Form 2220 Instructions

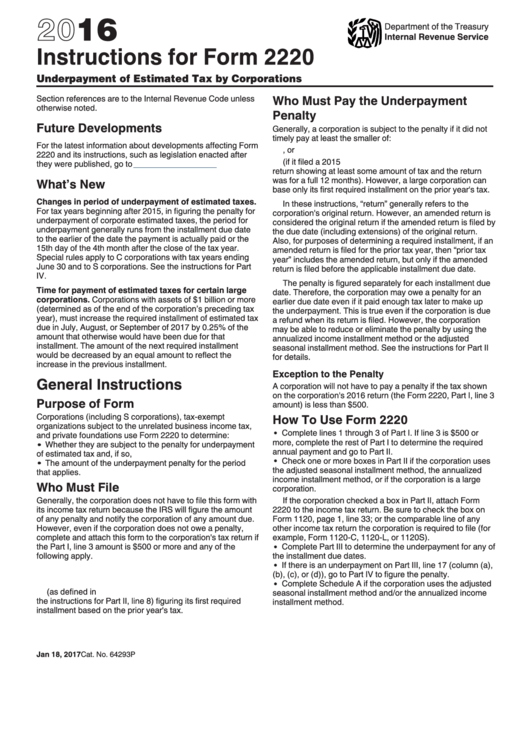

Form 2220 Instructions - Web for instructions and the latest information. However, the corporation may still use form 2220 to figure the. All filers (other than s corporations). Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount of the underpayment penalty for the period that applies. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Alabama form 2220al closely mirrors federal form 2220. If the minimum amount was not paid timely, we may impose penalty and interest. Generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Before filing your tax return. How to use form 2220;

Generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Before filing your tax return. Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount of the underpayment penalty for the period that applies. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates. General information what is the purpose of this form? Alabama form 2220al closely mirrors federal form 2220. Who must pay the underpayment penalty. How to use form 2220; Web how do you file this form? All filers (other than s corporations).

How to use form 2220; However, the corporation may still use form 2220 to figure the. Generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates. Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount of the underpayment penalty for the period that applies. If the minimum amount was not paid timely, we may impose penalty and interest. Web for instructions and the latest information. Before filing your tax return. Who must pay the underpayment penalty. (i) compute the underpayment penalty.

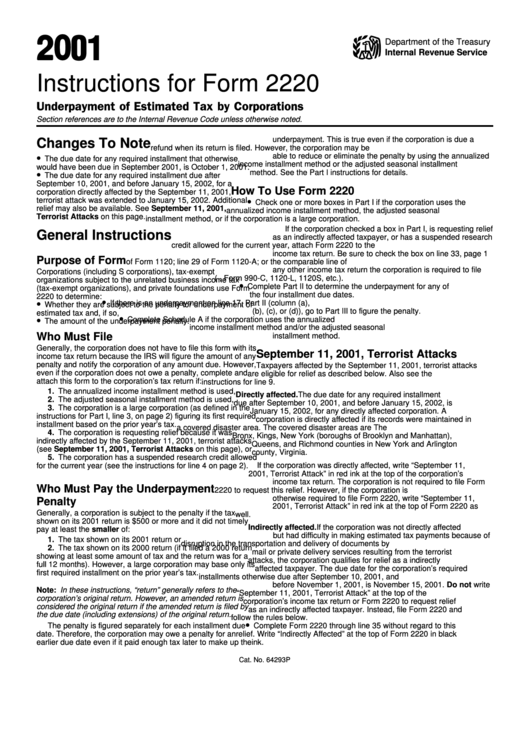

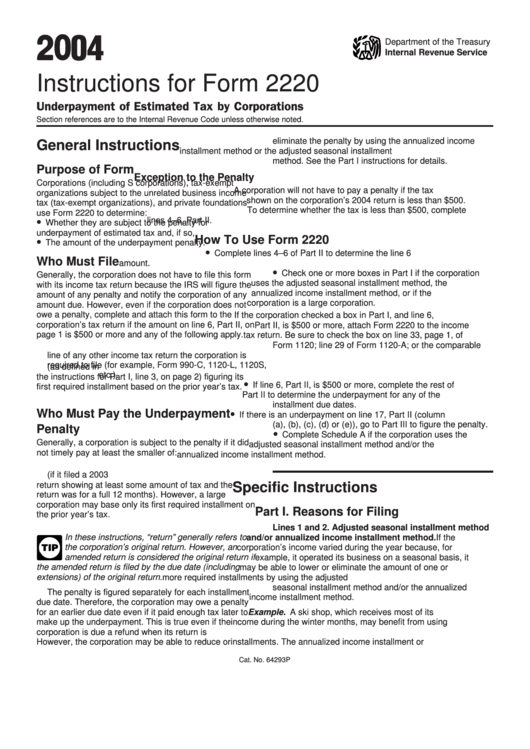

Instructions For Form 2220 Underpayment Of Estimated Tax By

Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount of the underpayment penalty for the period that applies. If the minimum amount was not paid timely, we may impose penalty and interest. This form allows you to calculate penalties you may owe if you did not • make timely estimated payments, •.

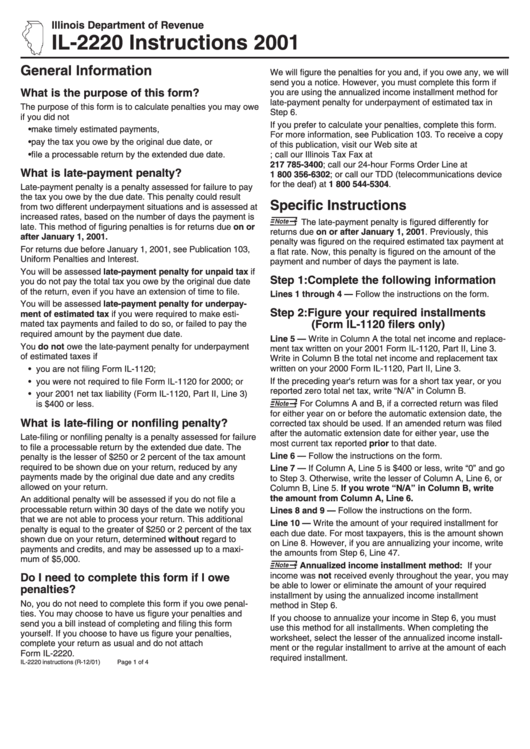

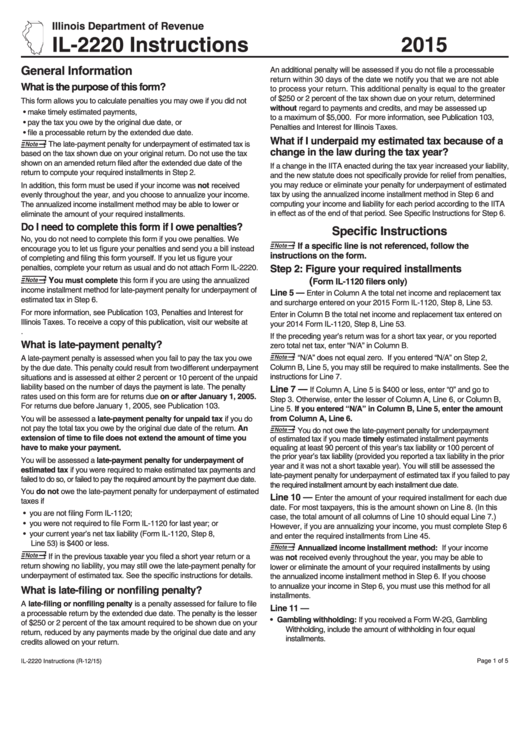

Form Il2220 Instructions 2001 printable pdf download

However, the corporation may still use form 2220 to figure the. Who must pay the underpayment penalty. Web for instructions and the latest information. Alabama form 2220al closely mirrors federal form 2220. Before filing your tax return.

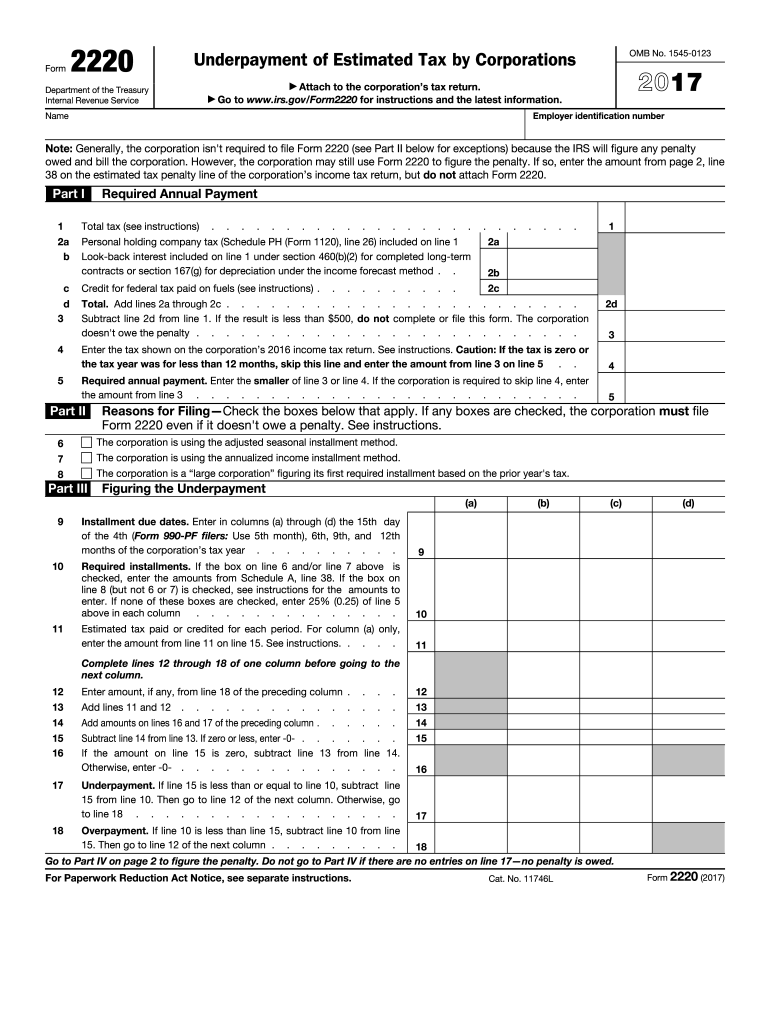

Form 2220 Instructions 2018 Fill Out and Sign Printable PDF Template

All filers (other than s corporations). Web how do you file this form? The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates. This form allows you to calculate penalties you may owe if you did not • make timely estimated payments, •.

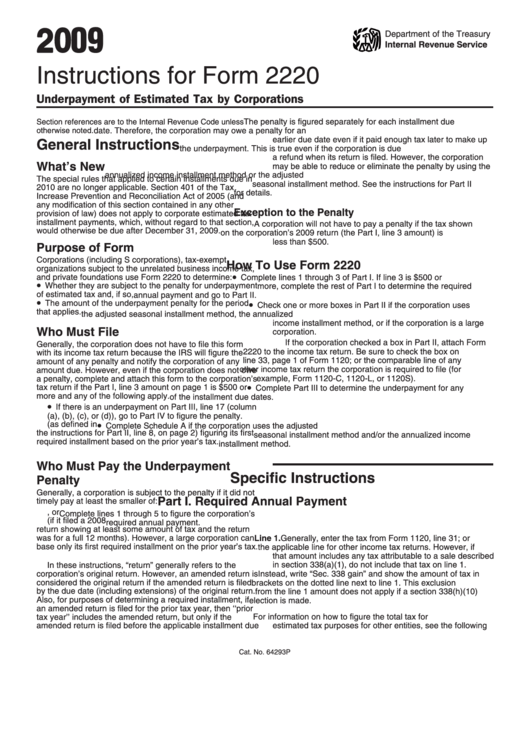

Instructions For Form 2220 2009 printable pdf download

If the minimum amount was not paid timely, we may impose penalty and interest. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. (i) compute the underpayment penalty. How to use form 2220; This form allows you to calculate penalties you may owe if you.

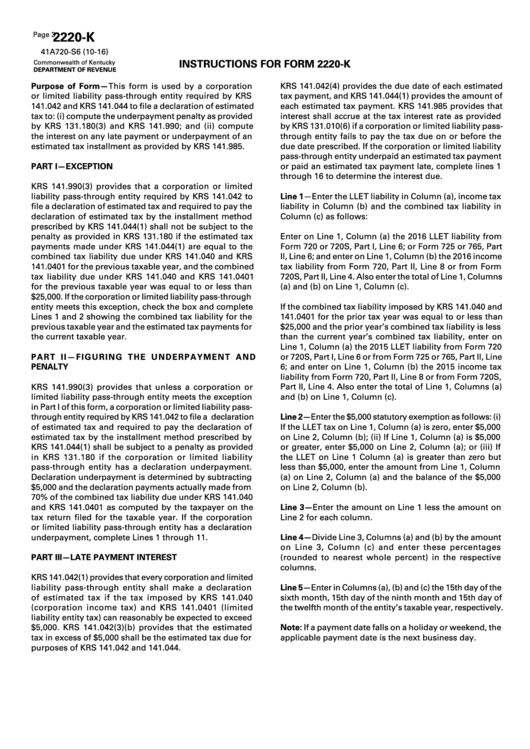

Form 2220K Instructions For Form 2220K 2016 printable pdf download

Alabama form 2220al closely mirrors federal form 2220. Who must pay the underpayment penalty. How to use form 2220; The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates. If the minimum amount was not paid timely, we may impose penalty and interest.

Instructions For Form 2220 Underpayment Of Estimated Tax By

The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates. General information what is the purpose of this form? Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount of the underpayment penalty for the period.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

If the minimum amount was not paid timely, we may impose penalty and interest. This form allows you to calculate penalties you may owe if you did not • make timely estimated payments, • pay the tax you owe by the original due date, or • file a processable return by the extended due date. Generally, the corporation is not.

Form Il2220 Instructions Illinois Department Of Revenue 2015

General information what is the purpose of this form? This form allows you to calculate penalties you may owe if you did not • make timely estimated payments, • pay the tax you owe by the original due date, or • file a processable return by the extended due date. (i) compute the underpayment penalty. Web for instructions and the.

Instructions For Form 2220 Underpayment Of Estimated Tax By

How to use form 2220; General information what is the purpose of this form? (i) compute the underpayment penalty. Who must pay the underpayment penalty. Web for instructions and the latest information.

How to avoid a penalty using Form 2220?

Alabama form 2220al closely mirrors federal form 2220. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates. However, the corporation may still use form 2220 to figure the. (i) compute the underpayment penalty. Whether they are subject to the penalty for underpayment.

(I) Compute The Underpayment Penalty.

Whether they are subject to the penalty for underpayment of estimated tax and, if so, the amount of the underpayment penalty for the period that applies. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Who must pay the underpayment penalty. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of quarterly estimates.

How To Use Form 2220;

General information what is the purpose of this form? However, the corporation may still use form 2220 to figure the. Alabama form 2220al closely mirrors federal form 2220. All filers (other than s corporations).

Web How Do You File This Form?

Generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. This form allows you to calculate penalties you may owe if you did not • make timely estimated payments, • pay the tax you owe by the original due date, or • file a processable return by the extended due date. Before filing your tax return. If the minimum amount was not paid timely, we may impose penalty and interest.