Form 2316 Bir

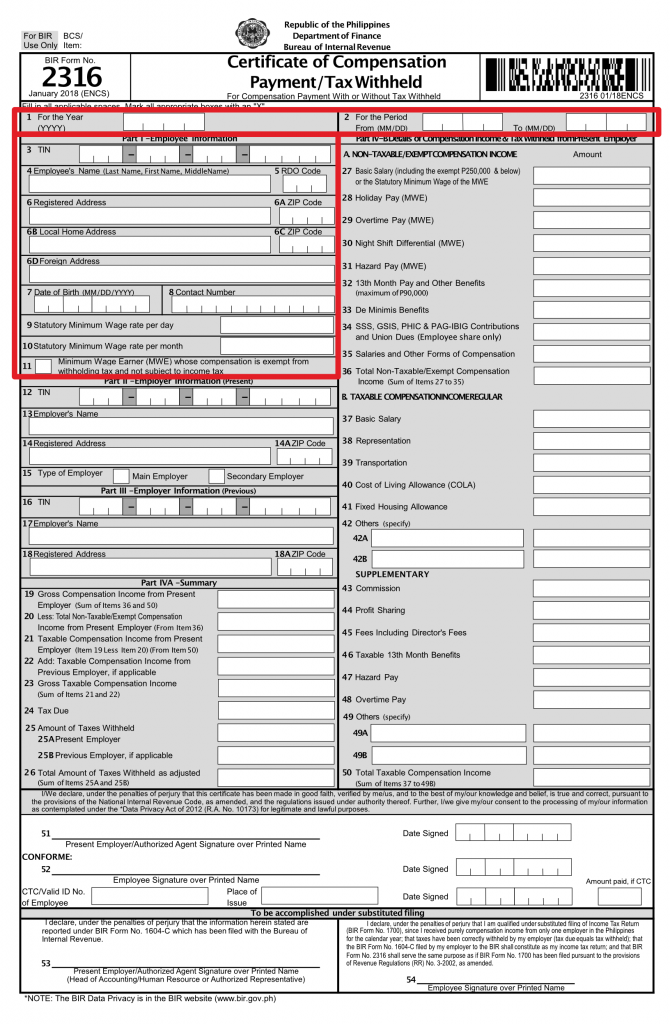

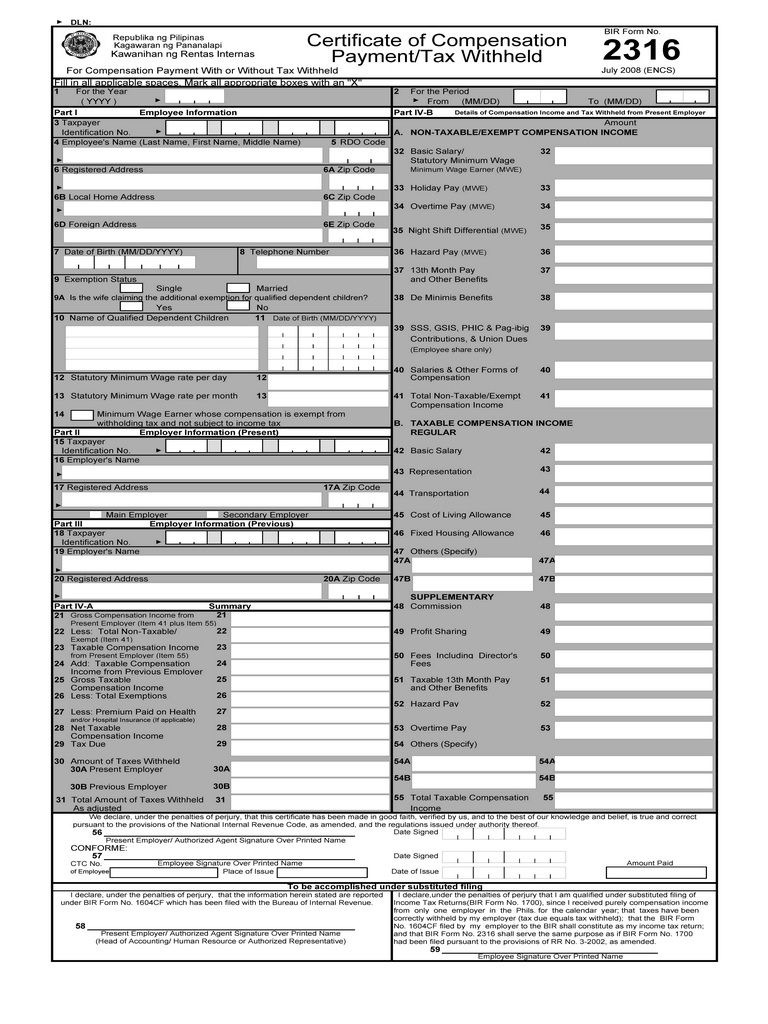

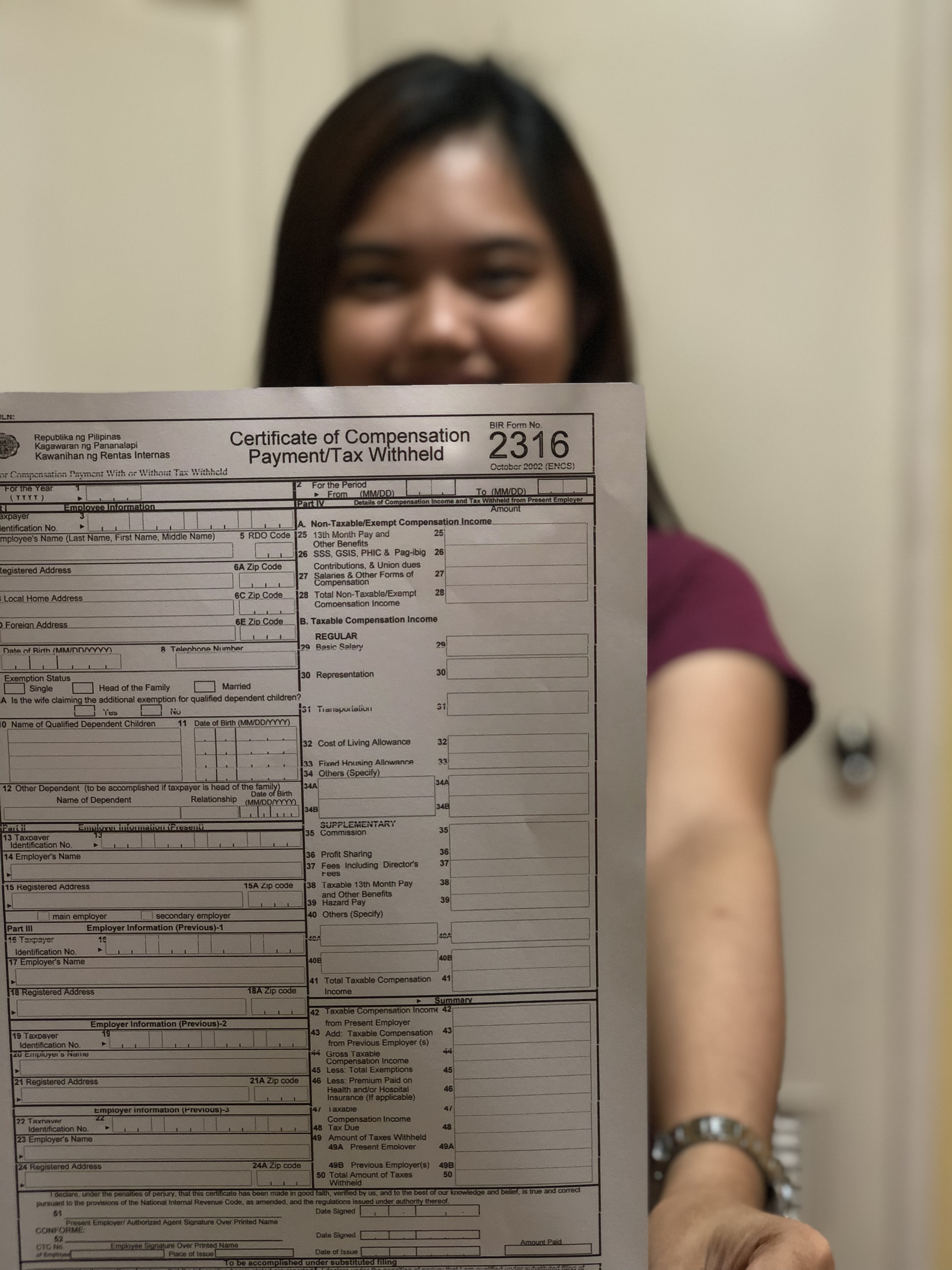

Form 2316 Bir - Of revenue regulations (rr) no. Fill & download for free get form download the form how to edit the bir form 2316 freely online start on editing, signing and sharing your bir form 2316. Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. Employers must attach form 2316 to the annual. Is an annual tax return form that all philippine companies must submit to the bir that had engaged employees within the. Type text, add images, blackout confidential details, add comments, highlights and more. Web bir form no. Edit your bir form 2316 online. This document was uploaded by user and they confirmed that they have the permission to share it. Web the itr is a tax return, while the bir form 2316 is a certification of an employee’s income and taxes withheld.

Web download bir form 2316. Draw your signature, type it,. 2316 or certificate of compensation payment / tax withheld for compensation payment with or without tax withheld is a certificate issued by the. Web the bir form no. Sign it in a few clicks. 2316, or the certificates of compensation payment and tax withheld. Type text, add images, blackout confidential details, add comments, highlights and more. Is an annual tax return form that all philippine companies must submit to the bir that had engaged employees within the. This document was uploaded by user and they confirmed that they have the permission to share it. Web the commissioner of internal revenue (cir) has issued rmc no.

Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. Edit your bir form 2316 online. Employers must attach form 2316 to the annual. Web bir form no. 2316, or the certificates of compensation payment and tax withheld. Type text, add images, blackout confidential details, add comments, highlights and more. This document was uploaded by user and they confirmed that they have the permission to share it. Draw your signature, type it,. Web download bir form 2316. Web the itr is a tax return, while the bir form 2316 is a certification of an employee’s income and taxes withheld.

bir 2316 philippin news collections

Web bir form no. Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. Web bir form 2316 or certificate of compensation payment/tax withheld shows the breakdown of all the income received by an employee from his/her employer within the applicable. Web bir form 2316 must be accomplished by an employer for each.

Ultimate Guide on How to Fill Out BIR Form 2316 FullSuite

Draw your signature, type it,. Type text, add images, blackout confidential details, add comments, highlights and more. Web bir form 2316 or certificate of compensation payment/tax withheld shows the breakdown of all the income received by an employee from his/her employer within the applicable. Employers must attach form 2316 to the annual. The certificate should identify the.

BIR Form 2316 Everything You Need to Know FullSuite

2316 or certificate of compensation payment / tax withheld for compensation payment with or without tax withheld is a certificate issued by the. This document was uploaded by user and they confirmed that they have the permission to share it. Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form.

bir 2316 philippin news collections

Sign it in a few clicks. Web bir form no. Web bir form 2316 must be accomplished by an employer for each employee receiving salaries, wages, and other forms of remuneration, indicating the total amount. Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. Web in a nutshell, the bir form 2316:

bir 2316 philippin news collections

Web bir form no. Web bir form 2316 must be accomplished by an employer for each employee receiving salaries, wages, and other forms of remuneration, indicating the total amount. Web the itr is a tax return, while the bir form 2316 is a certification of an employee’s income and taxes withheld. Web bir form 2316 is completed and issued to.

Ultimate Guide on How to Fill Out BIR Form 2316 FullSuite

Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. Web the commissioner of internal revenue (cir) has issued rmc no. Draw your signature, type it,. The certificate should identify the. Web bir form no.

bir 2316 philippin news collections

Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. Type text, add images, blackout confidential details, add comments, highlights and more. Web in a nutshell, the bir form 2316: Of revenue regulations (rr) no. Web bir form 2316 must be accomplished by an employer for each employee receiving salaries, wages, and other.

bir 2316 philippin news collections

2316, or the certificates of compensation payment and tax withheld. Web download bir form 2316. The certificate should identify the. Employers must attach form 2316 to the annual. Fill & download for free get form download the form how to edit the bir form 2316 freely online start on editing, signing and sharing your bir form 2316.

bir 2316 philippin news collections

Web the bir form no. Edit your bir form 2316 online. Of revenue regulations (rr) no. Web bir form 2316 or certificate of compensation payment/tax withheld shows the breakdown of all the income received by an employee from his/her employer within the applicable. Web in a nutshell, the bir form 2316:

Breanna Bir 2316 Form 2019

This document was uploaded by user and they confirmed that they have the permission to share it. Web the commissioner of internal revenue (cir) has issued rmc no. Edit your bir form 2316 online. Web in a nutshell, the bir form 2316: Is an annual tax return form that all philippine companies must submit to the bir that had engaged.

Web The Commissioner Of Internal Revenue (Cir) Has Issued Rmc No.

Web bir form 2316 must be accomplished by an employer for each employee receiving salaries, wages, and other forms of remuneration, indicating the total amount. Sign it in a few clicks. 2316, or the certificates of compensation payment and tax withheld. Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld.

Of Revenue Regulations (Rr) No.

Web the bir form no. The certificate should identify the. Draw your signature, type it,. Web bir form 2316 or certificate of compensation payment/tax withheld shows the breakdown of all the income received by an employee from his/her employer within the applicable.

Web In A Nutshell, The Bir Form 2316:

Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. Web download bir form 2316. Employers must attach form 2316 to the annual. 2316 or certificate of compensation payment / tax withheld for compensation payment with or without tax withheld is a certificate issued by the.

Edit Your Bir Form 2316 Online.

Web the itr is a tax return, while the bir form 2316 is a certification of an employee’s income and taxes withheld. Is an annual tax return form that all philippine companies must submit to the bir that had engaged employees within the. Web bir form no. This document was uploaded by user and they confirmed that they have the permission to share it.