Form 4797 Pdf

Form 4797 Pdf - Web community discussions taxes investors & landlords bigbarr25 new member how do i fill out tax form 4797 after sale of a rental property? Web the irs form 4797 is a tax form distributed by the irs that is used to report the income generated by the sale or exchange of a business property. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web you are reporting income on schedule 1 (form 1040), line 8z, from form 8814 (relating to election to report child's interest and dividends). Web 1 best answer michellet level 2 to add form 4797 to your return: Get ready for tax season deadlines by completing any required tax forms today. Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder. Complete, edit or print tax forms instantly. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web you would otherwise include on form 4797, part i.

Web community discussions taxes investors & landlords bigbarr25 new member how do i fill out tax form 4797 after sale of a rental property? Web you would otherwise include on form 4797, part i. Web use form 4797 to report:the sale or exchange of: Identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17. Select take to my tax return, search for 4797, sale of business property (use this exact phrase). This exclusion also applies to an interest in, or property of, certain renewal community businesses. Web assets on form 4797, part i, ii, or iii, as applicable. Web (4.9 / 5) 75 votes get your form 4797 in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately what is form 4797? • sale of a portion of a macrs asset. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and.

Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web you are reporting income on schedule 1 (form 1040), line 8z, from form 8814 (relating to election to report child's interest and dividends). This exclusion also applies to an interest in, or property of, certain renewal community businesses. Get ready for tax season deadlines by completing any required tax forms today. See sections 1400f(c) and (d). Web 1 best answer michellet level 2 to add form 4797 to your return: Real property used in your trade or business; Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web loss from property used as an employee on schedule a (form 1040), line 23. Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a.

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Hello all, i am trying to. • sale of a portion of a macrs asset. Get ready for tax season deadlines by completing any required tax forms today. General instructions purpose of form. Web we last updated the sales of business property in december 2022, so this is the latest version of form 4797, fully updated for tax year 2022.

IRS Instructions 4797 2019 2020 Fill out and Edit Online PDF Template

Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder. Web developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. • sale of a portion of a macrs asset. Hello all, i am trying to. Real property used in your trade.

IRS Instructions 4797 2018 2019 Fill out and Edit Online PDF Template

Depreciable and amortizable tangible property used in your trade or business. Web 1 best answer michellet level 2 to add form 4797 to your return: Complete, edit or print tax forms instantly. See sections 1400f(c) and (d). Enter here and on form 1040, line 14 form.

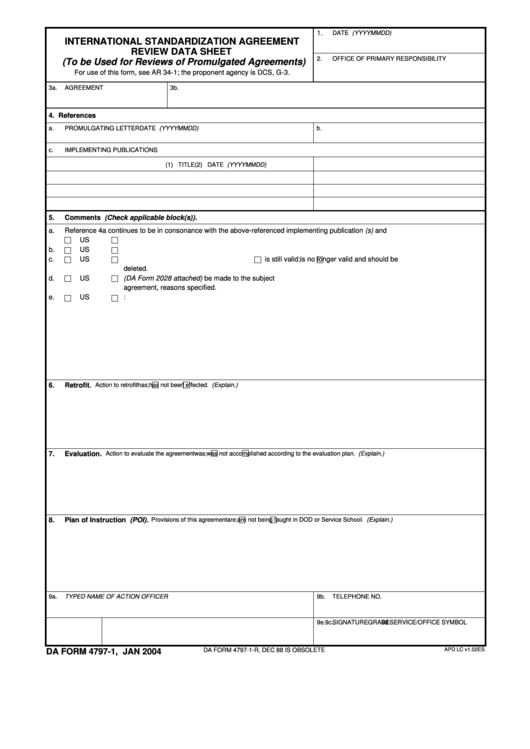

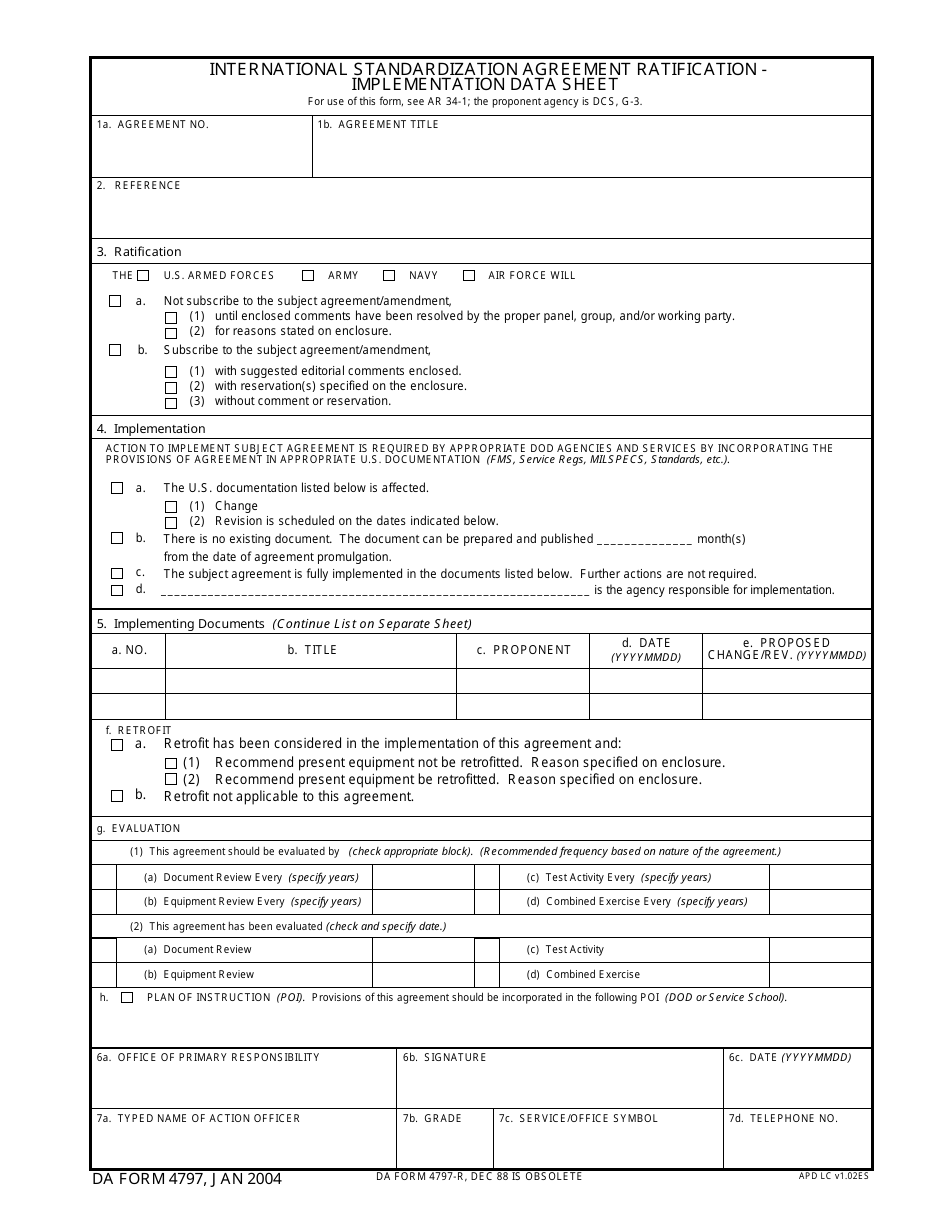

Fillable Form Da Form 47971 International Standardization Agreement

Web community discussions taxes investors & landlords bigbarr25 new member how do i fill out tax form 4797 after sale of a rental property? Select take to my tax return, search for 4797, sale of business property (use this exact phrase). This exclusion also applies to an interest in, or property of, certain renewal community businesses. Web we last updated.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Enter here and on form 1040, line 14 form. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,. Real property used in your trade or business; This exclusion also applies to an interest in, or property of, certain renewal community.

DA Form 4797 Download Fillable PDF or Fill Online International

Web use form 4797 to report:the sale or exchange of: Web the irs form 4797 is a tax form distributed by the irs that is used to report the income generated by the sale or exchange of a business property. • sale of a portion of a macrs asset. Web (4.9 / 5) 75 votes get your form 4797 in.

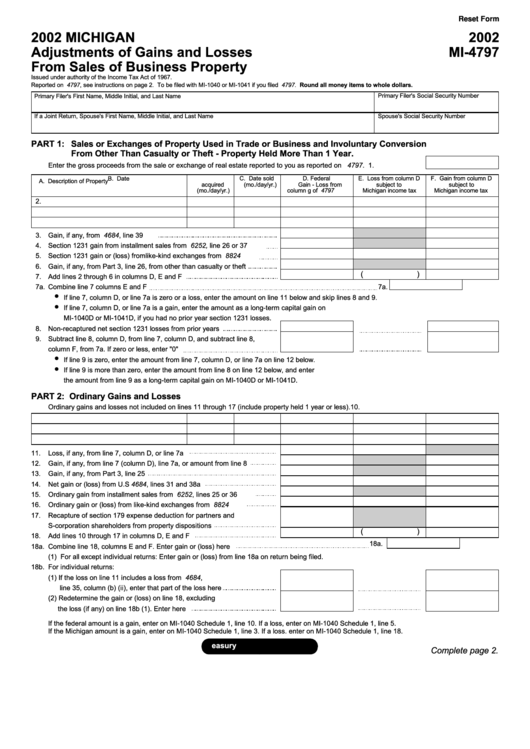

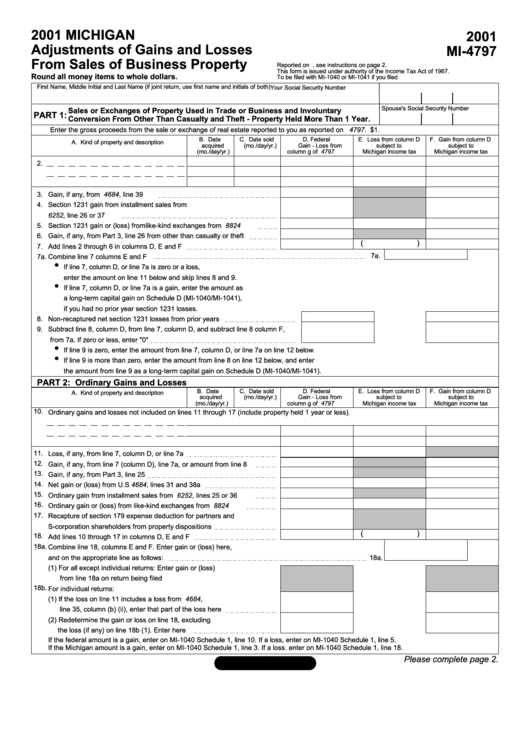

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. • sale of a portion of a macrs asset. Hello all, i am trying to. This exclusion also applies to an interest in, or property of, certain renewal community businesses. Web you are reporting income on.

1996 Form IRS 4797 Fill Online, Printable, Fillable, Blank PDFfiller

Web use form 4797 to report:the sale or exchange of: Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Real property used in your trade or business; Web.

Form Mi4797 Michigan Adjustments Of Gains And Losses From Sales Of

Web 1 best answer michellet level 2 to add form 4797 to your return: You can download or print current. Web community discussions taxes investors & landlords bigbarr25 new member how do i fill out tax form 4797 after sale of a rental property? Web (4.9 / 5) 75 votes get your form 4797 in 3 easy steps 01 fill.

WAR (We Are Rich) has been in business since 1983.

Web 1 best answer michellet level 2 to add form 4797 to your return: Depreciable and amortizable tangible property used in your trade or business. Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder. Select take to my tax return, search for 4797, sale of business property (use this exact.

Web Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And.

Web 1 best answer michellet level 2 to add form 4797 to your return: Web you are reporting income on schedule 1 (form 1040), line 8z, from form 8814 (relating to election to report child's interest and dividends). • involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,.

Web Identify As From “Form 4797, Line 18A.” See Instructions Redetermine The Gain Or (Loss) On Line 17 Excluding The Loss, If Any, On Line 18A.

General instructions purpose of form. Identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17. Depreciable and amortizable tangible property used in your trade or business. This exclusion also applies to an interest in, or property of, certain renewal community businesses.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web loss from property used as an employee on schedule a (form 1040), line 23. Complete, edit or print tax forms instantly. You can download or print current.

Hello All, I Am Trying To.

Real property used in your trade or business; Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder. Enter here and on form 1040, line 14 form.