buyer pays to the seller as a security against the property they want to buy. Lastly, link the deposit to the bill credit: The deposit slip is given to the buyer.

Earnest Money Contract Template Qualads

Web the following contingencies shall apply to the earnest money deposit: A release of earnest money form is a waiver signed by both the buyer and seller before an earnest money deposit towards a property may be released. From the vendors menu, select pay bills. In the amount column, enter the appropriate amount for each account. Your real estate agent.

Texas Earnest Money Contract Information Form Download Printable PDF

Earnest money will be returned if undisclosed problems on property are discovered through inspection. Web the following contingencies shall apply to the earnest money deposit: Web go to the expenses tab, then enter the accounts on the original bill. Check the deposit that matches the vendor check amount. Web updated october 31, 2022.

Release Of Earnest Money Deposit Form

Earnest money will be returned if undisclosed problems on property are discovered through inspection. Acceptable payment methods include personal check, certified check and wire transfer. Earnest money will be returned if buyer’s mortgage falls through. Web the following contingencies shall apply to the earnest money deposit: This earnest money will become part of the purchase price of the property and.

Free Earnest Money Deposit Receipt (for Real Estate) PDF Word eForms

From the vendors menu, select pay bills. Your real estate agent may recommend a different percentage depending on local practices and current market conditions. For example, a $300,000 home will require an earnest money deposit between $3,000 to $9,000. This earnest money will become part of the purchase price of the property and will be applied to any applicable down.

FREE 7+ Release of Earnest Money Forms in PDF

The earnest money should be made payable to a reputable third party such as an established real estate brokerage, legal firm, escrow company, or title. Check the deposit that matches the vendor check amount. In the amount column, enter the appropriate amount for each account. This earnest money will become part of the purchase price of the property and will.

Earnest Money Agreement Form Fill Out and Sign Printable PDF Template

Lastly, link the deposit to the bill credit: Earnest money will be returned if undisclosed problems on property are discovered through inspection. Your real estate agent may recommend a different percentage depending on local practices and current market conditions. For example, if the buyer entered into an agreement to purchase property contingent on an inspection being conducted, and the roof.

Fillable Online Contract Release and Earnest Money Disposition Request

An earnest money deposit receipt is given to a buyer of real estate after entering into a purchase agreement with a seller. Web the earnest money shall only be deposited after landlord and tenant buyer and seller have signed this agreement. This earnest money will become part of the purchase price of the property and will be applied to any.

Earnest Money Will Be Returned If Undisclosed Problems On Property Are Discovered Through Inspection.

Your real estate agent may recommend a different percentage depending on local practices and current market conditions. In the amount column, enter the appropriate amount for each account. An earnest money deposit receipt is given to a buyer of real estate after entering into a purchase agreement with a seller. Web go to the expenses tab, then enter the accounts on the original bill.

Web Updated October 31, 2022 An Earnest Money Deposit Receipt Is Supplied To A Buyer Who Has Expressed Interest In A Piece Of Property By Providing A Monetary Deposit In A Show Of Good Faith.

For example, if the buyer entered into an agreement to purchase property contingent on an inspection being conducted, and the roof is found to leak, the. For example, a $300,000 home will require an earnest money deposit between $3,000 to $9,000. Web contractor(s) who are not enlisted with mes / who are enlisted but have not executed the standing security bond shall submit earnest money deposit as detailed in notice of tender in one of the following forms, alongwith their tender/ bid, deposit at call receipt from a scheduled bank in favour of garrison engineer. Web the earnest money shall only be deposited after landlord and tenant buyer and seller have signed this agreement.

The Earnest Money Should Be Made Payable To A Reputable Third Party Such As An Established Real Estate Brokerage, Legal Firm, Escrow Company, Or Title.

Web key takeaways earnest money is a good faith deposit, which the buyer pays to the seller as a security against the property they want to buy. Web the following contingencies shall apply to the earnest money deposit: The deposit slip is given to the buyer after funds have been received. Web earnest money deposits are usually 1% to 3% of a home’s purchase price.

Lastly, Link The Deposit To The Bill Credit:

Acceptable payment methods include personal check, certified check and wire transfer. Web updated october 31, 2022. Earnest money will be returned if buyer’s mortgage falls through. Web paying earnest money deposit.