Form 211 Irs

Form 211 Irs - How long does the process take? Submit a whistleblower claim 3. Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Form 211 rewards can be. Read the instructions before completing this form. Examples of tax frauds or tax avoidance to report 6. Hire an irs whistleblower attorney 2.2. M/s 4110 ogden, ut 84404 A description of the alleged tax noncompliance, including a written narrative explaining the issue(s). Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature.

There is no question that the. Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Web a claimant must file a formal claim for award by completing and sending form 211, application for award for original information, to be considered for the whistleblower program. M/s 4110 ogden, ut 84404 Web what is irs form 211? How long does the process take? Examples of tax frauds or tax avoidance to report 6. Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s. Submit a whistleblower claim 3. Instructions for form 941 pdf

There may be other more appropriate forms specific to your. How to report tax fraud 2.1. A description of the alleged tax noncompliance, including a written narrative explaining the issue(s). Web employer's quarterly federal tax return. Form 211 rewards can be. Gather specific and credible evidence 2.3. There is no question that the. Web a claimant must file a formal claim for award by completing and sending form 211, application for award for original information, to be considered for the whistleblower program. Web what is irs form 211? Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s.

IRS Form 211 Ausfüllhilfe und Erläuterung Wiensworld

Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s. Web a claimant must file a formal claim.

Tax Whistleblower — The Dos And Don'ts Of Filing A Form 211 Tax

There may be other more appropriate forms specific to your. Read the instructions before completing this form. Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Individuals must then mail the form 211 with supporting documentation to: A description of the alleged tax noncompliance, including a written narrative explaining.

Form 211 Application for Award for Original Information (2014) Free

How to report tax fraud 2.1. There is no question that the. Gather specific and credible evidence 2.3. Form 211 rewards can be. How long does the process take?

Turning in U.S. tax cheats and getting paid for it Don't Mess With Taxes

Hire an irs whistleblower attorney 2.2. Web employer's quarterly federal tax return. Web what is irs form 211? Examples of tax frauds or tax avoidance to report 6. Individuals must then mail the form 211 with supporting documentation to:

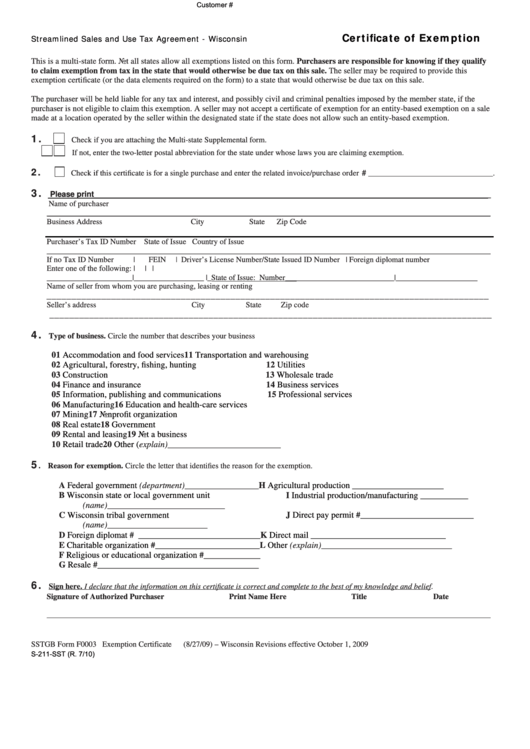

Fillable Form S211Sst Wisconsin Streamlined Sales And Use Tax

Gather specific and credible evidence 2.3. There is no question that the. Hire an irs whistleblower attorney 2.2. Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Read the instructions before completing this form.

IRS Whistleblower Program ‹ Get a Reward for Reporting Tax Fraud

How to report tax fraud 2.1. Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web.

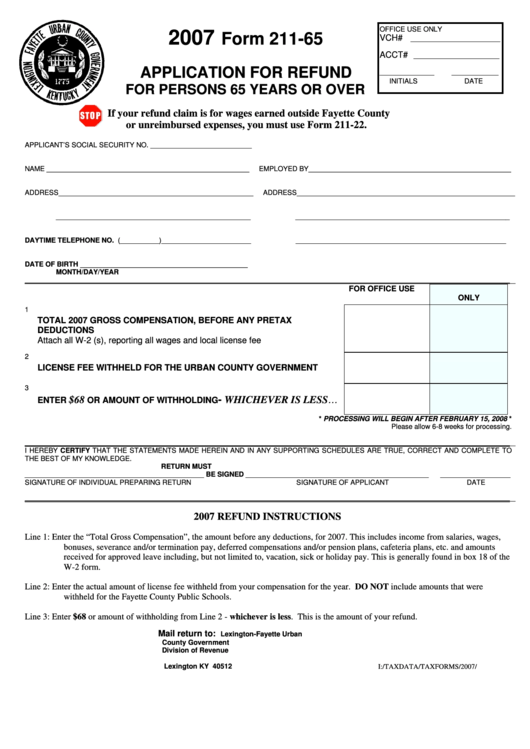

Form 21165 Application For Refund For Persons 65 Years Or Over

How to report tax fraud 2.1. Examples of tax frauds or tax avoidance to report 6. Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing.

Child Support IRS Form 211 Whistleblower Award Issued YouTube

Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Individuals must then mail the form 211 with supporting documentation to: Form 211 rewards can be. Examples of tax frauds or tax avoidance to report 6. Read the instructions before completing this form.

irs form 3949a 2022 Fill Online, Printable, Fillable Blank form

Send completed form along with any supporting information to: Instructions for form 941 pdf Individuals must then mail the form 211 with supporting documentation to: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web the whistleblower's original signature on the declaration.

Form 211

Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Gather specific and credible evidence 2.3. Examples of tax frauds or tax avoidance to report 6. Web what is irs form 211? There may be other more appropriate forms specific to your.

Web Whistleblowers Must Use Irs Form 211, Application For Award For Original Information, And Ensure That It Contains The Following:

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. M/s 4110 ogden, ut 84404 Read the instructions before completing this form. Submit a whistleblower claim 3.

Instructions For Form 941 Pdf

Gather specific and credible evidence 2.3. Hire an irs whistleblower attorney 2.2. Individuals must then mail the form 211 with supporting documentation to: There is no question that the.

A Description Of The Alleged Tax Noncompliance, Including A Written Narrative Explaining The Issue(S).

Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. Form 211 rewards can be. Web what is irs form 211? Send completed form along with any supporting information to:

Web Employer's Quarterly Federal Tax Return.

Web a claimant must file a formal claim for award by completing and sending form 211, application for award for original information, to be considered for the whistleblower program. Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s. There may be other more appropriate forms specific to your. How to report tax fraud 2.1.