Form 104 Colorado Nonresident Tax Return

Form 104 Colorado Nonresident Tax Return - Web form 104 and any tax payment owed are due april 15, 2014. This form is for income earned in tax year 2022, with. Web printable colorado income tax form 104. Ad download or email co 104 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. You may file by mail with paper forms or. Use this screen to complete part year and nonresident information for form 104. Ad download or email co 104 & more fillable forms, register and subscribe now! Web based on your description and colorado law, you would not have to file a colorado tax return because you are a nonresident. Web file now with turbotax.

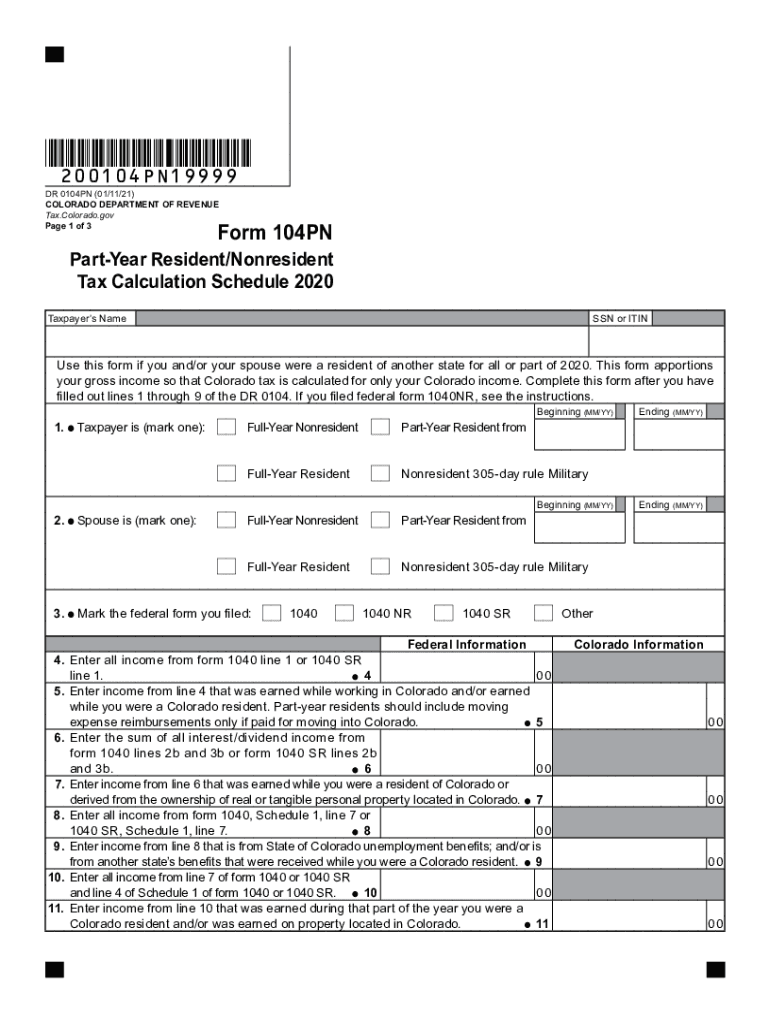

This form is for income earned in tax year 2022, with. Web more about the colorado form 104pn nonresident we last updated colorado form 104pn in january 2023 from the colorado department of revenue. Web select a different state: Ad download or email co 104 & more fillable forms, register and subscribe now! Web printable colorado income tax form 104. You may file by mail with paper forms or. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web estimated tax payments are due on a quarterly basis; Ad download or email co 104 & more fillable forms, register and subscribe now! We last updated colorado form 104 in february 2023 from the colorado department of revenue.

Web select a different state: Ad download or email co 104 & more fillable forms, register and subscribe now! Web based on your description and colorado law, you would not have to file a colorado tax return because you are a nonresident. Web form 104 and any tax payment owed are due april 15, 2014. Web 6 rows form 104 is the general, and simplest, income tax return for individual residents of. Use this screen to complete part year and nonresident information for form 104. Web file now with turbotax. Web the dr 0104us with your return. Web more about the colorado form 104pn nonresident we last updated colorado form 104pn in january 2023 from the colorado department of revenue. Returns that are mailed must be postmarked by.

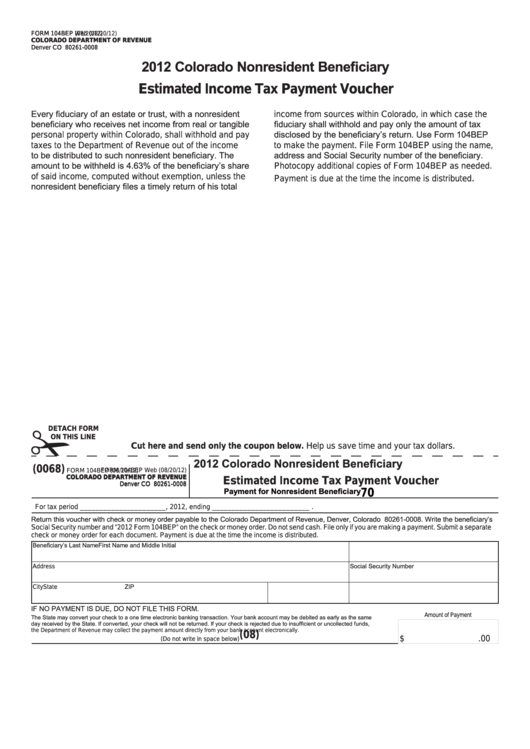

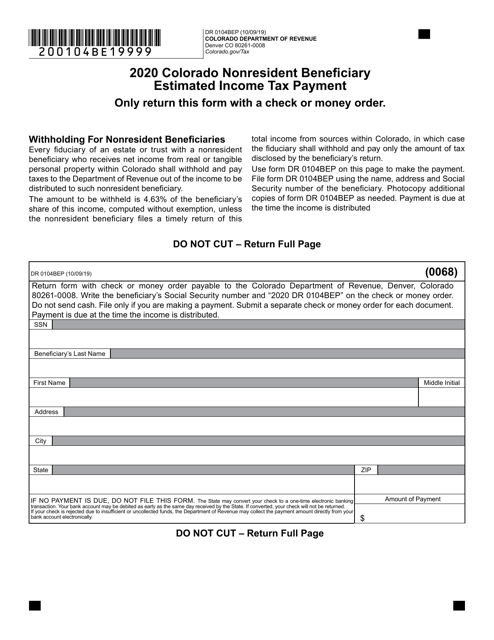

Fillable Form 104bep Colorado Nonresident Beneficiary Estimated

Get ready for tax season deadlines by completing any required tax forms today. We last updated colorado form 104 in february 2023 from the colorado department of revenue. Ad download or email co 104 & more fillable forms, register and subscribe now! Ad download or email co 104 & more fillable forms, register and subscribe now! Complete, edit or print.

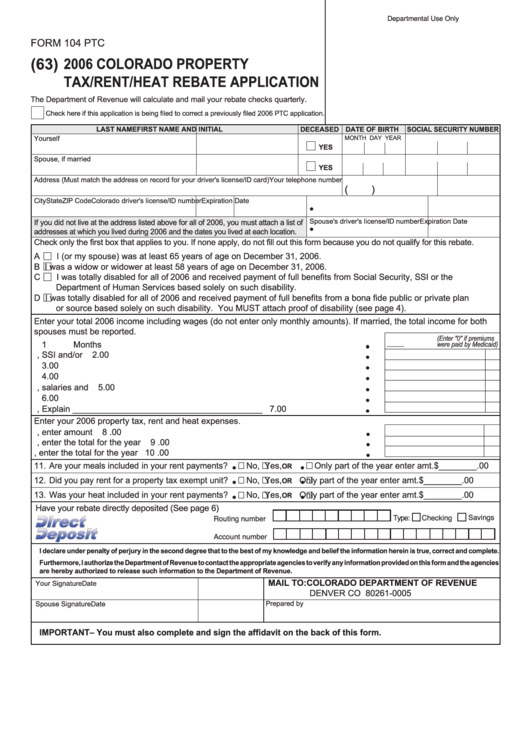

Fillable Form 104 Ptc Colorado Property Tax/rent/heat Rebate

Net colorado tax, sum of lines 17 and 18 19 00 20. Web form 104 and any tax payment owed are due april 15, 2014. Web anyone who (a) lives in colorado; Revenue online will accept returns as timely filed until midnight. April 15 (first calender quarter), june 15 (second calender quarter), september 15.

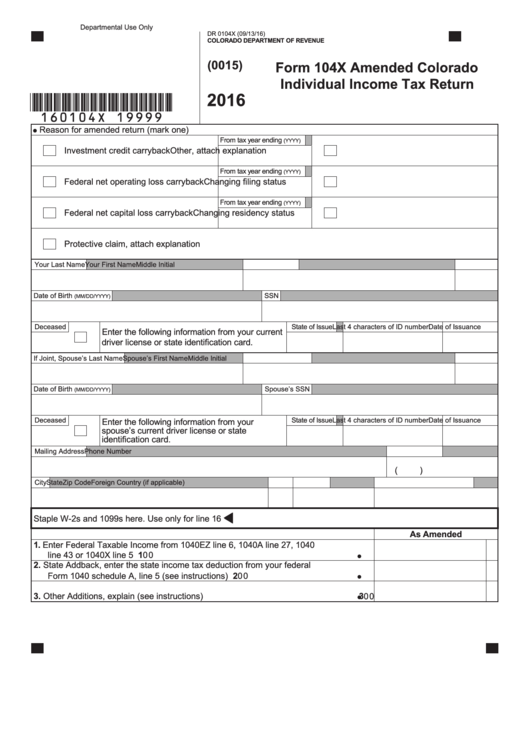

Fillable Form 104x Amended Colorado Individual Tax Return

Web anyone who (a) lives in colorado; Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Use this screen to complete part year and nonresident information for form 104. Returns that are mailed must be postmarked by. Revenue online will accept returns as timely filed until midnight.

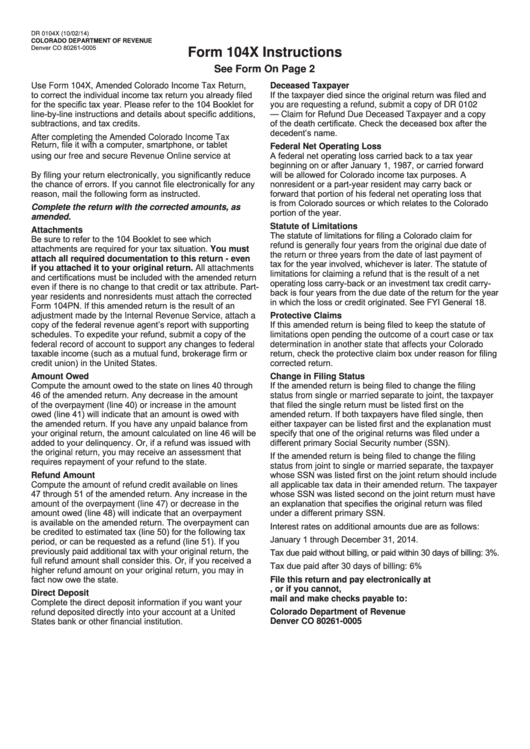

Fillable Form 104x Amended Colorado Individual Tax Return

Web form 104 and any tax payment owed are due april 15, 2014. (b) is required to file a federal income tax return; Ad download or email co 104 & more fillable forms, register and subscribe now! Use this screen to complete part year and nonresident information for form 104. Web file now with turbotax.

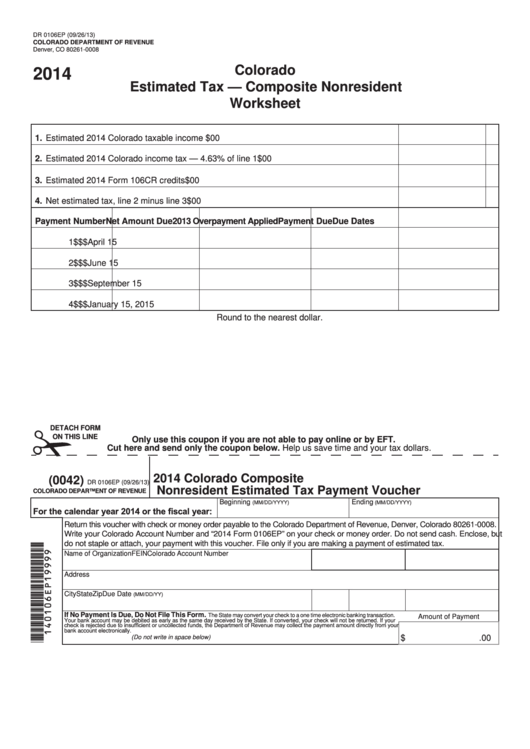

Fillable Form 0106ep Colorado Estimated Tax Composite Nonresident

Web file now with turbotax. You may file by mail with paper forms or. Web printable colorado income tax form 104. Returns that are mailed must be postmarked by. Form 104 is the general, and simplest, income tax return for individual residents of colorado.

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

Returns that are mailed must be postmarked by. This form is for income earned in tax year 2022, with. We last updated colorado form 104 in february 2023 from the colorado department of revenue. Get ready for tax season deadlines by completing any required tax forms today. Net colorado tax, sum of lines 17 and 18 19 00 20.

2020 Form CO DoR 104PN Fill Online, Printable, Fillable, Blank pdfFiller

We last updated colorado form 104 in february 2023 from the colorado department of revenue. This form is for income earned in tax year 2022, with. Returns that are mailed must be postmarked by. Web based on your description and colorado law, you would not have to file a colorado tax return because you are a nonresident. (b) is required.

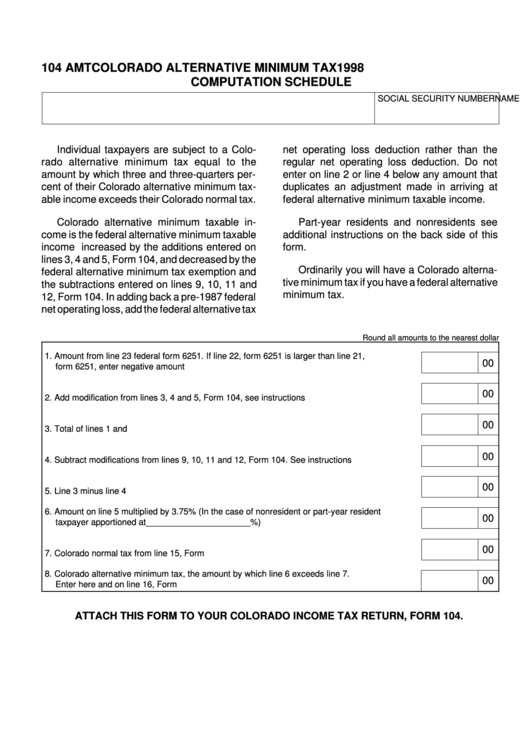

Fillable Form 104 Amt Colorado Alternative Minimum Tax Computation

Complete, edit or print tax forms instantly. Use this screen to complete part year and nonresident information for form 104. Returns that are mailed must be postmarked by. April 15 (first calender quarter), june 15 (second calender quarter), september 15. Form 104 is the general, and simplest, income tax return for individual residents of colorado.

Individual Tax Form 104 Colorado Free Download

Complete, edit or print tax forms instantly. Web select a different state: You may file by mail with paper forms or. We last updated colorado form 104 in february 2023 from the colorado department of revenue. A colorado resident is a person.

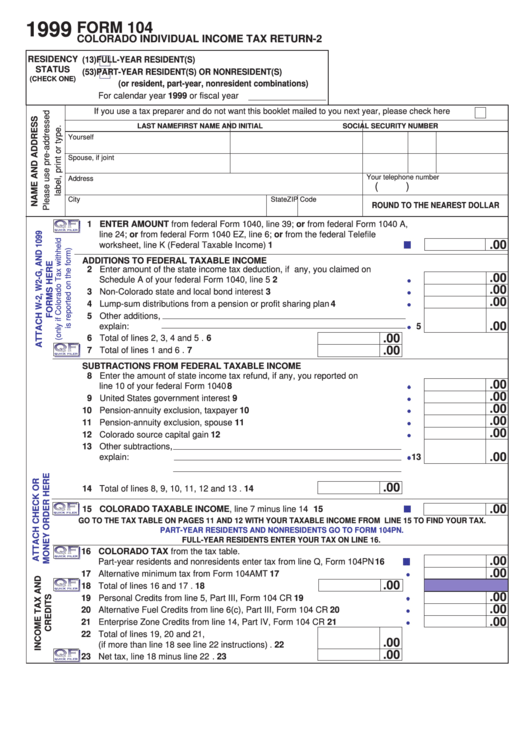

Form 104 Colorado Individual Tax Return2 1999 printable pdf

(b) is required to file a federal income tax return; Ad download or email co 104 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web more about the colorado form 104pn nonresident we last updated colorado form 104pn in january 2023 from the colorado department of revenue. Web printable colorado income tax form.

Web Printable Colorado Income Tax Form 104.

Returns that are mailed must be postmarked by. Net colorado tax, sum of lines 17 and 18 19 00 20. Web based on your description and colorado law, you would not have to file a colorado tax return because you are a nonresident. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.

Web Select A Different State:

Complete, edit or print tax forms instantly. Web the dr 0104us with your return. This form is for income earned in tax year 2022, with. Ad download or email co 104 & more fillable forms, register and subscribe now!

And (C) Has A Current Year Colorado Tax Liability, Is Required To File A Colorado.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web more about the colorado form 104pn nonresident we last updated colorado form 104pn in january 2023 from the colorado department of revenue. A colorado resident is a person.

You May File By Mail With Paper Forms Or.

April 15 (first calender quarter), june 15 (second calender quarter), september 15. Web 6 rows form 104 is the general, and simplest, income tax return for individual residents of. Revenue online will accept returns as timely filed until midnight. Web estimated tax payments are due on a quarterly basis;