Form 2553 Late Filing Reasonable Cause

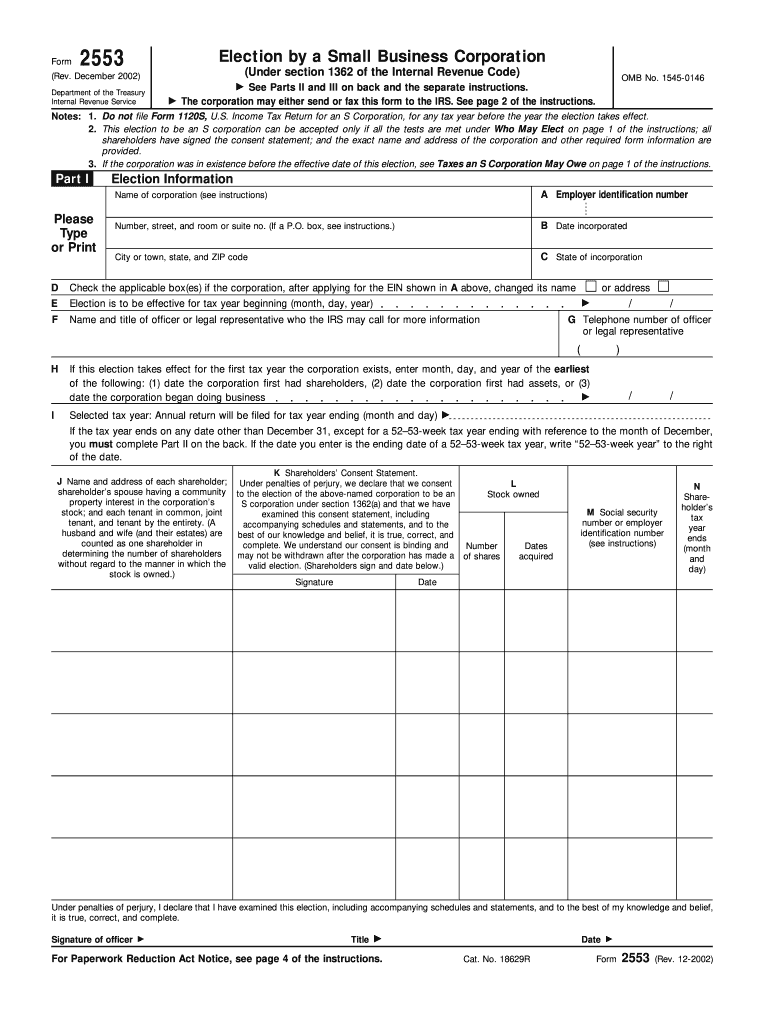

Form 2553 Late Filing Reasonable Cause - Income tax return for an s corporation, for the. You must have reasonable cause for filing late or for mistakes on your initial filing. Call the irs if you. Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as an s corporation, but when form. Web 0:00 / 28:25 introduction how to file a late s corp election by completing form 2553 navi maraj, cpa 18.8k subscribers subscribe 815 views 1 month ago. Reasonable cause is determined on a case by case basis considering all the facts and circumstances of your situation. Web the entity requests relief for a late s corporation election by filing a properly completed form 2553 with its form 1120s, u.s. Under election information, fill in the corporation's name and address, along with your ein number and date and state. The irs does not specify what. Web request relief on the grounds of reasonable cause.

Web have a good excuse: Web to obtain relief for a late s election, the corporation must file irs form 2553 and include at the top of the form “filed pursuant to rev. It can either be filled out on your computer or printed and. Call the irs if you. Web you must have reasonable cause for your failure to timely file the form 2553 by its due date. Web a late election to be an s corporation generally is effective for the tax year following the tax year beginning on the date entered on line e of form 2553. Reasons that qualify for relief due to. Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as an s corporation, but when form. Web generally, the relief under the revenue procedure can be granted when the entity fails to qualify solely because it failed to file the appropriate election under. If this late election is being made by an entity eligible to elect to.

Web generally, the relief under the revenue procedure can be granted when the entity fails to qualify solely because it failed to file the appropriate election under. Web 0:00 / 28:25 introduction how to file a late s corp election by completing form 2553 navi maraj, cpa 18.8k subscribers subscribe 815 views 1 month ago. You must have reasonable cause for filing late or for mistakes on your initial filing. Web you must have reasonable cause for your failure to timely file the form 2553 by its due date. For example, you didn’t know that you needed to submit. Under election information, fill in the corporation's name and address, along with your ein number and date and state. (1) for failure to file a tax return, and failure to pay, under. Web the entity requests relief for a late s corporation election by filing a properly completed form 2553 with its form 1120s, u.s. If this late election is being made by an entity eligible to elect to. How to file a late s corporation election step 1:

What is IRS Form 2553? Bench Accounting

Web to request relief from a late filing for reasonable cause, complete the narrative section at the bottom of page 1, explaining why you are filing late (you can use. How to file a late s corporation election step 1: (1) for failure to file a tax return, and failure to pay, under. Web 0:00 / 28:25 introduction how to.

Ssurvivor Form 2553 Irs Pdf

Reasonable cause refers to when a taxpayer didn’t file the forms on time due to a “valid reason” so to speak. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. If this late election is being made by an entity eligible to elect to. The irs does.

2553 Vorwahl

Web generally, the relief under the revenue procedure can be granted when the entity fails to qualify solely because it failed to file the appropriate election under. Web 0:00 / 28:25 introduction how to file a late s corp election by completing form 2553 navi maraj, cpa 18.8k subscribers subscribe 815 views 1 month ago. (1) for failure to file.

Learn How to Fill the Form 2553 Election by a Small Business

Web you must have reasonable cause for your failure to timely file the form 2553 by its due date. Web a late election to be an s corporation generally is effective for the tax year following the tax year beginning on the date entered on line e of form 2553. (1) for failure to file a tax return, and failure.

How To Fill Out Form 2553 Make it simple, Filling, Tax forms

You must have reasonable cause for filing late or for mistakes on your initial filing. Reasonable cause is determined on a case by case basis considering all the facts and circumstances of your situation. Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as.

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

Reasonable cause refers to when a taxpayer didn’t file the forms on time due to a “valid reason” so to speak. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Reasons that qualify for relief due to. (1) for failure to file a tax return, and failure.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

Web a late election to be an s corporation generally is effective for the tax year following the tax year beginning on the date entered on line e of form 2553. Web to request relief from a late filing for reasonable cause, complete the narrative section at the bottom of page 1, explaining why you are filing late (you can.

Ssurvivor Form 2553 Irs Pdf

Call the irs if you. If this late election is being made by an entity eligible to elect to. Web a late election to be an s corporation generally is effective for the tax year following the tax year beginning on the date entered on line e of form 2553. Reasonable cause is determined on a case by case basis.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Reasonable cause refers to when a taxpayer didn’t file the forms on time due to a “valid reason” so to speak. The irs does not specify what. It can either be filled out on your computer or printed and. Web have a good excuse: (1) for failure to file a tax return, and failure to pay, under.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web generally, the relief under the revenue procedure can be granted when the entity fails to qualify solely because it failed to file the appropriate election under. Income tax return for an s corporation, for the. Web to obtain relief for a late s election, the corporation must file irs form 2553 and include at the top of the form.

If This Late Election Is Being Made By An Entity Eligible To Elect To.

Web a late election to be an s corporation generally is effective for the tax year following the tax year beginning on the date entered on line e of form 2553. Web request relief on the grounds of reasonable cause. You must have reasonable cause for filing late or for mistakes on your initial filing. Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as an s corporation, but when form.

Web The Entity Requests Relief For A Late S Corporation Election By Filing A Properly Completed Form 2553 With Its Form 1120S, U.s.

Reasonable cause is determined on a case by case basis considering all the facts and circumstances of your situation. Call the irs if you. Web 0:00 / 28:25 introduction how to file a late s corp election by completing form 2553 navi maraj, cpa 18.8k subscribers subscribe 815 views 1 month ago. Web to become an s corp in the next tax year, you must file form 2553 prior to two months and fifteen days after the start of the current tax year.

For Example, You Didn’t Know That You Needed To Submit.

Web to request relief from a late filing for reasonable cause, complete the narrative section at the bottom of page 1, explaining why you are filing late (you can use. The irs does not specify what. Reasons that qualify for relief due to. Web you must have reasonable cause for your failure to timely file the form 2553 by its due date.

Income Tax Return For An S Corporation, For The.

Web generally, the relief under the revenue procedure can be granted when the entity fails to qualify solely because it failed to file the appropriate election under. (1) for failure to file a tax return, and failure to pay, under. Web to make an election, the corporation must meet certain criteria and show reasonable cause for missing the filing deadline. Web have a good excuse: