Form 3520 Turbotax

Form 3520 Turbotax - Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain overseas persons. Owner files this form annually to provide information about: Decedents) file form 3520 with the irs to report: Download or email irs 3520 & more fillable forms, register and subscribe now! All information must be in english. Complete, edit or print tax forms instantly. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Complete, edit or print tax forms instantly. Rather, if a foreign person gifts u.s. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules.

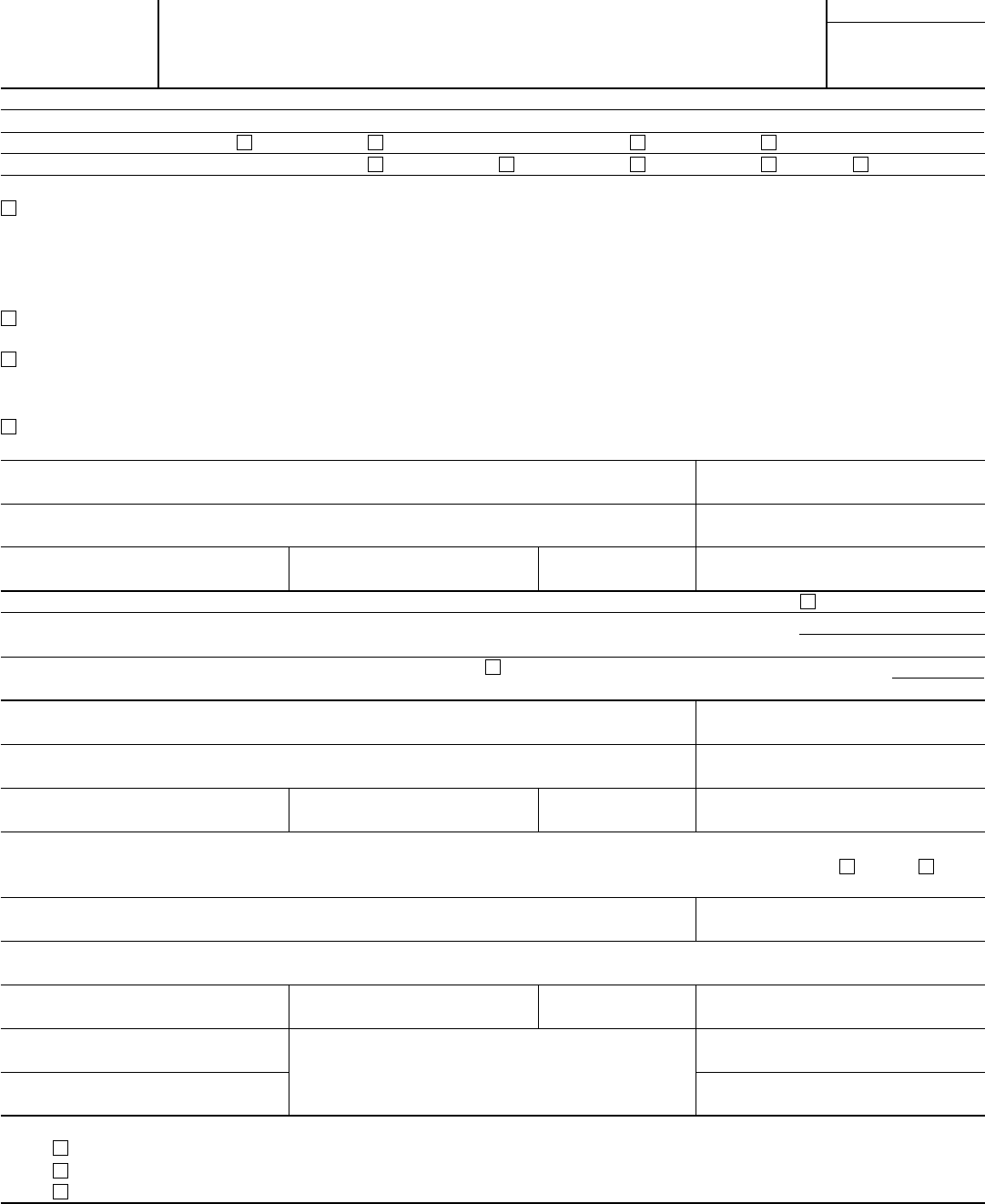

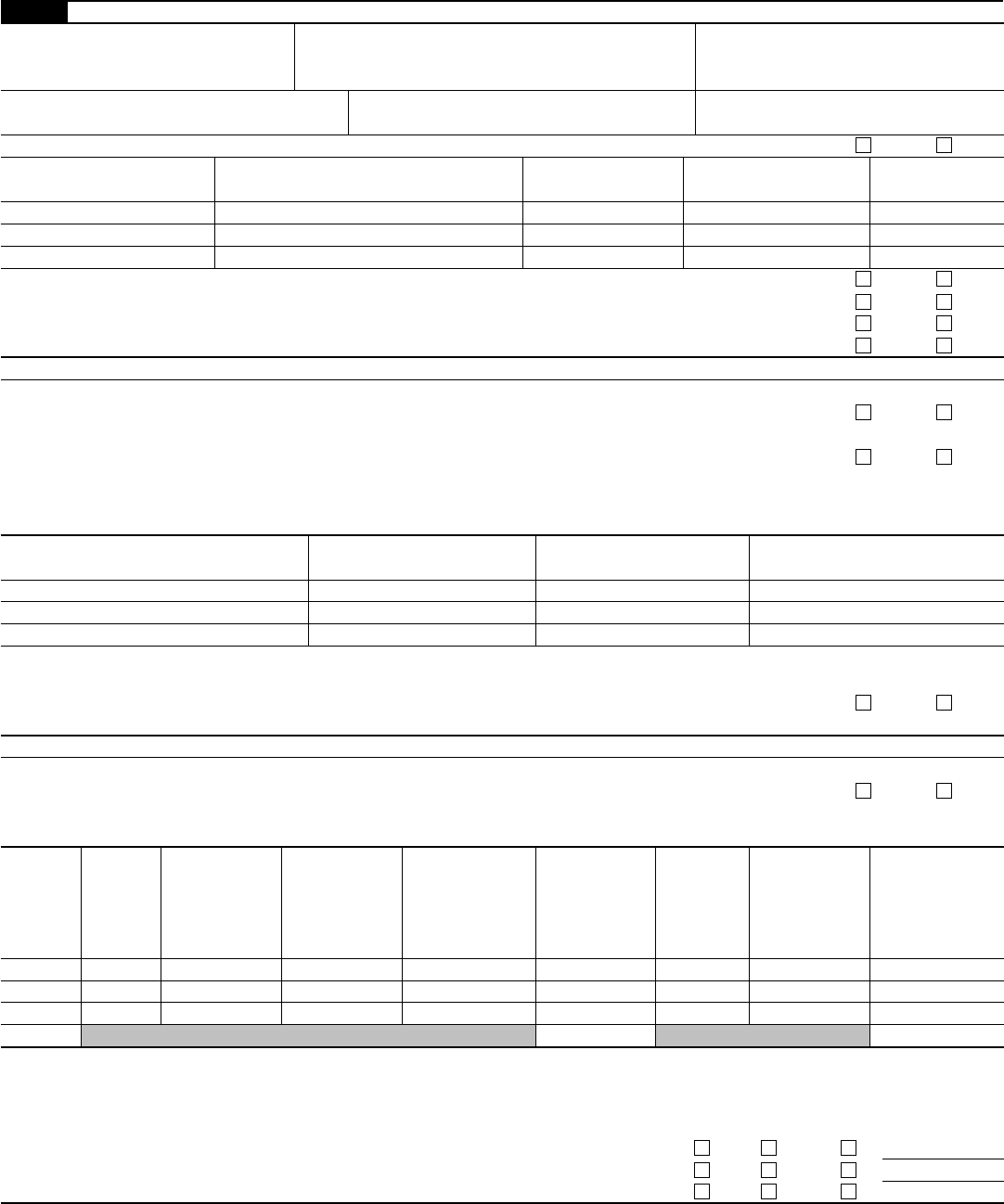

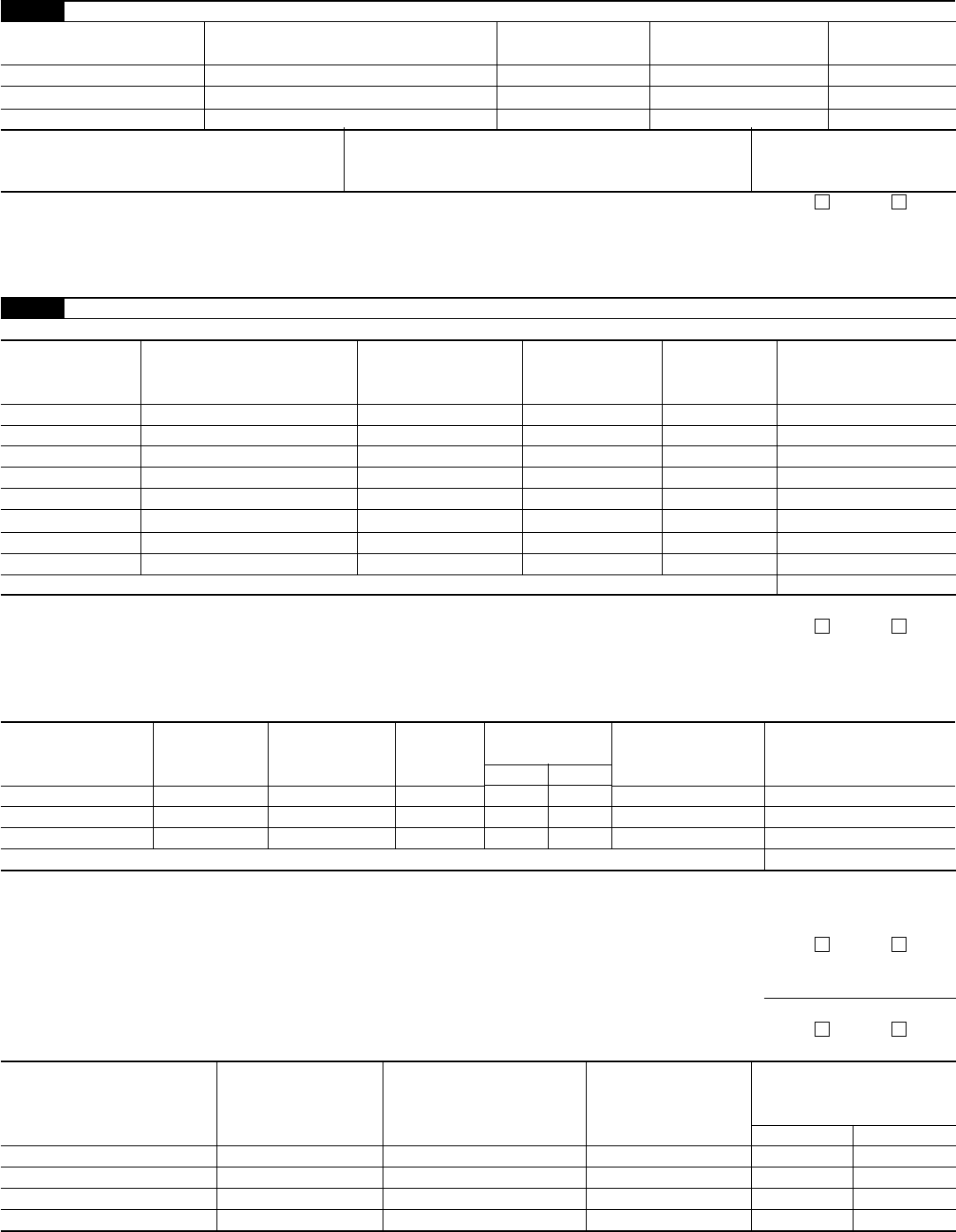

Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain overseas persons. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. It's my understanding that i don't have to file form 3520 until april '24. Is that correct or do i file it this year, 2023? A separate 5% penalty or $10,000 penalty, whichever value is greater, may be added to the fee if the taxpayer. Decedents) file form 3520 with the irs to report: Complete, edit or print tax forms instantly. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and instructions on how to file. Not everyone who is a us person and receives a gift from a foreign person will have to file form 3520.

Only certain taxpayers are eligible. The following situations will trigger a requirement for americans living abroad to file irs form 3520: Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. Download or email irs 3520 & more fillable forms, register and subscribe now! Taxpayer, whichever value is greater, as the initial penalty. All information must be in english. Persons (and executors of estates of u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and instructions on how to file. Register and subscribe now to work on your irs form 3520 & more fillable forms. Complete, edit or print tax forms instantly.

Steuererklärung dienstreisen Form 3520

Show all amounts in u.s. Web form 3520 sorelya level 2 posted march 1, 2023 6:00 pm last updated march 01, 2023 6:00 pm form 3520 i received a gift from a foreign country in feb. Taxpayer, whichever value is greater, as the initial penalty. The irs f orm 3520 is used to report a foreign gift, inheritance or trust.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Show all amounts in u.s. Is that correct or do i file it this year, 2023? All information must be in english. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Taxpayer, whichever value is greater, as the initial penalty.

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Web form 3520 & instructions: Owner files this form annually to provide information about: Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to persuade the irs to even. Only certain taxpayers are eligible. Complete, edit or print tax forms instantly.

US Taxes and Offshore Trusts Understanding Form 3520

Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. For calendar year 2022, or tax year beginning , 2022, ending , 20. Show all amounts in u.s. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

It does not have to be a “foreign gift.”. Is that correct or do i file it this year, 2023? All information must be in english. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Complete, edit or print tax forms instantly.

What Is Form 8822 Change of Address TurboTax Tax Tips & Videos

Is that correct or do i file it this year, 2023? The form provides information about the foreign trust, its u.s. It's my understanding that i don't have to file form 3520 until april '24. The form 3520 complexity is on a sliding scale. Web a simple tax return is one that's filed using irs form 1040 only, without having.

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. It does not have to be a “foreign gift.”. Not a product question 0 8 237 reply All information must be in english. All information must be in english.

Ssurvivor Form 2441 Turbotax

Not a product question 0 8 237 reply Taxpayer, whichever value is greater, as the initial penalty. Show all amounts in u.s. Not everyone who is a us person and receives a gift from a foreign person will have to file form 3520. A separate 5% penalty or $10,000 penalty, whichever value is greater, may be added to the fee.

form 3520a 2021 Fill Online, Printable, Fillable Blank

The form provides information about the foreign trust, its u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and instructions on how to file. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person..

Form 9 Turbotax The Latest Trend In Form 9 Turbotax AH STUDIO Blog

Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the internal revenue service (“irs”). Person who has any ownership the foreign trust, and also income of. Owner a foreign trust with at least one u.s. The form provides information about the.

Rather, If A Foreign Person Gifts U.s.

Complete, edit or print tax forms instantly. Not everyone who is a us person and receives a gift from a foreign person will have to file form 3520. Person who is treated as an owner of any portion of the foreign trust. Web go to www.irs.gov/form3520a for instructions and the latest information omb no.

For Calendar Year 2022, Or Tax Year Beginning , 2022, Ending , 20.

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Taxpayer, whichever value is greater, as the initial penalty. However, if you meet the conditions of having to file form 3250 (receipt of more than $100,000 in value from a foreign source), then failure to file it can lead to a fine of up to 5% per month (maximum of 25%) of the amount received. File form 3520 to report certain transactions with foreign trusts, and ownership of foreign trusts.

Show All Amounts In U.s.

The form provides information about the foreign trust, its u.s. This information includes its u.s. Not a product question 0 8 237 reply Owner files this form annually to provide information about:

Web Form 3520 Department Of The Treasury Internal Revenue Service Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts Go To Www.irs.gov/Form3520 For Instructions And The Latest Information.

Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). Person who has any ownership the foreign trust, and also income of. It does not have to be a “foreign gift.”. Persons (and executors of estates of u.s.