Form 13873 E

Form 13873 E - Only list a spouse if their own. Signatures are required for any taxpayer listed. Web what is irs form 13873 e? Any version of irs form 13873 that clearly states that the form is provided to the individual as. For filers of form 1120, include the amount. Any version of irs form 13873 that clearly states that the form is provided to the individual as. If you are not using marginal costing, skip part iii and go to part iv. Web ein and “2022 form 1041” on the payment. The address is for kansas city 1040 processing center. Online, by telephone, or by.

It sounds like a fraud. Only list a spouse if their own. Any version of irs form 13873 that clearly states that the form is provided to the individual as. The income verification express service (ives) program is used by mortgage lenders and others within the financial. Web ein and “2022 form 1041” on the payment. Web what is irs form 13873 e? Web there are several versions of irs form 13873 (e.g. Signatures are required for any taxpayer listed. Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g.

If you are not using marginal costing, skip part iii and go to part iv. Irs has no record of a tax return. Section a — foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Qualifying foreign trade income generally, qualifying. Web there are several versions of irs form 13873 (e.g. Online, by telephone, or by. Only list a spouse if their own. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web there are several versions of irs form 13873 (e.g.

Form 4506t Printable

Web there are several versions of irs form 13873 (e.g. Any version of irs form 13873 that clearly states that the form is provided to the. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on.

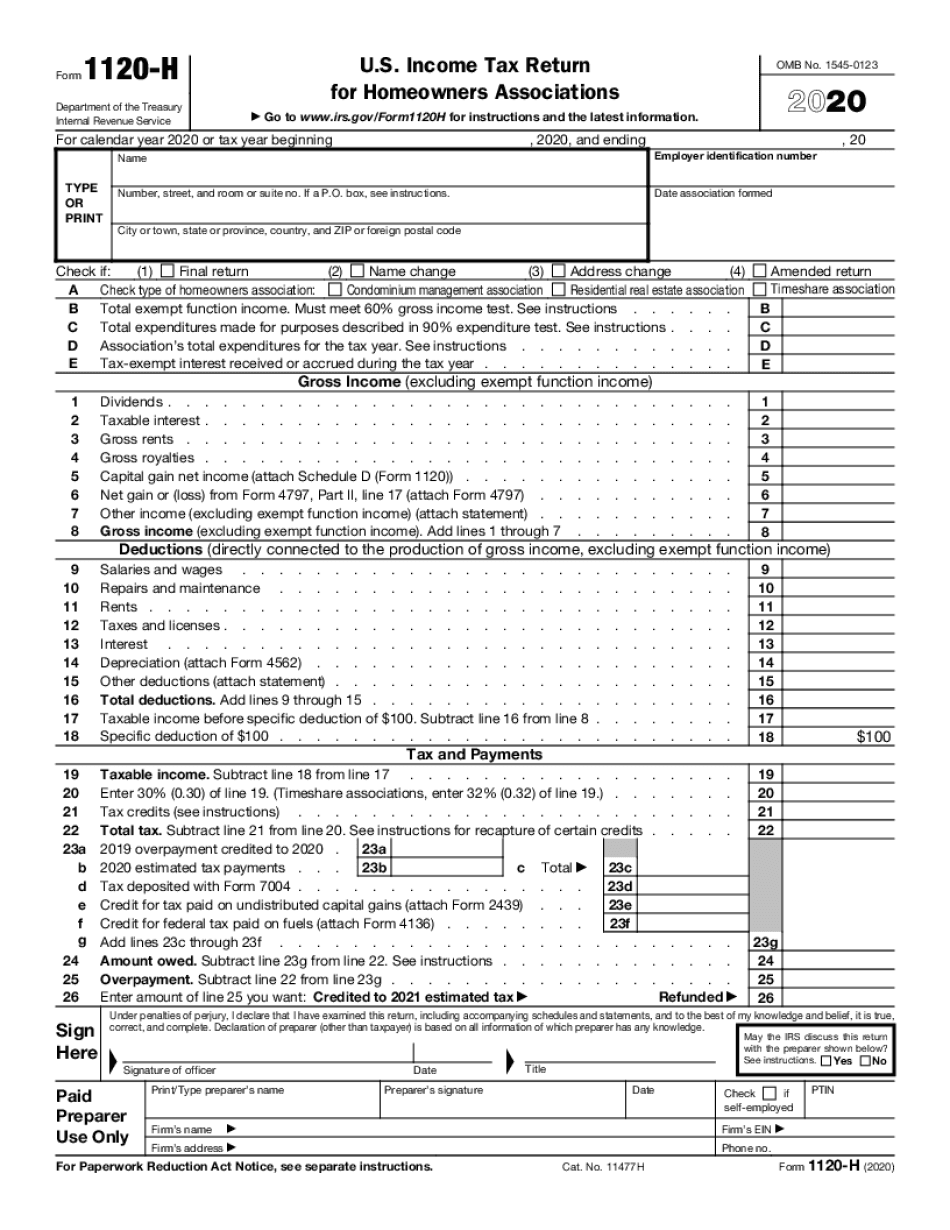

Edit Document Form 1120 With Us Fastly, Easyly, And Securely

Signatures are required for any taxpayer listed. Web the authorization must come from you in form of signed 4506t or power of attorney. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. Only list a spouse if their own. Any version of.

Irs W9 Forms 2020 Printable Pdf Example Calendar Printable

Only list a spouse if their own. It sounds like a fraud. Web there are several versions of irs form 13873 (e.g. For filers of form 1120, include the amount. Online, by telephone, or by.

2010 Form IRS 433F Fill Online, Printable, Fillable, Blank PDFfiller

Web income verification express service. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Only list a spouse if their own. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Section a — foreign trade income.

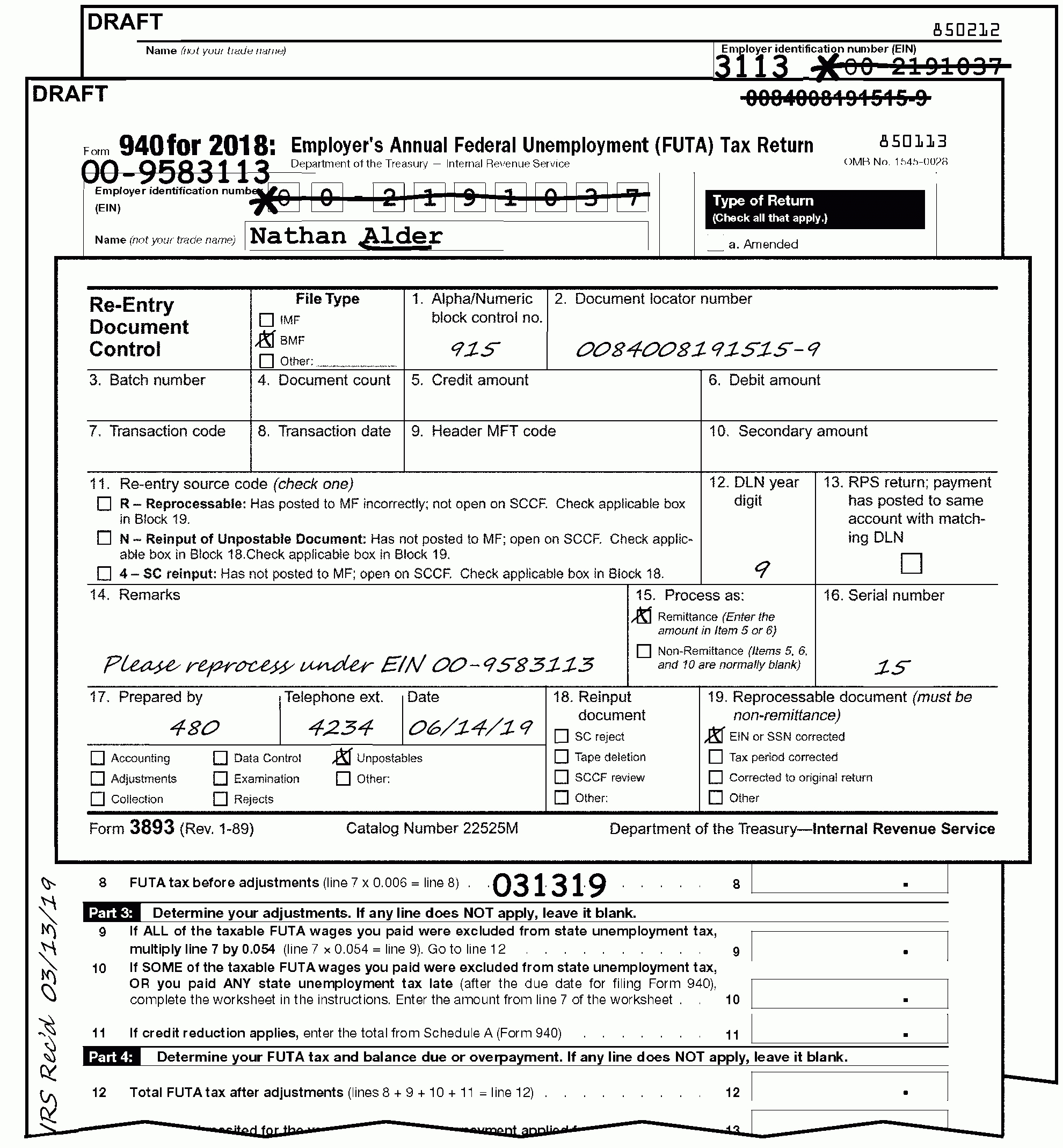

IRS Identity Theft Forms National Affinity Services

For filers of form 1120, include the amount. The income verification express service (ives) program is used by mortgage lenders and others within the financial. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying.

13873 E Lehigh Ave C, Aurora, CO 2 Bed, 1 Bath Condo 11 Photos

The address is for kansas city 1040 processing center. Web there are several versions of irs form 13873 (e.g. Any version of irs form 13873 that clearly states that the form is provided to the. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of.

EDGAR Filing Documents for 000075068620000052

Web ein and “2022 form 1041” on the payment. For filers of form 1120, include the amount. Web what is irs form 13873 e? Any version of irs form 13873 that clearly states that the form is provided to the. Irs has no record of a tax return.

Compilation Error undeclared identifier trying to pass values from

Section a — foreign trade income. Web ein and “2022 form 1041” on the payment. Irs has no record of a tax return. For filers of form 1120, include the amount. Web executive order 13873 of may 15, 2019 securing the information and communications technology and services supply chain

2014 Form IRS 14653 Fill Online, Printable, Fillable, Blank pdfFiller

Web income verification express service. The address is for kansas city 1040 processing center. Web if you are filing schedule e (form 1040), enter form 8873 and the amount on the other line under expenses in part i of schedule e. Web executive order 13873 of may 15, 2019 securing the information and communications technology and services supply chain Any.

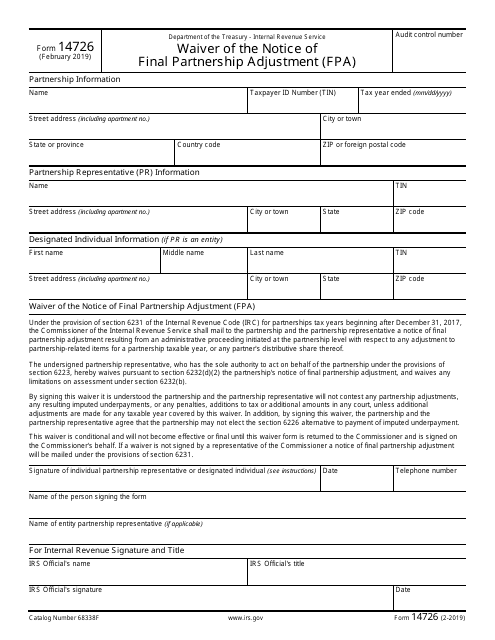

IRS Form 14726 Download Fillable PDF or Fill Online Waiver of the

Online, by telephone, or by. Signatures are required for any taxpayer listed. Any version of irs form 13873 that clearly states that the form is provided to the. Irs has no record of a tax return. The address is for kansas city 1040 processing center.

Section A — Foreign Trade Income.

Signatures are required for any taxpayer listed. If you are not using marginal costing, skip part iii and go to part iv. Online, by telephone, or by. It sounds like a fraud.

Web If You Are Filing Schedule E (Form 1040), Enter Form 8873 And The Amount On The Other Line Under Expenses In Part I Of Schedule E.

Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g. Web income verification express service. For filers of form 1120, include the amount.

Web There Are Several Versions Of Irs Form 13873 (E.g.

Irs has no record of a tax return. Web there are several versions of irs form 13873 (e.g. Web executive order 13873 of may 15, 2019 securing the information and communications technology and services supply chain Web what is irs form 13873 e?

Only List A Spouse If Their Own.

Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web ein and “2022 form 1041” on the payment. Any version of irs form 13873 that clearly states that the form is provided to the individual as.