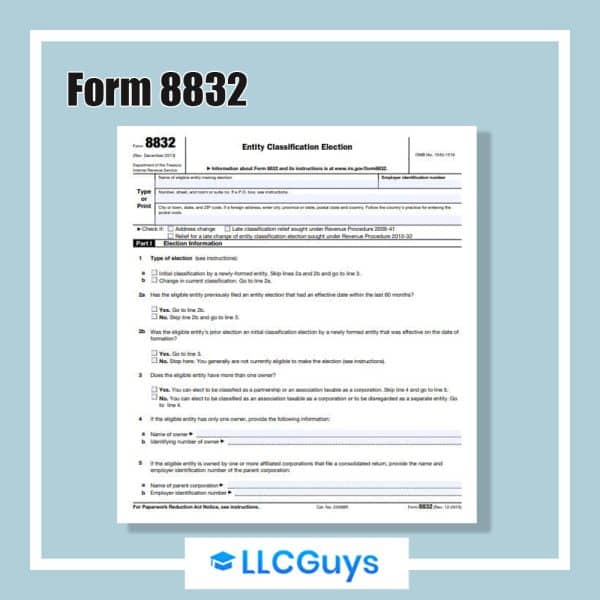

File Form 8832 Online

File Form 8832 Online - Web irs form 8832 entity classification election is completed to reflect how the entity has elected to be treated for federal tax purposes. Who should file form 8832? Web form 8832 entity classification election solved • by intuit • 91 • updated july 14, 2022 an eligible entity uses form 8832 to elect how it will be classified for. Information to have before filling out irs form 8832; Web up to 40% cash back guidance: Complete, edit or print tax forms instantly. If you are not certain of your business. Address to mail form to irs: Web certain foreign entities (see form 8832 instructions). Web there's no need to file irs form 8832 if you're content with your default tax status.

If you are not certain of your business. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax. Web filing form 8832. And the entity timely filed all required federal tax returns consistent with. What happens if i don't file form 8832? ~7 hours (irs estimate) turnaround: If you are located in. Web up to $32 cash back irs form 8832 is used by a business to elect — or change — how it will be classified for federal tax purposes including as a corporation, partnership, or a. Web up to 40% cash back guidance: You can select a different tax status for your organization than the default status by submitting.

Address to mail form to irs: Web there's no need to file irs form 8832 if you're content with your default tax status. You might choose to file it at the same time you start your business, or you might decide to file at a later point. Generally, llcs are not automatically included in this list, and are therefore not required. Web to file form 8832, you must have an authorized signature from one or more of the following people: You can select a different tax status for your organization than the default status by submitting. Complete, edit or print tax forms instantly. Web by submitting internal revenue service form 8832, you can do this. While the form can be. Web form 8832 is used by an llc or partnership to pay taxes like a c corporation.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

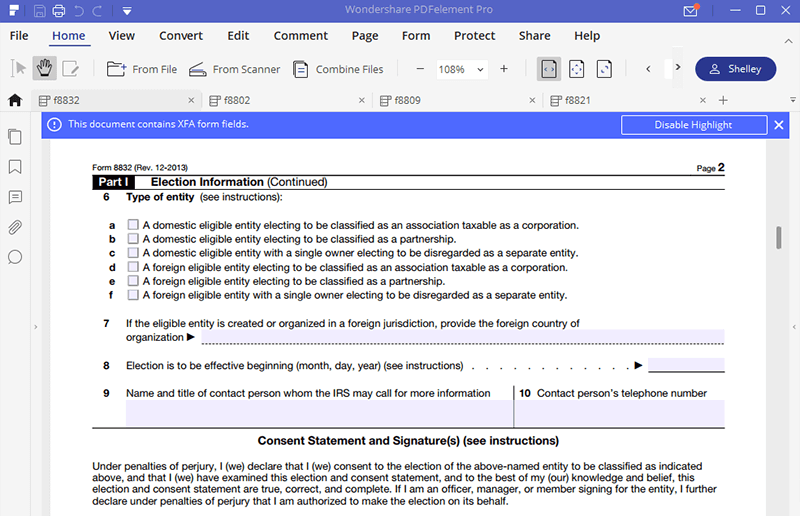

December 2013) department of the treasury internal revenue service omb no. Address to mail form to irs: Web you can file irs form 8832 at any time. Complete, edit or print tax forms instantly. You can select a different tax status for your organization than the default status by submitting.

What Is IRS Form 8832? Definition, Deadline, & More

Complete, edit or print tax forms instantly. Web there's no need to file irs form 8832 if you're content with your default tax status. Web form 8832 entity classification election solved • by intuit • 91 • updated july 14, 2022 an eligible entity uses form 8832 to elect how it will be classified for. If you are not certain.

Using Form 8832 to Change Your LLC’s Tax Classification

Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web to file the form with your individual return you would need to manually complete form 8832 and mail your paper return (be sure to read the filing.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed; Complete, edit or print tax forms instantly. Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a. What happens if i don't file form.

Form 8832 All About It and How to File It?

Web there's no need to file irs form 8832 if you're content with your default tax status. Web you can file irs form 8832 at any time. Web form 8832 is used by an llc or partnership to pay taxes like a c corporation. Web understanding and filing form 8832 are crucial for small business owners, online sellers, and individuals.

IRS Form 8832 How to Fill it Right

Generally, llcs are not automatically included in this list, and are therefore not required. Web irs form 8832 entity classification election is completed to reflect how the entity has elected to be treated for federal tax purposes. What happens if i don't file form 8832? Complete, edit or print tax forms instantly. If you are located in.

What Is IRS Form 8832? Definition, Deadline, & More

Who should file form 8832? Get ready for tax season deadlines by completing any required tax forms today. Web up to 40% cash back guidance: Complete, edit or print tax forms instantly. And the entity timely filed all required federal tax returns consistent with.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Web what is irs form 8832? There are several reasons your company might choose to file form 8832 and change your filing status. If you are not certain of your business. Who should file form 8832? Web filing form 8832.

Delaware Llc Uk Tax Treatment Eayan

Get ready for tax season deadlines by completing any required tax forms today. There are several reasons your company might choose to file form 8832 and change your filing status. If you are located in. Web up to 40% cash back guidance: Web understanding and filing form 8832 are crucial for small business owners, online sellers, and individuals looking to.

Address To Mail Form To Irs:

Web there's no need to file irs form 8832 if you're content with your default tax status. Complete, edit or print tax forms instantly. Web to file form 8832, you must have an authorized signature from one or more of the following people: Complete, edit or print tax forms instantly.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Only firms wishing to change their tax status should use this form. Web by submitting internal revenue service form 8832, you can do this. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. You might choose to file it at the same time you start your business, or you might decide to file at a later point.

There Are Several Reasons Your Company Might Choose To File Form 8832 And Change Your Filing Status.

Who should file form 8832? Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a. You can select a different tax status for your organization than the default status by submitting. Each person who is an owner of the business at the time of filing,.

Web The Entity Failed To Qualify As A Corporation Solely Because Form 8832 Was Not Timely Filed;

Complete, edit or print tax forms instantly. Generally, llcs are not automatically included in this list, and are therefore not required. ~7 hours (irs estimate) turnaround: December 2013) department of the treasury internal revenue service omb no.