Form 2290 Cost

Form 2290 Cost - Form 2290 amendment (taxable gross weight increase + mileage exceeded) $ 19.95: Ad file form 2290 for vehicles weighing 55,000 pounds or more. File your 2290 online & get schedule 1 in minutes. We've been in the trucking business for over 67+ years. Web how much does 2290 tax cost? Mini fleet (2 vehicles) $ 25.90: From filing amendments to reporting suspended vehicles, you can trust. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web and if your gross weight is over 75,000 pounds up to 80 or 90, your tax due is going to be $550.

Efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast Keller's pricing is set up to accommodate any size fleet or filing frequency. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Prepare your return for free and pay only when you submit your form. Web annual subscription (1 ein, unlimited forms and unlimited trucks): Choose to pay per filing. From filing amendments to reporting suspended vehicles, you can trust. Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Web know your estimated tax amount for your trucks here!

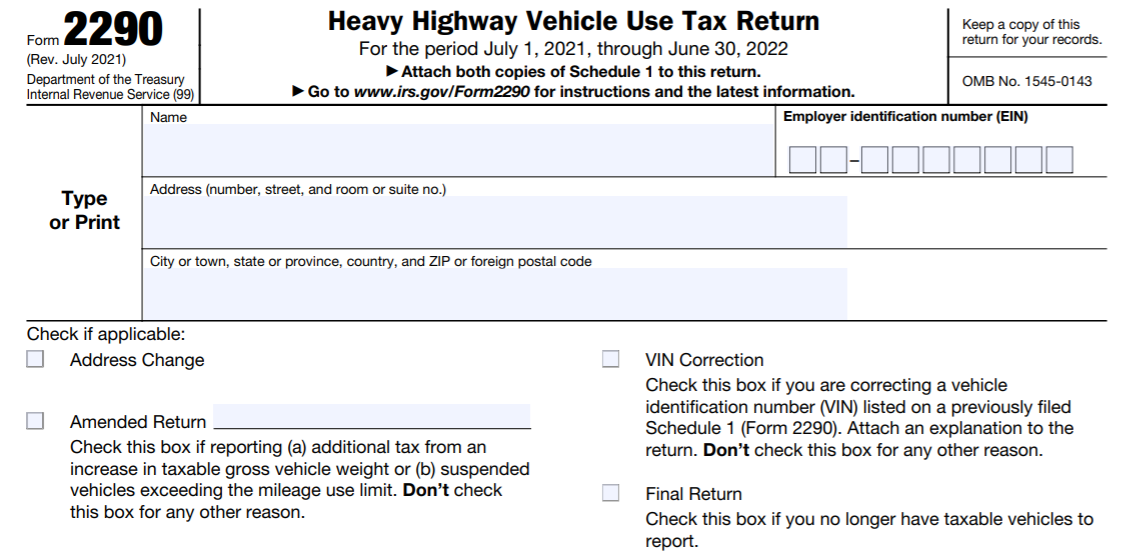

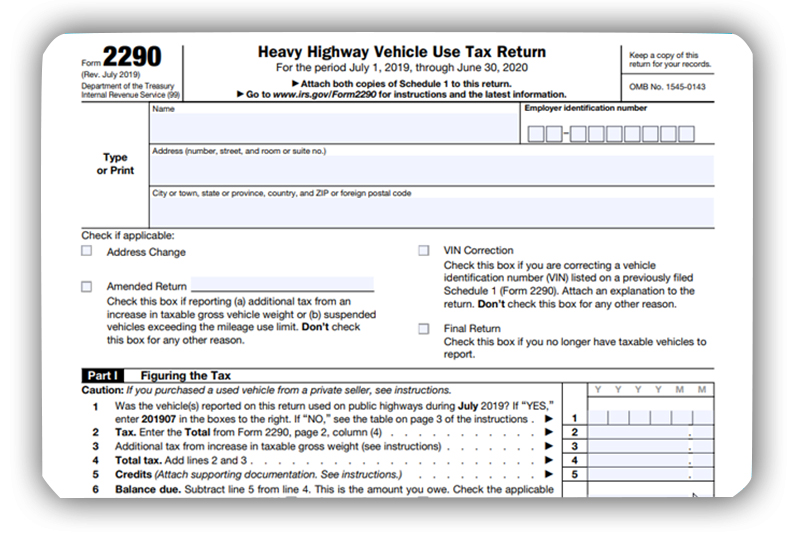

Choose to pay per filing. Web what is the cost to file form 2290? Department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web know your estimated tax amount for your trucks here! Form 8849 (sch.6 other claims) $ 19.95: Prepare your return for free and pay only when you submit your form. Mini fleet (2 vehicles) $ 25.90: It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. File your 2290 online & get schedule 1 in minutes. Our free 2290 tax calculator app for iphone, ipad, or android device can give you a glimpse into your 2290 tax filing future.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. Web and if your gross weight is over 75,000 pounds up to 80 or 90,.

Form 2290 The Trucker's Bookkeeper

Small fleet (3 to 24 vehicles) $ 44.90: Web know your estimated tax amount for your trucks here! Web 1 day agophoto courtesty of j. Web annual subscription (1 ein, unlimited forms and unlimited trucks): File your 2290 online & get schedule 1 in minutes.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Web and if your gross weight is over 75,000 pounds up to 80 or 90, your tax due is going to be $550. Keller's pricing is set up to accommodate any size fleet or filing frequency. Mini fleet (2 vehicles) $ 25.90: If you go to expresstrucktax.com, we have a tax calculator where you. Ad file form 2290 for vehicles.

Pin on form 2290

Ad file form 2290 for vehicles weighing 55,000 pounds or more. July 2021) heavy highway vehicle use tax return. Web how much does 2290 tax cost? Pricing for 2290online.com services j. Web and if your gross weight is over 75,000 pounds up to 80 or 90, your tax due is going to be $550.

How to Efile Form 2290 for 202223 Tax Period

Web pricing depends heavily on which service you choose; Pricing for 2290online.com services j. Contact us for special discounts. Web what is the cost to file form 2290? Prepare your return for free and pay only when you submit your form.

File Form 2290 Online & Get IRS Stamped Schedule 1 in Minutes

Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Web 1 day agophoto courtesty of j. Keller's pricing is set up to accommodate any size fleet or filing frequency. Web easy 2290 pricing details. Web pricing depends heavily on which service you choose;

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web 1 day agophoto courtesty of j. Ad file form 2290 for vehicles weighing 55,000 pounds or more. July 2021) heavy highway vehicle use tax return. Choose to pay per filing. Prepare your return for free and pay only when you submit your form.

Ssurvivor Form 2290 Irs

From filing amendments to reporting suspended vehicles, you can trust. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web easy 2290 pricing details. Medium.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web 1 day agophoto courtesty of j. Small fleet (3 to 24 vehicles) $ 44.90: Web easy 2290 pricing details. From filing amendments to reporting suspended vehicles, you can trust. Form 8849 (sch.6 other claims) $ 19.95:

INSTANT 2290 Filing Form 2290 Cost

Ad file form 2290 for vehicles weighing 55,000 pounds or more. July 2021) heavy highway vehicle use tax return. Small fleet (3 to 24 vehicles) $ 44.90: Prepare your return for free and pay only when you submit your form. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

We've Been In The Trucking Business For Over 67+ Years.

One truck (single vehicle) $ 14.90: July 2021) heavy highway vehicle use tax return. Form 8849 (sch.6 other claims) $ 19.95: Medium fleet (25 to 100 vehicles) $ 89.90:

Web And If Your Gross Weight Is Over 75,000 Pounds Up To 80 Or 90, Your Tax Due Is Going To Be $550.

Web form 2290 taxtax calculator app. Figure and pay the tax due on a vehicle for. Choose to pay per filing. Web 1 day agophoto courtesty of j.

Form 2290 Amendment (Taxable Gross Weight Increase + Mileage Exceeded) $ 19.95:

Mini fleet (2 vehicles) $ 25.90: Web how much does 2290 tax cost? If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Select the ‘first used month‘.

Prepare Your Return For Free And Pay Only When You Submit Your Form.

Web easy 2290 pricing details. Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Web annual subscription (1 ein, unlimited forms and unlimited trucks):