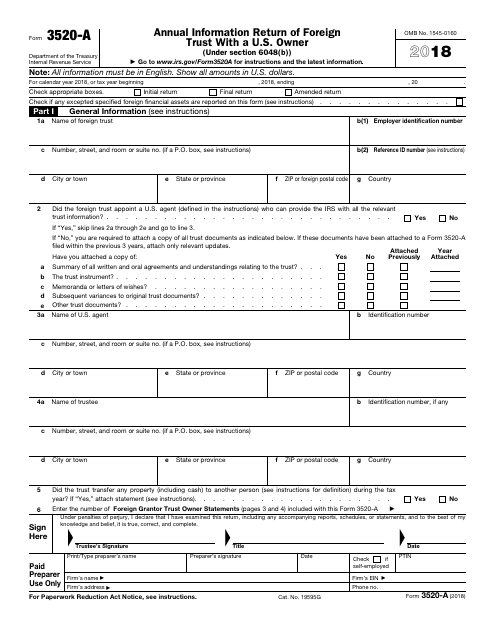

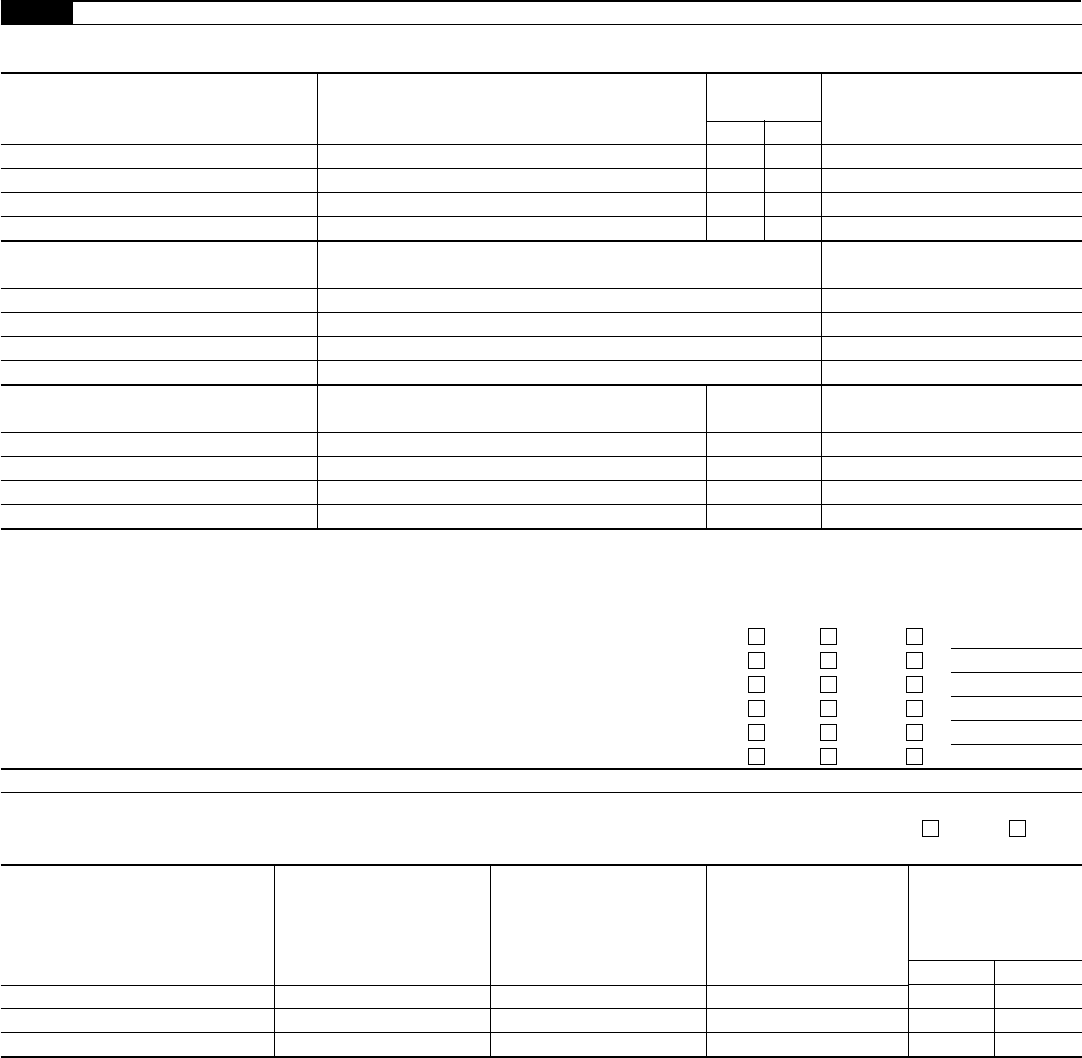

Form 3520 Part Iv

Form 3520 Part Iv - You may be required to file financial crimes enforcement network. Web complete the identifying information on page 1 of the form and part iv. What is irs form 3520? The first component of the form 3520 is fairly. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Talk to our skilled attorneys by scheduling a free consultation today. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons. Use part iv to indicate additional acts your named. Web form 3520 is due the fourth month following the end of the person's tax year, typically april 15.

This due date gets extended only if the taxpayer files a timely extension. Web form 3520’s full designation is a mouthful: Web file a separate form 3520 for each foreign trust. Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. Separately, you need to file an. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons. Web form 3520 & instructions: Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. See the instructions for part iv.

How can i obtain a copy of irs form 3520? Web form 3520 & instructions: What is irs form 3520? This due date gets extended only if the taxpayer files a timely extension. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. It does not have to be a “foreign gift.” rather, if a. Web form 3520 is due the fourth month following the end of the person's tax year, typically april 15. Separately, you need to file an. Use part iv to indicate additional acts your named. See the instructions for part iv.

Steuererklärung dienstreisen Form 3520

Web file a separate form 3520 for each foreign trust. A poa declaration gives representatives general privileges listed in part iii. What is irs form 3520? Web form 3520 & instructions: Web the form is due when a person’s tax return is due to be filed.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Web form 3520’s full designation is a mouthful: Separately, you need to file an. Web file a separate form 3520 for each foreign trust. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. You may be required to file financial crimes enforcement network.

form 3520a 2021 Fill Online, Printable, Fillable Blank

It does not have to be a “foreign gift.” rather, if a. Web form 3520 is due the fourth month following the end of the person's tax year, typically april 15. Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. The first component of the form 3520.

Steuererklärung dienstreisen Form 3520

Use part iv to indicate additional acts your named. It does not have to be a “foreign gift.” rather, if a. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Irs form 3520 is known as the. What is irs form 3520?

Form 3520A Annual Information Return of Foreign Trust with a U.S

Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. How can i obtain a copy of irs form 3520? Irs form 3520 is known.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

This due date gets extended only if the taxpayer files a timely extension. Irs form 3520 is known as the. See the instructions for part iv. You may be required to file financial crimes enforcement network. Web form 3520’s full designation is a mouthful:

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Web complete the identifying information on page 1 of the form and part iv. Web file a separate form 3520 for each foreign trust. You may be required to file financial crimes enforcement network. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Talk to our skilled attorneys by.

Epa form 3520 21 Instructions Fresh Wo A1 Model Based Controls for Use with

See the instructions for part iv. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 & instructions: Talk to our skilled attorneys by scheduling a free consultation today. Web the form is due when a person’s tax return is due to be filed.

IRS Creates “International Practice Units” for their IRS Revenue Agents

The first component of the form 3520 is fairly. How can i obtain a copy of irs form 3520? Web you must report the entire value of the inheritance, using the us dollar value as of the date of the person's death, not just the cash. The word “certain” in the form’s title. Even if the person does not have.

3.21.19 Foreign Trust System Internal Revenue Service

Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Transferor who, directly or indirectly, transferred money or other property during the. Web complete the identifying information on page 1 of the form and part iv. See the instructions for part iv. Web you must report the entire value of the inheritance, using the us dollar.

This Due Date Gets Extended Only If The Taxpayer Files A Timely Extension.

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Web the form is due when a person’s tax return is due to be filed. Talk to our skilled attorneys by scheduling a free consultation today. What is irs form 3520?

Irs Form 3520 Is Known As The.

Web file a separate form 3520 for each foreign trust. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520’s full designation is a mouthful: Web the fourth and final component of the form 3520 is utilized to report u.s person’s receipt of gifts or bequests from foreign persons.

The Irs F Orm 3520 Is Used To Report A Foreign Gift, Inheritance Or Trust Distribution From A Foreign Person.

See the instructions for part iv. Web complete the identifying information on page 1 of the form and part iv. Web form 3520 & instructions: Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues.

The Word “Certain” In The Form’s Title.

It does not have to be a “foreign gift.” rather, if a. Separately, you need to file an. Check either the “yes” or “no” box below for additional authorizations you would like to grant your representative(s) in addition to those. How can i obtain a copy of irs form 3520?