Form 3520 Inheritance

Form 3520 Inheritance - Web the form 3520 is generally required when a u.s. Web foreign inheritance & form 3520: Web form 3520 is an informational tax form used to report certain foreign assets, inheritances, or certain large gifts from foreign persons. Complete, edit or print tax forms instantly. The irs form 3520 is used to report certain foreign transactions involving gifts and trusts. You only need part iv u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you could land with big penalties. So, why are foreign inheritances included in the. Reportable gifts include transactions involving foreign individuals or entities, such as.

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. The form provides information about the foreign trust, its u.s. Person receives a bequest (inheritance) from a foreign person in excess of $100,000, the transaction requires a form 3520 filing requirement. You only need part iv u.s. The nature of the foreign. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. So, why are foreign inheritances included in the. The penalties for not properly reporting form 3520 can be significantly high — and if more than five months have passed since the reporting was. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution.

Even expatriates who live abroad must report an inheritance over that sum to. You only need part iv u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major. Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you could land with big penalties. Register and subscribe now to work on your irs form 3520 & more fillable forms. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. So, why are foreign inheritances included in the. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web form 3520 is an informational tax form used to report certain foreign assets, inheritances, or certain large gifts from foreign persons.

Reporting Foreign Inheritance with Form 3520

Web if you are a u.s. Web as its title states, form 3520 is an information return by which us persons, as well as executors of the estates of us decedents, report: Even expatriates who live abroad must report an inheritance over that sum to. Register and subscribe now to work on your irs form 3520 & more fillable forms..

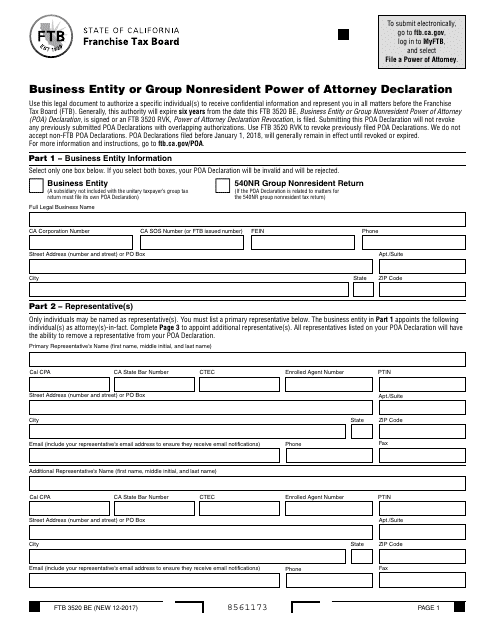

Form FTB 3520 BE Download Fillable PDF, Business Entity or Group

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. The form provides information about the foreign trust, its u.s. Web the common common reason for filing this irs form, is to report a foreign person gift. Ad talk to our.

Form 3520 US Taxes on Gifts and Inheritances

The irs form 3520 is used to report certain foreign transactions involving gifts and trusts. Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you could land with big penalties. Person who received foreign gifts of money or other property, you may need to report these gifts on.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major. Register and subscribe now to work on your irs form 3520 & more.

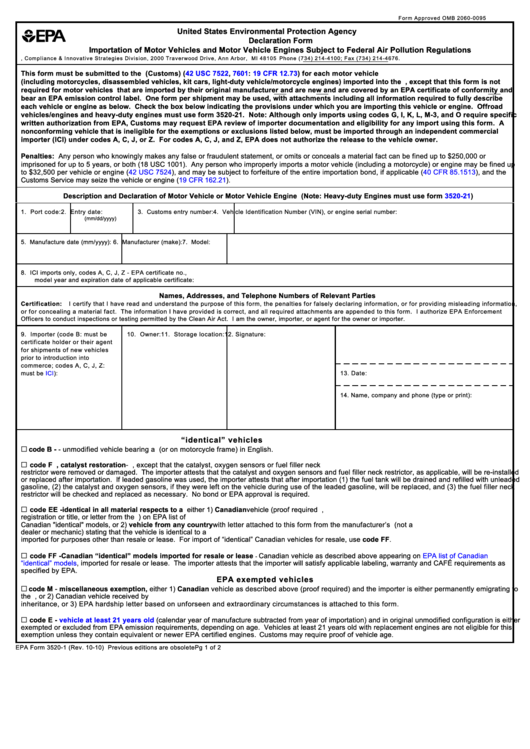

Top Epa Form 35201 Templates free to download in PDF format

The form provides information about the foreign trust, its u.s. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. Web foreign inheritance & form 3520: Web the common common reason for filing this irs form, is to report a foreign person gift. Even expatriates who live abroad must report an inheritance over that.

Form 3520 What is it and How to Report Foreign Gift, Trust and

Web the form 3520 is generally required when a u.s. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. Even expatriates who live abroad must report an inheritance over that sum to. Web if you are a u.s. Ad talk to our skilled.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Web foreign inheritance & form 3520: Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. Ad talk to our skilled attorneys by scheduling a free.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. So, why are foreign inheritances included in the. Web the common common reason for filing this irs form, is to report a foreign person gift. Person who received foreign gifts of money or other.

Inheritance Tax Illinois ellieldesign

The irs form 3520 is used to report certain foreign transactions involving gifts and trusts. Web foreign inheritance & form 3520: Reportable gifts include transactions involving foreign individuals or entities, such as. Web the common common reason for filing this irs form, is to report a foreign person gift. The form provides information about the foreign trust, its u.s.

Steuererklärung dienstreisen Form 3520

Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web the form 3520 is generally required when a u.s. The penalties for not properly reporting form 3520 can be significantly high — and if more than five months.

Person Receives A Bequest (Inheritance) From A Foreign Person In Excess Of $100,000, The Transaction Requires A Form 3520 Filing Requirement.

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over. Web the irs form 3520 reports annually information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and (d) major. The penalties for not properly reporting form 3520 can be significantly high — and if more than five months have passed since the reporting was. So, why are foreign inheritances included in the.

Web The Form 3520 Is Generally Required When A U.s.

Web if you have received a foreign gift or inheritance worth more than $100,000, you must file irs form 3520 or you could land with big penalties. Web irs form 3520 applies to american citizens who have inherited over $100,000 from another country. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to.

Complete, Edit Or Print Tax Forms Instantly.

Web foreign inheritance & form 3520: The form provides information about the foreign trust, its u.s. Register and subscribe now to work on your irs form 3520 & more fillable forms. The irs form 3520 is used to report certain foreign transactions involving gifts and trusts.

Ad Talk To Our Skilled Attorneys By Scheduling A Free Consultation Today.

The nature of the foreign. You only need part iv u.s. Complete, edit or print tax forms instantly. Web form 3520 is an informational tax form used to report certain foreign assets, inheritances, or certain large gifts from foreign persons.