Form 1065 Schedule K-3

Form 1065 Schedule K-3 - The 2022 form 1065 may also be used if: These instructions provide additional information specific to schedule k. Department of the treasury internal revenue service omb no. April 14, 2022 · 5 minute read. For calendar year 2022, or tax year beginning. Partner’s share of income, deductions, credits, etc.—. Web thomson reuters tax & accounting. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

Department of the treasury internal revenue service omb no. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year 2022, or tax year beginning. April 14, 2022 · 5 minute read. Web thomson reuters tax & accounting. Partner’s share of income, deductions, credits, etc.—. The 2022 form 1065 may also be used if: These instructions provide additional information specific to schedule k.

Web thomson reuters tax & accounting. For calendar year 2022, or tax year beginning. April 14, 2022 · 5 minute read. These instructions provide additional information specific to schedule k. Partner’s share of income, deductions, credits, etc.—. Department of the treasury internal revenue service omb no. The 2022 form 1065 may also be used if: Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

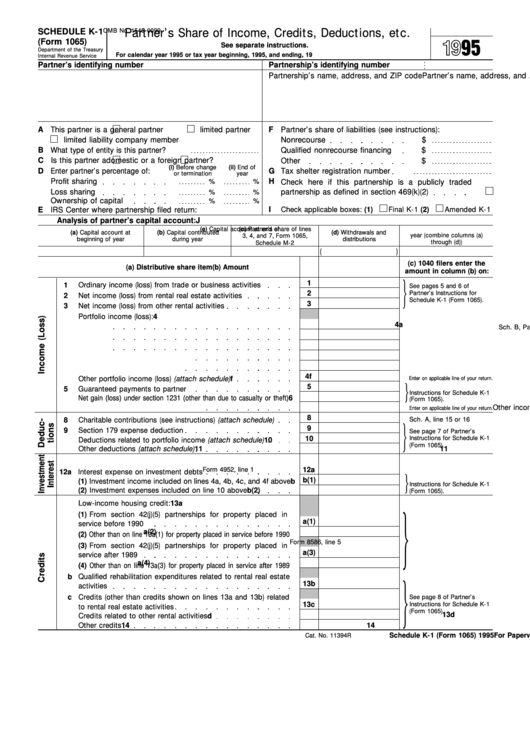

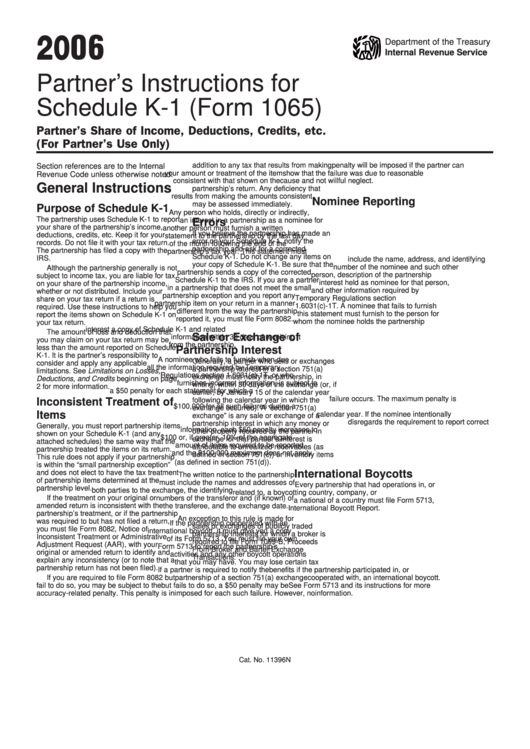

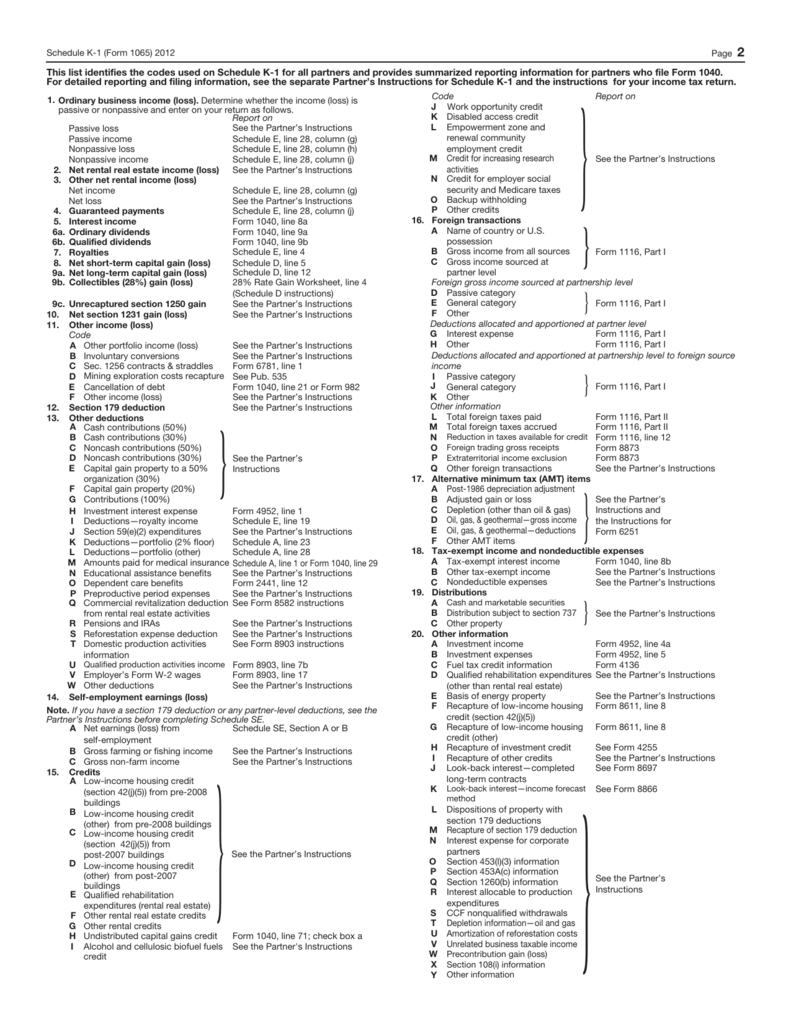

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Web thomson reuters tax & accounting. The 2022 form 1065 may also be used if: For calendar year 2022, or tax year beginning. These instructions provide additional information specific to schedule k. April 14, 2022 · 5 minute read.

How To Complete Form 1065 With Instructions

For calendar year 2022, or tax year beginning. Web thomson reuters tax & accounting. These instructions provide additional information specific to schedule k. April 14, 2022 · 5 minute read. Department of the treasury internal revenue service omb no.

2012 Form 1065 (Schedule K1)

Partner’s share of income, deductions, credits, etc.—. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year 2022, or tax year beginning. These instructions provide additional information specific to schedule k. The 2022 form 1065 may also be used if:

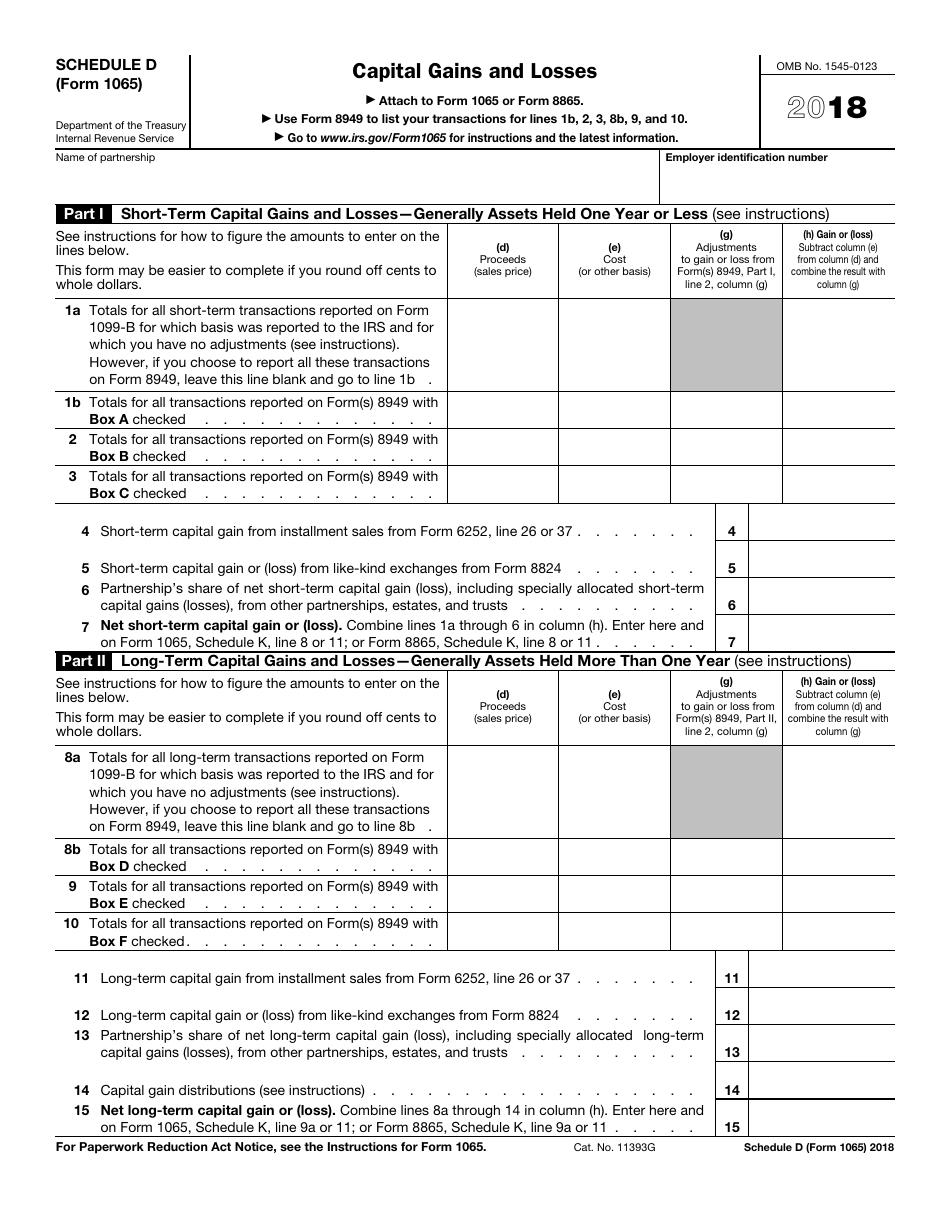

IRS Form 1065 Schedule D Download Fillable PDF or Fill Online Capital

For calendar year 2022, or tax year beginning. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Department of the treasury internal revenue service omb no. These instructions provide additional information specific to schedule k. Web thomson reuters tax & accounting.

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Department of the treasury internal revenue service omb no. The 2022 form 1065 may also be used if: Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. April 14, 2022 · 5 minute read. For calendar year 2022, or tax year beginning.

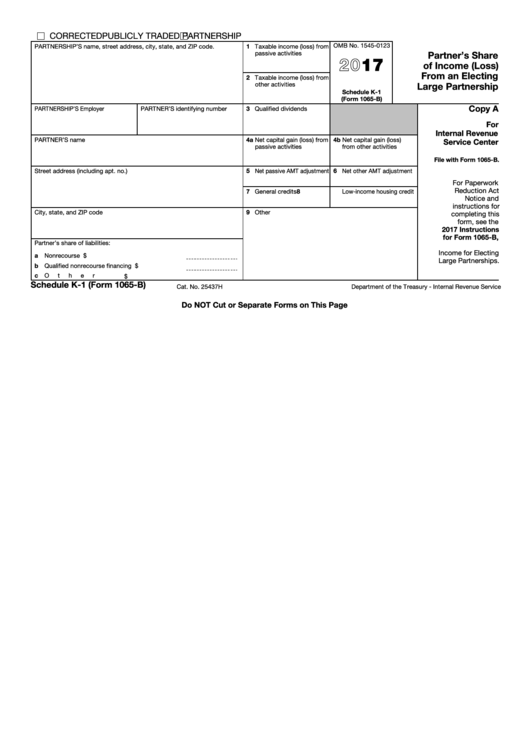

Fillable Schedule K1 (Form 1065B) Partner'S Share Of (Loss

Partner’s share of income, deductions, credits, etc.—. These instructions provide additional information specific to schedule k. For calendar year 2022, or tax year beginning. Web thomson reuters tax & accounting. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

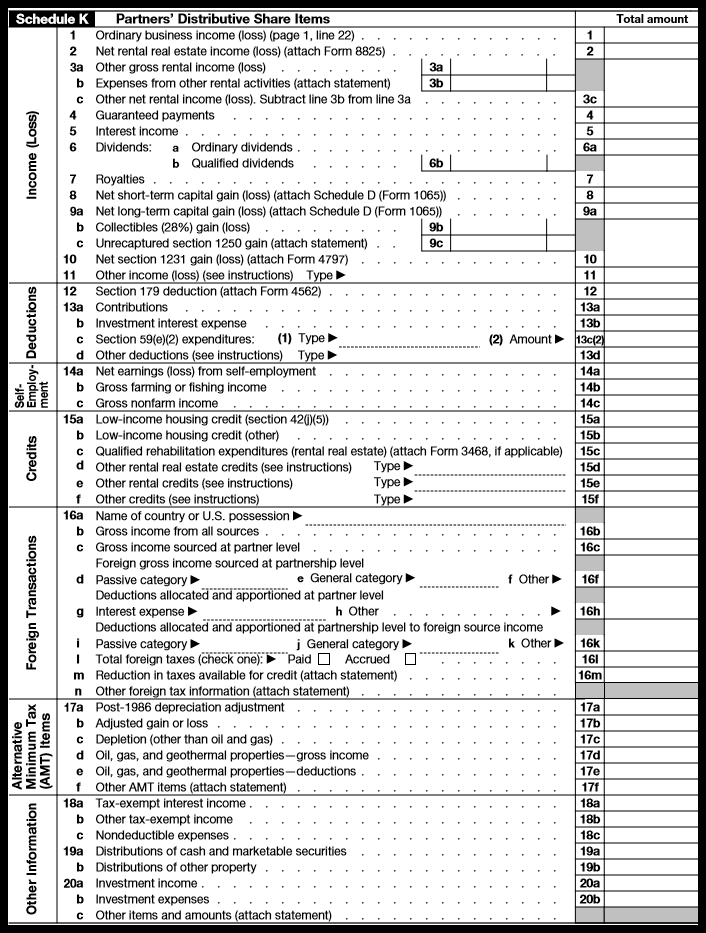

Schedule K1 (Form 1065) Partner'S Share Of Credits

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Partner’s share of income, deductions, credits, etc.—. Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read. The 2022 form 1065 may also be used if:

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

These instructions provide additional information specific to schedule k. Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Department of the treasury internal revenue service omb no.

Form 1065 (Schedule K1) Partner's Share of Deductions and

The 2022 form 1065 may also be used if: Department of the treasury internal revenue service omb no. These instructions provide additional information specific to schedule k. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year 2022, or tax year beginning.

Llc Tax Form 1065 Universal Network

For calendar year 2022, or tax year beginning. April 14, 2022 · 5 minute read. Web thomson reuters tax & accounting. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. These instructions provide additional information specific to schedule k.

April 14, 2022 · 5 Minute Read.

For calendar year 2022, or tax year beginning. These instructions provide additional information specific to schedule k. The 2022 form 1065 may also be used if: Partner’s share of income, deductions, credits, etc.—.

Web The 2022 Form 1065 Is An Information Return For Calendar Year 2022 And Fiscal Years That Begin In 2022 And End In 2023.

Web thomson reuters tax & accounting. Department of the treasury internal revenue service omb no.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/word-image-743.png)