Form 1042 Extension

Form 1042 Extension - Use form 7004 to request an automatic 6. If the deadline is a public holiday,. Web additionally, a withholding agent may use the extended due date for filing a form 1042 to claim a credit for any adjustments made to overwithholding. Web form 1042 can be extended for 6 months by filing form 7004. Web a withholding agent or intermediary required to file a return on form 1042, “annual withholding tax return for u.s. C, have you joined us 6 to 10 times; Web if additional time is required to file the form, an extension may be filed to extend the filing date but not the payment of the tax. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Complete, edit or print tax forms instantly. By filing form 8809, you will get an.

Is it, a, your first time; Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. C, have you joined us 6 to 10 times; Web 3 select the tax form, payment type, period, and amount (and subcategory information,. If the deadline is a public holiday,. Source income of foreign persons ,” for any taxable. The process for requesting both extensions. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Complete, edit or print tax forms instantly. How many times have you attended an irs national webinar?

Web if additional time is required to file the form, an extension may be filed to extend the filing date but not the payment of the tax. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Web deadlines, extensions and penalties of 1042. B, have you joined it 1 to 5 times; By filing form 8809, you will get an. Web a withholding agent or intermediary required to file a return on form 1042, “annual withholding tax return for u.s. Web additionally, a withholding agent may use the extended due date for filing a form 1042 to claim a credit for any adjustments made to overwithholding. How many times have you attended an irs national webinar? Web form 1042 can be extended for 6 months by filing form 7004. The process for requesting both extensions.

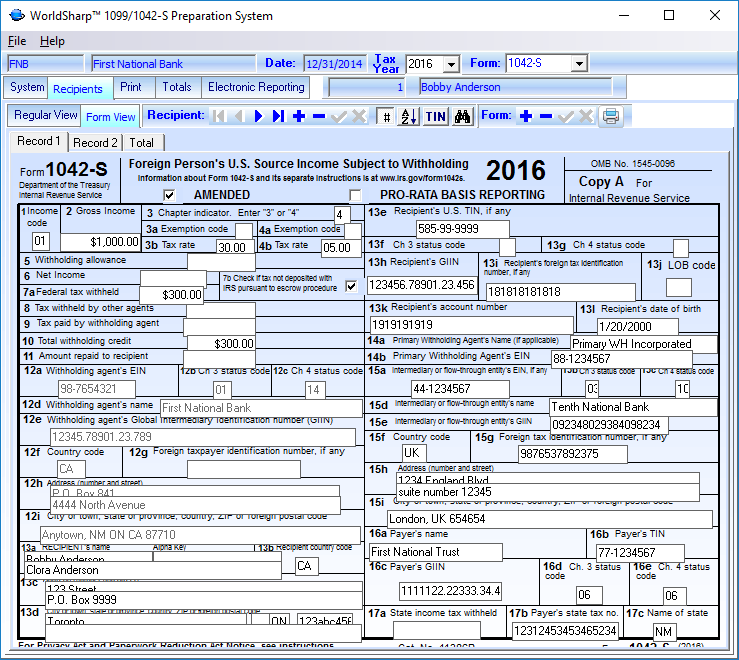

CED Form 1042 2015 Fill and Sign Printable Template Online US Legal

Complete, edit or print tax forms instantly. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Is it, a, your first time; Web if additional time is required to file the form, an extension may be filed to extend the filing date but not the payment of the tax. By filing form 8809,.

2019 2020 IRS Form Instruction 1042S Fill Out Digital PDF Sample

By filing form 8809, you will get an. Web 3 select the tax form, payment type, period, and amount (and subcategory information,. Web deadlines, extensions and penalties of 1042. Complete, edit or print tax forms instantly. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons.

1042 S Form slideshare

If the deadline is a public holiday,. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 1042, also annual withholding tax return for u.s. Web form 1042 can be extended for 6 months by filing form 7004. Complete, edit or print tax forms instantly.

Form 1042 Annual Withholding Tax Return for U.S. Source of

How many times have you attended an irs national webinar? Web a withholding agent or intermediary required to file a return on form 1042, “annual withholding tax return for u.s. The process for requesting both extensions. C, have you joined us 6 to 10 times; Payment due on an extension payment due with a return payment due on an irs.

1042 S Form slideshare

C, have you joined us 6 to 10 times; B, have you joined it 1 to 5 times; Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web 3 select the tax form, payment type, period, and amount (and subcategory information,. Download or email irs 1042 & more fillable forms, register and.

1042 S Form slideshare

The process for requesting both extensions. Web 3 select the tax form, payment type, period, and amount (and subcategory information,. By filing form 8809, you will get an. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

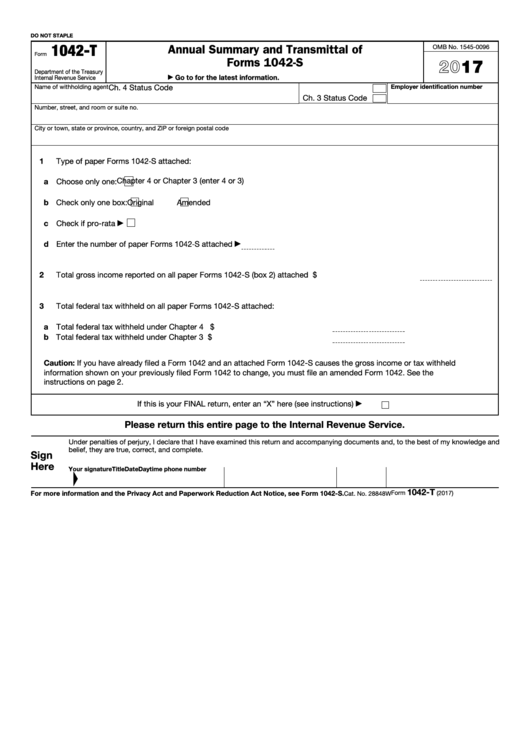

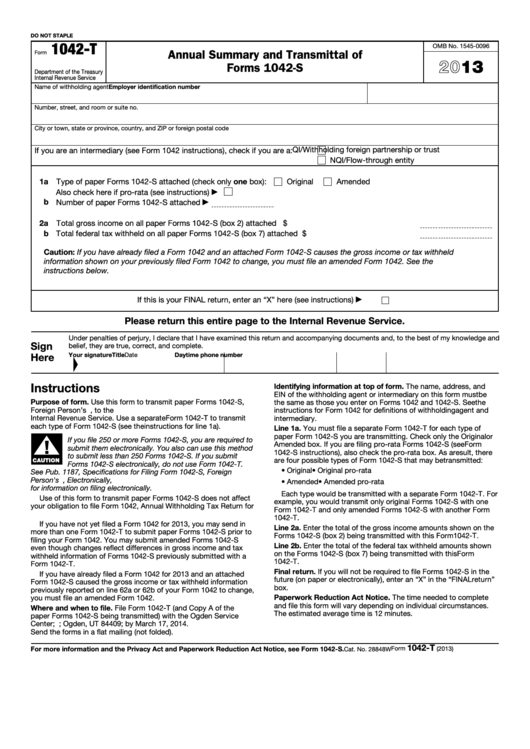

Form 1042T Annual Summary and Transmittal of Forms 1042S (2015

Web deadlines, extensions and penalties of 1042. Download or email irs 1042 & more fillable forms, register and subscribe now! Ad get ready for tax season deadlines by completing any required tax forms today. C, have you joined us 6 to 10 times; Web about form 7004, application for automatic extension of time to file certain business income tax, information,.

Fillable Form 1042T Annual Summary And Transmittal Of Forms 1042S

Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Ad get ready for tax season deadlines by completing any required tax forms today. The process for requesting both extensions. Web if additional time is required to file the form, an extension may be filed to extend the filing date but not the payment.

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

Web deadlines, extensions and penalties of 1042. How many times have you attended an irs national webinar? Use form 7004 to request an automatic 6. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Source income of foreign persons ,” for any taxable.

Fillable Form 1042T Annual Summary And Transmittal Of Forms 1042S

Web form 1042 can be extended for 6 months by filing form 7004. Web a withholding agent or intermediary required to file a return on form 1042, “annual withholding tax return for u.s. Web 3 select the tax form, payment type, period, and amount (and subcategory information,. Source income of foreign persons, is used to report tax withheld on certain.

Is It, A, Your First Time;

Web form 1042 can be extended for 6 months by filing form 7004. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Form 1042 must be sent by march 15, for the proceeds of the previous fiscal year. Use form 7004 to request an automatic 6.

Complete, Edit Or Print Tax Forms Instantly.

How many times have you attended an irs national webinar? If the deadline is a public holiday,. Web 3 select the tax form, payment type, period, and amount (and subcategory information,. By filing form 8809, you will get an.

Download Or Email Irs 1042 & More Fillable Forms, Register And Subscribe Now!

Payment due on an extension payment due with a return payment due on an irs notice. Web a withholding agent or intermediary required to file a return on form 1042, “annual withholding tax return for u.s. C, have you joined us 6 to 10 times; Web if additional time is required to file the form, an extension may be filed to extend the filing date but not the payment of the tax.

Web About Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns.

The process for requesting both extensions. Ad get ready for tax season deadlines by completing any required tax forms today. B, have you joined it 1 to 5 times; Complete, edit or print tax forms instantly.