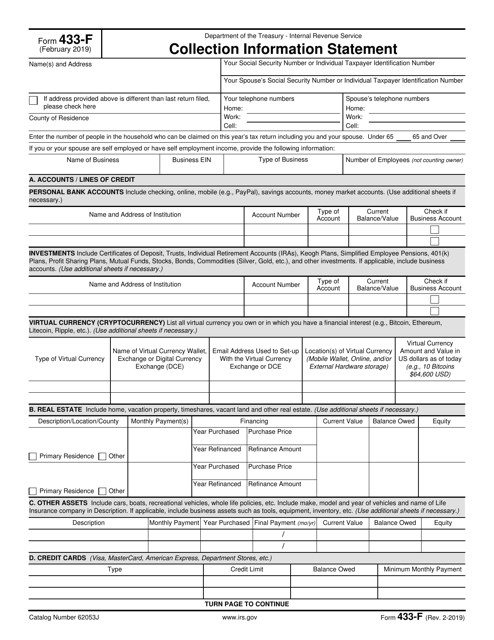

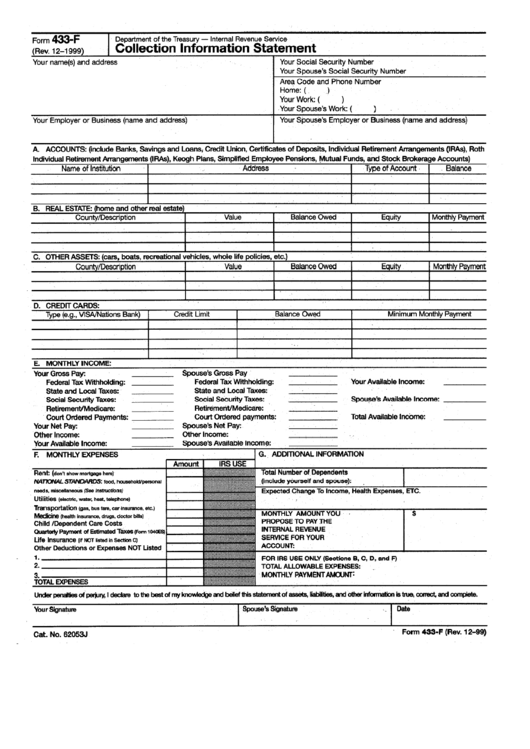

Form 433-F

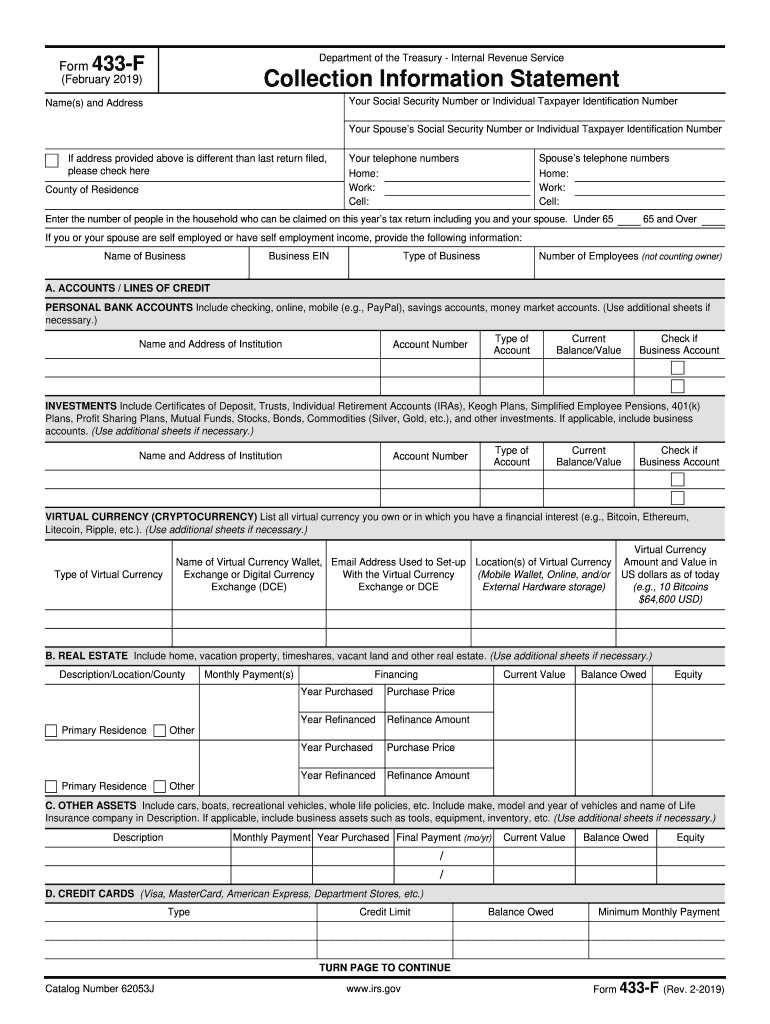

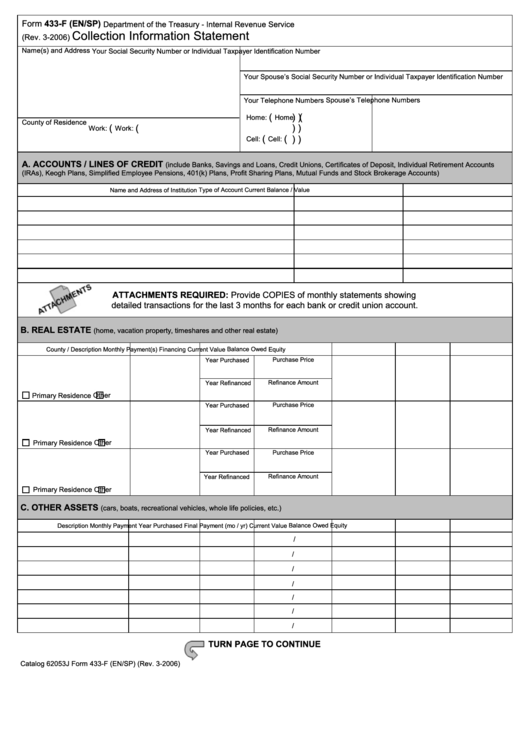

Form 433-F - This includes copies of cancelled checks, pay stubs etc. If filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. Web this form, such as copies of cancelled checks etc. Supporting documentation when submitting this form. Which show payments being made. These standards are effective on april 25, 2022 for purposes of federal tax administration only. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. That indicate payments are being made. Submit a copy of the

That indicate payments are being made. For any court ordered payments you. Web this form, such as copies of cancelled checks etc. If filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. Refer to form 8821, tax information authorization. Submit a copy of the All expenses claimed in box 5. Which show payments being made. These standards are effective on april 25, 2022 for purposes of federal tax administration only. You may be able to establish an online payment agreement on the.

For any court ordered payments you. This includes copies of cancelled checks, pay stubs etc. Requests for copy of tax. Which show payments being made. Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. Submit a copy of the The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. You may be able to establish an online payment agreement on the. All expenses claimed in box 5. Web this form, such as copies of cancelled checks etc.

IRS Form 433F Download Fillable PDF or Fill Online Collection

Which show payments being made. Web this form, such as copies of cancelled checks etc. It shows the irs the taxpayer's ability to pay (monthly cash flow). The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. Requests for copy of tax.

2003 Form IRS 433F Fill Online, Printable, Fillable, Blank pdfFiller

This includes copies of cancelled checks, pay stubs etc. You may be able to establish an online payment agreement on the. Which show payments being made. Refer to form 8821, tax information authorization. It shows the irs the taxpayer's ability to pay (monthly cash flow).

Form 433F Collection Information Statement (2013) Free Download

Web this form, such as copies of cancelled checks etc. Submit a copy of the That indicate payments are being made. Supporting documentation when submitting this form. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del

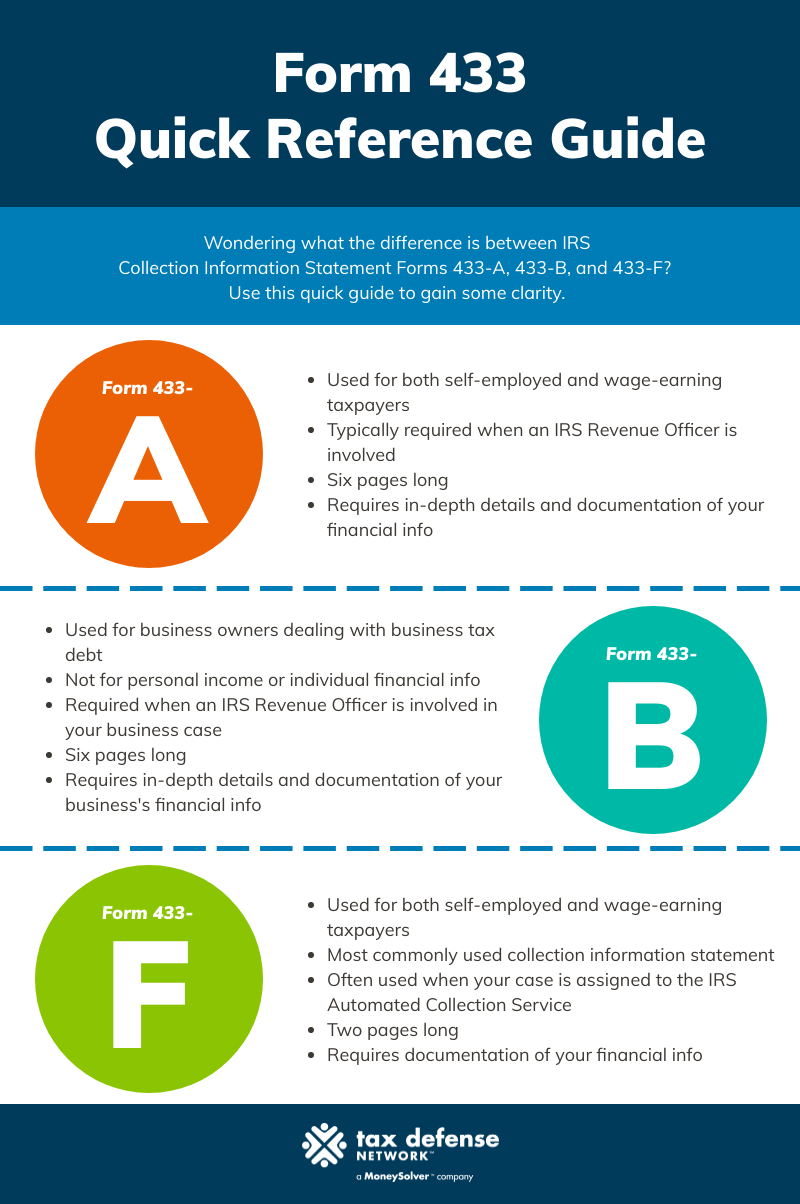

Form 433A & 433F How the IRS Decides Your Ability to Pay

All expenses claimed in box 5. If filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. This includes copies of cancelled checks, pay stubs etc. Supporting.

F Financial Necessary Latest Fill Out and Sign Printable PDF Template

For any court ordered payments you. Refer to form 8821, tax information authorization. All expenses claimed in box 5. Web this form, such as copies of cancelled checks etc. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions.

Form 433F Collection Information Statement (2013) Free Download

Refer to form 8821, tax information authorization. These standards are effective on april 25, 2022 for purposes of federal tax administration only. For any court ordered payments you. Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del Which show payments being made.

Form 433F Collection Information Statement (2013) Free Download

Refer to form 8821, tax information authorization. For any court ordered payments you. You may be able to establish an online payment agreement on the. Supporting documentation when submitting this form. This includes copies of cancelled checks, pay stubs etc.

Fillable Form 433F Collection Information Statement Department Of

Submit a copy of the Refer to form 8821, tax information authorization. These standards are effective on april 25, 2022 for purposes of federal tax administration only. It shows the irs the taxpayer's ability to pay (monthly cash flow). Requests for copy of tax.

Form 433F Collection Information Statement

Supporting documentation when submitting this form. If filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. That indicate payments are being made. Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. Refer to form 8821, tax information authorization.

Form 433F Collection Information Statement printable pdf download

If filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. These standards are effective on april 25, 2022 for purposes of federal tax administration only. Submit a copy of the It shows the irs the taxpayer's ability to pay (monthly cash flow). All expenses claimed in box.

Which Show Payments Being Made.

Usted tal vez pueda establecer un plan de pagos a plazos por internet en la página web del The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. For any court ordered payments you. It shows the irs the taxpayer's ability to pay (monthly cash flow).

Supporting Documentation When Submitting This Form.

Irs collection financial standards are intended for use in calculating repayment of delinquent taxes. You may be able to establish an online payment agreement on the. Requests for copy of tax. If filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees.

This Includes Copies Of Cancelled Checks, Pay Stubs Etc.

These standards are effective on april 25, 2022 for purposes of federal tax administration only. Refer to form 8821, tax information authorization. All expenses claimed in box 5. That indicate payments are being made.

Submit A Copy Of The

Web this form, such as copies of cancelled checks etc.