Form 3893 Pte

Form 3893 Pte - 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web to make a pte payment: By default, lacerte assumes your client will pay pte tax by mail, and will print an ftb 3893 voucher for any amount you haven't already. The qualified pte shall make an elective tax payment. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. For this discussion, ignore the effect of. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s website or by using form ftb 3893. Exception for exempt organizations, federal,.

Web following new pte elective tax forms and instructions: Partnerships and s corporations may. Web to make a pte payment: Web “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s website or by using form ftb 3893. By default, lacerte assumes your client will pay pte tax by mail, and will print an ftb 3893 voucher for any amount you haven't already. Web the california franchise tax board dec. 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web revised 2022, 2023 form 3893 instructions: The qualified pte shall make an elective tax payment.

Web the california franchise tax board dec. Web how to last modified: Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web following new pte elective tax forms and instructions: Web “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s website or by using form ftb 3893. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). The qualified pte shall make an elective tax payment. 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web california form 3893 (pte) for calendar year 2023 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web revised 2022, 2023 form 3893 instructions:

Form Kidz Pte Ltd Logo (With Warning) YouTube

Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web to make a pte payment: Exception for exempt organizations, federal,. Web “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s website or by using form ftb 3893. Web.

Fill Free fillable USCIS PDF forms

Partnerships and s corporations may. Web how to last modified: We anticipate the revised form 3893 will be available march 7, 2022. “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web “ptes must make all elective tax payments either by using the free web pay application accessed through the.

Ata Chapters And Subchapters Pdf Merge lasopapromotions

Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). For this discussion, ignore the effect of. We anticipate the revised form 3893 will be available march 7, 2022. Exception for exempt organizations, federal,. Web “ptes must make all elective tax payments either by using the free web pay.

PTE 기출, PTE study, PTE practice, PTE write form dictation, PTE WFD 1

Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Partnerships and s corporations may. The qualified pte shall make an elective tax payment. Web revised 2022, 2023 form 3893 instructions: Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january.

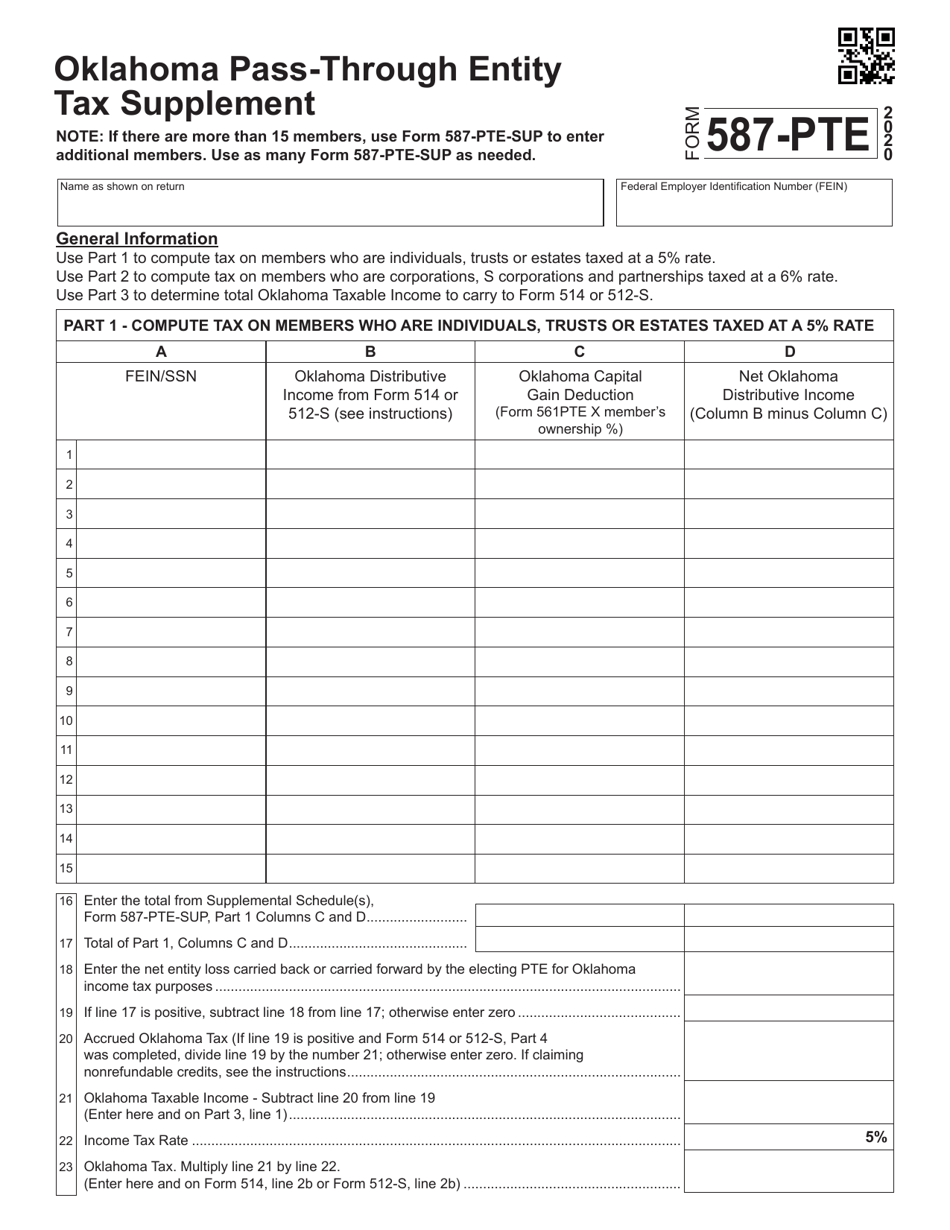

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

For this discussion, ignore the effect of. By default, lacerte assumes your client will pay pte tax by mail, and will print an ftb 3893 voucher for any amount you haven't already. Web following new pte elective tax forms and instructions: Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1,.

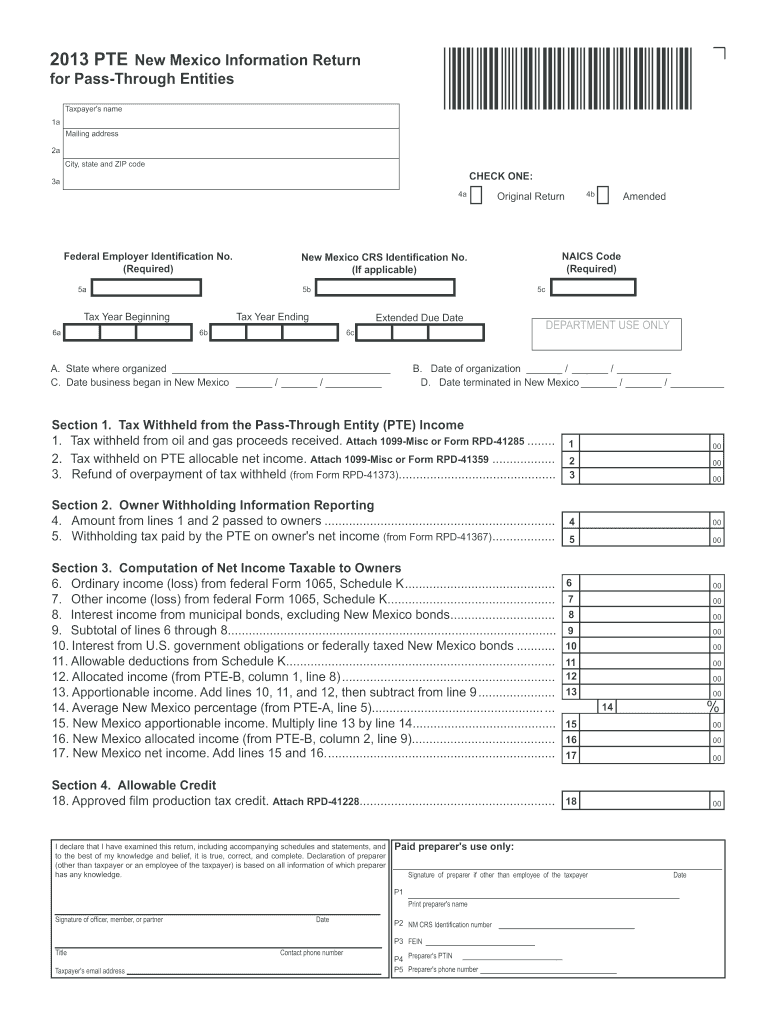

Nm Pte Form Fill Out and Sign Printable PDF Template signNow

“ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. However, the instructions to for ftb 3893 indicate. Web “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s website or by using form ftb 3893. Web california form 3893 (pte) for.

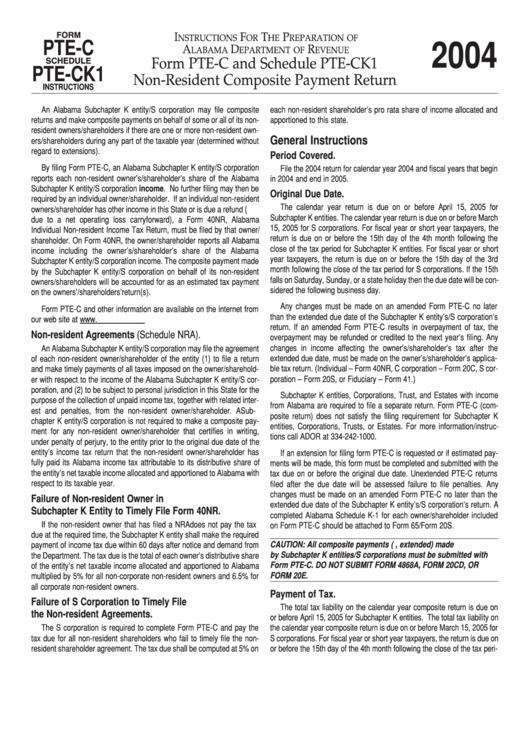

Form PteC And Schedule PteCk1 NonResident Composite Payment Return

We anticipate the revised form 3893 will be available march 7, 2022. For this discussion, ignore the effect of. Partnerships and s corporations may. By default, lacerte assumes your client will pay pte tax by mail, and will print an ftb 3893 voucher for any amount you haven't already. Web on november 1, 2021, franchise tax board (ftb) published pte.

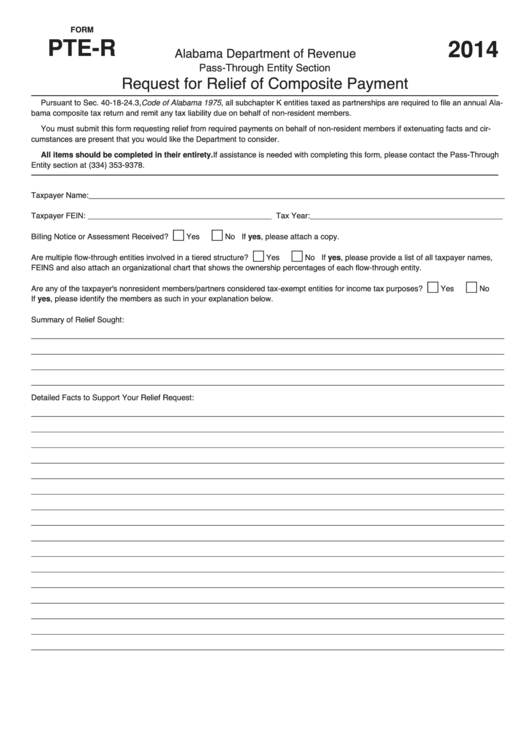

Fillable Form PteR Alabama Request For Relief Of Composite Payment

For this discussion, ignore the effect of. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web following new pte elective tax forms and instructions: 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web use.

Virginia fprm pte Fill out & sign online DocHub

“ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. For this discussion, ignore the effect of. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. 11/05/2022 objectives prepare and populate california form 3804 and.

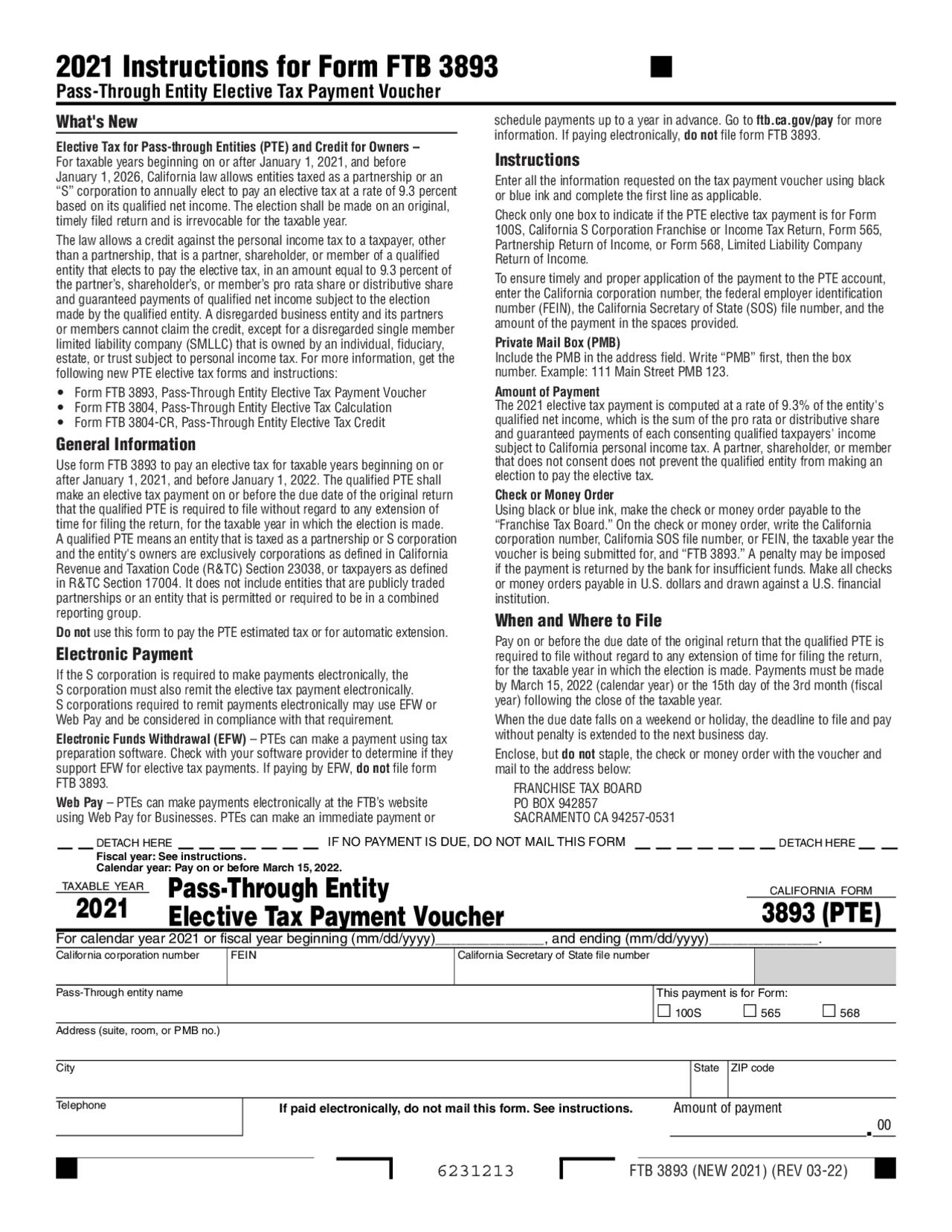

2021 Instructions for Form 3893, PassThrough Entity Elective

By default, lacerte assumes your client will pay pte tax by mail, and will print an ftb 3893 voucher for any amount you haven't already. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Web following new pte elective tax forms and instructions: The qualified pte shall make an.

11/05/2022 Objectives Prepare And Populate California Form 3804 And / Or Form 3893 In An S Corporation Return Using Worksheet View.

“ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. For this discussion, ignore the effect of. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). We anticipate the revised form 3893 will be available march 7, 2022.

Exception For Exempt Organizations, Federal,.

By default, lacerte assumes your client will pay pte tax by mail, and will print an ftb 3893 voucher for any amount you haven't already. The qualified pte shall make an elective tax payment. Web the california franchise tax board dec. Web how to last modified:

Web “Ptes Must Make All Elective Tax Payments Either By Using The Free Web Pay Application Accessed Through The Ftb’s Website Or By Using Form Ftb 3893.

Partnerships and s corporations may. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web to make a pte payment:

Web Revised 2022, 2023 Form 3893 Instructions:

Web following new pte elective tax forms and instructions: However, the instructions to for ftb 3893 indicate. Web california form 3893 (pte) for calendar year 2023 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________.