Extension Request Form

Extension Request Form - Form 7004 is used to request an automatic extension to file the certain returns. Note that extension request forms and claim forms must be received by the claims administrator by january 13, 2023 at 11:59pm pacific standard time (pst). Web there are three ways to request an automatic extension of time to file a u.s. Web persons seeking v nonimmigrant status or an extension of stay as a v nonimmigrant. If you have been unable to submit on time, please use the special considerations process and form below. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using direct pay, the electronic federal tax payment system, or using a credit or debit card. Please make sure that an extension is suitable for your circumstances. Web extension request for assessment form. 3501 et seq.), the securities and exchange commission (“commission”) has submitted to the office of management and budget a request for extension of the previously approved collection of information discussed below. Filing this form gives you until october 15 to file a return.

Please make sure that an extension is suitable for your circumstances. This form should be submitted as soon as possible, before the submission deadlines. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web persons seeking v nonimmigrant status or an extension of stay as a v nonimmigrant. Web application to request an extension before completing this form please refer to lse.ac.uk/extensionpolicy and the notes overleaf for information regarding requesting an extension. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using direct pay, the electronic federal tax payment system, or using a credit or debit card. Web notice is hereby given that pursuant to the paperwork reduction act of 1995 (44 u.s.c. If you have been unable to submit on time, please use the special considerations process and form below. If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Web the extension request form is now available for class members who have missed the july 13, 2022 claims deadline.

Filing this form gives you until october 15 to file a return. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using direct pay, the electronic federal tax payment system, or using a credit or debit card. 3501 et seq.), the securities and exchange commission (“commission”) has submitted to the office of management and budget a request for extension of the previously approved collection of information discussed below. Please make sure that an extension is suitable for your circumstances. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Web there are three ways to request an automatic extension of time to file a u.s. This form should be submitted as soon as possible, before the submission deadlines. Web extension request for assessment form. Web application to request an extension before completing this form please refer to lse.ac.uk/extensionpolicy and the notes overleaf for information regarding requesting an extension.

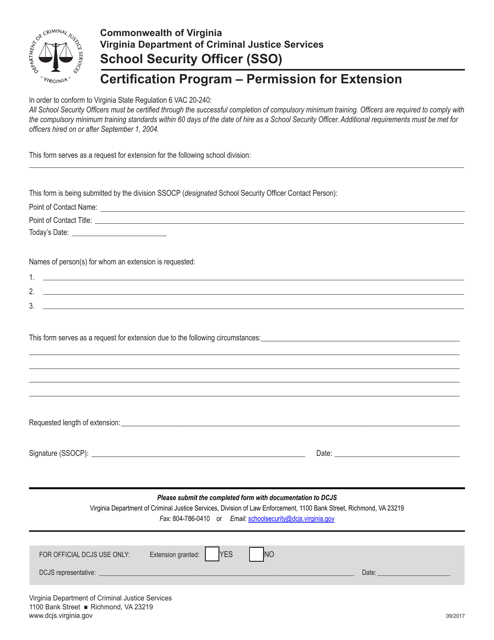

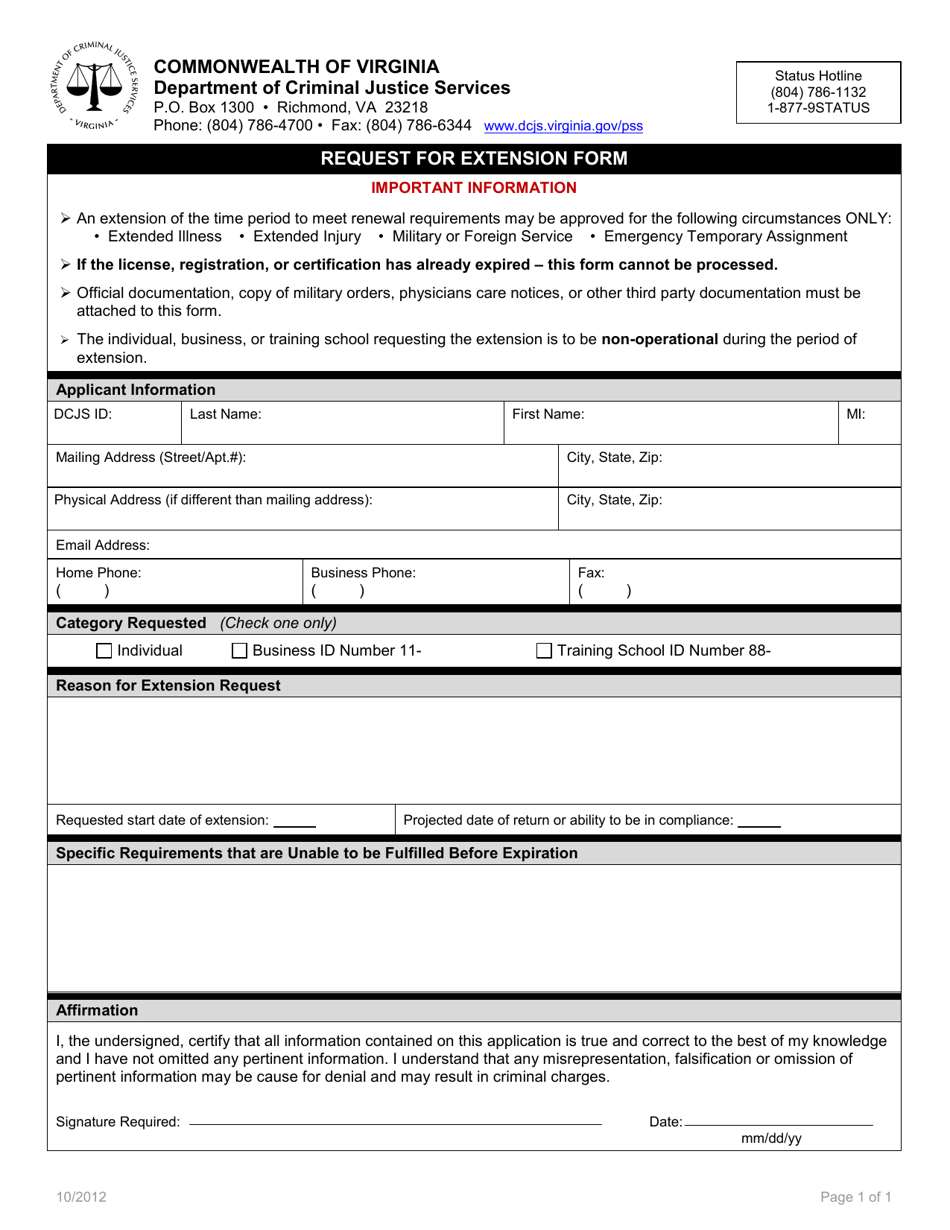

Virginia Extension Request Form Certification Program School

Web the extension request form is now available for class members who have missed the july 13, 2022 claims deadline. If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Form 7004 is used to request an automatic extension to file the certain returns. Citizen or resident files this.

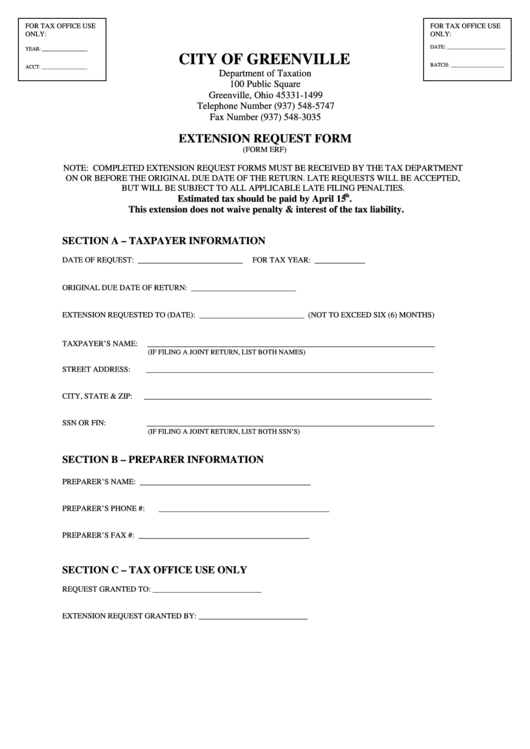

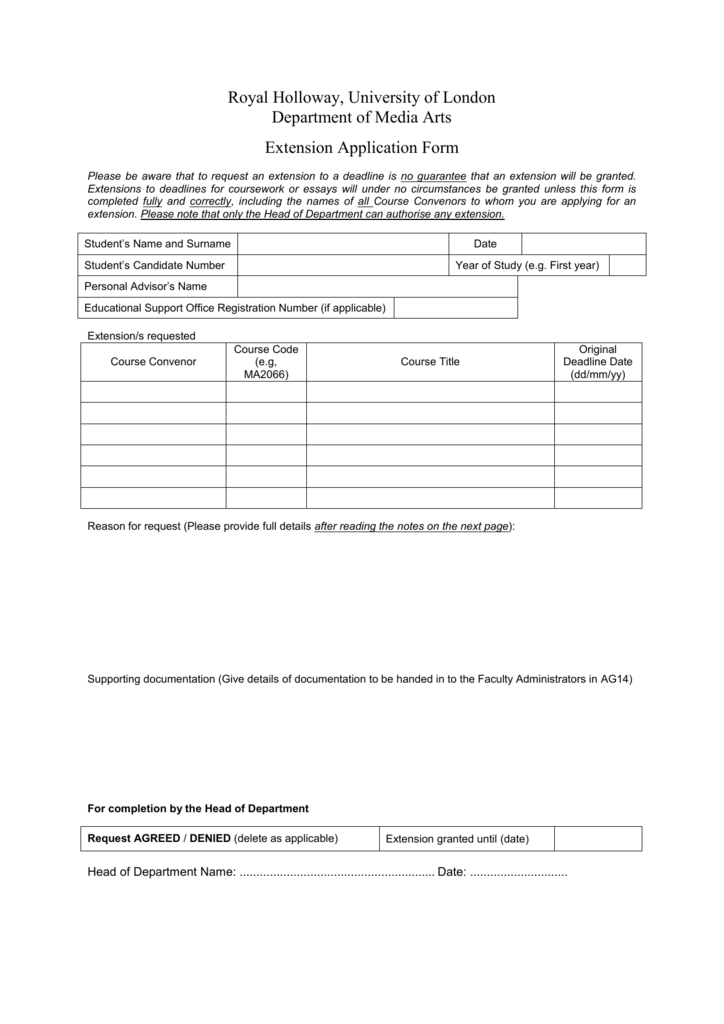

Form Erf Extension Request Form printable pdf download

3501 et seq.), the securities and exchange commission (“commission”) has submitted to the office of management and budget a request for extension of the previously approved collection of information discussed below. Web extension request form engagement and contact information step 1 of 5. Form 7004 is used to request an automatic extension to file the certain returns. See how to.

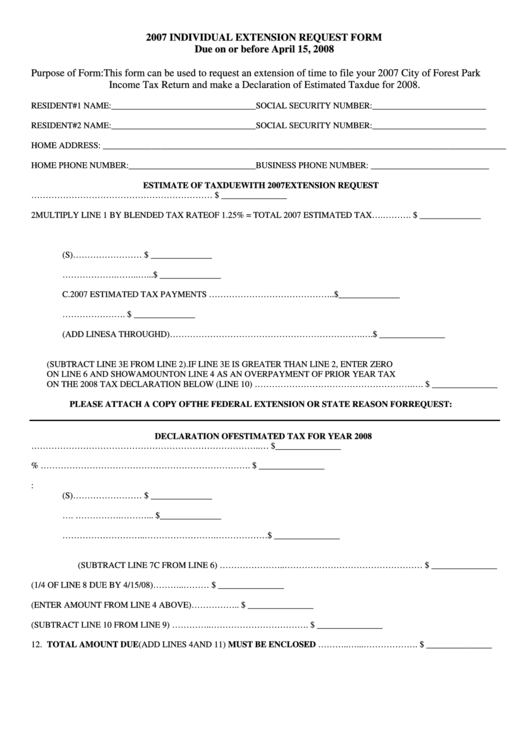

2007 Individual Extension Request Form printable pdf download

Citizen or resident files this form to request an automatic extension of time to file a u.s. Please make sure that an extension is suitable for your circumstances. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using direct pay, the electronic federal tax payment system, or using.

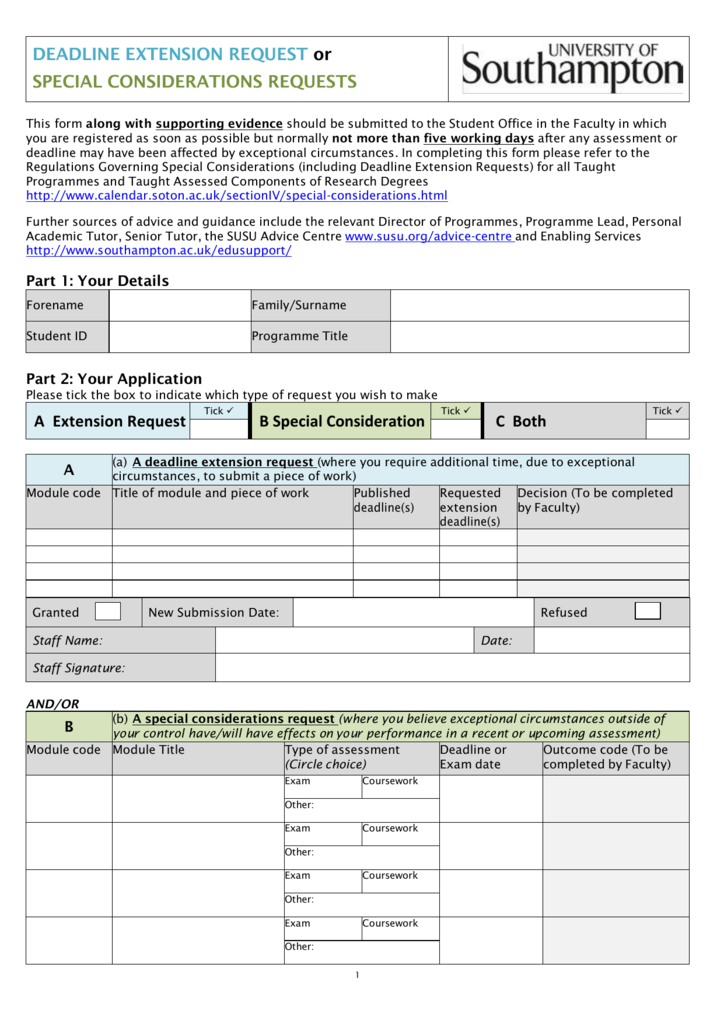

Extension Request Form MSc

If you have been unable to submit on time, please use the special considerations process and form below. Note that extension request forms and claim forms must be received by the claims administrator by january 13, 2023 at 11:59pm pacific standard time (pst). You can pay all or part of your estimated income tax due and indicate that the payment.

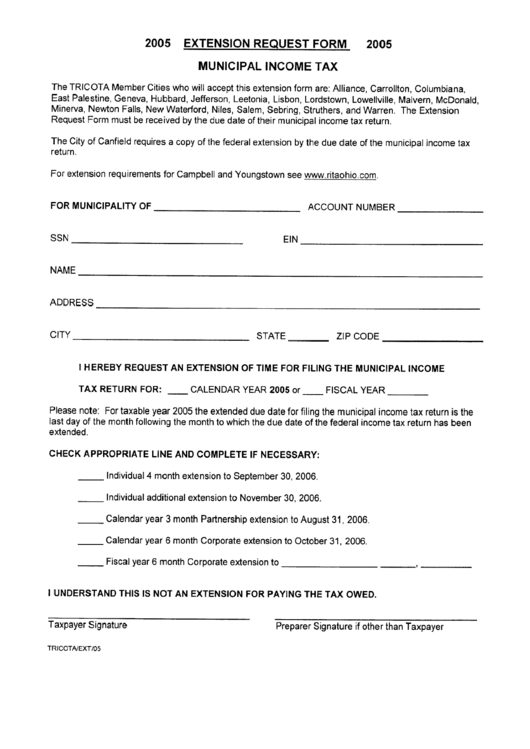

Extension Request Form Municipal Tax 2005 printable pdf download

Web application to request an extension before completing this form please refer to lse.ac.uk/extensionpolicy and the notes overleaf for information regarding requesting an extension. Web extension request for assessment form. Form 7004 is used to request an automatic extension to file the certain returns. 3501 et seq.), the securities and exchange commission (“commission”) has submitted to the office of management.

A Extension Request

See how to make a payment, later. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web the extension request form is now available for class members who have missed the july 13, 2022 claims deadline. Note that extension request forms and claim forms must be received by the claims administrator by.

Virginia Request for Extension Form Download Fillable PDF Templateroller

Form 7004 is used to request an automatic extension to file the certain returns. 3501 et seq.), the securities and exchange commission (“commission”) has submitted to the office of management and budget a request for extension of the previously approved collection of information discussed below. Please make sure that an extension is suitable for your circumstances. Citizen or resident files.

Extension Request Form

Web the extension request form is now available for class members who have missed the july 13, 2022 claims deadline. This form should be submitted as soon as possible, before the submission deadlines. 3501 et seq.), the securities and exchange commission (“commission”) has submitted to the office of management and budget a request for extension of the previously approved collection.

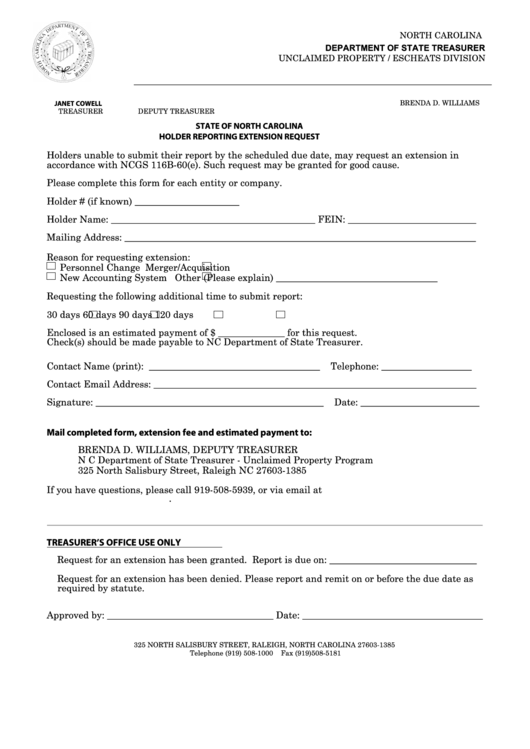

Holder Reporting Extension Request Form printable pdf download

Please make sure that an extension is suitable for your circumstances. If you have been unable to submit on time, please use the special considerations process and form below. If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Web the extension request form is now available for class.

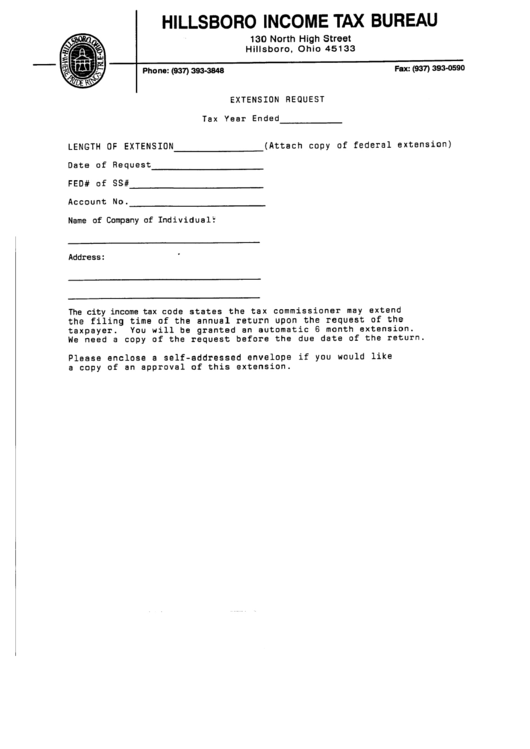

Extension Request Form State Of Ohio printable pdf download

Please make sure that an extension is suitable for your circumstances. Note that extension request forms and claim forms must be received by the claims administrator by january 13, 2023 at 11:59pm pacific standard time (pst). Form 7004 is used to request an automatic extension to file the certain returns. Web the extension request form is now available for class.

Web Extension Request Form Engagement And Contact Information Step 1 Of 5.

If october 15 falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Please make sure that an extension is suitable for your circumstances. Web extension request for assessment form. Web application to request an extension before completing this form please refer to lse.ac.uk/extensionpolicy and the notes overleaf for information regarding requesting an extension.

Web Information About Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns, Including Recent Updates, Related Forms, And Instructions On How To File.

Form 7004 is used to request an automatic extension to file the certain returns. Note that extension request forms and claim forms must be received by the claims administrator by january 13, 2023 at 11:59pm pacific standard time (pst). See how to make a payment, later. Web notice is hereby given that pursuant to the paperwork reduction act of 1995 (44 u.s.c.

3501 Et Seq.), The Securities And Exchange Commission (“Commission”) Has Submitted To The Office Of Management And Budget A Request For Extension Of The Previously Approved Collection Of Information Discussed Below.

Web there are three ways to request an automatic extension of time to file a u.s. Extensions cannot be accepted after the deadline. This form should be submitted as soon as possible, before the submission deadlines. Filing this form gives you until october 15 to file a return.

Citizen Or Resident Files This Form To Request An Automatic Extension Of Time To File A U.s.

Web persons seeking v nonimmigrant status or an extension of stay as a v nonimmigrant. If you have been unable to submit on time, please use the special considerations process and form below. Web the extension request form is now available for class members who have missed the july 13, 2022 claims deadline. You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using direct pay, the electronic federal tax payment system, or using a credit or debit card.