Form 2553 Pdf

Form 2553 Pdf - Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. How to complete form 2553. Web how to file form 2553. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. Utah, washington, wyoming • the corporation has not filed a tax return for the tax year beginning on the date entered on line e of form 2553. Web timely file form 2553. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Check here to show that the corporation agrees to adopt or change to a tax year ending december 31 if necessary for the irs Our form 2553 instructions guide below covers:

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. Web get a 2553 here. Utah, washington, wyoming • the corporation has not filed a tax return for the tax year beginning on the date entered on line e of form 2553. • the corporation files form 2553 as an attachment to acceptance or nonacceptance of form 1120s no later than 6 months after the due date of See the instructions for details regarding the gross receipts from sales and services. Our form 2553 instructions guide below covers: Web when filing form 2553 for a late s corporation election, the corporation (entity) must enter in the top margin of the first page of form 2553 “filed pursuant to rev. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). Business owners can fill it out by typing directly into the form or by printing it out and completing it by hand. Where to file form 2553.

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. Where to file form 2553. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. Our form 2553 instructions guide below covers: See the instructions for details regarding the gross receipts from sales and services. See the instructions for details regarding the gross receipts from sales and services. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web timely file form 2553. Web when filing form 2553 for a late s corporation election, the corporation (entity) must enter in the top margin of the first page of form 2553 “filed pursuant to rev.

Form 2553 (Rev December 2007) Edit, Fill, Sign Online Handypdf

Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. See the instructions for details regarding the gross receipts from sales.

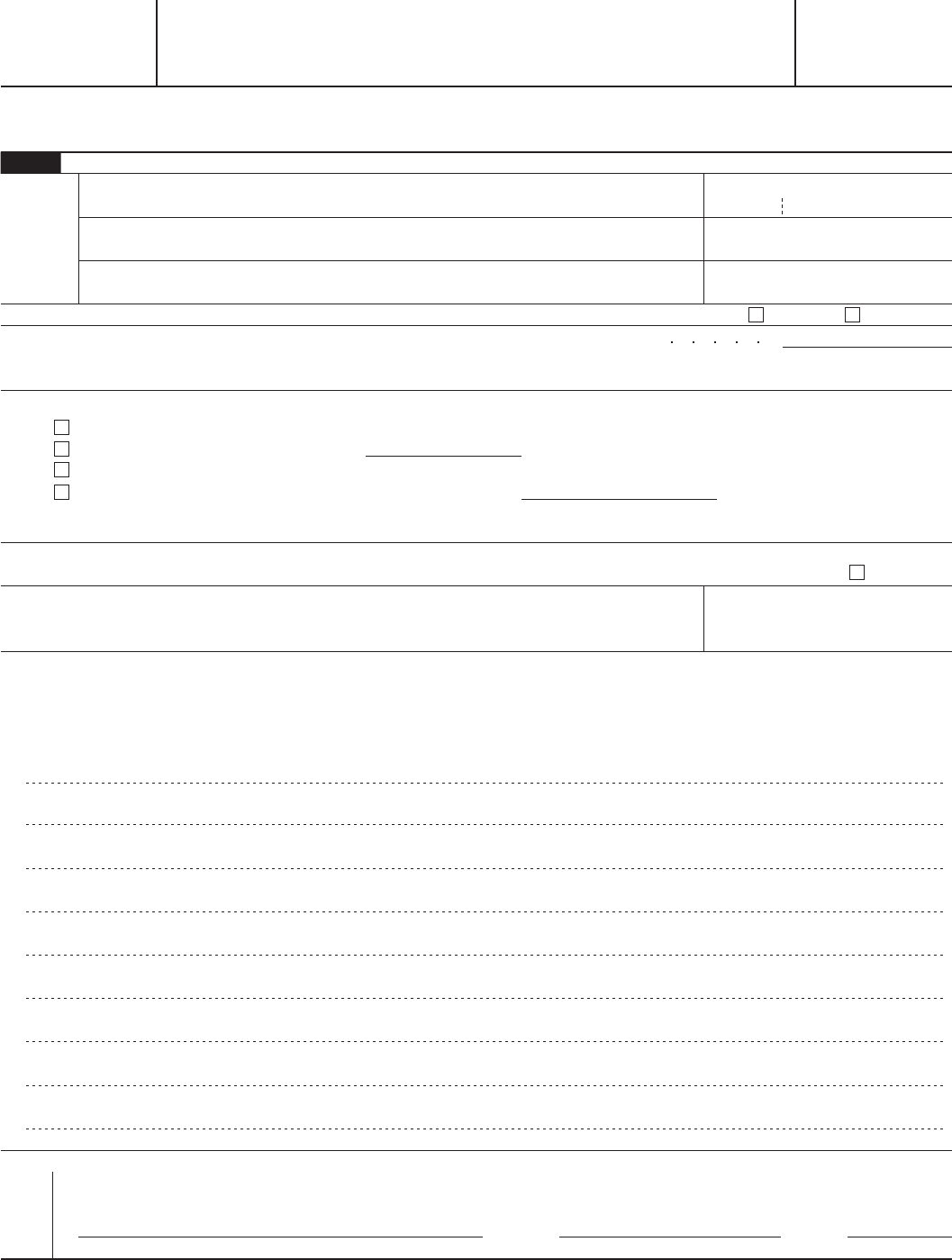

Irs form 2553 fill in 2002 Fill out & sign online DocHub

Business owners can fill it out by typing directly into the form or by printing it out and completing it by hand. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. Web when filing form 2553 for.

Ssurvivor Form 2553 Irs Pdf

Where to file form 2553. See the instructions for details regarding the gross receipts from sales and services. • the corporation files form 2553 as an attachment to acceptance or nonacceptance of form 1120s no later than 6 months after the due date of Web how to file form 2553. Check here to show that the corporation agrees to adopt.

BIR Form 2553 Download

See the instructions for details regarding the gross receipts from sales and services. • the corporation files form 2553 as an attachment to acceptance or nonacceptance of form 1120s no later than 6 months after the due date of A corporation or other entity eligible to be treated as a corporation files this form to make an election under section.

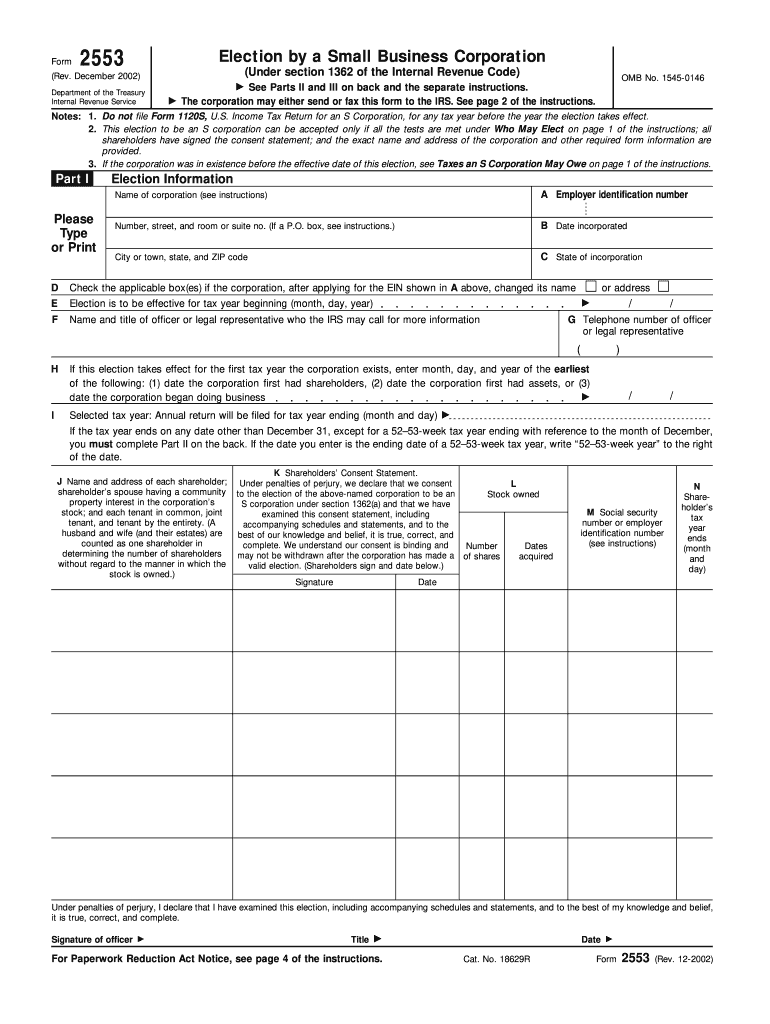

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. Where to file form 2553. • the corporation files form 2553 as an attachment to acceptance or nonacceptance of form 1120s no later than 6 months after the.

Form 2553 YouTube

How to complete form 2553. See the instructions for details regarding the gross receipts from sales and services. Business owners can fill it out by typing directly into the form or by printing it out and completing it by hand. Check here to show that the corporation agrees to adopt or change to a tax year ending december 31 if.

Form 2553 Fill Out and Sign Printable PDF Template signNow

Web get a 2553 here. Web how to file form 2553. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). A corporation or other entity eligible to be treated as a corporation files this form to make an election under section.

VA Form 102553 Download Fillable PDF or Fill Online Certificate of

How to complete form 2553. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. Where to file form 2553. See the instructions for details regarding the gross receipts from sales and services. To make the election, you must complete form 8716,.

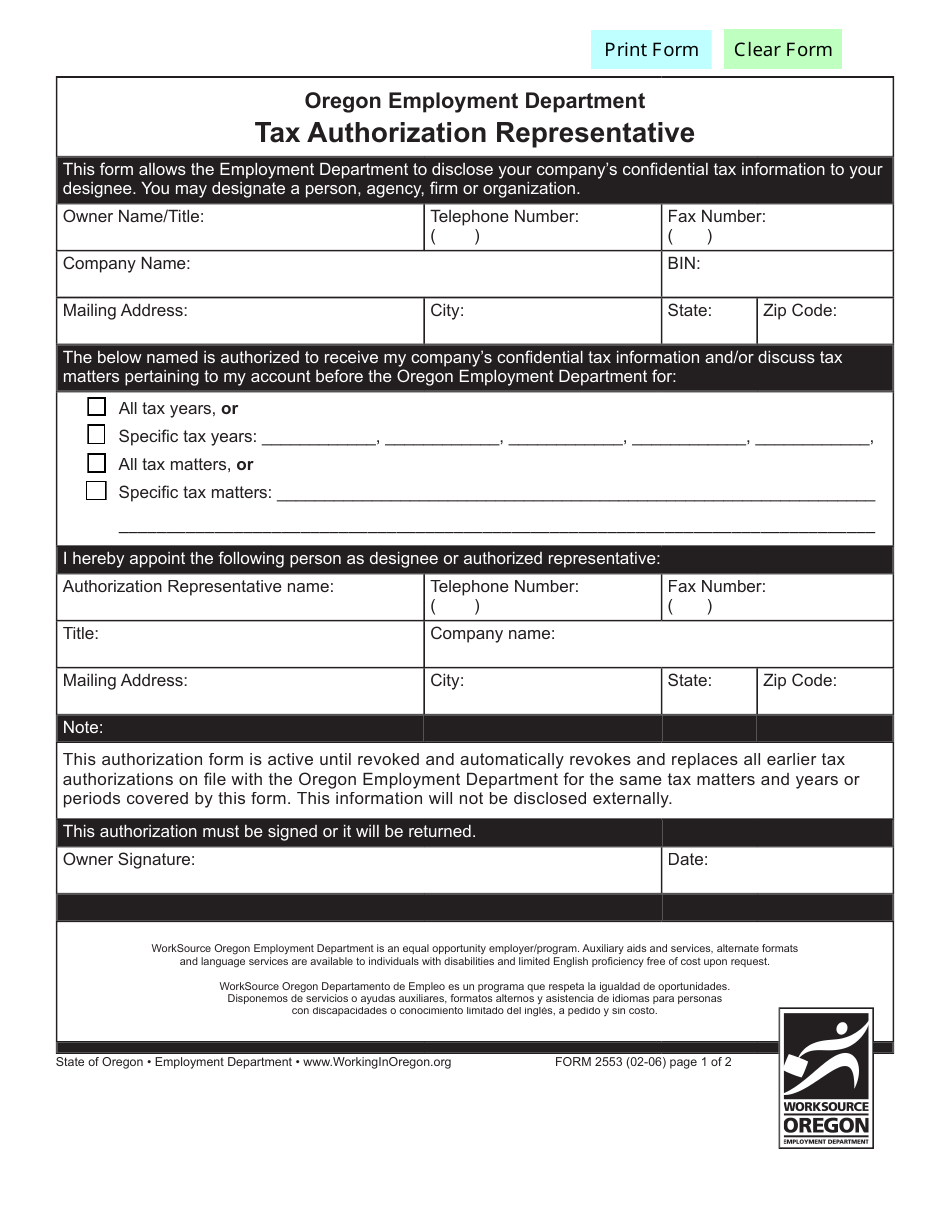

Form 2553 Instructions ≡ Fill Out Printable PDF Forms Online

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Where to file form 2553. Web how to file form 2553. Web when filing form 2553 for a late s corporation election, the corporation (entity) must enter in the top margin of the first page of form 2553 “filed.

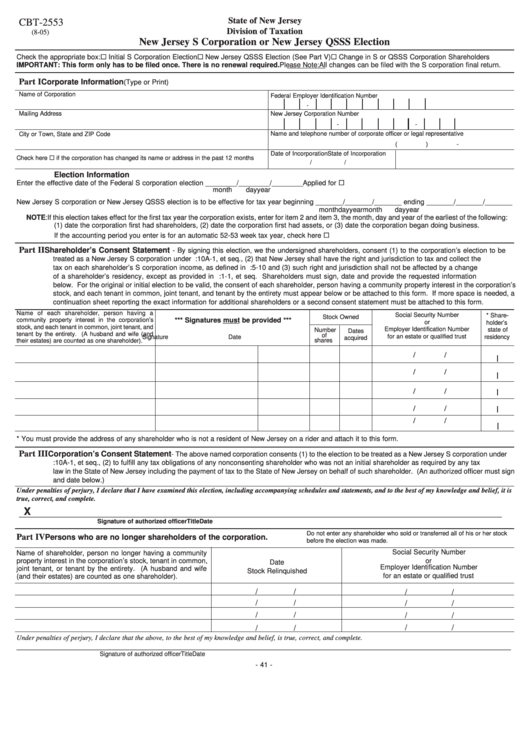

Fillable Form Cbt2553 New Jersey S Corporation Or New Jersey Qsss

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately..

Web When Filing Form 2553 For A Late S Corporation Election, The Corporation (Entity) Must Enter In The Top Margin Of The First Page Of Form 2553 “Filed Pursuant To Rev.

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose. Utah, washington, wyoming • the corporation has not filed a tax return for the tax year beginning on the date entered on line e of form 2553. See the instructions for details regarding the gross receipts from sales and services. Web get a 2553 here.

See The Instructions For Details Regarding The Gross Receipts From Sales And Services.

Our form 2553 instructions guide below covers: Web how to file form 2553. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. How to complete form 2553.

Web Form 2553 Is Used By Limited Liability Companies (Llcs) And Corporations To Elect The S Corporation (S Corp) Tax Classification With The Us Internal Revenue Service (Irs).

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Where to file form 2553. Business owners can fill it out by typing directly into the form or by printing it out and completing it by hand.

Web Timely File Form 2553.

• the corporation files form 2553 as an attachment to acceptance or nonacceptance of form 1120s no later than 6 months after the due date of Check here to show that the corporation agrees to adopt or change to a tax year ending december 31 if necessary for the irs Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business purpose.