Form 1120-X

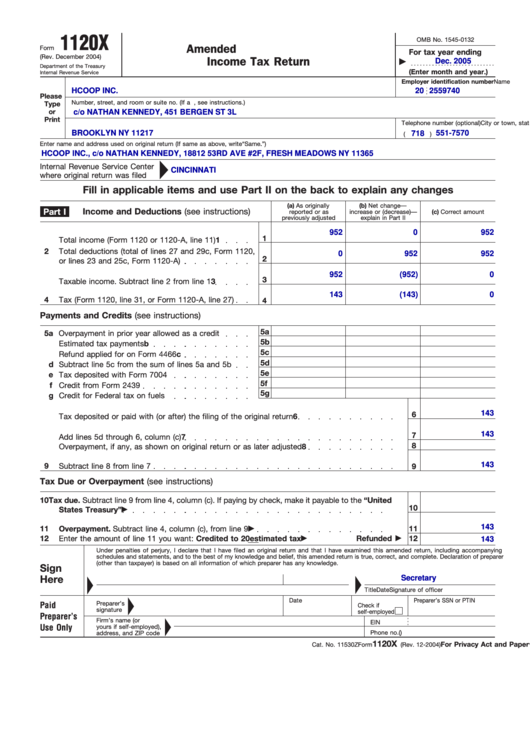

Form 1120-X - Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Corporation income tax return, including recent updates, related forms, and instructions on how to file. You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable. It often takes 3 to 4 months to process form 1120x. Disclose information for each reportable transaction in which the corporation participated. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. It often takes 3 to 4 months to process form 1120x. Solved•by intuit•updated september 22, 2022. Web form 1120x, amended u.s.

Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t) (mandatory). Or, you may need to amend your form if you claimed a deduction you. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. You will need a digital or printed copy of your original return to copy from. It often takes 3 to 4 months to process form 1120x. Solved•by intuit•updated september 22, 2022. See section 6511 for more details and other special rules. You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form.

Web common questions regarding corporate amended return (form 1120x) in lacerte. See section 6511 for more details and other special rules. You will need a digital or printed copy of your original return to copy from. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Or, you may need to amend your form if you claimed a deduction you. It often takes 3 to 4 months to process form 1120x. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

It often takes 3 to 4 months to process form 1120x. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. You may need to file an amended form 1120 if you forgot.

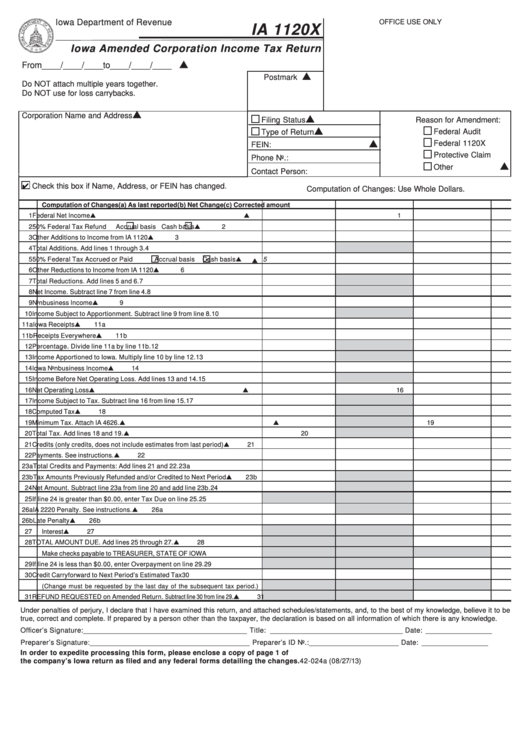

Fillable Form Ia 1120x Iowa Amended Corporation Tax Return

You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. Disclose information for each reportable transaction in which the corporation participated. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Web common questions regarding corporate amended return (form 1120x) in lacerte. See section 6511 for more details and other special rules. Or, you may need to amend your form if you claimed a deduction you. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Corporation income tax return, to correct a previously filed form.

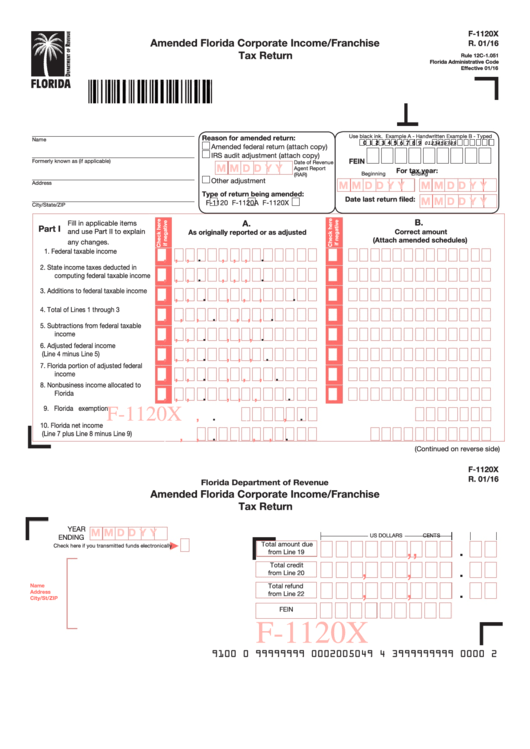

Form F1120x Amended Florida Corporate Tax Return

Web form 1120x, amended u.s. Solved•by intuit•updated september 22, 2022. Or, you may need to amend your form if you claimed a deduction you. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web common questions regarding corporate amended return (form 1120x) in lacerte.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. Web common questions regarding corporate amended return (form 1120x) in lacerte. Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t) (mandatory). See section.

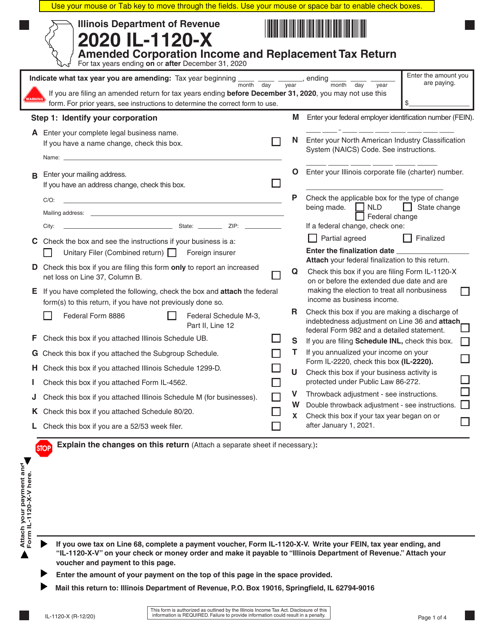

Form IL1120X Download Fillable PDF or Fill Online Amended Corporation

Disclose information for each reportable transaction in which the corporation participated. You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. See section 6511 for more details and other special rules. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web common.

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Web common questions regarding corporate amended return (form 1120x) in lacerte. Web form 1120x, amended u.s. Corporation income tax return, to correct a previously filed form 1120. You will need a digital or printed copy of your original return to copy from. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120.

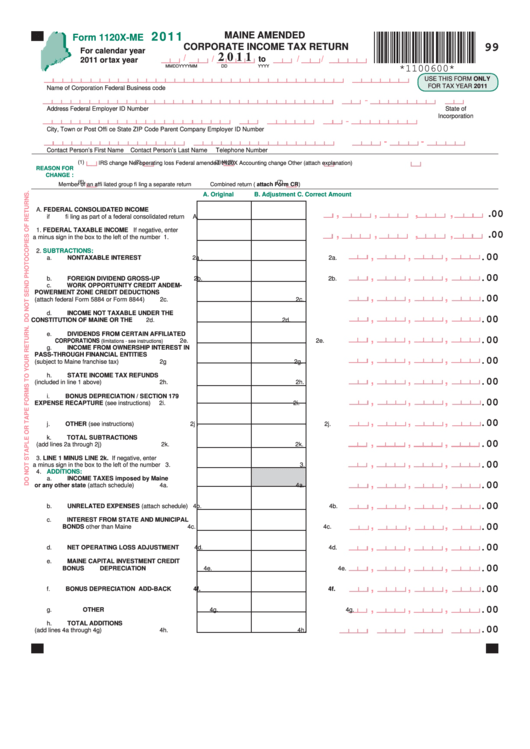

Form 1120xMe Maine Amended Corporate Tax Return 2011

It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable. It often takes 3 to 4 months to process form 1120x. Disclose information for each reportable transaction in which the corporation participated. Web a form 1120x based on a bad debt or worthless security must.

Form 1120x Amended U.s. Corporation Tax Return printable pdf

Web form 1120x, amended u.s. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120. Corporation income.

Form 1120 Amended Return Overview & Instructions

You may need to file an amended form 1120 if you forgot to include expenses or deductions on your originally filed form. Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t) (mandatory). Corporation income tax return, allows businesses to correct mistakes made on their already.

Web Form 1120X, Amended U.s.

Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. See section 6511 for more details and other special rules. It often takes 3 to 4 months to process form 1120x. It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable.

You May Need To File An Amended Form 1120 If You Forgot To Include Expenses Or Deductions On Your Originally Filed Form.

Solved•by intuit•updated september 22, 2022. See section 6511 for more details and other special rules. Use screen 55, amended return (1120x), to indicate the return should be amended by making a selection in federal/state return (s) to amend (ctrl+t) (mandatory). It often takes 3 to 4 months to process form 1120x.

Web A Form 1120X Based On A Bad Debt Or Worthless Security Must Be Filed Within 7 Years After The Due Date Of The Return For The Tax Year In Which The Debt Or Security Became Worthless.

Disclose information for each reportable transaction in which the corporation participated. Web common questions regarding corporate amended return (form 1120x) in lacerte. Corporation income tax return, to correct a previously filed form 1120. Corporation income tax return, allows businesses to correct mistakes made on their already filed form 1120.

You Will Need A Digital Or Printed Copy Of Your Original Return To Copy From.

Corporation income tax return, including recent updates, related forms, and instructions on how to file. Or, you may need to amend your form if you claimed a deduction you.