Form 1099 Patr

Form 1099 Patr - Distributions you received from a cooperative may be included in your income. Report any amounts shown in boxes 1, 2, 3, and 5 as income, on schedule f , schedule c , or form 4835 (farm rental income and expenses). If you have questions, work with a tax preparer or specialist. Get ready for tax season deadlines by completing any required tax forms today. This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. Complete, edit or print tax forms instantly. Cooperatives issue form 1099 patr to those taxpayers that received money from the cooperative. Ad complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

Report any amounts shown in boxes 1, 2, 3, and 5 as income, on schedule f , schedule c , or form 4835 (farm rental income and expenses). If you have questions, work with a tax preparer or specialist. Get ready for tax season deadlines by completing any required tax forms today. Follow the instructions to enter info about your farm; Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. Cooperatives issue form 1099 patr to those taxpayers that received money from the cooperative. It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories. Distributions you received from a cooperative may be included in your income.

Follow the instructions to enter info about your farm; Complete, edit or print tax forms instantly. If you have questions, work with a tax preparer or specialist. Get ready for tax season deadlines by completing any required tax forms today. Report any amounts shown in boxes 1, 2, 3, and 5 as income, on schedule f , schedule c , or form 4835 (farm rental income and expenses). Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories. Ad complete irs tax forms online or print government tax documents.

Form 1099PATR Taxable Distributions Received From Cooperatives Definition

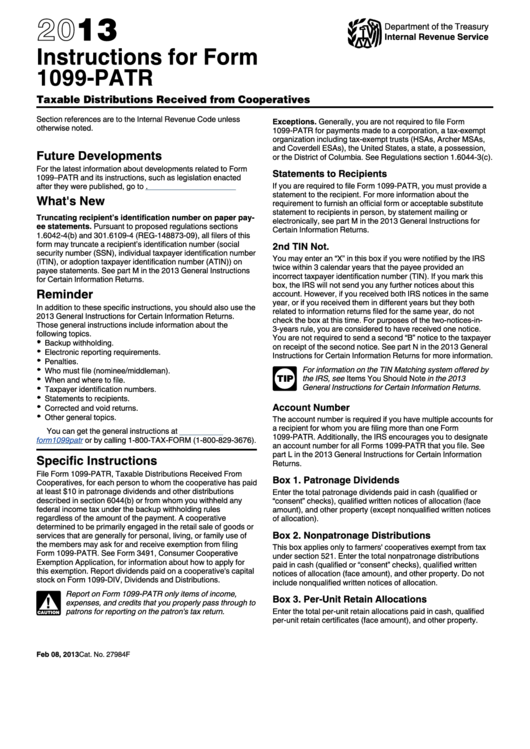

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. Taxpayers will receive these forms in january 2013 to report calendar year 2012 information to its patrons. If you have.

1099PATR Data Entry

Complete, edit or print tax forms instantly. Follow the instructions to enter info about your farm; This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. If you have questions, work with a tax preparer or specialist. Ad access irs tax forms.

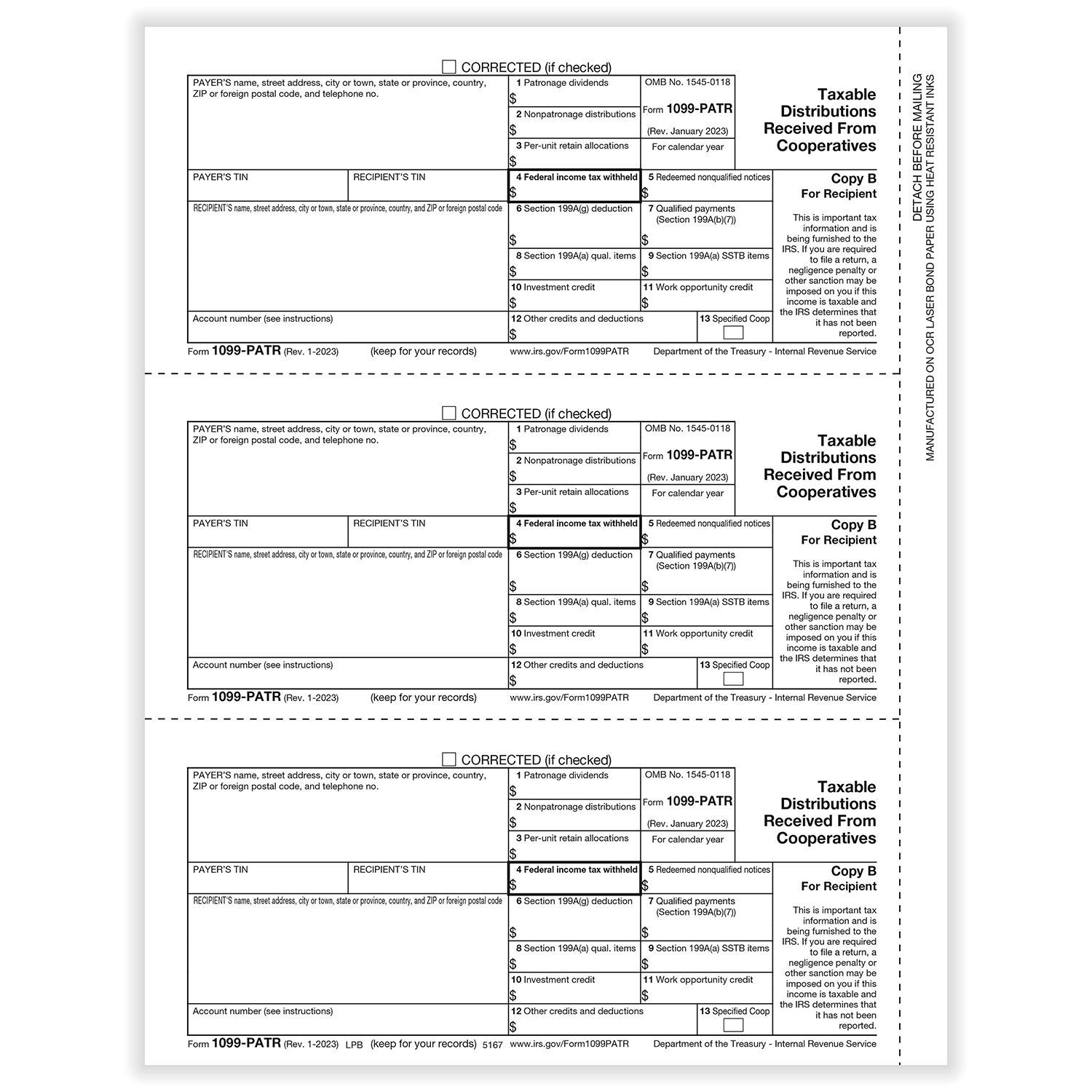

1099PATR Laser Recipient Copy B Item 895167

Get ready for tax season deadlines by completing any required tax forms today. This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories. Follow the instructions to enter info about your.

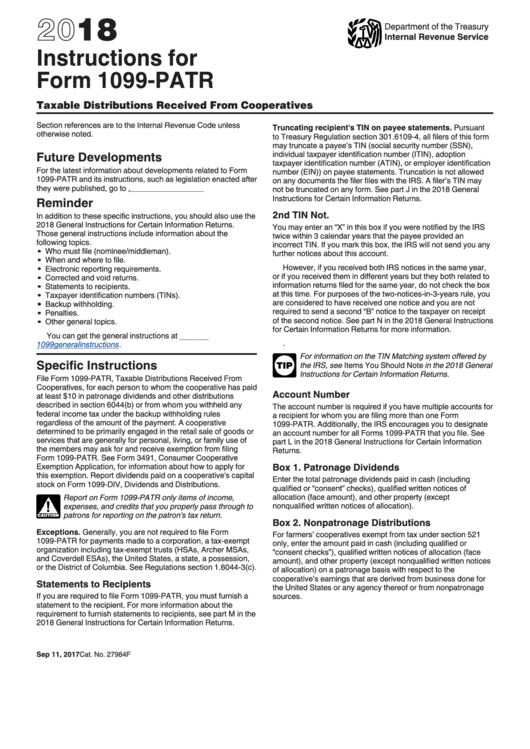

IRS Form 1099PATR 2018 2019 Fillable and Editable PDF Template

If you have questions, work with a tax preparer or specialist. It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents.

Instructions For Form 1099Patr 2018 printable pdf download

Get ready for tax season deadlines by completing any required tax forms today. Distributions you received from a cooperative may be included in your income. Get ready for tax season deadlines by completing any required tax forms today. It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories. Follow the instructions.

Instructions For Form 1099Patr 2013 printable pdf download

If you have questions, work with a tax preparer or specialist. Taxpayers will receive these forms in january 2013 to report calendar year 2012 information to its patrons. Follow the instructions to enter info about your farm; Complete, edit or print tax forms instantly. Ad access irs tax forms.

Form 1099PATR Taxable Distributions Received From Cooperatives, IRS Copy A

Ad complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by completing any required tax forms today. Taxpayers will receive these forms in january 2013 to report calendar year 2012 information to its patrons. Ad access irs tax forms. If you have questions, work with a tax preparer or specialist.

1099PATR Patronage Rec Copy B Cut Sheet (500 Forms/Pack)

Distributions you received from a cooperative may be included in your income. Ad complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. This form has a lot of information on it that affects.

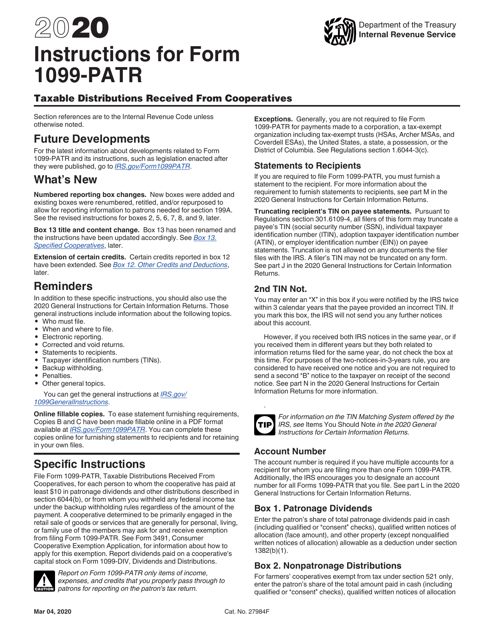

Download Instructions for IRS Form 1099PATR Taxable Distributions

If you have questions, work with a tax preparer or specialist. Cooperatives issue form 1099 patr to those taxpayers that received money from the cooperative. Ad access irs tax forms. Follow the instructions to enter info about your farm; It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories.

Form 1099PATR Taxable Distributions Received From Cooperatives

Report any amounts shown in boxes 1, 2, 3, and 5 as income, on schedule f , schedule c , or form 4835 (farm rental income and expenses). This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that. Ad access irs tax forms. If you have questions, work with a.

If You Have Questions, Work With A Tax Preparer Or Specialist.

Complete, edit or print tax forms instantly. Follow the instructions to enter info about your farm; Report any amounts shown in boxes 1, 2, 3, and 5 as income, on schedule f , schedule c , or form 4835 (farm rental income and expenses). Taxpayers will receive these forms in january 2013 to report calendar year 2012 information to its patrons.

Distributions You Received From A Cooperative May Be Included In Your Income.

It contains a significant amount of specific information that must be reported correctly and in the appropriate tax categories. Ad complete irs tax forms online or print government tax documents. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Cooperatives issue form 1099 patr to those taxpayers that received money from the cooperative. This form has a lot of information on it that affects an individual’s farm tax schedule, so it’s important that.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)