Form 1099 F

Form 1099 F - June 4, 2019 5:49 pm. Web what is a 1099 form? For internal revenue service center. You are engaged in a trade. If you have a profit or a loss, it gets. Learn more about how to simplify your businesses 1099 reporting. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. A 1099 is a tax. At or before closing, you must request from. You are not engaged in a trade or business.

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web what is a 1099 form? Web you'll receive a form 1099 if you earned money from a nonemployer source. Web you are not required to file information return (s) if any of the following situations apply: For internal revenue service center. Learn more about how to simplify your businesses 1099 reporting. What form are you referring to, federal or state? For internal revenue service center. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040.

Form 1099 is one of several irs tax forms (see the variants section) used in the united states to. You are not engaged in a trade or business. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. Web i have recieved a form 1099f from the title company. June 4, 2019 5:49 pm. Web you'll receive a form 1099 if you earned money from a nonemployer source. You are engaged in a trade. For internal revenue service center. Certain fishing boat crewmembers created date: Ad success starts with the right supplies.

Form 1099R Definition

Web 6 rows use schedule f (form 1040) to report farm income and expenses. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to. Web i have recieved a form 1099f from the title company. You are not engaged in a trade or business. File it with form 1040,.

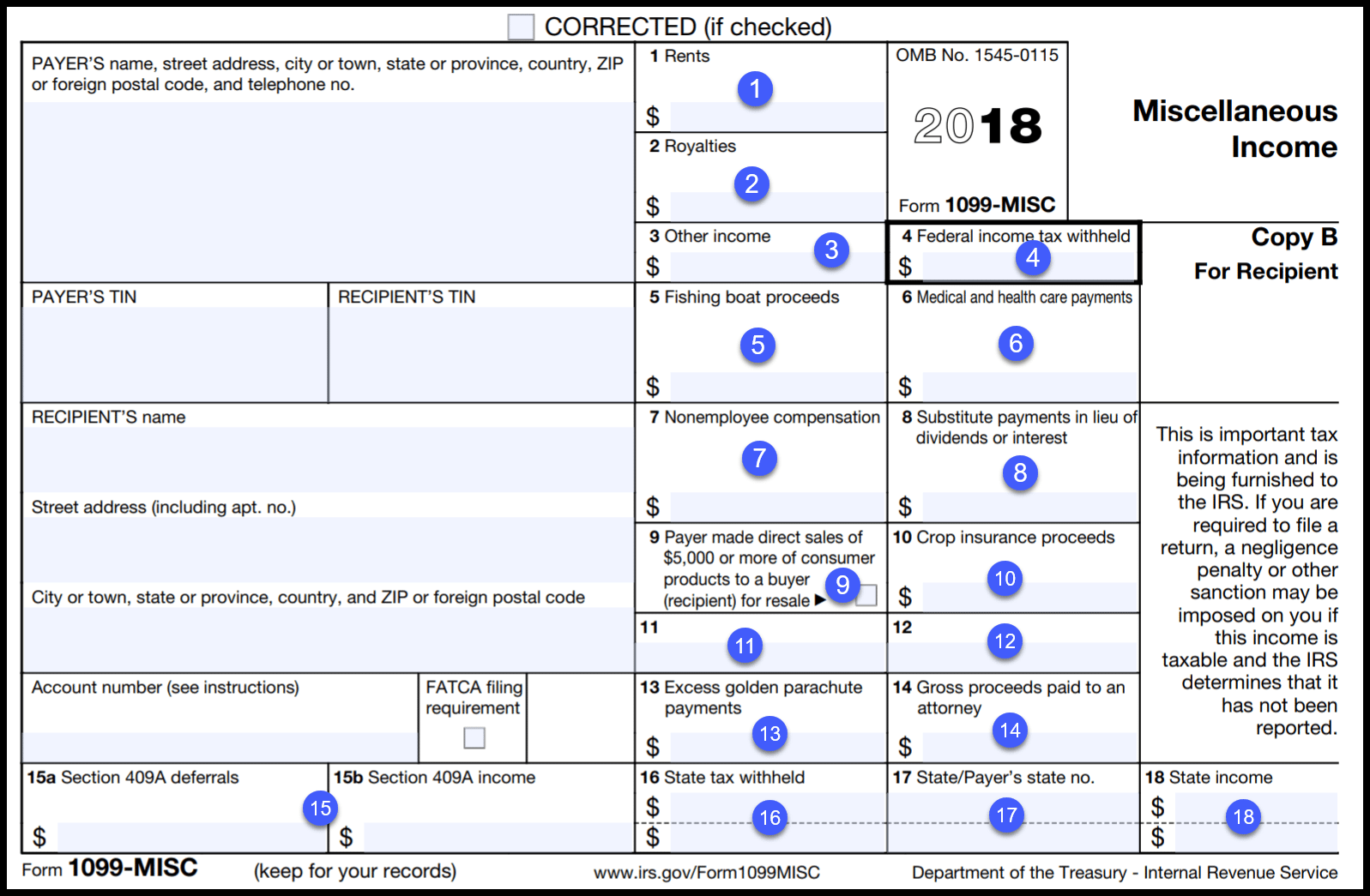

IRS Form 1099 Reporting for Small Business Owners

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to. Web form 1099 is one of several irs tax forms (see the variants section) used in the united.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Web you'll receive a form 1099 if you earned money from a nonemployer source. At or before closing, you must request from. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to. Web what is a 1099 form? What form are you referring to, federal or state?

1099 NEC Form 2022

From the latest tech to workspace faves, find just what you need at office depot®! What form are you referring to, federal or state? At or before closing, you must request from. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. For internal revenue service center.

Irs Printable 1099 Form Printable Form 2022

Certain fishing boat crewmembers created date: If you have a profit or a loss, it gets. Web 6 rows use schedule f (form 1040) to report farm income and expenses. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. File it with form 1040,.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

If you have a profit or a loss, it gets. A 1099 is a tax. You are engaged in a trade. What form are you referring to, federal or state? The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that.

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

Ad success starts with the right supplies. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. June 4, 2019 5:49 pm. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to. Web you'll receive a form 1099 if you.

What is a 1099Misc Form? Financial Strategy Center

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web you are not required to file information return (s) if any of the following situations apply: What form are you referring to, federal or state? For internal revenue service center. Web 6 rows use schedule f.

Form 1099MISC for independent consultants (6 step guide)

Ad success starts with the right supplies. Learn more about how to simplify your businesses 1099 reporting. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Here are some common types of 1099 forms: For internal revenue service center.

Here Are Some Common Types Of 1099 Forms:

Learn more about how to simplify your businesses 1099 reporting. What form are you referring to, federal or state? Web 6 rows use schedule f (form 1040) to report farm income and expenses. From the latest tech to workspace faves, find just what you need at office depot®!

You Are Not Engaged In A Trade Or Business.

At or before closing, you must request from. For internal revenue service center. File it with form 1040,. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to.

Web I Have Recieved A Form 1099F From The Title Company.

Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web schedule f ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. You are engaged in a trade. June 4, 2019 5:49 pm.

Ad Success Starts With The Right Supplies.

Web you are not required to file information return (s) if any of the following situations apply: Certain fishing boat crewmembers created date: Web you'll receive a form 1099 if you earned money from a nonemployer source. If you have a profit or a loss, it gets.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)