Form 1099 Due Date

Form 1099 Due Date - Employers and other businesses should be sure to make this. Tax payers submit payments in box eight or box 10 of the tax form; The short answer is usually january 31st, but it depends on the specific 1099. Web the path act, p.l. If february 28 or 29 falls on. Web the deadline for most of the 1099 forms is january 31st of the tax year. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the due date for paper filing form 1099 is january 31st, 2022. If you are filing through paper forms, the due date is february 28. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

Employers and other businesses should be sure to make this. Web the path act, p.l. Web the deadline for most of the 1099 forms is january 31st of the tax year. While the irs has extended the deadline from january 31st to february. Tax payers submit payments in box eight or box 10 of the tax form; These due dates for information. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to january 31 and. 5 need to know facts. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web 22 rows the form 1099 misc recipient copy deadline is january 31.

Web due date to recipient: These due dates for information. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web the due date for paper filing form 1099 is january 31st, 2022. Web the deadline for most of the 1099 forms is january 31st of the tax year. Web being a responsible employer, it’s important to prepare and issue 1099s to the recipients, and file them to irs without any delay. Web so, when are 1099 due? Web the path act, p.l. 5 need to know facts. Employers and other businesses should be sure to make this.

Form 1099 Misc Due Date Universal Network

If you are filing through paper forms, the due date is february 28. 1099 misc form with box 8 & 10: Employers and other businesses should be sure to make this. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web being a responsible employer, it’s important to prepare and issue 1099s to.

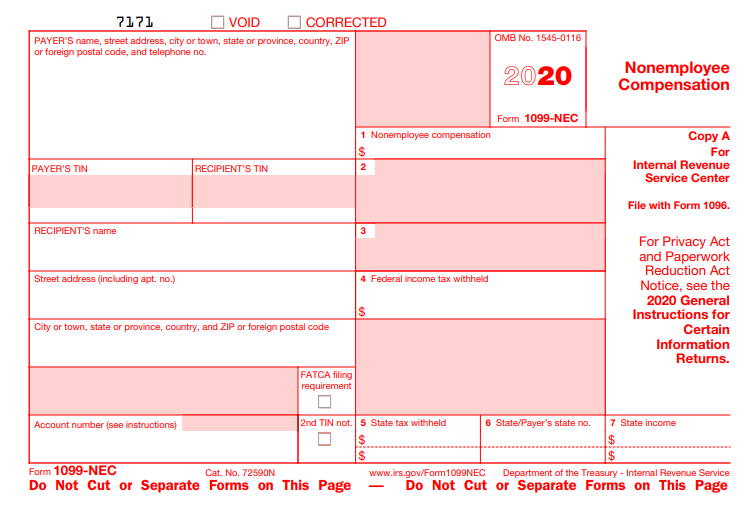

IRS Form 1099NEC Due Date 1099NEC Deadline for 2020

Recipient copy (no data in box 8 or 10) jan 31, 2023. If february 28 or 29 falls on. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to january 31 and. Web the due date for paper filing form 1099 is january 31st, 2022. If you are filing through paper forms,.

Irs 1099 Form Due Date 2015 Form Resume Examples

These due dates for information. If february 28 or 29 falls on. Web due date to recipient: Web the deadline for most of the 1099 forms is january 31st of the tax year. Web this guide explains the filing due date for different 1099 forms and explains other important things freelancers and independent contractors need to know about these tax.

Irs 1099 Forms Due Date Form Resume Examples

If february 28 or 29 falls on. Recipient copy (with data in box. Web 22 rows the form 1099 misc recipient copy deadline is january 31. Web this guide explains the filing due date for different 1099 forms and explains other important things freelancers and independent contractors need to know about these tax forms. While the irs has extended the.

Form1099NEC

These due dates for information. 5 need to know facts. Employers and other businesses should be sure to make this. Tax payers submit payments in box eight or box 10 of the tax form; Web being a responsible employer, it’s important to prepare and issue 1099s to the recipients, and file them to irs without any delay.

When is tax form 1099MISC due to contractors? GoDaddy Blog

201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to january 31 and. 1099 misc form with box 8 & 10: While the irs has extended the deadline from january 31st to february. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. If february 28.

1099s Due February 1st, 2021 Guidelines RTW Xxact

Web due date to recipient: 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to january 31 and. Web the due date for paper filing form 1099 is january 31st, 2022. If february 28 or 29 falls on. Web being a responsible employer, it’s important to prepare and issue 1099s to the.

IRS Form 1099 Reporting for Small Business Owners

201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to january 31 and. Recipient copy (no data in box 8 or 10) jan 31, 2023. Web the deadline for most of the 1099 forms is january 31st of the tax year. Ap leaders rely on iofm’s expertise to keep them up to.

Efile 2022 Form 1099R Report the Distributions from Pensions

Employers and other businesses should be sure to make this. If february 28 or 29 falls on. Web the path act, p.l. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. 1099 misc form with box 8 & 10:

What is a 1099Misc Form? Financial Strategy Center

1099 misc form with box 8 & 10: While the irs has extended the deadline from january 31st to february. Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The electronic filing due.

Web The Due Date For The 1099 Tax Form’s Electronic Filing Is 31 St March Of The 2022 Tax Year.

Web 22 rows the form 1099 misc recipient copy deadline is january 31. Tax payers submit payments in box eight or box 10 of the tax form; Web this guide explains the filing due date for different 1099 forms and explains other important things freelancers and independent contractors need to know about these tax forms. While the irs has extended the deadline from january 31st to february.

If February 28 Or 29 Falls On.

5 need to know facts. 1099 misc form with box 8 & 10: Recipient copy (no data in box 8 or 10) jan 31, 2023. Web the path act, p.l.

Recipient Copy (With Data In Box.

If you are filing through paper forms, the due date is february 28. Web deadlines for irs form 1099misc: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web due date to recipient:

Web So, When Are 1099 Due?

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The electronic filing due date is. These due dates for information. Web being a responsible employer, it’s important to prepare and issue 1099s to the recipients, and file them to irs without any delay.