Form 321 Charity Code

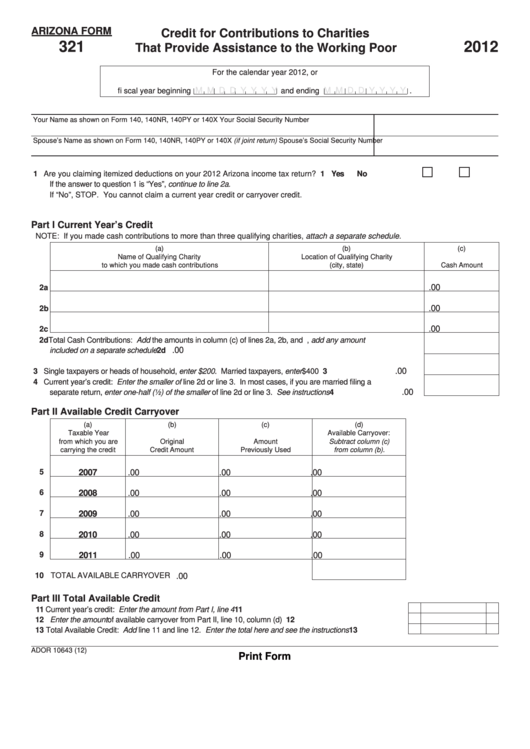

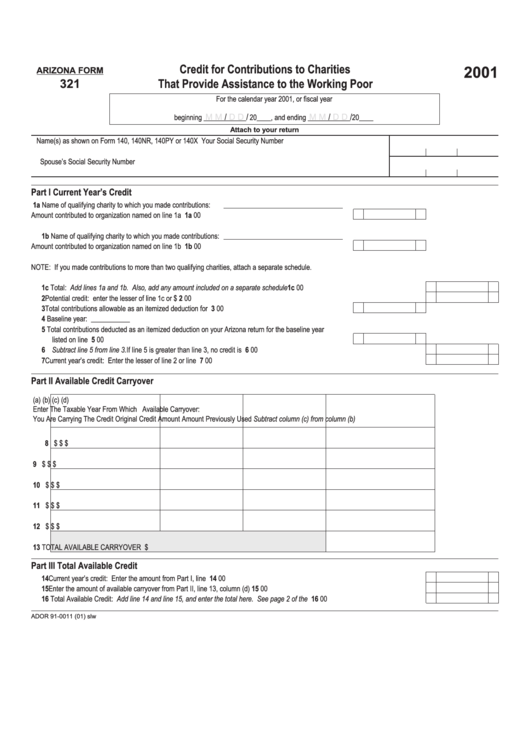

Form 321 Charity Code - For the calendar year 2020 or fiscal year beginning m m d d2 0 2 0 and ending m m d d y y y y. Web charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed on az form 352) (d) cash. Part 1 current year’s credit a. Web 321to qualifying charitable organizations2020 include with your return. The five digit code number of the qualifying charity or the uco fund code (for example: Web complete az form 321 and include it when you file your 2022 state taxes. The name of the qualifying charity or the uco fund name;. Web to claim the certified credit, file form 348. Web and include it with the credit form. Ador 10643 (20) az form 321 (2020) page 3 of 3 your name (as shown on.

For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmddyyyy. Web 11 rows credit for contributions to qualifying charitable organizations. Any charitable contribution that is included in itemized deductions on your federal return must. Web there are codes for arizona form 321 that apply to donations made by 12/13/18 and different codes that apply to donations made between 1/1/19 and 4/17/19. Ador 10643 (20) az form 321 (2020) page 3 of 3 your name (as shown on. Web and include it with the credit form. Web to claim the credit, you must fill out form 321 and file the form with your individual arizona 140 tax return. Web charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed on az form 352) (d) cash. Web 2019 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web arizona form 321 1 (1) include with your return.

Web location of qualifying charity (city, state) (c) cash amount 1a 00 1b 00 1c 00 1d total cash contributions: Cash contributions made january 1, 2021 through december 31, 2021. Web 11 rows credit for contributions to qualifying charitable organizations. Web there are codes for arizona form 321 that apply to donations made by 12/13/18 and different codes that apply to donations made between 1/1/19 and 4/17/19. The name of the qualifying charity or the uco fund name;. Web 321to qualifying charitable organizations2020 include with your return. For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmddyyyy. Web 2019 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Ador 10643 (20) az form 321 (2020) page 3 of 3 your name (as shown on. Web to claim the credit, you must fill out form 321 and file the form with your individual arizona 140 tax return.

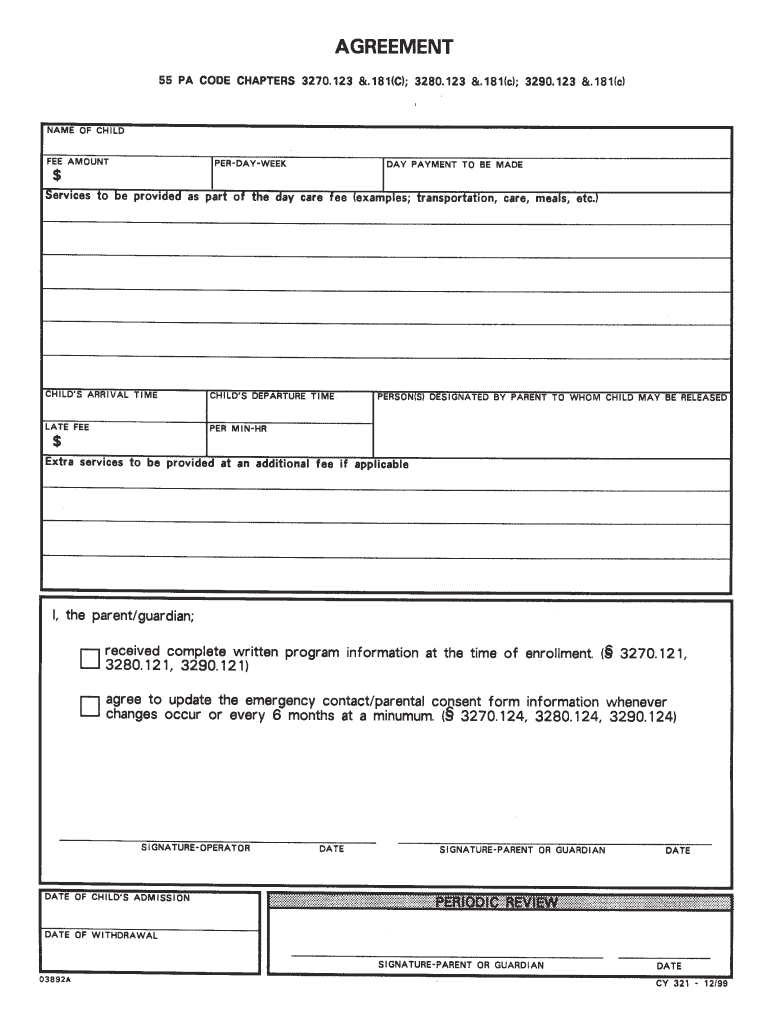

Pa Child Care Forms Fill Out and Sign Printable PDF Template signNow

Web there are codes for arizona form 321 that apply to donations made by 12/13/18 and different codes that apply to donations made between 1/1/19 and 4/17/19. Beginning with the 2016 tax year and continuing, contributions made to. For the calendar year 2020 or fiscal year beginning m m d d2 0 2 0 and ending m m d d.

Form 321

For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmddyyyy. Web arizona form 321 not accepting qco codes for the 2022 list i made a qco donation between 1/1/2022 and 4/18/2022, but form 321 will not accept the qco code. (a) qualifying charity code (b) name of qualifying charity. Ador 10643 (20) az form 321 (2020) page.

Code for Charity 2014 YouTube

Cash contributions made january 1, 2021 through december 31, 2021. Web 2019 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: A complete list of stos here. A nonrefundable individual tax credit for voluntary cash contributions to a qualifying. A separate credit is available for donations or fees paid.

Fillable Arizona Form 321 Credit For Contributions To Charities That

Web location of qualifying charity (city, state) (c) cash amount 1a 00 1b 00 1c 00 1d total cash contributions: Web you’ll need to fill out form 321, which you can download from the arizona department of revenue website. Web 321to qualifying charitable organizations2022 include with your return. Beginning with the 2016 tax year and continuing, contributions made to. Web.

Arizona Form 321 Credit For Contributions To Charities That Provide

Web arizona form 321 1 (1) include with your return. Web 321to qualifying charitable organizations2021 include with your return. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmddyyyy. Web 11 rows credit for contributions to qualifying charitable organizations. A nonrefundable individual tax credit for voluntary cash contributions to a qualifying.

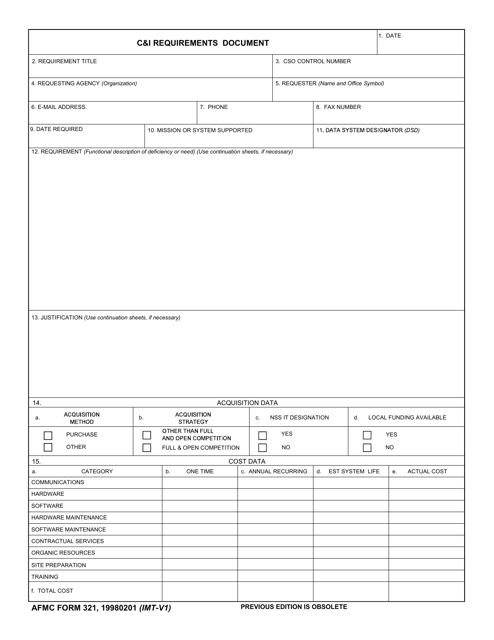

AFMC Form 321 Download Fillable PDF or Fill Online C & I Requirements

Add the amounts in column (c) of lines 1a, 1b, and 1c. The name of the qualifying charity or the uco fund name;. A complete list of stos here. Web and include it with the credit form. Beginning with the 2016 tax year and continuing, contributions made to.

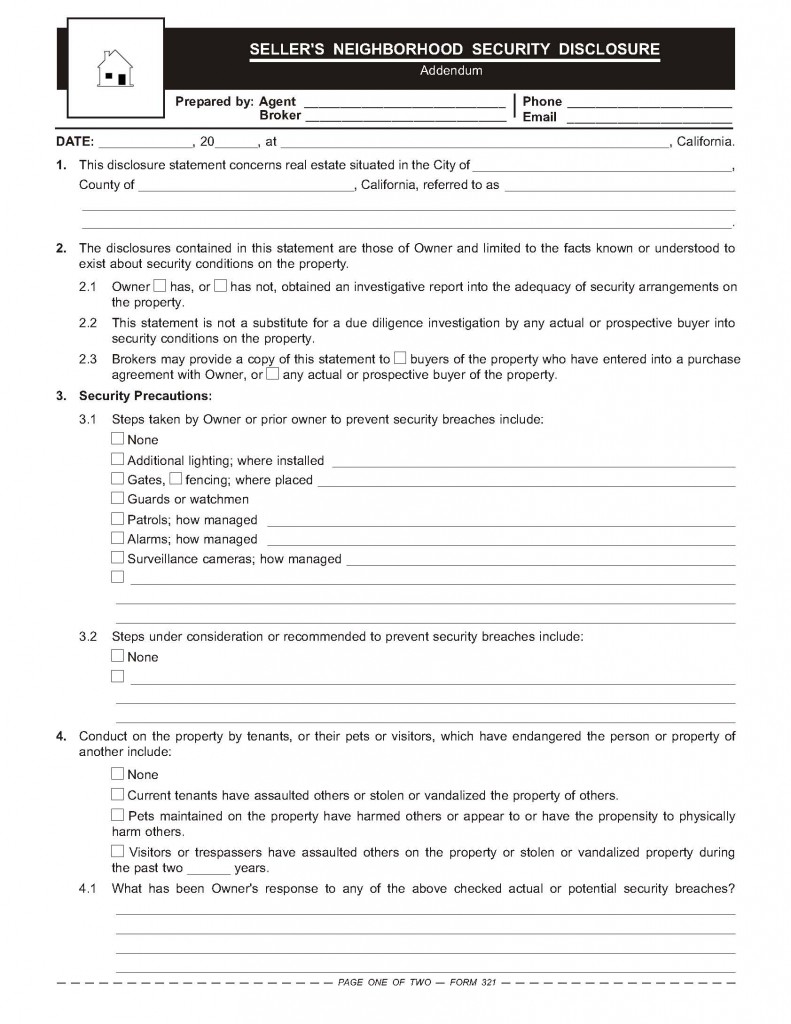

Neighborhood security disclosure the safety addendum first tuesday

Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmddyyyy. Web charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed on az form 352) (d) cash. A separate.

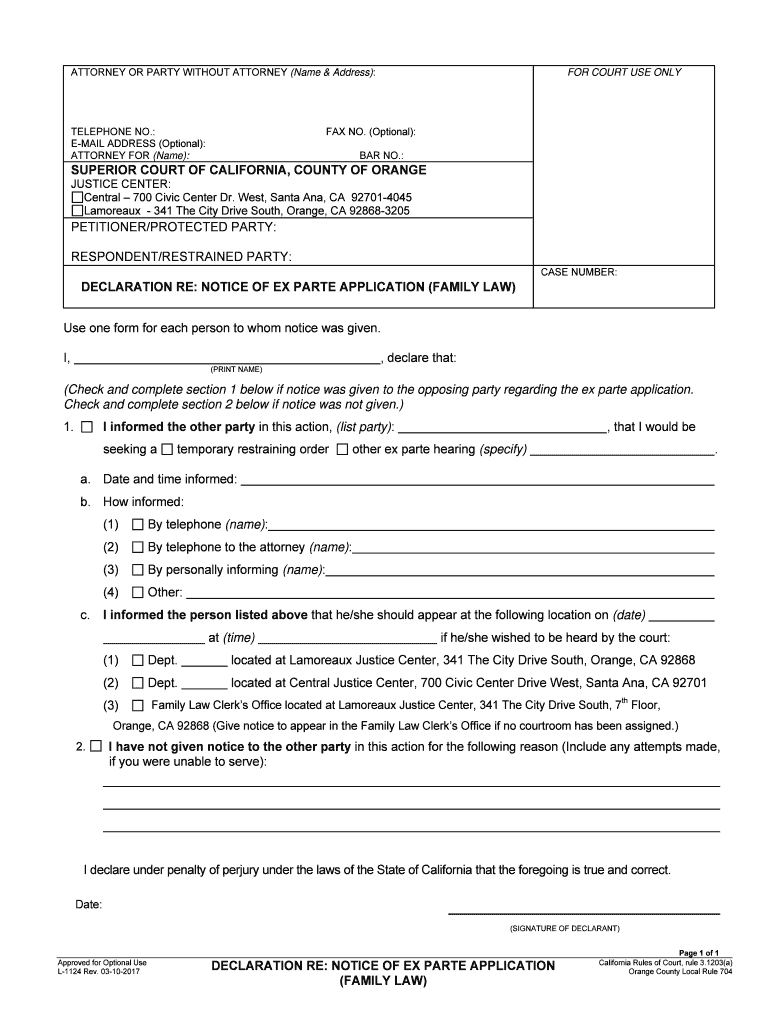

California Form Fl 321 Fill Online, Printable, Fillable, Blank

Web location of qualifying charity (city, state) (c) cash amount 1a 00 1b 00 1c 00 1d total cash contributions: Ador 10643 (20) az form 321 (2020) page 3 of 3 your name (as shown on. Web 11 rows credit for contributions to qualifying charitable organizations. Web arizona form 321 not accepting qco codes for the 2022 list i made.

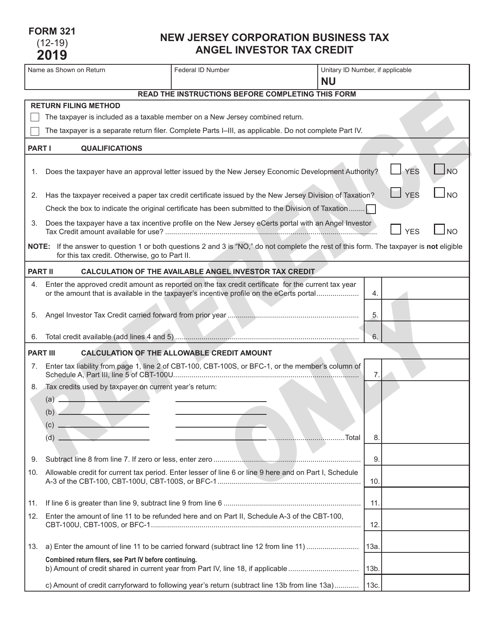

Form 321 Download Printable PDF or Fill Online Angel Investor Tax

A separate credit is available for donations or fees paid to public schools ($400/$200). Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web 2019 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web 321to.

Donation & Tax Credit Info New Creation Trades, Inc

Add the amounts in column (c) of lines 1a, 1b, and 1c. Web and include it with the credit form. Web 321to qualifying charitable organizations2021 include with your return. A nonrefundable individual tax credit for voluntary cash contributions to a qualifying. Web to claim the credit, you must fill out form 321 and file the form with your individual arizona.

(A) Qualifying Charity Code (B) Name Of Qualifying Charity.

Web 11 rows credit for contributions to qualifying charitable organizations. The name of the qualifying charity or the uco fund name;. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmddyyyy. A separate credit is available for donations or fees paid to public schools ($400/$200).

Web 2021 Credit For Contributions Arizona Form To Qualifying Charitable Organizations 321 For Information Or Help, Call One Of The Numbers Listed:

Web to claim the certified credit, file form 348. Any charitable contribution that is included in itemized deductions on your federal return must. For the calendar year 2020 or fiscal year beginning m m d d2 0 2 0 and ending m m d d y y y y. Cash contributions made january 1, 2021 through december 31, 2021.

Web You’ll Need To Fill Out Form 321, Which You Can Download From The Arizona Department Of Revenue Website.

Web complete az form 321 and include it when you file your 2022 state taxes. A complete list of stos here. Web arizona form 321 not accepting qco codes for the 2022 list i made a qco donation between 1/1/2022 and 4/18/2022, but form 321 will not accept the qco code. Web 321to qualifying charitable organizations2020 include with your return.

Web To Claim The Credit, You Must Fill Out Form 321 And File The Form With Your Individual Arizona 140 Tax Return.

Ador 10643 (20) az form 321 (2020) page 3 of 3 your name (as shown on. Web location of qualifying charity (city, state) (c) cash amount 1a 00 1b 00 1c 00 1d total cash contributions: Web 321to qualifying charitable organizations2022 include with your return. Web charity code (c) name of qualifying charity (contributions to qualifying foster care charitable organizations are claimed on az form 352) (d) cash.