Form 1120 Business Activity Codes

Form 1120 Business Activity Codes - If you do not know the principal business. It conducts 100% of its business in. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless. What is the business activity code based. Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). Web corporations may have to file this schedule if, at any time during the tax year, they had assets in or operated a business in a foreign country or a u.s. Form 7004 (automatic extension of time to file); Also, the partner or shareholder needs. Web instructions for form 1120 u.s.

Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. What is the business activity code based. Principal business activity code (as pertains to. Web form 1120 principal business activity codes—2019 returns principal business activity codeslargest percentage of its “total receipts.” total receipts is 2a, 2b, and 2c. Choose the applicable code from the drop list or click in the field and. It has florida net income of $45,000 or less. Web instructions for form 1120 u.s. Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). Web instructions for form 1120 u.s. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless.

Form 7004 (automatic extension of time to file); Web form 1120 principal business activity codes—2019 returns principal business activity codeslargest percentage of its “total receipts.” total receipts is 2a, 2b, and 2c. Effective 01/23 page 1 of 6. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless. It has florida net income of $45,000 or less. Also, the partner or shareholder needs. What is the business activity code based. The instructions for form 1120s provide a list of business activity codes. Web instructions for form 1120 u.s. It conducts 100% of its business in.

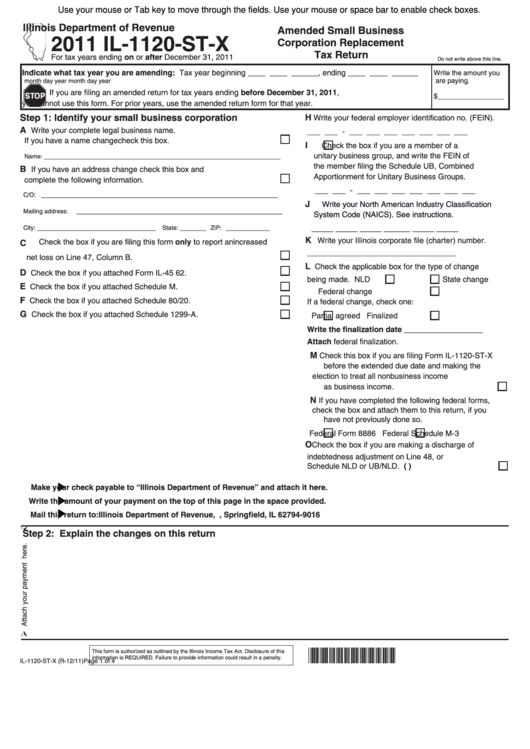

Fillable Form Il1120StX Amended Small Business Corporation

The instructions for form 1120s provide a list of business activity codes. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. It conducts 100% of its business in. What is the business activity code based. Web this list of principal business activities and their associated codes.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

Also, the partner or shareholder needs. Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). Web corporations may have to file this schedule if, at any time during the tax year, they had assets in or operated a business in a foreign country or a u.s. Corporation income tax return department.

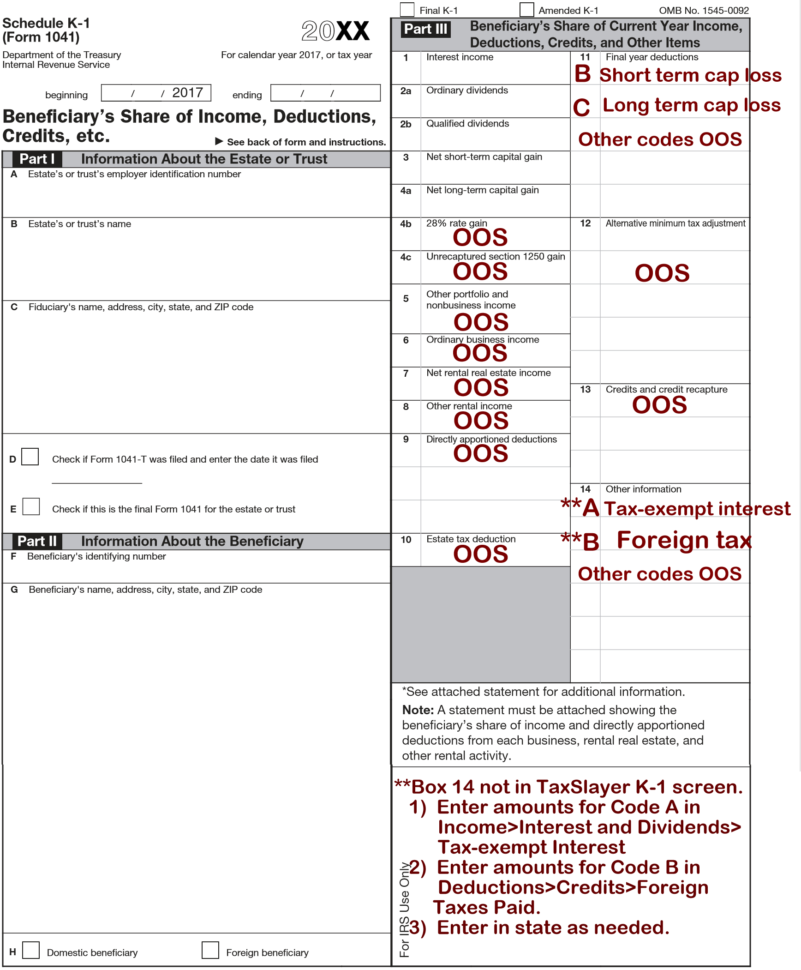

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Web this list of principal business activities and their associated codes is designed to classify an enterprise by the type of activity in which it is engaged to facilitate the administration. The instructions for form 1120s provide a list of business activity codes. Web form 1120 principal business activity codes—2019 returns principal business activity codeslargest percentage of its “total receipts.”.

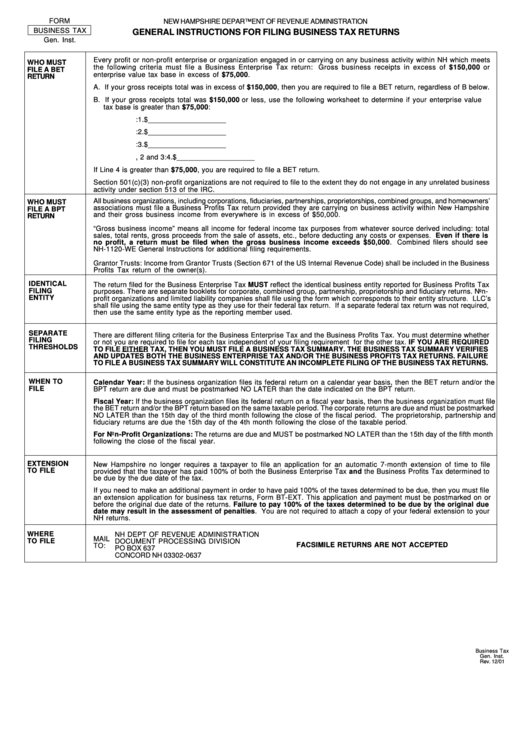

Form Business Tax General Instructions For Filing Business Tax

Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Effective 01/23 page 1 of 6. Choose the applicable code from the drop list or click in the field and. Web corporations may have to file this schedule if, at any time during the tax year, they.

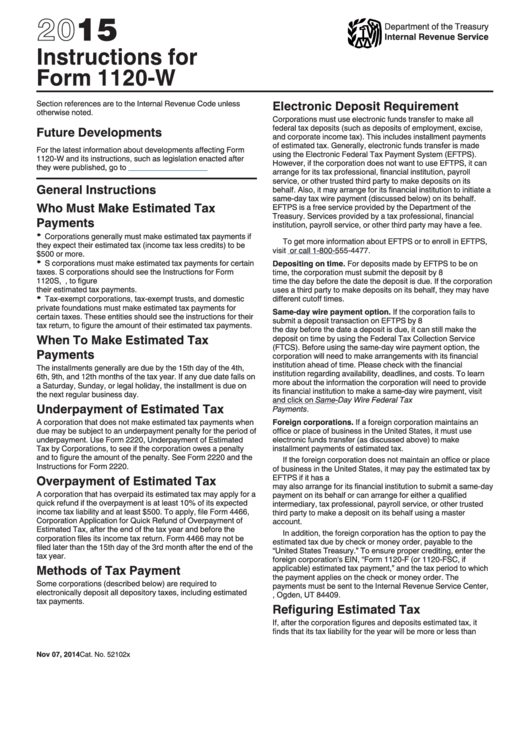

Instructions For Form 1120W Estimated Tax For Corporations 2015

Web instructions for form 1120 u.s. Web corporations may have to file this schedule if, at any time during the tax year, they had assets in or operated a business in a foreign country or a u.s. Web the principal business activity code for a company must be entered in order to file a business return electronically. Web 2 quickfinder®.

2001 HTML Instructions for Form 1120ICDISC, Schedules J, K, L, N, O and P

Also, the partner or shareholder needs. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless. Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). The instructions for form 1120s provide a list of business activity codes. Effective 01/23 page 1.

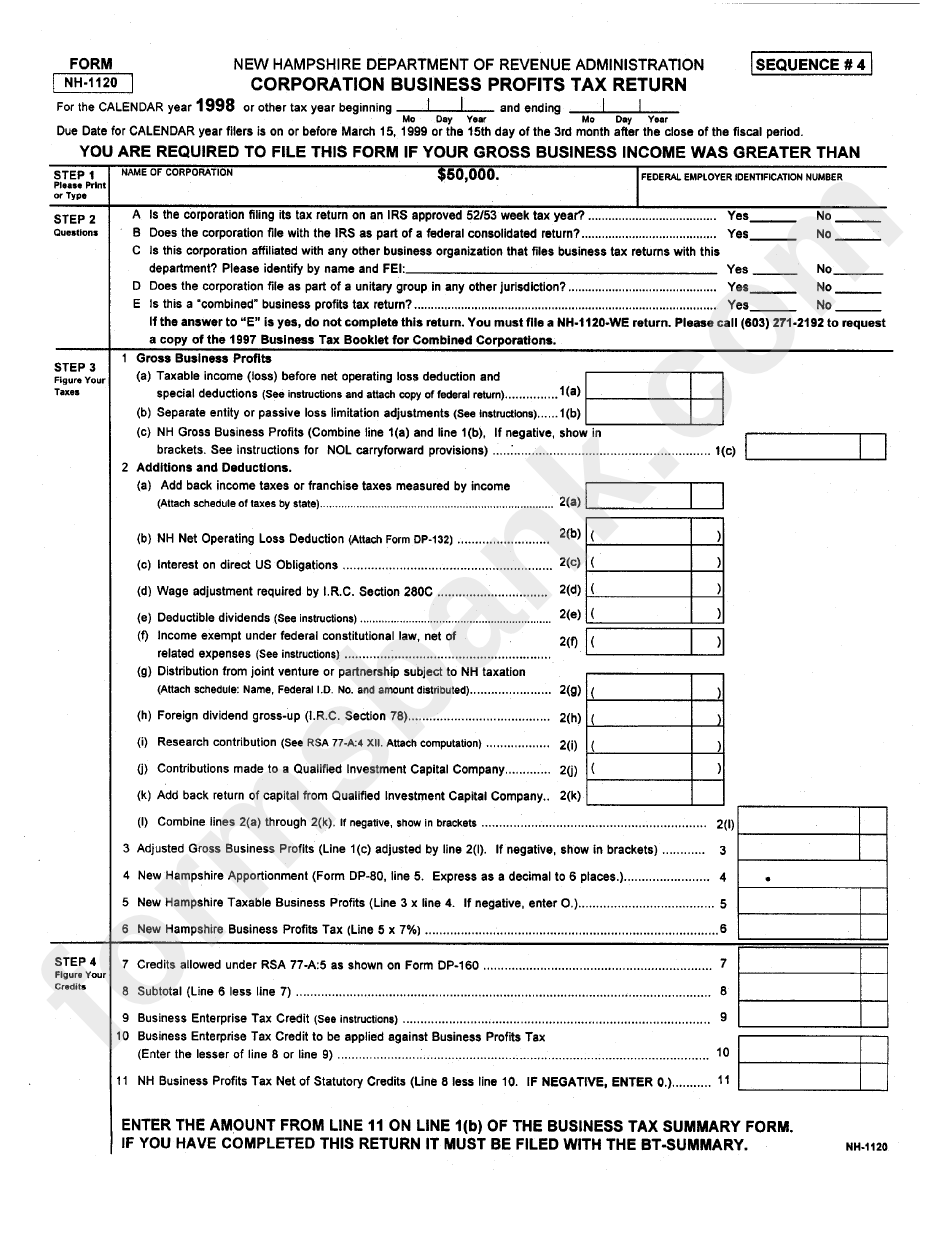

Fillable Form Nh1120 Corporation Business Profits Tax Return

What is the business activity code based. Web instructions for form 1120 u.s. Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless. Web instructions for form 1120 u.s.

Business Activity Code for Bloggers and Related Businesses in 2020

What is the business activity code based. It has florida net income of $45,000 or less. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless. If you do not know the principal business. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

Web this list of principal business activities and their associated codes is designed to classify an enterprise by the type of activity in which it is engaged to facilitate the administration. What is the business activity code based. Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). Web instructions for form.

Instructions for Form 1120ICDISC (12/2019) Internal Revenue Service

Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Also, the partner or shareholder needs. It has florida net income of $45,000 or less. What is the business activity code based. It conducts 100% of its business in.

Choose The Applicable Code From The Drop List Or Click In The Field And.

Web instructions for form 1120 u.s. Also, the partner or shareholder needs. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. What is the business activity code based.

Form 7004 (Automatic Extension Of Time To File);

The instructions for form 1120s provide a list of business activity codes. It conducts 100% of its business in. Web this list of principal business activities and their associated codes is designed to classify an enterprise by the type of activity in which it is engaged to facilitate the administration. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless.

Web Form 1120 Principal Business Activity Codes—2019 Returns Principal Business Activity Codeslargest Percentage Of Its “Total Receipts.” Total Receipts Is 2A, 2B, And 2C.

Web in an 1120, enter the business activity code on screen k schedule k other information (general tab). If you do not know the principal business. Effective 01/23 page 1 of 6. Principal business activity code (as pertains to.

Web Instructions For Form 1120 U.s.

Web the principal business activity code for a company must be entered in order to file a business return electronically. It has florida net income of $45,000 or less. Web corporations may have to file this schedule if, at any time during the tax year, they had assets in or operated a business in a foreign country or a u.s. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless.