Form 15111 Irs

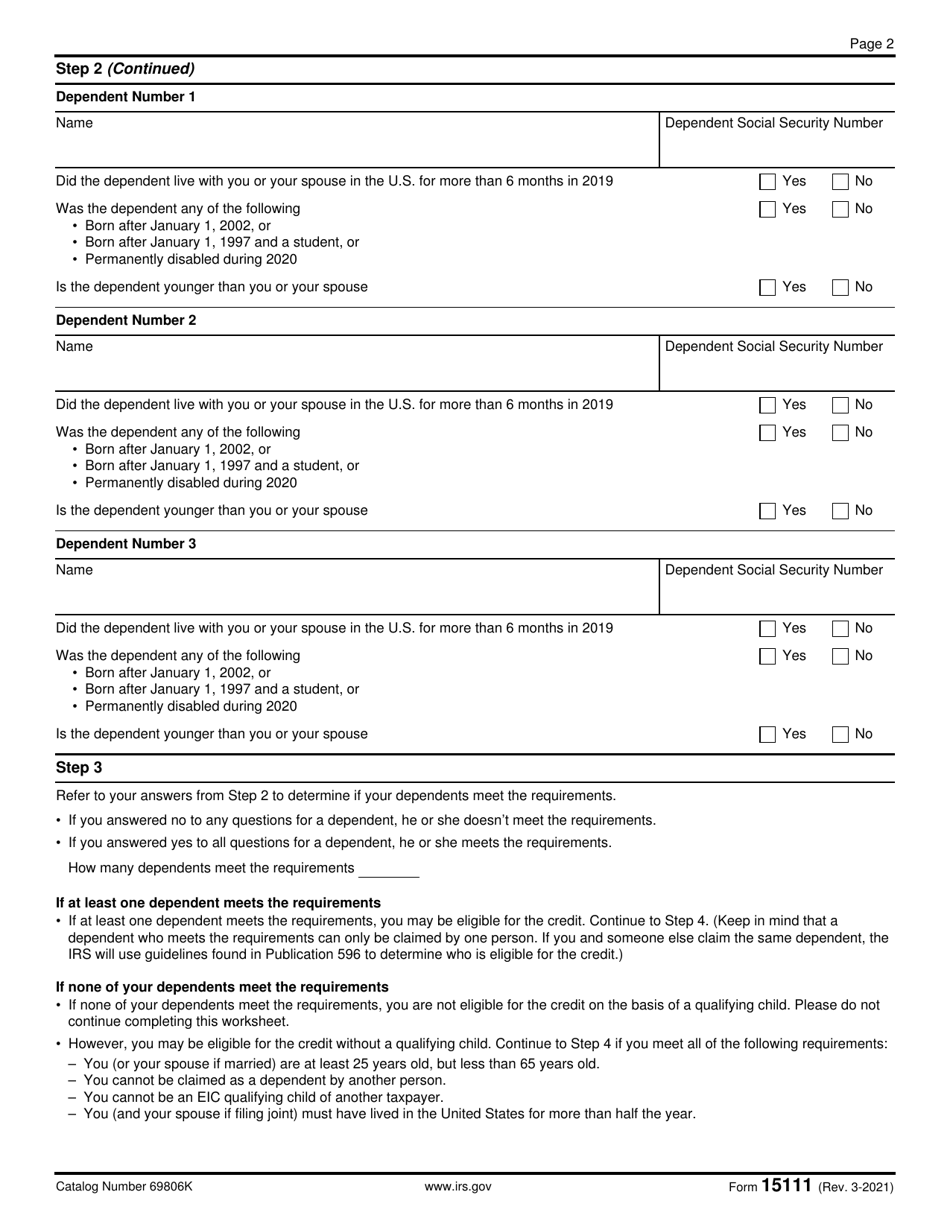

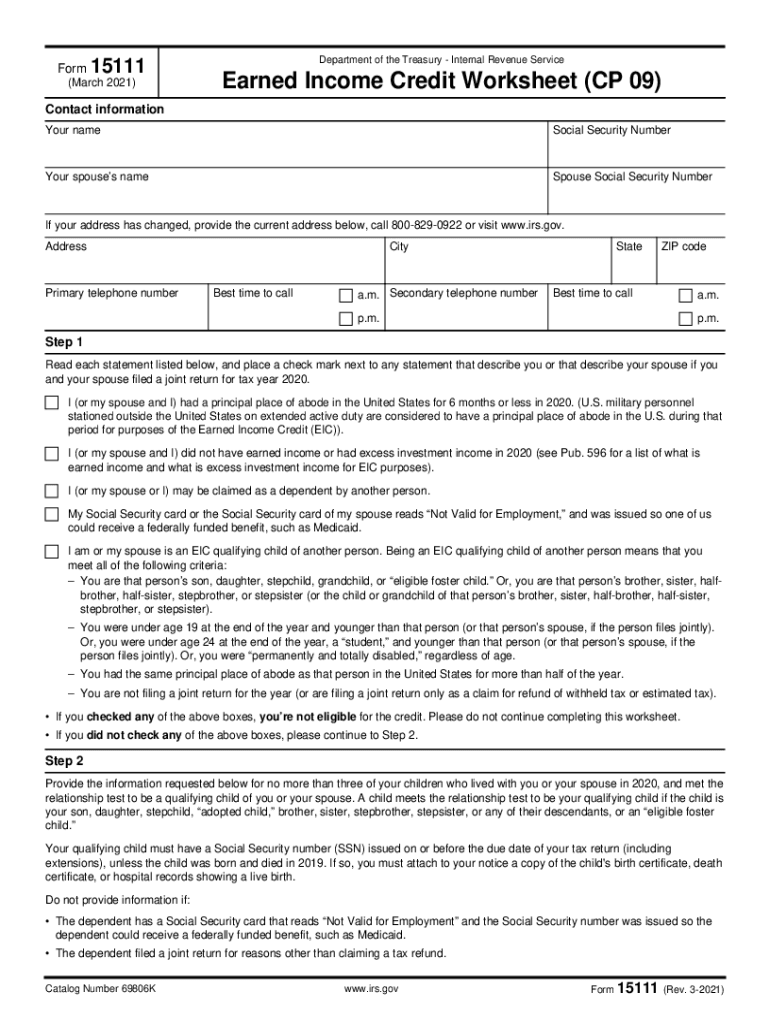

Form 15111 Irs - Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within 6 to 8 weeks. This is an irs internal form. How to claim the eitc using irs form 15111. Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Web what you need to do. Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. You can view a sample form 15111 worksheet on the irs website. They should have sent it to you to complete if they wanted you to send it back to them. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : Earned income credit worksheet (cp 09) (irs) form is 3 pages long and contains:

In this article, we’ll walk you through: Refer to your notice cp09 for information on the document upload tool. You can view a sample form 15111 worksheet on the irs website. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : Web what you need to do. This is an irs internal form.

Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web what you need to do. Refer to your notice cp09 for information on the document upload tool. You can view a sample form 15111 worksheet on the irs website. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. Let’s begin with a brief rundown of this tax form. Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. This is an irs internal form.

I sent in my form 15111 for 2020 and i got an updated date on my

If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Let’s begin with a brief rundown of this tax form. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents.

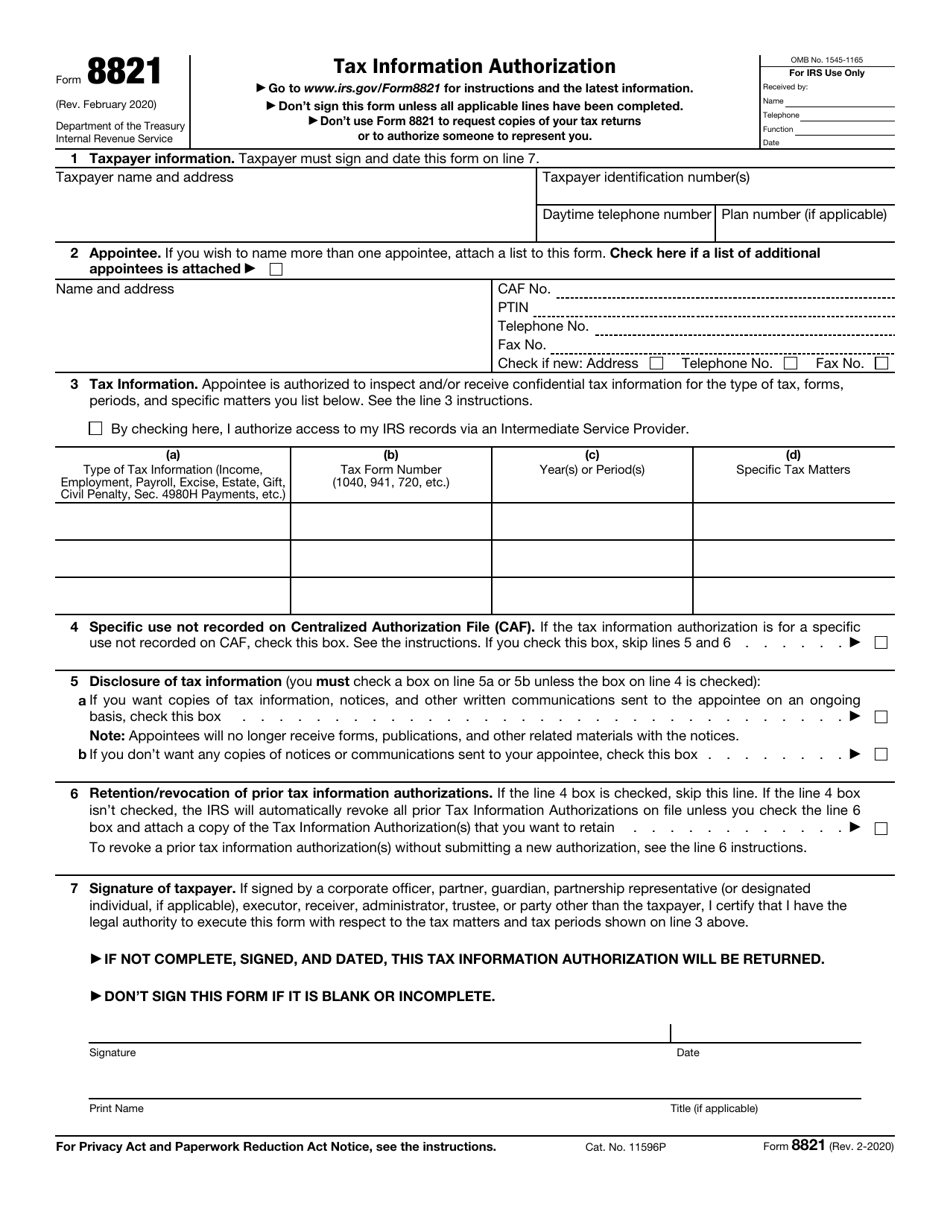

IRS Form 8821 Download Fillable PDF or Fill Online Tax Information

They should have sent it to you to complete if they wanted you to send it back to them. In this article, we’ll walk you through: Web what you need to do. Refer to your notice cp09 for information on the document upload tool. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 :

Form 15111 (May be eligible for EIC) r/IRS

Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. Refer to your notice cp09 for information on the document upload tool. In this article, we’ll walk you through: If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Complete earned income.

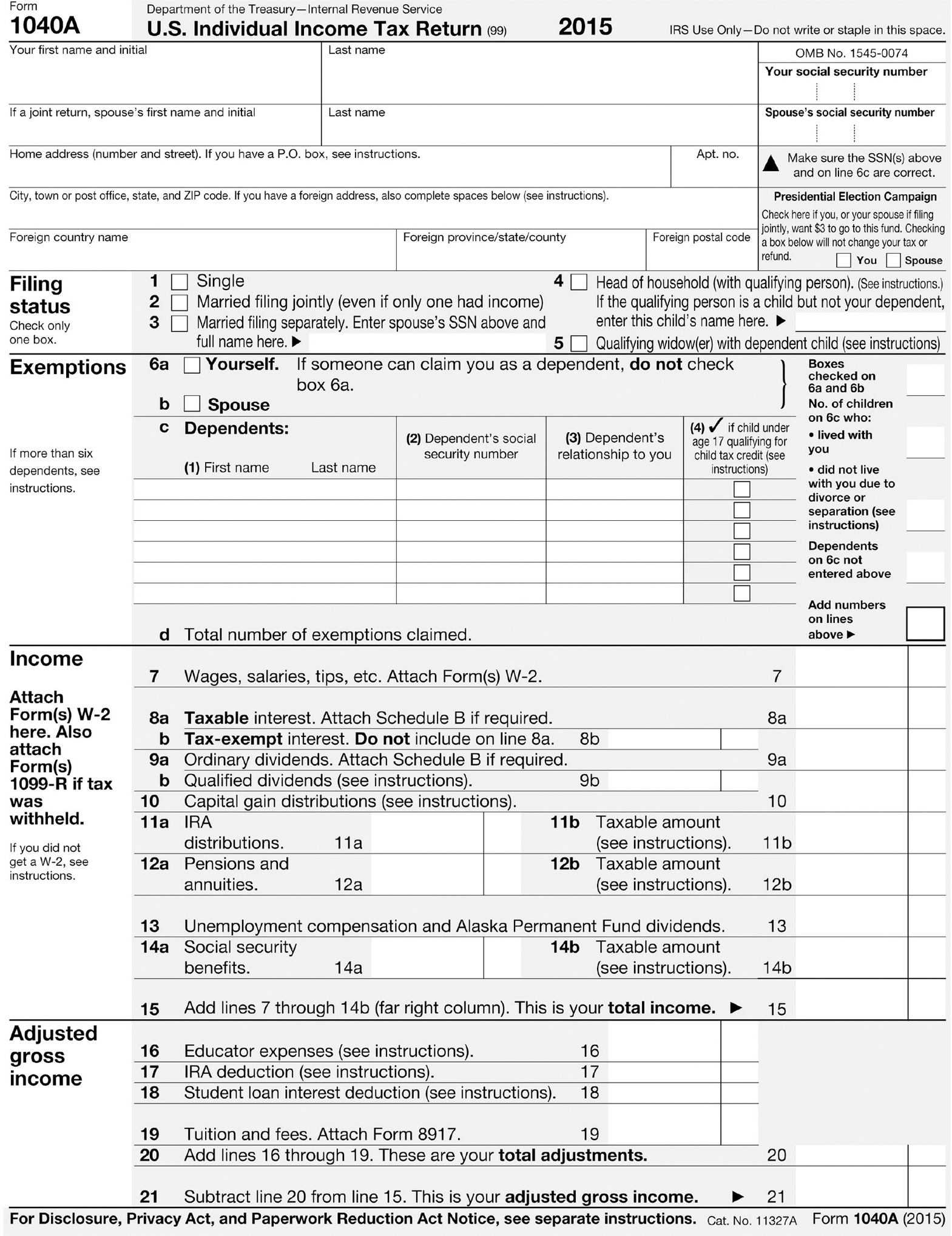

Irs Form 1065 K1 Leah Beachum's Template

Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. You can view a sample form 15111 worksheet on the irs website. This.

Sample Forms Paying for College Without Going Broke Princeton

Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Earned income credit worksheet (cp 09) (irs) form is 3 pages long and contains: Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. They should have sent it to you to.

Form 15111? r/IRS

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents.

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Find out what to do. In this article, we’ll walk you through: Web what you need to do. This is an irs internal form. You can view a sample form 15111 worksheet on the irs website.

IRS Form 1120C Download Fillable PDF or Fill Online U.S. Tax

You can view a sample form 15111 worksheet on the irs website. Did you receive a letter from the irs about the eitc? In this article, we’ll walk you through: Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. How to claim the eitc using irs form 15111.

IRS Form 15111 Download Fillable PDF or Fill Online Earned

You can view a sample form 15111 worksheet on the irs website. How to claim the eitc using irs form 15111. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. Web the irs.

15111 Form Fill Online, Printable, Fillable, Blank pdfFiller

Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it. Let’s begin with a brief rundown of this tax form. Form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. Earned income credit worksheet (cp.

Did You Receive A Letter From The Irs About The Eitc?

Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Form 15111 (sp) earned income credit worksheet (cp 09) (spanish version) jan 2023 : Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf.

Earned Income Credit Worksheet (Cp 09) (Irs) Form Is 3 Pages Long And Contains:

Earned income credit worksheet (cp 09) (irs) on average this form takes 9 minutes to complete. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Refer to your notice cp09 for information on the document upload tool. Sometimes, the same worksheet may be included as part of your cp09 notice and not have the form 15111 header on it.

Let’s Begin With A Brief Rundown Of This Tax Form.

In this article, we’ll walk you through: They should have sent it to you to complete if they wanted you to send it back to them. Find out what to do. This is an irs internal form.

You Can View A Sample Form 15111 Worksheet On The Irs Website.

Earned income credit worksheet (cp 09) mar 2023 : Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check to the taxpayer within 6 to 8 weeks. Web in this case, you may need to complete irs form 15111 to determine your eligibility and to claim an eitc refund. Web if you amend your return to include the earned income credit, there is no reason to send back irs form 15111.