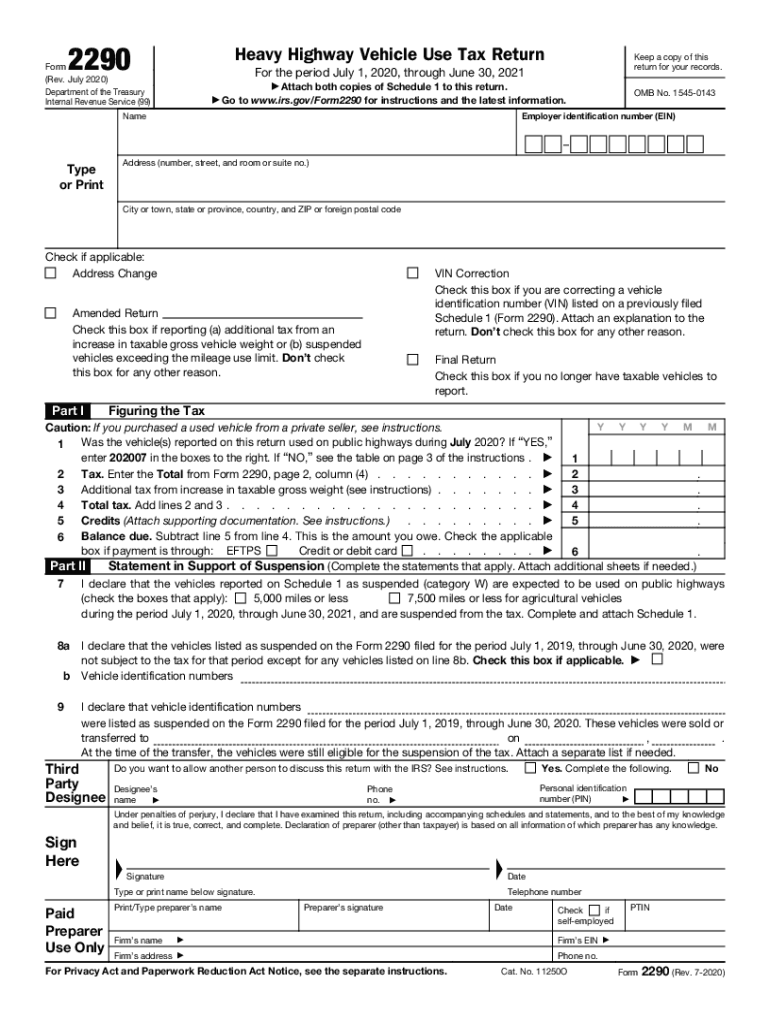

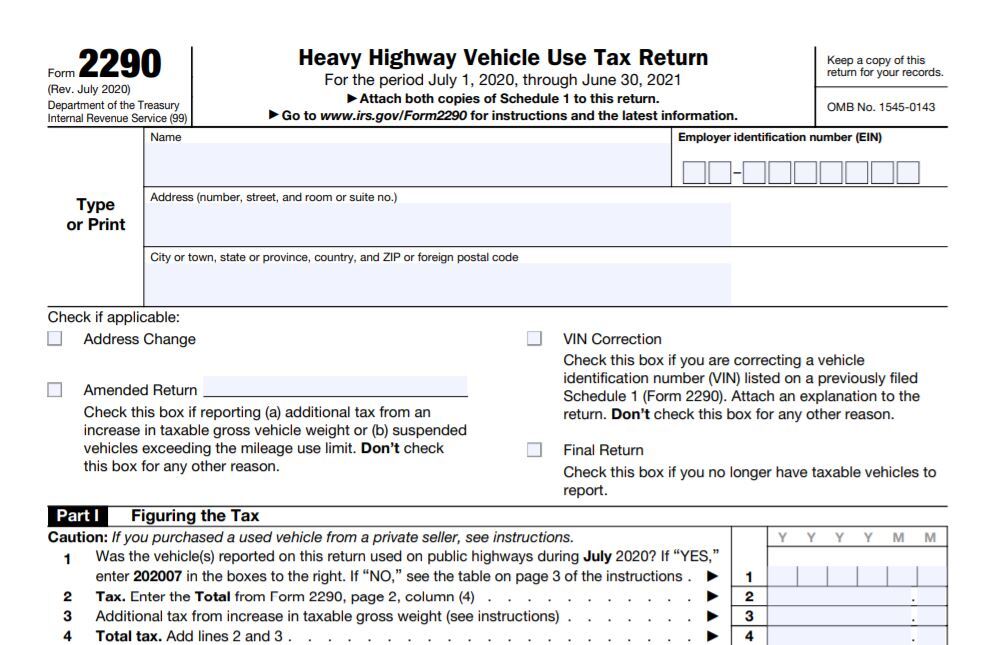

Form 2290 2022

Form 2290 2022 - In general, the irs requires every. Web the 2290 form is due annually between july 1 and august 31. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. The sample is available in pdf format; Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. The current period begins july 1, 2023, and ends june 30,. Ad upload, modify or create forms. You'll need a pdf reader to open and print it. Web the irs 2290 form is a “ federal heavy vehicle use tax return form ” used to report heavy vehicle information to the internal revenue service. Web you can visit the official irs website to download and print out the blank 2290 form for 2022.

Web you can visit the official irs website to download and print out the blank 2290 form for 2022. Easy, fast, secure & free to try. July 2023 to june 2024: Web the irs 2290 form is a “ federal heavy vehicle use tax return form ” used to report heavy vehicle information to the internal revenue service. Web december 6, 2022 draft as of form 2290 (rev. The annual due date to file and pay the heavy vehicle use tax form 2290 is. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web form tax year tax period actions; Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,.

Web form tax year tax period actions; Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax paid for the use of a vehicle. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Web december 6, 2022 draft as of form 2290 (rev. Web the irs 2290 form is a “ federal heavy vehicle use tax return form ” used to report heavy vehicle information to the internal revenue service. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. Every year, millions of trucking companies file their 2290. Do your truck tax online & have it efiled to the irs! Web 13 rows month form 2290 must be filed;

IRS 2290 20202022 Fill and Sign Printable Template Online US Legal

July 2022 to june 2023: Try it for free now! Web 13 rows month form 2290 must be filed; Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax paid for the use of a vehicle. Therefore, the form 2290 tax should be.

form 2290 20182022 Fill Online, Printable, Fillable Blank

Try it for free now! Use the table below to determine your. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Easy, fast, secure & free to try. The sample is available in pdf format;

Free Printable Form 2290 Printable Templates

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. This tax is.

IRS Form 2290 Instructions for 20222023

Web the irs 2290 form is a “ federal heavy vehicle use tax return form ” used to report heavy vehicle information to the internal revenue service. Web you can visit the official irs website to download and print out the blank 2290 form for 2022. Web form tax year tax period actions; Do your truck tax online & have.

Tax Credit 2023 2023

Web you can visit the official irs website to download and print out the blank 2290 form for 2022. Web the 2290 form is due annually between july 1 and august 31. Do your truck tax online & have it efiled to the irs! Web you must file form 2290 and schedule 1 for the tax period beginning on july.

Understanding Form 2290 StepbyStep Instructions for 20222023

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Easy, fast, secure & free to try. Web it is due.

File IRS 2290 Form Online for 20222023 Tax Period

Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax paid for the use of a vehicle. Web the 2290 form is due annually between july 1 and august 31. July 2022 to june 2023: Try it for free now! July 2023) department.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. You'll need a pdf reader to open and print it. Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax paid.

Ez Form Taxes 2017 Universal Network

Web form 2290 deadline generally applies to file form 2290 and paying tax payments along with the form 2290 tax return for the tax year that begins july 1, 2022, and ends june 30,. You'll need a pdf reader to open and print it. Ad upload, modify or create forms. July 2022 to june 2023: The annual due date to.

Printable IRS Form 2290 for 2020 Download 2290 Form

Therefore, the form 2290 tax should be made in advance for the current tax year, from. Web 13 rows month form 2290 must be filed; The annual due date to file and pay the heavy vehicle use tax form 2290 is. Web form 2290 deadline generally applies to file form 2290 and paying tax payments along with the form 2290.

Try It For Free Now!

This tax is assessed on vehicles that weigh 55,000 pounds or more and is used to hel. Web last updated on july 19, 2022 by eformblogadmin the purpose of filing irs form 2290 is to report the proof of the heavy vehicle use tax paid for the use of a vehicle. Every year, millions of trucking companies file their 2290. Web you can visit the official irs website to download and print out the blank 2290 form for 2022.

Ad Get Schedule 1 In Minutes, Your Form 2290 Is Efiled Directly To The Irs.

Do your truck tax online & have it efiled to the irs! Easy, fast, secure & free to try. Web it is due in june each year, and it is payable by the end of august of the same year. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways.

July 2023 To June 2024:

The annual due date to file and pay the heavy vehicle use tax form 2290 is. Web form tax year tax period actions; The sample is available in pdf format; Ad upload, modify or create forms.

Web The Irs 2290 Form Is A “ Federal Heavy Vehicle Use Tax Return Form ” Used To Report Heavy Vehicle Information To The Internal Revenue Service.

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. The current period begins july 1, 2023, and ends june 30,. July 2023) department of the treasury internal revenue service heavy highway vehicle use tax return for the period july 1,. You'll need a pdf reader to open and print it.