Form 4136 Pdf

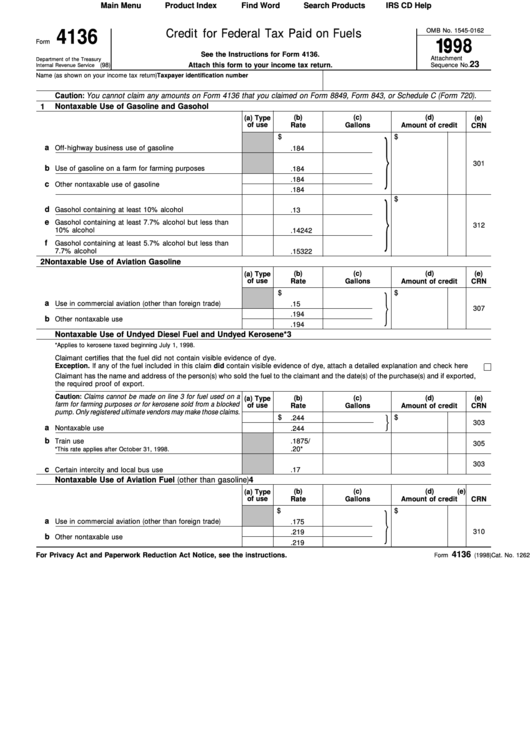

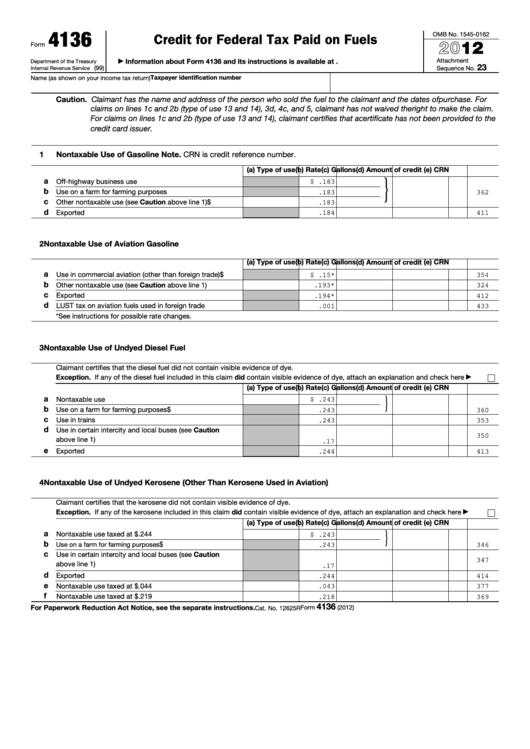

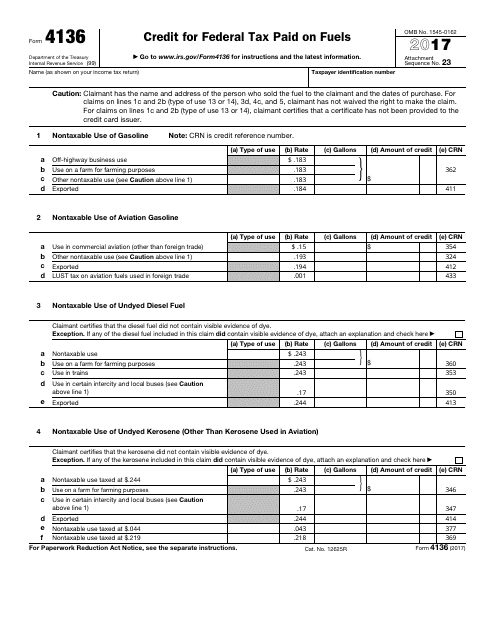

Form 4136 Pdf - Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. The credits available on form 4136 are: A claimant certifies that it sold the diesel. Generally, you can claim by sending irs form 4136 if you use the fuel for: To find out if you can use schedule 3 (form 8849). Reserved for future use registration no. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered. Web form 4136 (2010) page 4 13 registered credit card issuers registration no. (b) rate (c) gallons (d) amount of credit (e) crn a diesel fuel sold for the exclusive use of a state or. Web use form 4136 to claim a credit for federal taxes paid on certain fuels.

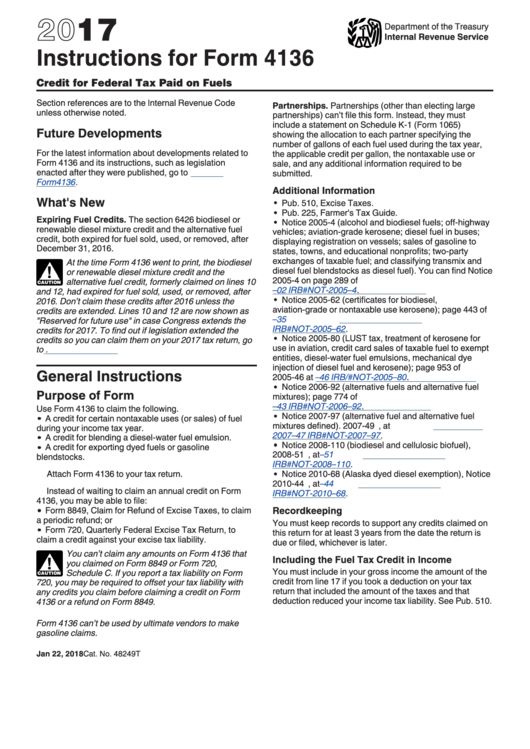

To find out if you can use schedule 3 (form 8849). Web use form 4136 to claim the following. Web form 4136 (2010) page 4 13 registered credit card issuers registration no. Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest information. A claimant certifies that it sold the diesel. Search by form number, name or organization. Reserved for future use registration no. Web form 4136 (2018) page. Use form 4136 to claim a credit. You can use form 4136 to claim the credit for mixtures or fuels sold or used during the 2019 calendar year.

To see which fuel credits are still available, go to irs instructions for form 4136 credit for federal tax paid on fuels. (b) rate (c) gallons (d) amount of credit (e) crn a diesel fuel sold for the exclusive use of a state or. Extension of alternative fuel credits. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest information. Web search irs and state income tax forms to efile or complete, download online and back taxes. See the instructions for line 10 for. Web use form 4136 to claim the following. A claimant certifies that it sold the diesel. Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form 4136.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web form 4136 (2010) page 4 13 registered credit card issuers registration no. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered. Search by form number, name or organization. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. To see which.

Ra 4136 Vehicle Registration Plate Truck

Reserved for future use registration no. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Search by form number, name or organization. Get ready for tax season deadlines by completing.

Fillable Credit For Federal Tax Paid On Fuels Irs 4136 printable pdf

Web form 4136 (2010) page 4 13 registered credit card issuers registration no. To find out if you can use schedule 3 (form 8849). See the instructions for line 10 for. Ad access irs tax forms. You can download or print.

Form 4136 Credit For Federal Tax Paid On Fuels 2002 printable pdf

Get ready for tax season deadlines by completing any required tax forms today. Web the 4136 form is also known as the credit for federal tax paid on fuels. Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. Generally,.

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

Web for paperwork reduction act notice, see the separate instructions. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Web what irs form 4136 is used for what types of fuel use qualify for fuel credits how to complete irs form 4136 let’s start.

How to Prepare IRS Form 4136 (with Form) wikiHow

Get ready for tax season deadlines by completing any required tax forms today. Extension of alternative fuel credits. Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form 4136. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form.

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Web what irs form 4136 is used for what types of fuel use qualify for fuel credits how to complete irs form 4136 let’s start by discussing exactly how to complete irs. See the instructions for line 10 for. To see which fuel credits are still available, go to irs instructions for form 4136 credit for federal tax paid on.

How to Prepare IRS Form 4136 (with Form) wikiHow

See the instructions for line 10 for. Use form 4136 to claim a credit. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Ad access irs tax forms. Web what irs form 4136 is used for what types of fuel use.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Web the 4136 form is also known as the credit for federal tax paid on fuels. Ad access irs tax forms. It was created and provided to the taxpayers by the department of the treasury internal revenue. The credits available on form 4136 are: Web use form 4136 to claim the following.

12625Rform 4136 5Kerosene Used In Aviation (See Caution Above Line 1) 6Sales By Registered Ultimate Vendors Of Undyed Diesel Fuel Registration No.

Web form 4136 (2018) page. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web for paperwork reduction act notice, see the separate instructions.

Web Search Irs And State Income Tax Forms To Efile Or Complete, Download Online And Back Taxes.

Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. For claims on lines 1c and 2b (type of use 13 or 14),. You can use form 4136 to claim the credit for mixtures or fuels sold or used during the 2019 calendar year. Generally, you can claim by sending irs form 4136 if you use the fuel for:

Credit For Certain Nontaxable Uses (Or Sales) Of Fuel During Your Income Tax Year.

To see which fuel credits are still available, go to irs instructions for form 4136 credit for federal tax paid on fuels. 12625rform 4136 5kerosene used in aviation 6sales by registered ultimate vendors of undyed diesel fuel registration no. Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. Extension of alternative fuel credits.

Use Form 4136 To Claim A Credit.

Web the 4136 form is also known as the credit for federal tax paid on fuels. You can download or print. Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form 4136. See the instructions for line 10 for.