Form 1065 Schedule M-2 Instructions

Form 1065 Schedule M-2 Instructions - This line has gone through a few changes in the past years, including; If the partnership's principal business, office, or agency is located in: And the total assets at the end of the. Part i, line 11, must equal part ii, line 26, column (a); Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. Analysis of partners' capital accounts.54 codes for. They go on to state if net. Beginning with tax years ending on or after. Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner.

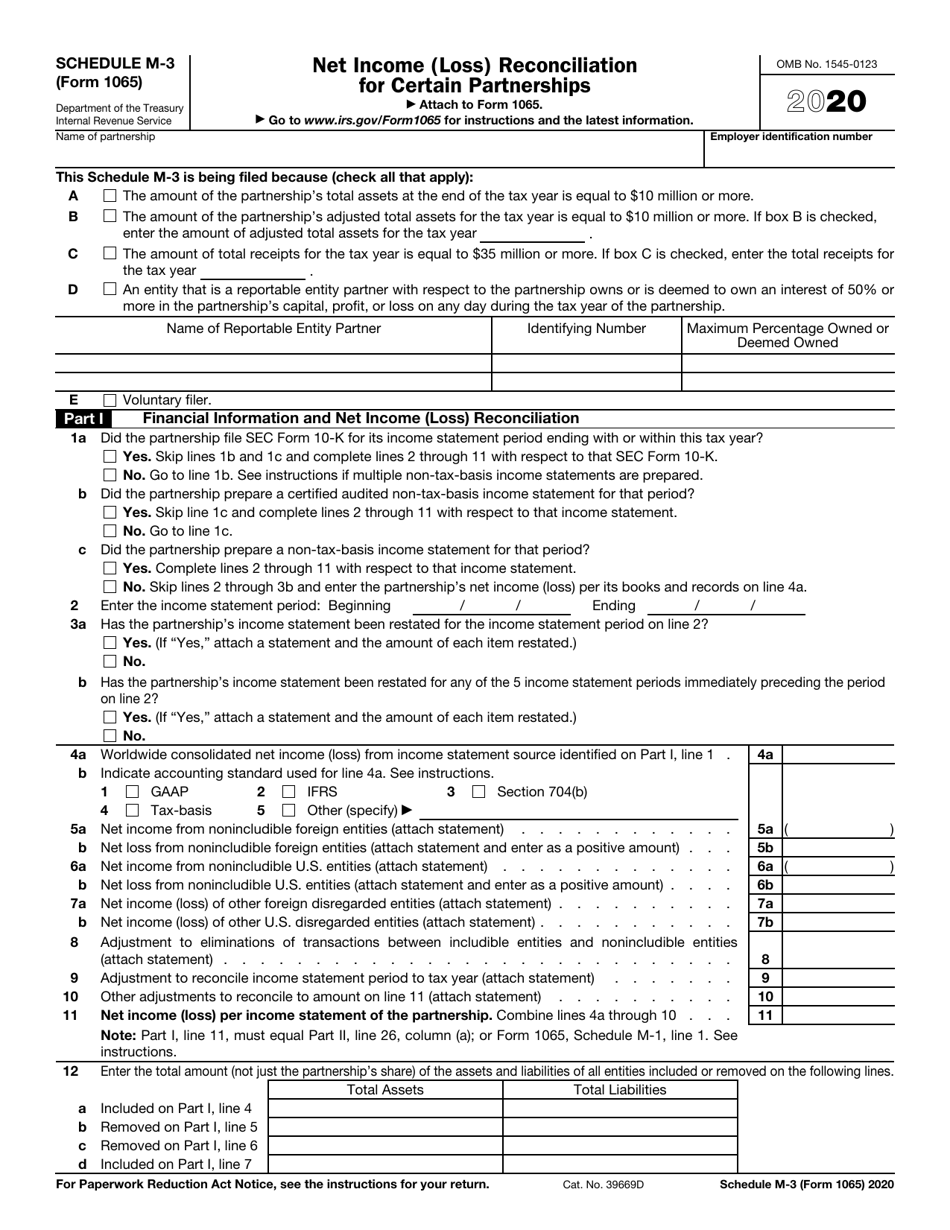

Part i, line 11, must equal part ii, line 26, column (a); Beginning with tax years ending on or after. This line has gone through a few changes in the past years, including; Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. They go on to state if net. Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Analysis of partners' capital accounts.54 codes for. Web since tax year 2021, federal form 1065 instructions for line 3 have been modified. Web go to www.irs.gov/form1065 for instructions and the latest information. December 2021) net income (loss) reconciliation.

And the total assets at the end of the. Web find irs mailing addresses by state to file form 1065. Analysis of partners' capital accounts.54 codes for. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers to calculate partner. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. Analysis of partners' capital accounts. Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. Beginning with tax years ending on or after. This line has gone through a few changes in the past years, including; December 2021) net income (loss) reconciliation.

Form 7 Analysis Of Net Five Secrets About Form 7 Analysis Of Net

Web find irs mailing addresses by state to file form 1065. This line has gone through a few changes in the past years, including; Analysis of partners' capital accounts. December 2021) net income (loss) reconciliation. If the partnership's principal business, office, or agency is located in:

Llc Tax Form 1065 Universal Network

This line has gone through a few changes in the past years, including; Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. If the partnership's principal business, office, or agency is located in: They go on to.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

December 2021) net income (loss) reconciliation. Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Web go to www.irs.gov/form1065 for instructions and the latest information. Part i, line 11, must equal part ii, line 26, column (a); Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner.

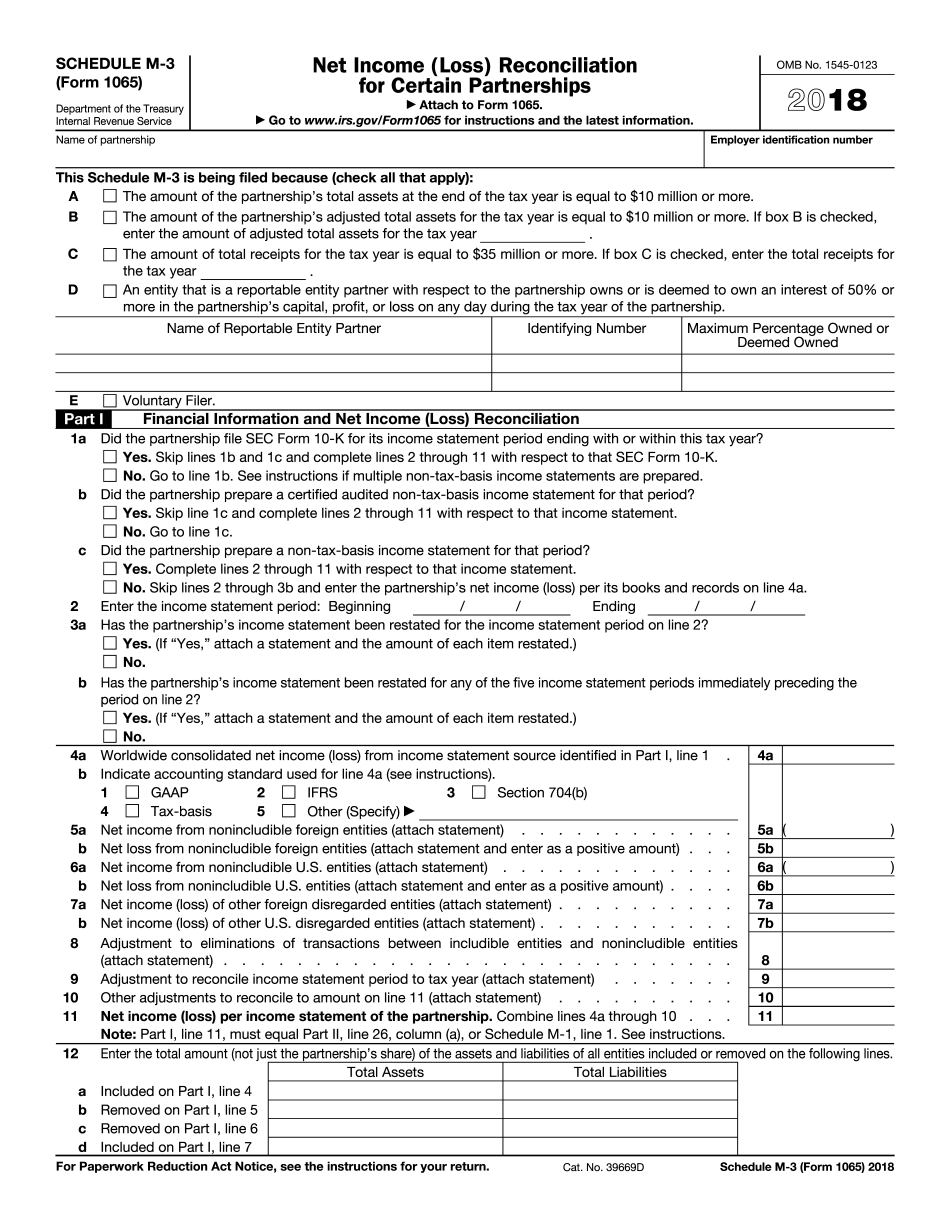

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

They go on to state if net. If the partnership's principal business, office, or agency is located in: Analysis of partners' capital accounts.54 codes for. Beginning with tax years ending on or after. Part i, line 11, must equal part ii, line 26, column (a);

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

Beginning with tax years ending on or after. December 2021) net income (loss) reconciliation. Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax year 2020, taxpayers.

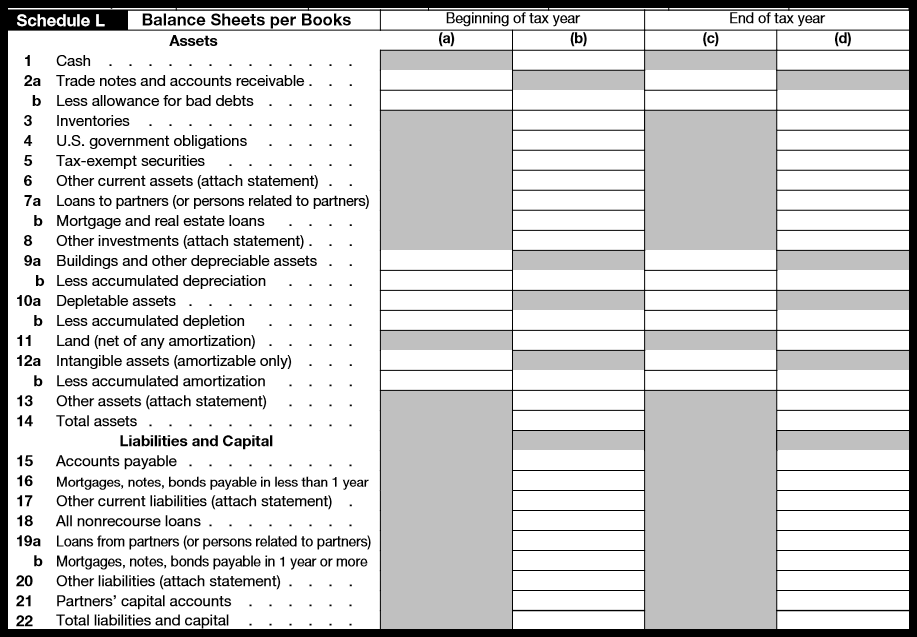

1120 EF Message 0042 Schedule M2 is out of Balance (M1, M2, ScheduleL)

Beginning with tax years ending on or after. This line has gone through a few changes in the past years, including; If the partnership's principal business, office, or agency is located in: Part i, line 11, must equal part ii, line 26, column (a); Web since tax year 2021, federal form 1065 instructions for line 3 have been modified.

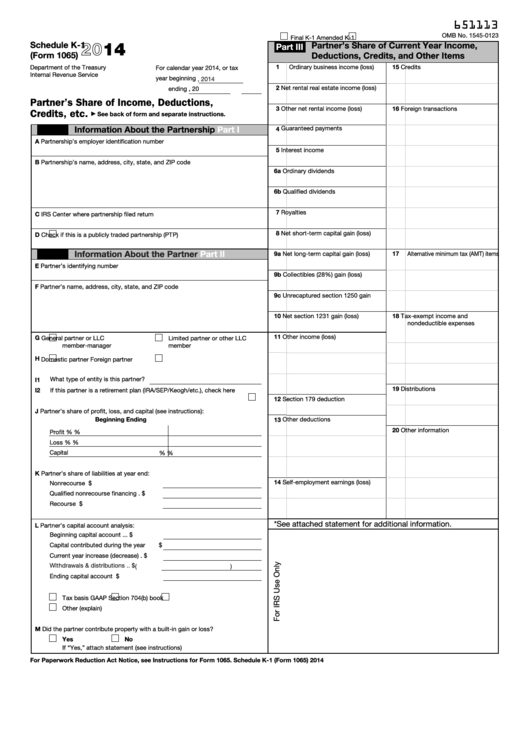

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Part i, line 11, must equal part ii, line 26, column (a); Analysis of partners' capital accounts. And the total assets at the end of the. This line has gone through a few changes in the past years, including; Web since tax year 2021, federal form 1065 instructions for line 3 have been modified.

IRS Form 1065 Schedule M3 Download Fillable PDF or Fill Online Net

Part i, line 11, must equal part ii, line 26, column (a); Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. This line has gone through a few changes in the past years, including; Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting.

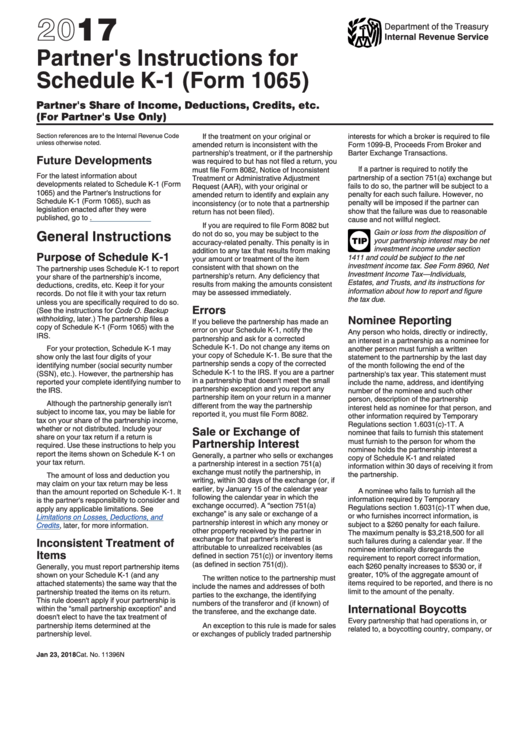

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

This line has gone through a few changes in the past years, including; Analysis of partners' capital accounts. Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return. And the total assets at the end of the. Web on october 22, 2020 and january 14, 2021, the irs released form 1065 draft instructions that would require, for the tax.

Form 1065 (Schedule K1) Partner's Share of Deductions and

This line has gone through a few changes in the past years, including; This line has gone through a few changes in the past years, including; They go on to state if net. Web go to www.irs.gov/form1065 for instructions and the latest information. And the total assets at the end of the.

Part I, Line 11, Must Equal Part Ii, Line 26, Column (A);

Web go to www.irs.gov/form1065 for instructions and the latest information. If the partnership's principal business, office, or agency is located in: Web for tax year 2021, federal form 1065 instructions for line 3 have been modified. Web since tax year 2021, federal form 1065 instructions for line 3 have been modified.

Web On October 22, 2020 And January 14, 2021, The Irs Released Form 1065 Draft Instructions That Would Require, For The Tax Year 2020, Taxpayers To Calculate Partner.

They go on to state if net. Beginning with tax years ending on or after. Web find irs mailing addresses by state to file form 1065. December 2021) net income (loss) reconciliation.

Analysis Of Partners' Capital Accounts.54 Codes For.

Web the irs updated the form 1065 instructions for tax year 2020 to reflect changes to partner capital account reporting requirements. And the total assets at the end of the. This line has gone through a few changes in the past years, including; Analysis of partners' capital accounts.

This Line Has Gone Through A Few Changes In The Past Years, Including;

Reconciliation of income \⠀䰀漀猀猀尩 per books with income \⠀䰀漀猀猀尩 per return.