Form 1099 G Virginia

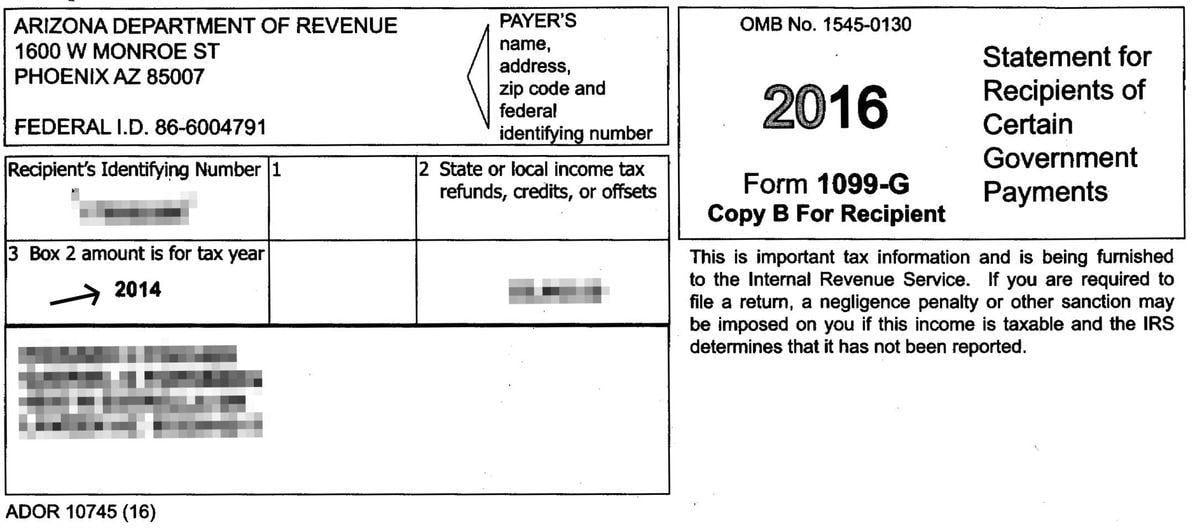

Form 1099 G Virginia - Web welcome to the claimant self service portal. Total virginia state tax withheld: From the latest tech to workspace faves, find just what you need at office depot®! For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. Complete, edit or print tax forms instantly. This new service is available through the. Web the virginia department of taxation jan. The virginia employment commission has mailed out form 1099g to applicable customers who had. Web instructions for recipient recipient’s taxpayer identification number (tin).

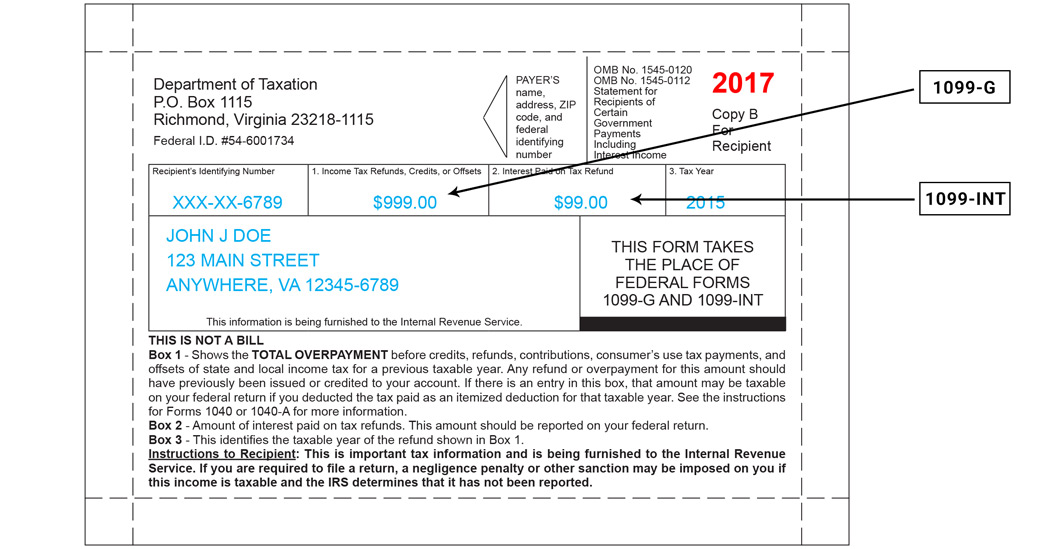

Web form 1099g/1099int now available online all individual income taxpayers now have access to form 1099g/1099int electronically. Web virginia department of taxation. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. Complete your registration with the state. Web welcome to the claimant self service portal. Ad success starts with the right supplies. Reminder that your 1099g information is now available electronically! From the latest tech to workspace faves, find just what you need at office depot®! Find them all in one convenient place. Web instructions for recipient recipient’s taxpayer identification number (tin).

The virginia employment commission has mailed out form 1099g to applicable customers who had. The form 1099g is a report of income you received from. As a registered claimant, you can: Web go to the irs website. Web form 1099g/1099int now available online all individual income taxpayers now have access to form 1099g/1099int electronically. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. Total virginia state tax withheld: The virginia employment commission will send you (and the irs) form 1099g at the year’s end detailing the benefits you received plus any federal tax. Web instructions for recipient recipient’s taxpayer identification number (tin). Web virginia department of taxation.

Your 1099G/1099INT What You Need to Know Virginia Tax

Easily fill out pdf blank, edit, and sign them. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. Save or instantly send your ready documents. As a registered claimant, you can: Web instructions for recipient recipient’s taxpayer identification number (tin).

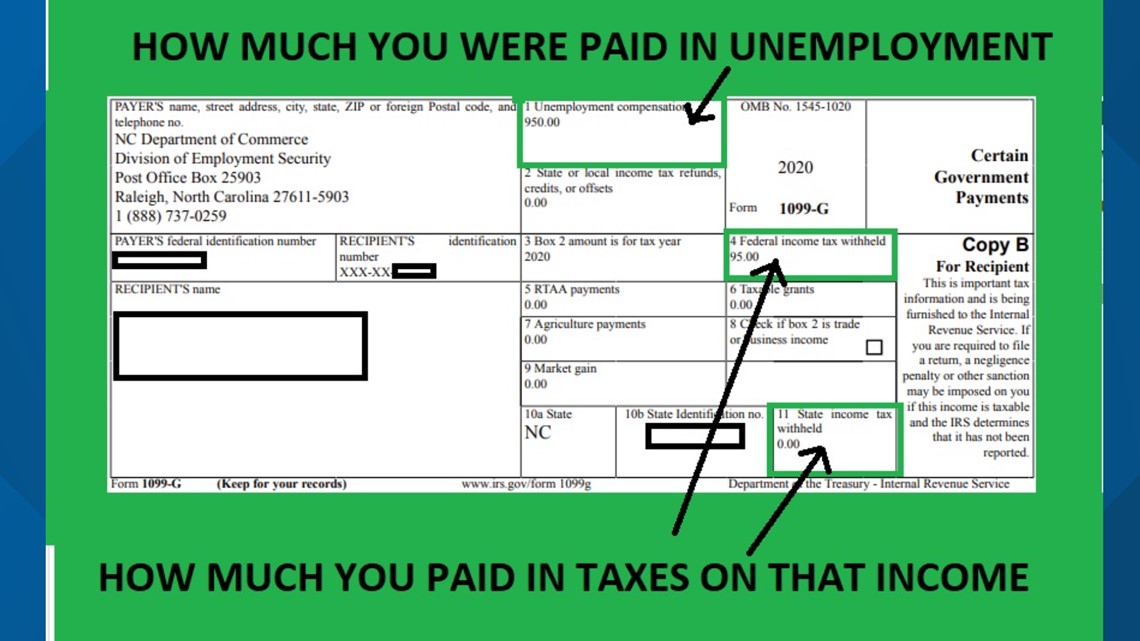

When Will I Get My 1099 G From Unemployment

The virginia employment commission will send you (and the irs) form 1099g at the year’s end detailing the benefits you received plus any federal tax. The form 1099g is a report of income you received from. As a registered claimant, you can: Find them all in one convenient place. Complete, edit or print tax forms instantly.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web instructions for recipient recipient’s taxpayer identification number (tin). The form 1099g is a report of income you received from. Web instructions for recipient recipient’s taxpayer identification number (tin). The virginia employment commission will send you (and the irs) form 1099g at the year’s end detailing the benefits you received plus any federal tax. The virginia employment commission has mailed.

Unemployment fraud causes issues with 1099G forms for Kansans

Complete your registration with the state. Web go to the irs website. From the latest tech to workspace faves, find just what you need at office depot®! The form 1099g is a report of income you received from. Ad success starts with the right supplies.

How To Get 1099 G Form Online Iowa Nicolette Mill's Template

Ad get ready for tax season deadlines by completing any required tax forms today. The virginia employment commission has mailed out form 1099g to applicable customers who had. Web instructions for recipient recipient’s taxpayer identification number (tin). Easily fill out pdf blank, edit, and sign them. Web welcome to the claimant self service portal.

State Tax Department No Longer Sending 1099s West Virginia Public

The virginia employment commission has mailed out form 1099g to applicable customers who had. Ad get ready for tax season deadlines by completing any required tax forms today. Total virginia state tax withheld: Reminder that your 1099g information is now available electronically! Find them all in one convenient place.

Irs Form 1099 Contract Labor Form Resume Examples

The virginia employment commission has mailed out form 1099g to applicable customers who had. Web the virginia department of taxation jan. Web form 1099g/1099int now available online all individual income taxpayers now have access to form 1099g/1099int electronically. Web complete vec 1099 g virginia online with us legal forms. Web virginia department of taxation.

How Do I Get My 1099 G Form For Unemployment

You might need to go to your state’s unemployment. Web welcome to the claimant self service portal. Find them all in one convenient place. Complete your registration with the state. The virginia employment commission has mailed out form 1099g to applicable customers who had.

Why do the boxes on my 1099 R form not match the

Total virginia state tax withheld: You might need to go to your state’s unemployment. Easily fill out pdf blank, edit, and sign them. Ad get ready for tax season deadlines by completing any required tax forms today. Web welcome to the claimant self service portal.

Complete Your Registration With The State.

Web form 1099g/1099int now available online all individual income taxpayers now have access to form 1099g/1099int electronically. Total virginia state tax withheld: As a registered claimant, you can: The virginia employment commission has mailed out form 1099g to applicable customers who had.

Web Complete Vec 1099 G Virginia Online With Us Legal Forms.

The form 1099g is a report of income you received from. This new service is available through the. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. From the latest tech to workspace faves, find just what you need at office depot®!

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web welcome to the claimant self service portal. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or. Save or instantly send your ready documents. Web the virginia department of taxation jan.

Total Virginia State Tax Withheld:

Easily fill out pdf blank, edit, and sign them. The virginia employment commission will send you (and the irs) form 1099g at the year’s end detailing the benefits you received plus any federal tax. Web instructions for recipient recipient’s taxpayer identification number (tin). Reminder that your 1099g information is now available electronically!

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)

/do0bihdskp9dy.cloudfront.net/01-31-2021/t_a42990ff498143deb68cf9fcef90282f_name_file_1280x720_2000_v3_1_.jpg)

/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)