Form 4972 Instructions

Form 4972 Instructions - General instructions purpose of form. Irs form 4972 is considered one of the more complex forms for. Web who can file irs form 4972? Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. How do i complete form 4972? Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Use this form to figure the. Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Web enter name of recipient of distribution. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions).

Forget about scanning and printing out forms. Paperwork reduction act notice we ask for the information on. Web form 4972 and the part 2 and part 3 instructions. Complete this part to see if you can use form 4972; Web who can file irs form 4972? Web instructions for form 5472 department of the treasury internal revenue service (rev. Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Who can use the form c. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Irs form 4972 is considered one of the more complex forms for.

Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Web who can file irs form 4972? Web form 4972 and the part 2 and part 3 instructions. Web instructions for form 5472 department of the treasury internal revenue service (rev. Web how to make the election. General instructions purpose of form. Paperwork reduction act notice we ask for the information on. Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. Web enter name of recipient of distribution. Complete this part to see if you can use form 4972;

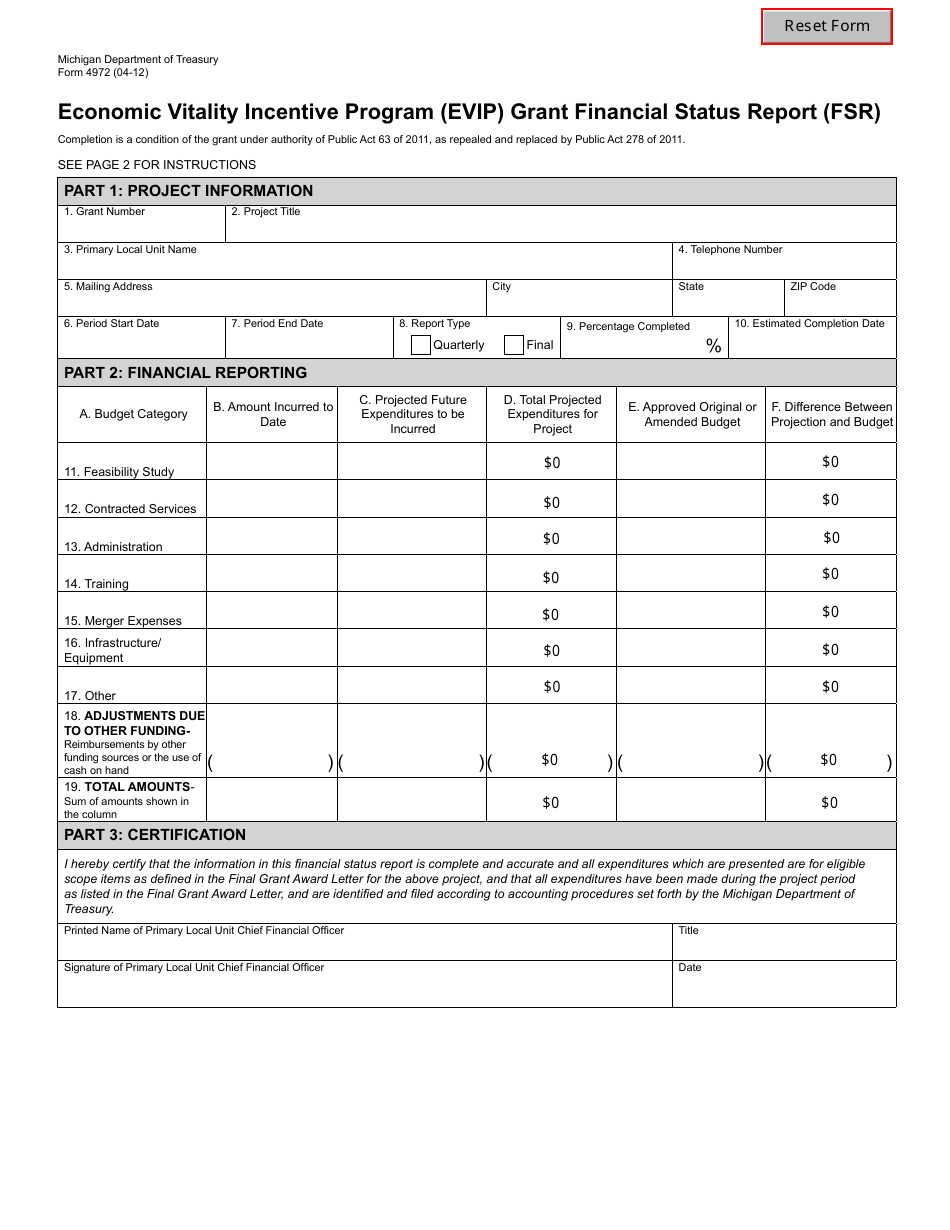

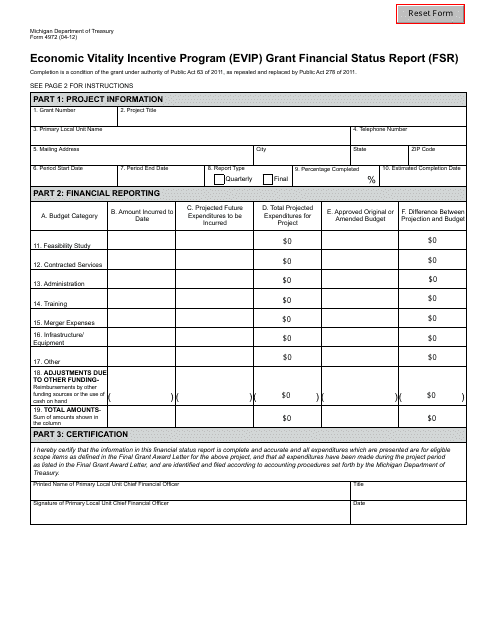

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Complete this part to see if you can use form 4972; Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Who can use the form c. Web how to make the election. Irs form 4972 is considered one of the more complex forms for.

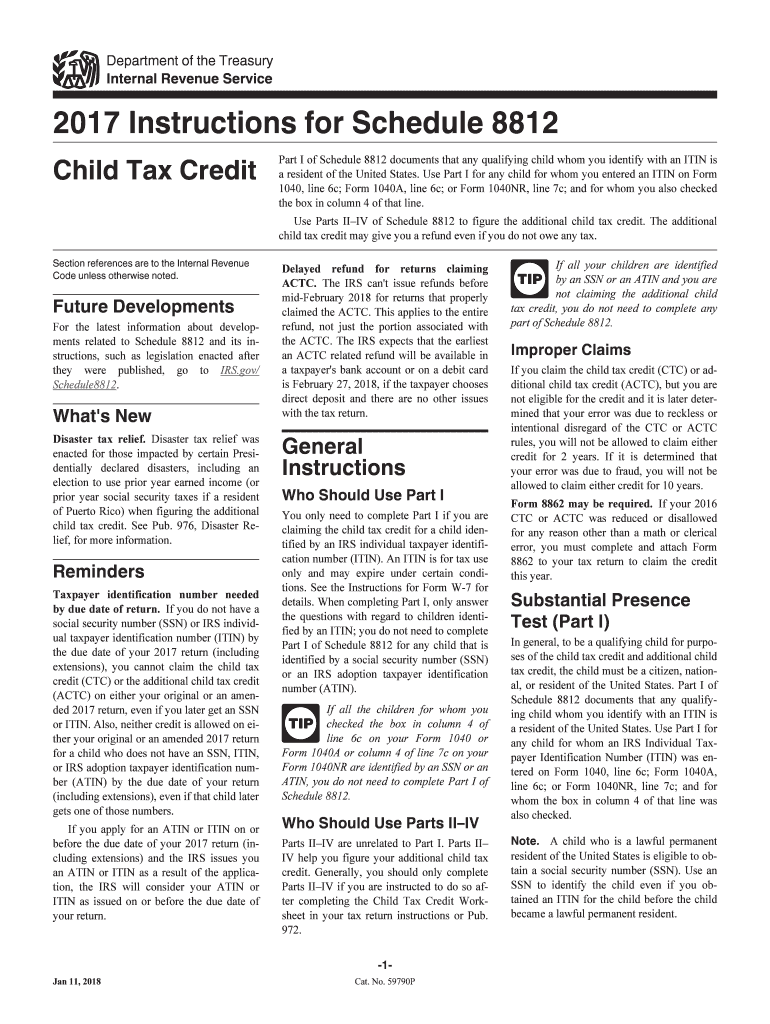

Irs form 8814 instructions

Web who can file irs form 4972? Web quick guide on how to complete form 4972 2017. Forget about scanning and printing out forms. Complete this part to see if you can use form 4972; Paperwork reduction act notice we ask for the information on.

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Paperwork reduction act notice we ask for the information on. Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Complete this part to see if you can use form 4972; To make the election, complete and attach form (s) 8814 to your tax return and file your return.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Use our detailed instructions to fill out and esign your documents online. How do i complete form 4972? Web how to make the election. Web enter name of recipient of distribution. Web who can file irs form 4972?

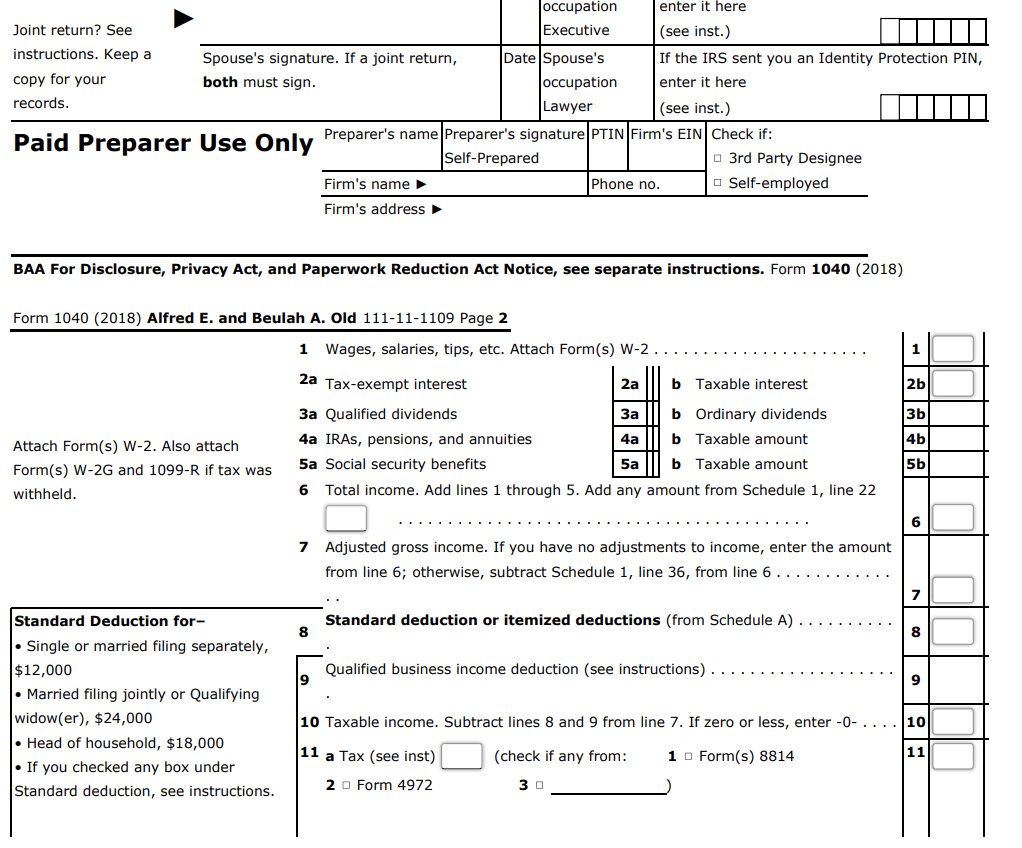

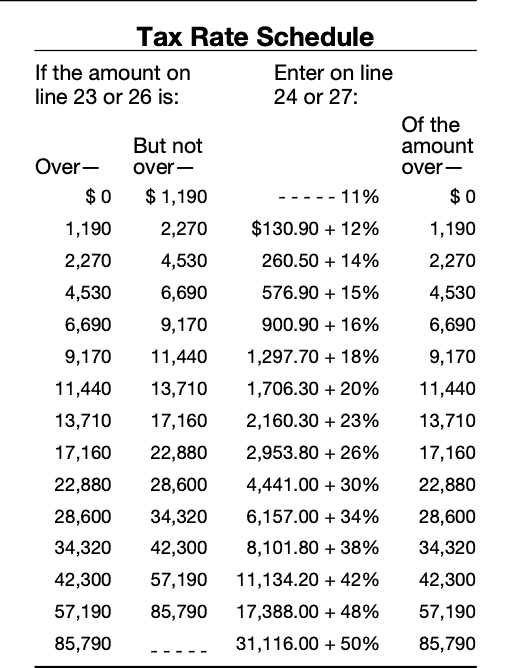

Instructions Note This problem is for the 2018 tax

Irs form 4972 is considered one of the more complex forms for. Use this form to figure the. Web who can file irs form 4972? Web form 4972 and the part 2 and part 3 instructions. Web how to make the election.

IRS Form 4972A Guide to Tax on LumpSum Distributions

To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Web enter name of recipient of distribution. Web form 4972 and its instructions, such as legislation enacted after they were published, go to. Web quick guide on how to complete form 4972 2017. Forget about scanning.

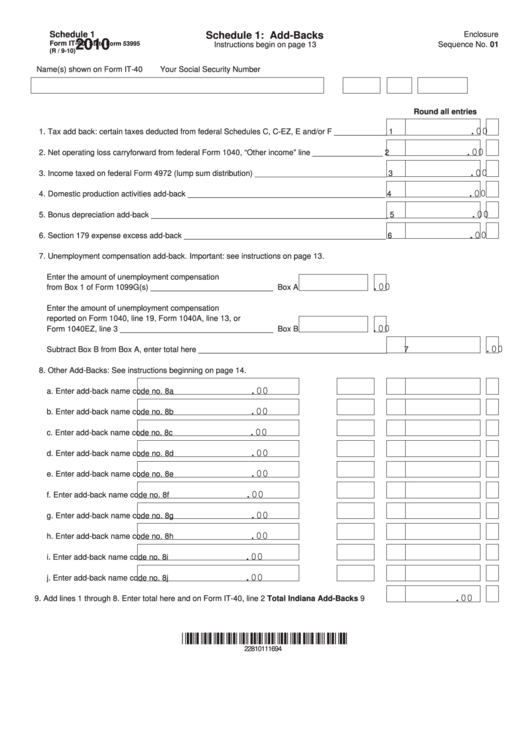

Fillable Form It40 Schedule 1 AddBacks 2010 Indiana printable

Irs form 4972 is considered one of the more complex forms for. Web quick guide on how to complete form 4972 2017. Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Web instructions for form 5472 department of the treasury internal revenue service (rev. Web how to make.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Use our detailed instructions to fill out and esign your documents online. General instructions purpose of form. Who can use the form c. Web form 4972 and the part 2 and part 3 instructions. Forget about scanning and printing out forms.

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Use this form to figure the. How do i complete form 4972? Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. Complete this part to see if you can use form 4972; Web enter name of recipient of distribution.

LEGO 4972 Animals Instructions, Duplo

Web who can file irs form 4972? Forget about scanning and printing out forms. Web instructions for recipient generally, distributions from retirement plans (iras, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Web.

Paperwork Reduction Act Notice We Ask For The Information On.

Web enter name of recipient of distribution. Web quick guide on how to complete form 4972 2017. Web instructions for form 5472 department of the treasury internal revenue service (rev. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions).

Web Who Can File Irs Form 4972?

Forget about scanning and printing out forms. Use this form to figure the. Irs form 4972 is considered one of the more complex forms for. Web form 4972 and its instructions, such as legislation enacted after they were published, go to.

Web Instructions For Recipient Generally, Distributions From Retirement Plans (Iras, Qualified Plans, Section 403(B) Plans, And Governmental Section 457(B) Plans), Insurance.

Who can use the form c. General instructions purpose of form. How do i complete form 4972? Use our detailed instructions to fill out and esign your documents online.

Web Form 4972 And The Part 2 And Part 3 Instructions.

Web how to make the election. Complete this part to see if you can use form 4972; Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting.