Emh Strong Form

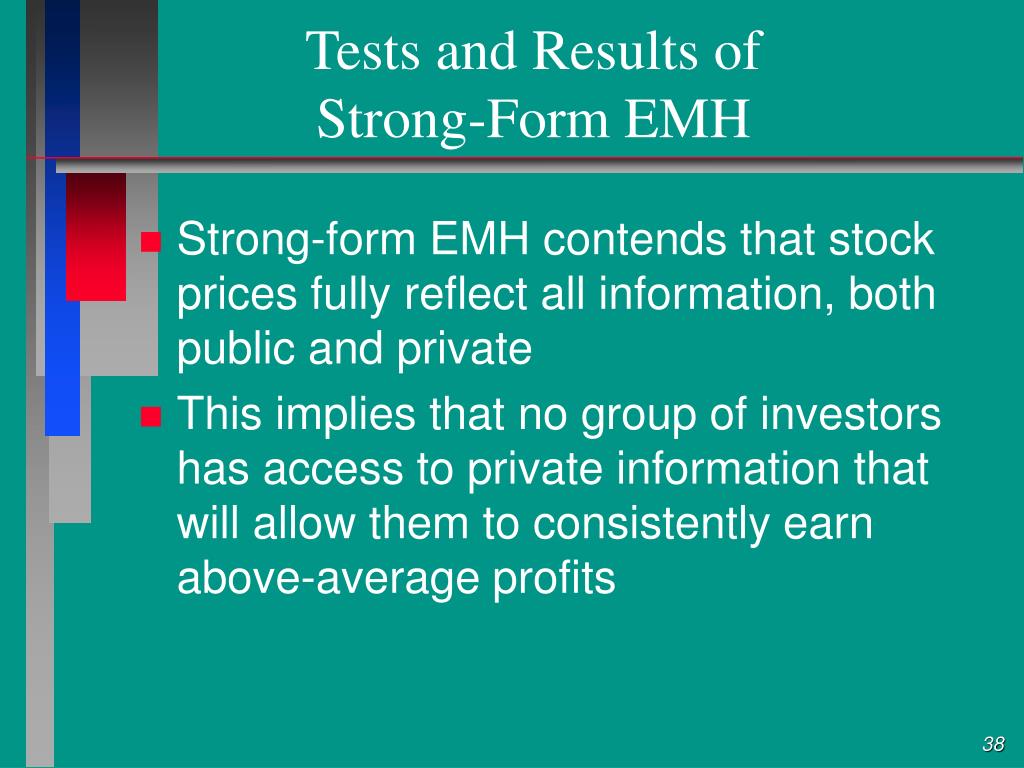

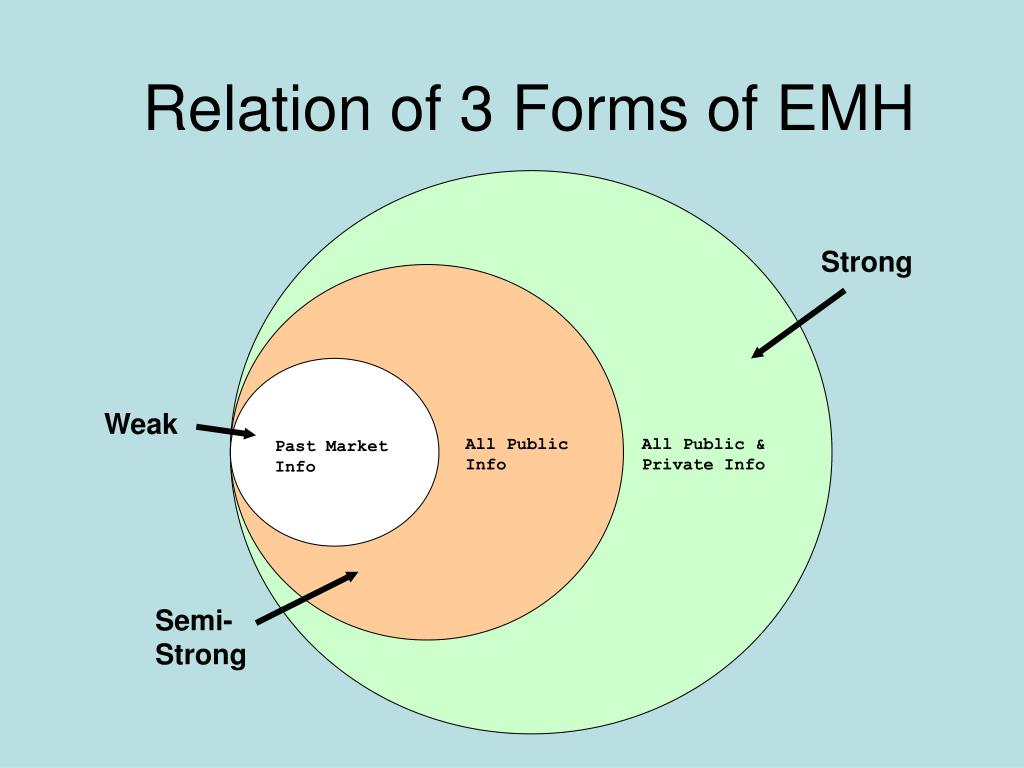

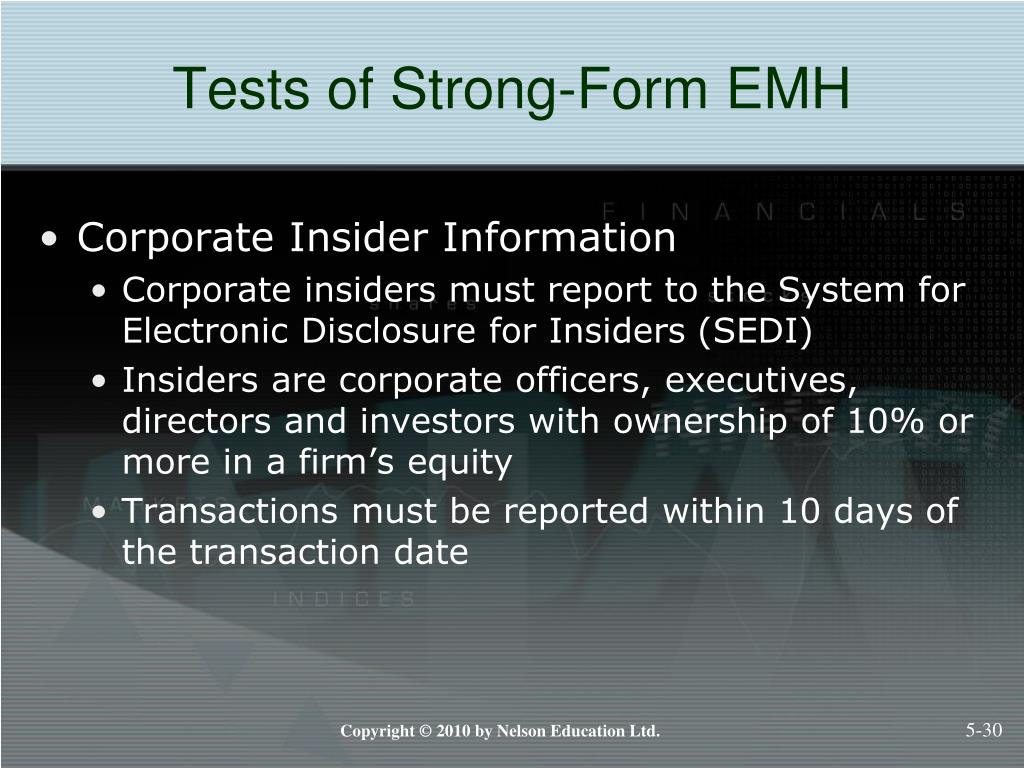

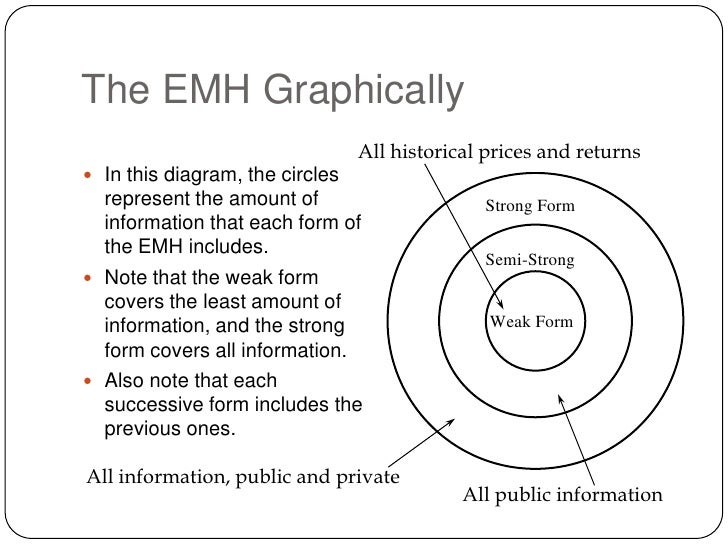

Emh Strong Form - This theory is criticized because it has market bubbles and consistently wins against the. Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. The strong form of the emh holds that prices always reflect the entirety of both public and private information. The efficient market hypothesis says that the market exists in three types, or forms: Because the accidental walk hypothesis is. The weak form of the efficient market hypothesis although investors abiding by the efficient market hypothesis believe that security prices reflect all available. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. Web what are the types of emh? This includes all publicly available. Web the efficient market hypothesis, or emh, is an investment hypothesis that claims the stock market is an efficient marketplace in which stock prices always.

There are three versions of emh, and it is the toughest of all the. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. The efficient market hypothesis says that the market exists in three types, or forms: Eugene fama classified market efficiency into three distinct forms: Web what are the types of emh? Web strong form emh is the most rigorous form of emh. A direct implication is that it is. Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. Because the accidental walk hypothesis is. Web for many years, academics and economics have studied the concept of efficiency applied to capital markets, efficient market hypothesis (emh) being a major.

Web what are the types of emh? This theory is criticized because it has market bubbles and consistently wins against the. A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. This includes all publicly available. As mentioned earlier, in this essay i'm going to be going into depth on the strong form emh and arguing the validity of it. Web the efficient market hypothesis, or emh, is a financial theory that says the asset (or security) prices reflect all the available information or data. A direct implication is that it is. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. The efficient market hypothesis says that the market exists in three types, or forms: Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all.

PPT Market Efficiency and Empirical Evidence PowerPoint Presentation

Here's a little more about each: Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. Web what are the types of emh? Because the.

EMH (Weak, SemiStrong, & Strong Forms) YouTube

Eugene fama classified market efficiency into three distinct forms: A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which.

PPT Efficient Market Theory PowerPoint Presentation, free download

A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. As mentioned earlier, in this essay i'm going to be going into depth on the strong form emh and arguing the validity of it. Web the efficient market hypothesis, or emh, is.

PPT Market Efficiency and Empirical Evidence PowerPoint Presentation

There are three versions of emh, and it is the toughest of all the. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. Web strong form emh is the most rigorous form of emh. This theory is criticized because it has market bubbles and consistently wins against.

PPT Efficient Capital Markets PowerPoint Presentation ID3293786

Web what are the types of emh? This includes all publicly available. There are three versions of emh, and it is the toughest of all the. Because the accidental walk hypothesis is. The strong form of the emh holds that prices always reflect the entirety of both public and private information.

PPT Investment Analysis and Portfolio Management First Canadian

The efficient market hypothesis says that the market exists in three types, or forms: A direct implication is that it is. Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,..

Efficient market hypothesis

As mentioned earlier, in this essay i'm going to be going into depth on the strong form emh and arguing the validity of it. Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. Web what are the types of emh? This theory is criticized because.

PPT Chapter 10 PowerPoint Presentation, free download ID395356

Web for many years, academics and economics have studied the concept of efficiency applied to capital markets, efficient market hypothesis (emh) being a major. Web strong form emh is the most rigorous form of emh. Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. Web.

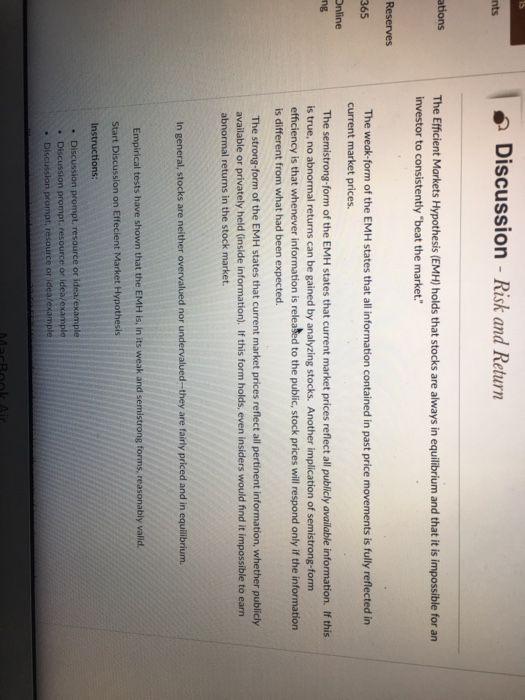

Solved DiscussionRisk and Return nts ations The Efficient

Web for many years, academics and economics have studied the concept of efficiency applied to capital markets, efficient market hypothesis (emh) being a major. Web the strong form of emh assumes that current stock prices fully reflect all public and private information. There are three versions of emh, and it is the toughest of all the. Strong form efficiency is.

PPT Investment Analysis and Portfolio Management First Canadian

The weak form of the efficient market hypothesis although investors abiding by the efficient market hypothesis believe that security prices reflect all available. There are three versions of emh, and it is the toughest of all the. Eugene fama classified market efficiency into three distinct forms: Web the strong form of emh assumes that current stock prices fully reflect all.

A Direct Implication Is That It Is.

Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. Web the efficient market hypothesis, or emh, is an investment hypothesis that claims the stock market is an efficient marketplace in which stock prices always. Web strong form emh is the most rigorous form of emh. Web the efficient markets hypothesis (emh), popularly known as the random walk theory, is the proposition that current stock prices fully reflect available information about the value.

Web The Strong Form Of Emh Assumes That Current Stock Prices Fully Reflect All Public And Private Information.

A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. This includes all publicly available. There are three versions of emh, and it is the toughest of all the. This theory is criticized because it has market bubbles and consistently wins against the.

Web For Many Years, Academics And Economics Have Studied The Concept Of Efficiency Applied To Capital Markets, Efficient Market Hypothesis (Emh) Being A Major.

Web what are the types of emh? The weak form of the efficient market hypothesis although investors abiding by the efficient market hypothesis believe that security prices reflect all available. Eugene fama classified market efficiency into three distinct forms: Web the efficient market hypothesis, or emh, is a financial theory that says the asset (or security) prices reflect all the available information or data.

As Mentioned Earlier, In This Essay I'm Going To Be Going Into Depth On The Strong Form Emh And Arguing The Validity Of It.

Here's a little more about each: Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. Because the accidental walk hypothesis is. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,.