Form 511 Eic

Form 511 Eic - This return should not be filed until complete when? For more information on printing our forms, including print samples, contact the public. Oklahoma individual income tax payment voucher : Web up to $40 cash back if you form asks for email address, type your email address and press enter. Beginning in 2016, the oklahoma earned income credit is calculated in part ii and. Web in prior years, the oklahoma eic was figured in part iii of form 511 and was a refundable credit. Web 611 e 5th st, hialeah fl, is a single family home that contains 1752 sq ft and was built in 1946.it contains 3 bedrooms and 2 bathrooms.this home last sold for. Web enter a 1 or 2 in the field labeled elect to use 2021 earned income and nontaxable combat pay for: You cannot claim the credit if you are married and filing a. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high.

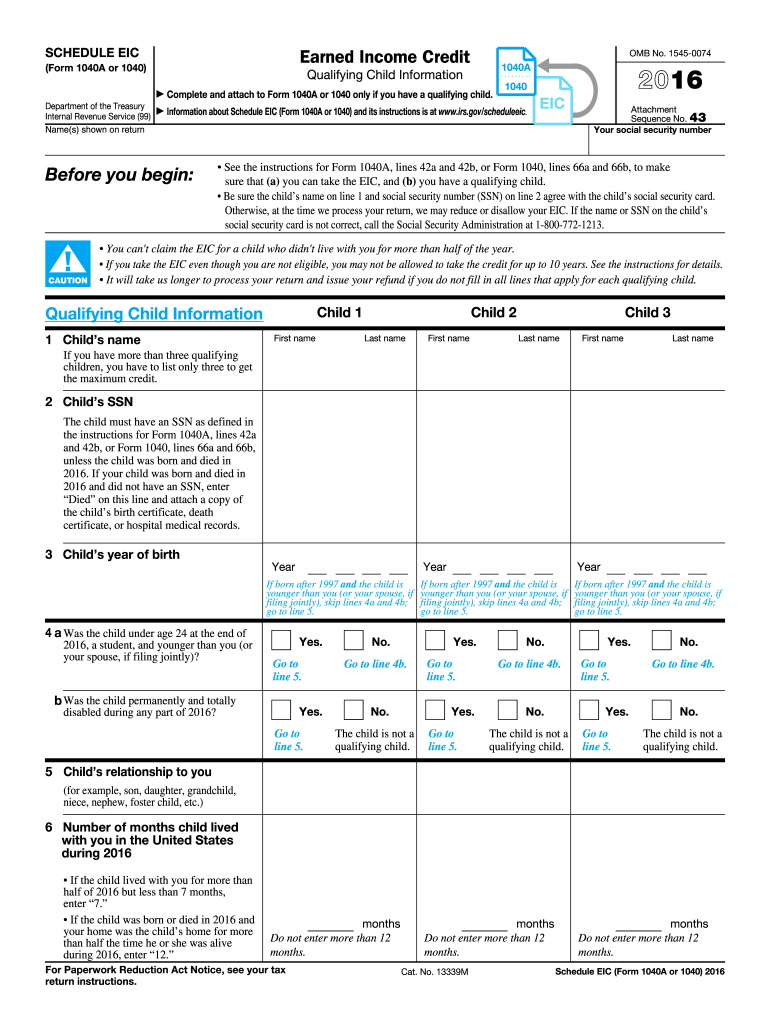

Web up to $40 cash back if you form asks for email address, type your email address and press enter. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: After you have figured your earned income credit (eic), use schedule eic to give the irs information about. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high. Web you are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live in the same household as your. In the less common income, other compensation, then prisoner. Oklahoma capital gain deduction for non/py. The earned income credit was claimed for federal tax purposes; Oklahoma individual income tax payment voucher : Web schedule eic (form 1040) 2021.

1=eic and additional child tax credit, 2=eic only,. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: This return should not be filed until complete when? Web enter a 1 or 2 in the field labeled elect to use 2021 earned income and nontaxable combat pay for: Download past year versions of this tax form as. For more information on printing our forms, including print samples, contact the public. Web 611 e 5th st, hialeah fl, is a single family home that contains 1752 sq ft and was built in 1946.it contains 3 bedrooms and 2 bathrooms.this home last sold for. After you have figured your earned income credit (eic), use schedule eic to give the irs information about. Web you are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live in the same household as your. Oklahoma individual income tax payment voucher :

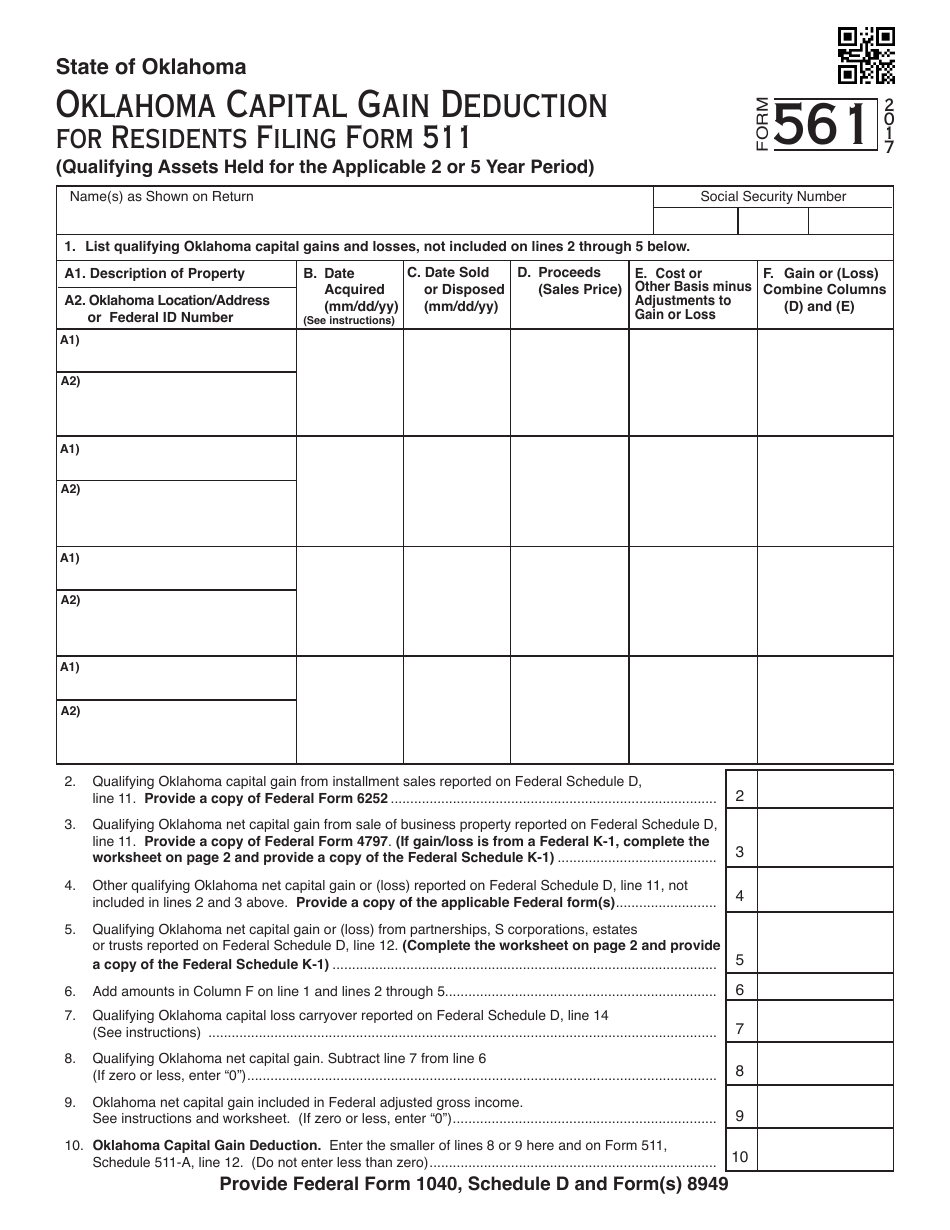

OTC Form 561 Download Fillable PDF or Fill Online Capital Gain

Oklahoma capital gain deduction : Web the earned income tax credit (eitc) is available either as a recurring advanced payment, which the employer adds to the individual's regular paycheck or as a lump sum payment. Oklahoma individual income tax payment voucher : Web you are legally separated according to your state law under a written separation agreement or a decree.

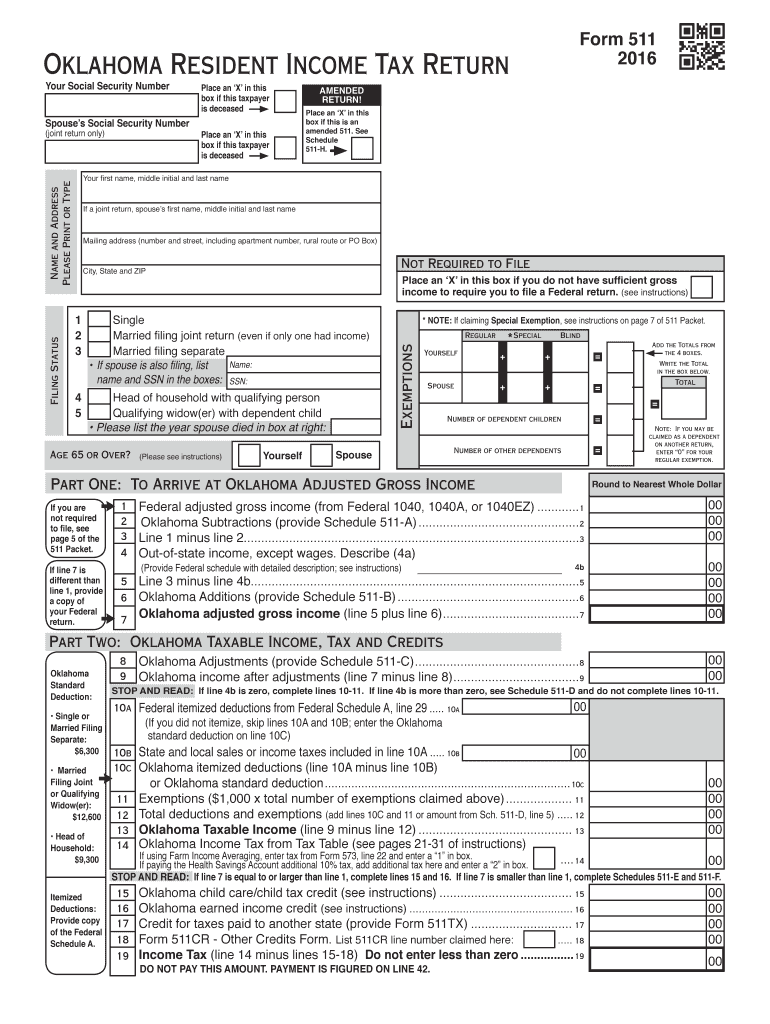

2014 OK Form 511 Fill Online, Printable, Fillable, Blank pdfFiller

The earned income credit was claimed for federal tax purposes; Web schedule eic (form 1040) 2021. Web the earned income tax credit (eitc) is available either as a recurring advanced payment, which the employer adds to the individual's regular paycheck or as a lump sum payment. Web up to $40 cash back if you form asks for email address, type.

Maryland Form 511 for PassThrough Entities Hoffman Group

You cannot claim the credit if you are married and filing a. Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: Oklahoma capital gain deduction : The following diagnostic is generating: Web you are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live.

Form Eic Fill Out and Sign Printable PDF Template signNow

After you have figured your earned income credit (eic), use schedule eic to give the irs information about. Web schedule eic (form 1040) 2021. The following diagnostic is generating: Oklahoma individual income tax payment voucher : You cannot claim the credit if you are married and filing a.

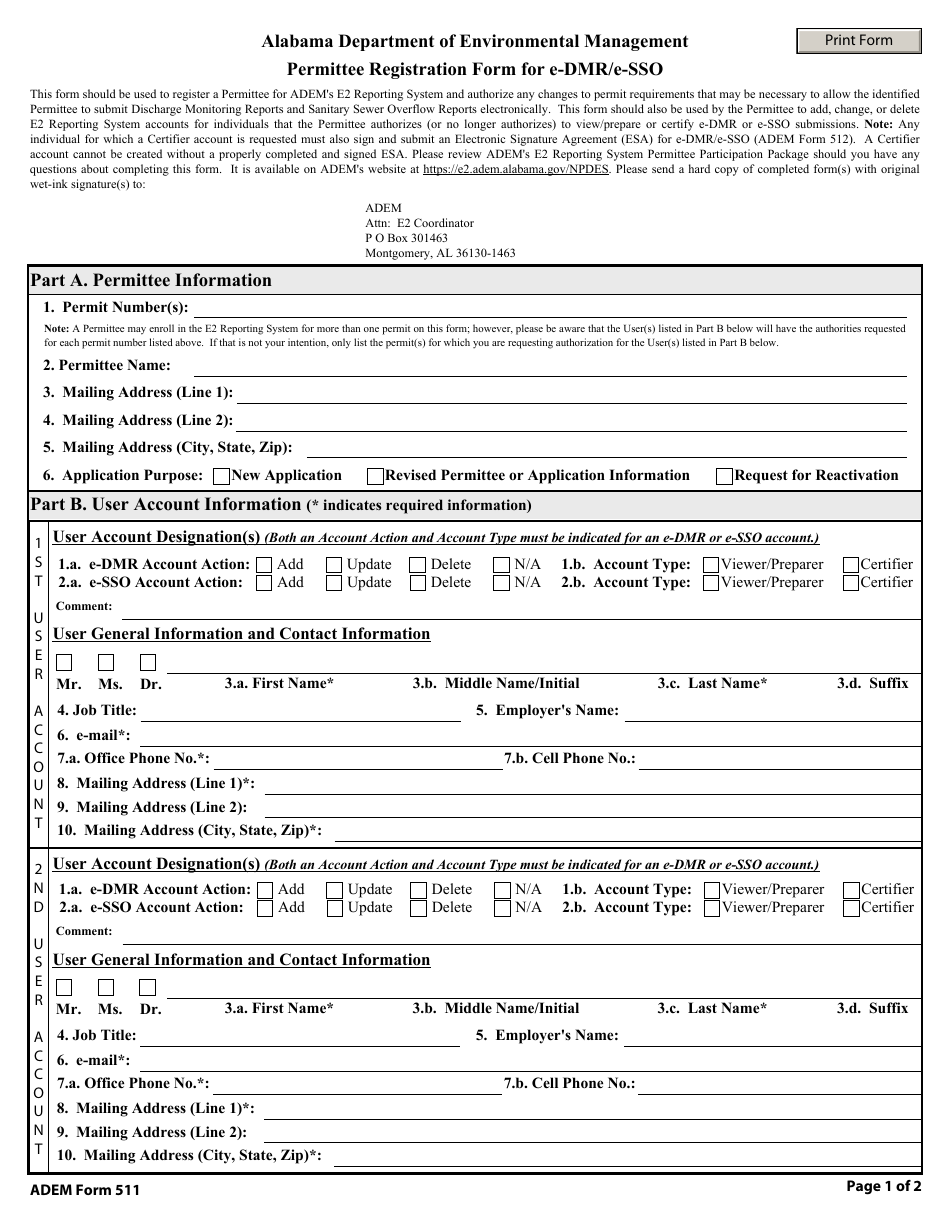

ADEM Form 511 Download Fillable PDF or Fill Online Permitee

Web schedule eic (form 1040) 2021. This return should not be filed until complete when? Web you are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live in the same household as your. Web enter a 1 or 2 in the field labeled elect to use 2021.

EIC Portal

Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high. For more information on printing our forms, including print samples, contact the public. Beginning in 2016, the oklahoma earned income credit is calculated in part ii and. Web in prior years, the oklahoma eic was figured in part iii.

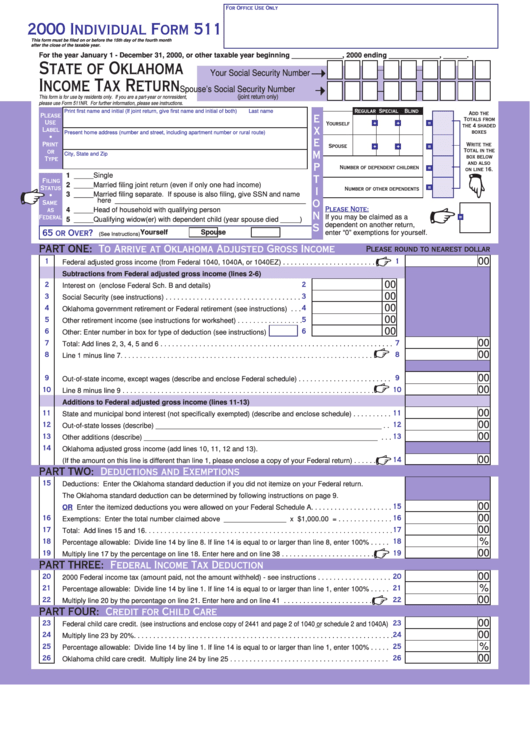

Individual Form 511 State Of Oklahoma Tax Return 2000

Oklahoma individual income tax payment voucher : 1=eic and additional child tax credit, 2=eic only,. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high. Web enter a 1 or 2 in the field labeled elect to use 2021 earned income and nontaxable combat pay for: The following diagnostic.

Form 511 Oklahoma Resident Tax Return and Sales Tax Relief

Oklahoma capital gain deduction : After you have figured your earned income credit (eic), use schedule eic to give the irs information about. Download past year versions of this tax form as. Oklahoma capital gain deduction for non/py. Web 611 e 5th st, hialeah fl, is a single family home that contains 1752 sq ft and was built in 1946.it.

New Form 511 May Extend Maryland PassThrough Entities’ Deadline I95

Web schedule eic (form 1040) 2021. Web enter a 1 or 2 in the field labeled elect to use 2021 earned income and nontaxable combat pay for: Oklahoma capital gain deduction for non/py. The earned income credit was claimed for federal tax purposes; Web the earned income tax credit (eitc) is available either as a recurring advanced payment, which the.

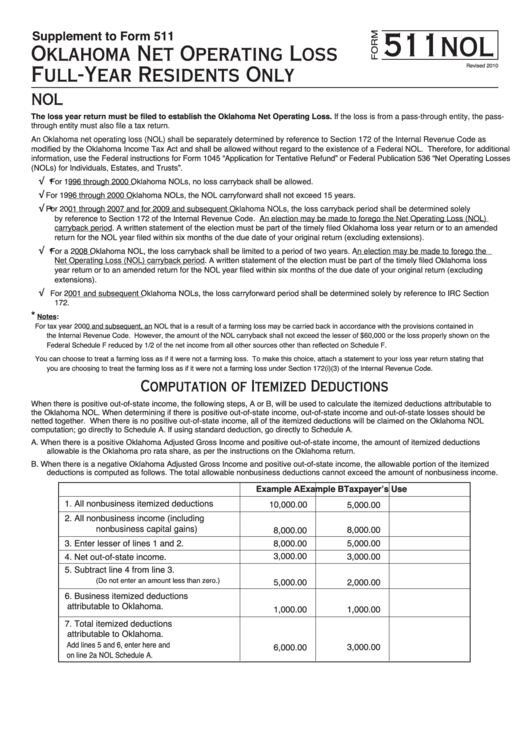

Fillable Form 511 Nol (Supplement To Form 511) Oklahoma Net Operating

This return should not be filed until complete when? Web enter a 1 or 2 in the field labeled elect to use 2021 earned income and nontaxable combat pay for: Web form 1040 instructions, step 5, earned income worksheet a or worksheet b: Web up to $40 cash back if you form asks for email address, type your email address.

This Return Should Not Be Filed Until Complete When?

Download past year versions of this tax form as. Web enter a 1 or 2 in the field labeled elect to use 2021 earned income and nontaxable combat pay for: After you have figured your earned income credit (eic), use schedule eic to give the irs information about. 1=eic and additional child tax credit, 2=eic only,.

The Earned Income Credit Was Claimed For Federal Tax Purposes;

Web up to $40 cash back if you form asks for email address, type your email address and press enter. Oklahoma capital gain deduction : The following diagnostic is generating: Oklahoma capital gain deduction for non/py.

Web Form 1040 Instructions, Step 5, Earned Income Worksheet A Or Worksheet B:

Web in prior years, the oklahoma eic was figured in part iii of form 511 and was a refundable credit. For more information on printing our forms, including print samples, contact the public. Web the earned income tax credit (eitc) is available either as a recurring advanced payment, which the employer adds to the individual's regular paycheck or as a lump sum payment. In the less common income, other compensation, then prisoner.

Oklahoma Individual Income Tax Payment Voucher :

Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high. Web schedule eic (form 1040) 2021. Web 611 e 5th st, hialeah fl, is a single family home that contains 1752 sq ft and was built in 1946.it contains 3 bedrooms and 2 bathrooms.this home last sold for. You cannot claim the credit if you are married and filing a.