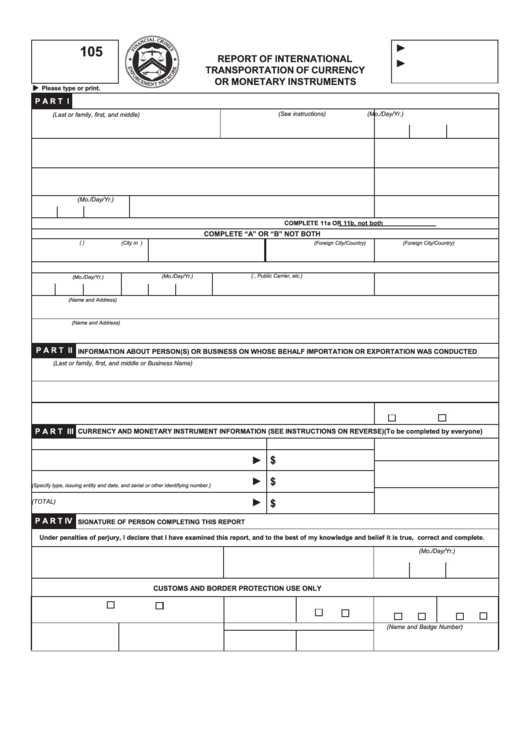

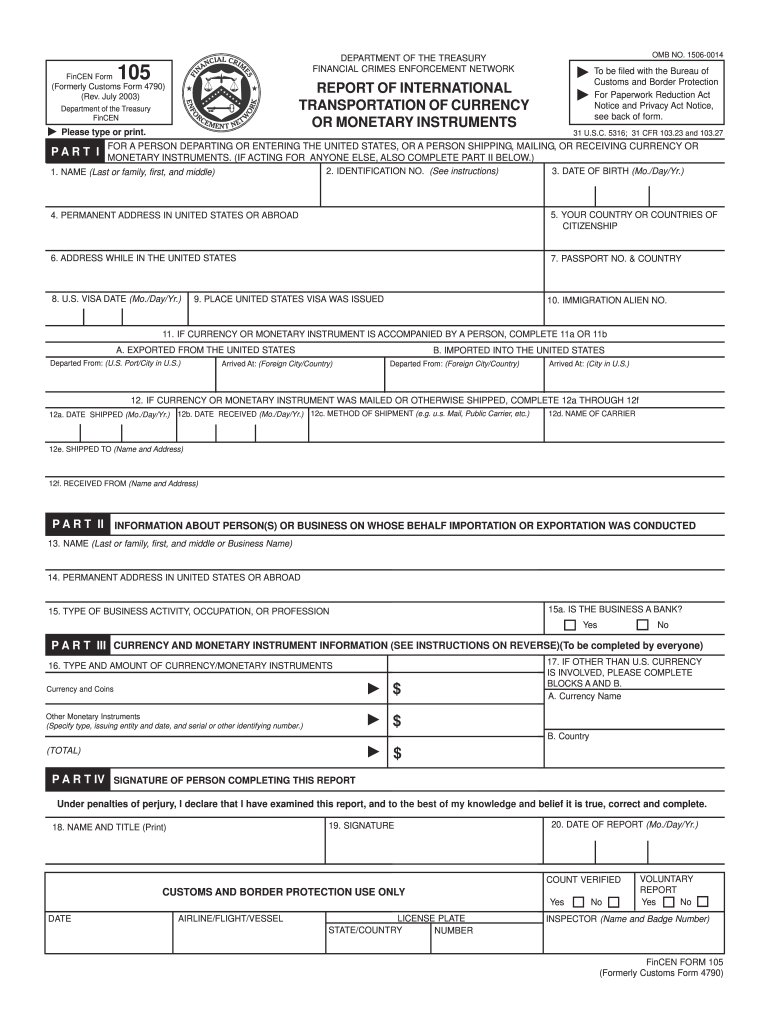

Fincen Form 105

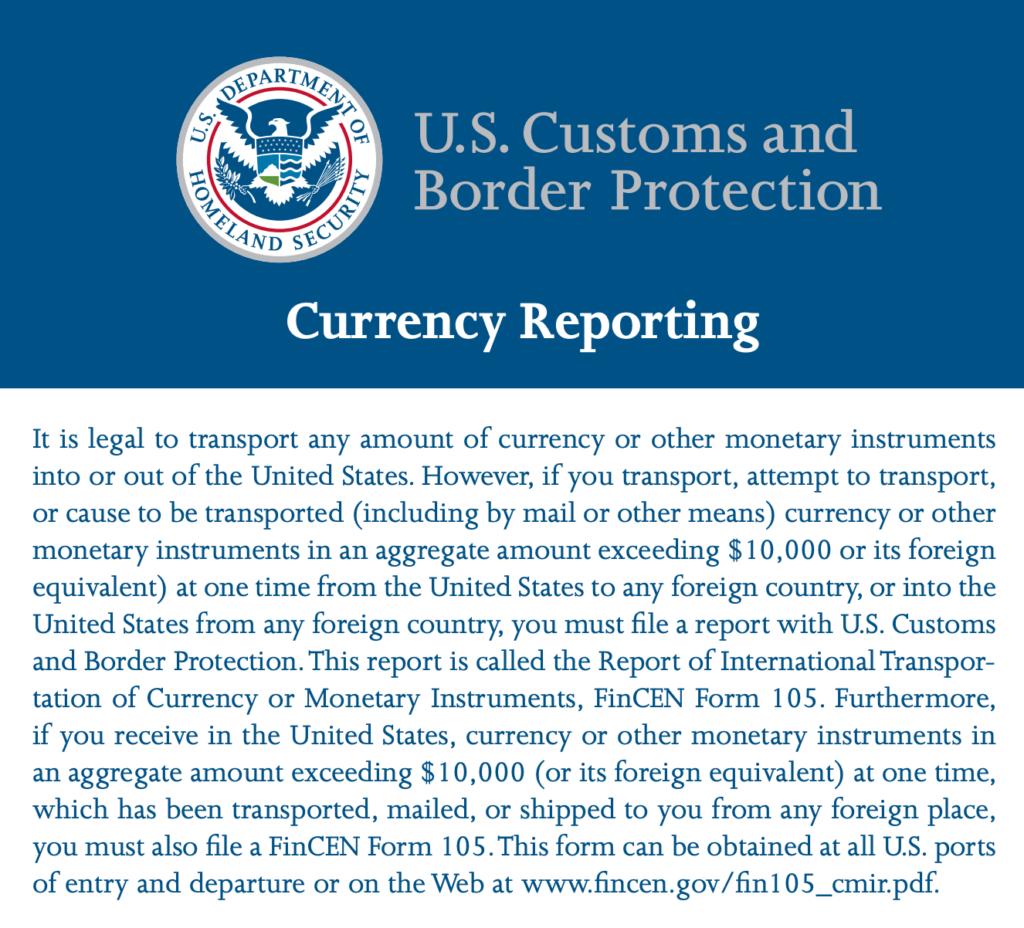

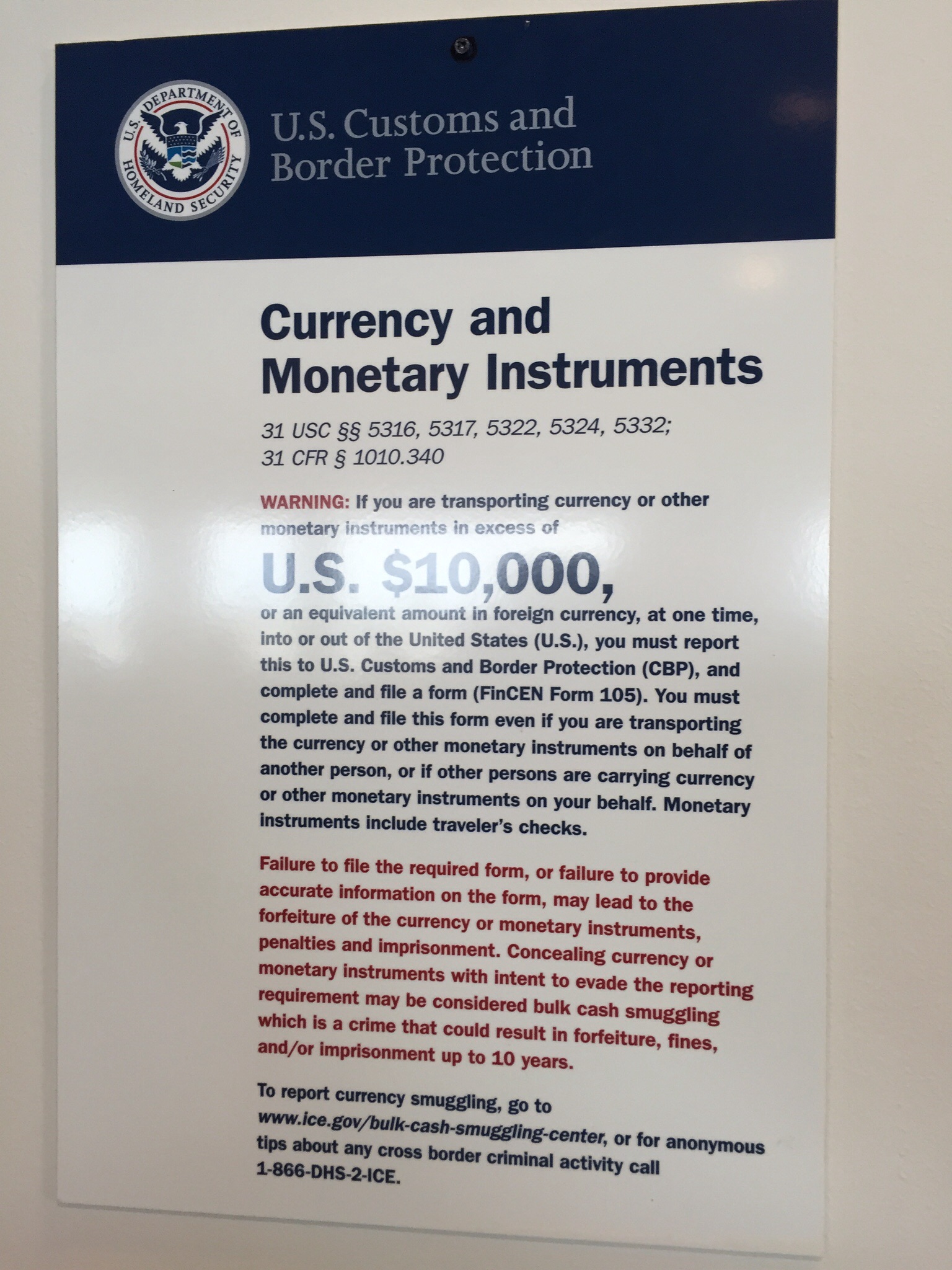

Fincen Form 105 - Treasury/ financial crimes enforcement network. Customs and border protection attention: Find other forms created by the u.s. Web the fincen form 105 is dominantly associated with and required for traveling to and away from the us. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Or foreign coins and currency; Web you must also file a fincen form 105.

International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Customs and border protection attention: How does filing a fincen form 105 benefit the customs and border protection (cbp) or homeland security investigations (hsi)? This form can be obtained at all u.s. Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. Department of the treasury’s financial crimes enforcement network (fincen) including fincen form 104, 112, 114, and form 6059b. So, if you are departing or arriving in the us, keep the fincen form 105 in mind. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Find other forms created by the u.s. Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf.

International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. You may bring into or take out of the country, including by mail, as much money as you wish. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Web you must also file a fincen form 105. Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. The completed form should be sent to the following address: T 3) negotiable instruments (including checks, promissory notes, Web the fincen form 105 is dominantly associated with and required for traveling to and away from the us. How does filing a fincen form 105 benefit the customs and border protection (cbp) or homeland security investigations (hsi)? Find other forms created by the u.s.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: You may bring into or take out of the country, including by mail, as much money as you wish. Web you.

Formulario Fincen 105 En Español Fill Online, Printable, Fillable

Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. Find other forms created by the u.s. The completed form should be sent to the following address: Web you must also file a fincen form.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Customs and border protection attention: U 2)raveler checks in any form; T 3) negotiable instruments (including checks, promissory notes, Department of the treasury’s financial crimes enforcement network (fincen) including fincen form 104, 112, 114, and form 6059b. Web you need to enable javascript to run this app.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Web the fincen form 105 is dominantly associated with and required for traveling to and away from the us. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. Web you can obtain the fincen form 105, and.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. How does filing a fincen form 105 benefit the customs and border protection (cbp) or homeland security investigations (hsi)? This form can be obtained at all u.s. Web you can obtain the fincen form 105, and additional information on what constitutes a monetary instrument.

Fincen Form 105 Report Of International Transportation Of Currency Or

Treasury/ financial crimes enforcement network. Customs and border protection attention: Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. The completed form should be sent to the following address: Web in the united states.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Passengers carrying over $10,000 in monetary instruments into or out of the united states must file this form with cbp at the time of entry into the united states or at the time of departure. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs.

Fincen Form Fill Out and Sign Printable PDF Template signNow

Or foreign coins and currency; Web you can obtain the fincen form 105, and additional information on what constitutes a monetary instrument and who is required to file is on the u.s. The completed form should be sent to the following address: Web in the united states shall file fincen form 105, within 15 days after receipt of the currency.

Cash Reporting Requirement & FinCen 105 Great Lakes Customs Law

Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf. Treasury/ financial crimes enforcement network. How does filing a fincen form 105 benefit the customs and border protection (cbp) or homeland security investigations (hsi)? Customs and border protection (dhs.gov). Web you can obtain the fincen form 105, and additional information on what constitutes a monetary instrument and who is.

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

Web you must also file a fincen form 105. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). T 3) negotiable instruments (including checks, promissory notes, U 2)raveler checks in any form; International travelers entering the united states must declare if they are carrying.

Or Foreign Coins And Currency;

Department of the treasury’s financial crimes enforcement network (fincen) including fincen form 104, 112, 114, and form 6059b. T 3) negotiable instruments (including checks, promissory notes, So, if you are departing or arriving in the us, keep the fincen form 105 in mind. Ports of entry and departure or on the web at www.fincen.gov/fin105_cmir.pdf.

How Does Filing A Fincen Form 105 Benefit The Customs And Border Protection (Cbp) Or Homeland Security Investigations (Hsi)?

Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by mail addressed to: Web you may file in paper form or file electronically at fincen form 105 cmir, u.s. The completed form should be sent to the following address: Web the fincen form 105 is dominantly associated with and required for traveling to and away from the us.

Web You Can Obtain The Fincen Form 105, And Additional Information On What Constitutes A Monetary Instrument And Who Is Required To File Is On The U.s.

Customs and border protection attention: You may bring into or take out of the country, including by mail, as much money as you wish. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their customs declaration form (cbp form 6059b) and then. This form can be obtained at all u.s.

Web Use The Online Fincen 105 Currency Reporting Site Or Ask A Cbp Officer For The Paper Copy Of The Currency Reporting Form (Fincen 105).

Web you must also file a fincen form 105. Find other forms created by the u.s. U 2)raveler checks in any form; Treasury/ financial crimes enforcement network.