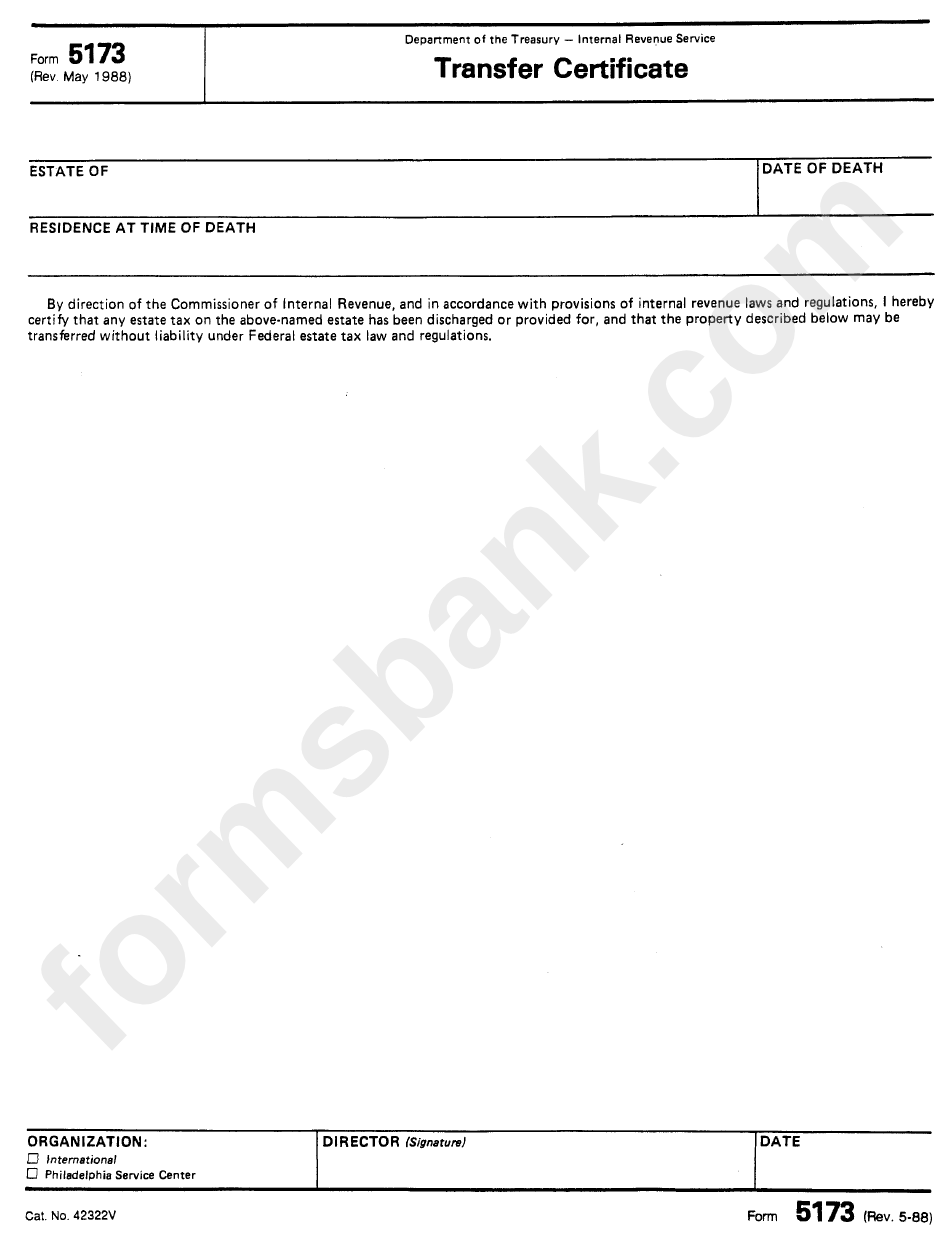

Form 5173 Irs

Form 5173 Irs - Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. It will explain how much you owe and how to pay it. Web to request a transfer certificate for an estate of a nonresident citizen of the united states. The member has no operations in or related to a boycotting country (or with the government, a company, or a national of a Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. The executor of the person's estate must provide form 5173 to a u.s. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Get everything done in minutes. Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for.

The member has no operations in or related to a boycotting country (or with the government, a company, or a national of a Web income tax return, each member of the controlled group must file form 5713 separately. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. A member of a controlled group (as defined in section 993(a)(3)) is not required to file form 5713 if all of the following conditions apply. Persons having operations in or related to countries that require participation in or. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Introduction to irs transfer certificate and form 706 na Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. It will explain how much you owe and how to pay it.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Introduction to irs transfer certificate and form 706 na Web read your notice carefully. Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. Web to request a transfer certificate for an estate of a nonresident citizen of the united states. If you receive income unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. What is a form 5173? A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Form 5713 is used by u.s. Persons having operations in or related to countries that require participation in or.

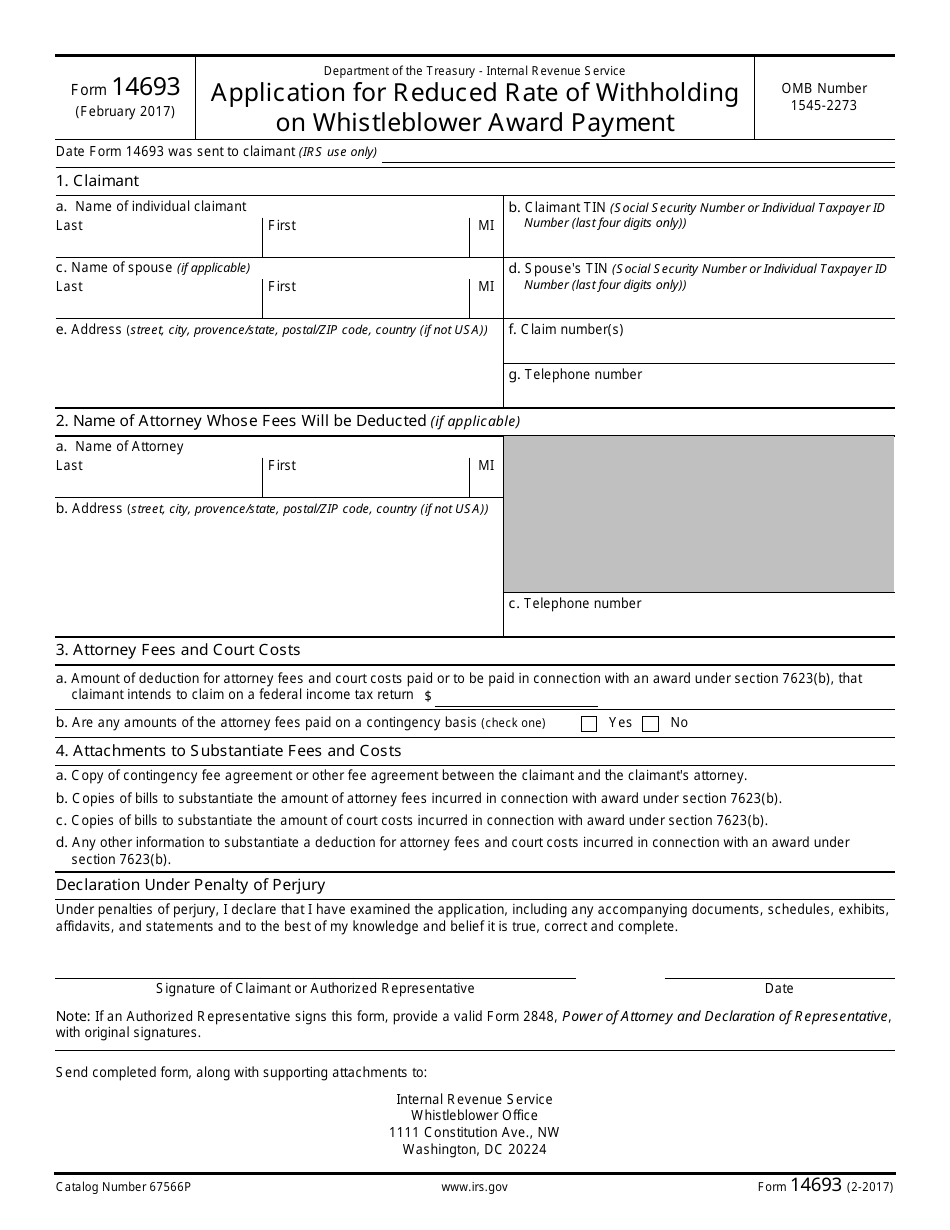

IRS Form 14693 Download Fillable PDF or Fill Online Application for

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web to request a transfer certificate for an estate of a nonresident not a.

The Process of Obtaining a Federal Transfer Certificate from the IRS

Web read your notice carefully. Web to request a transfer certificate for an estate of a nonresident citizen of the united states. Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Introduction to irs transfer certificate and form 706 na Check out how easy it is to complete.

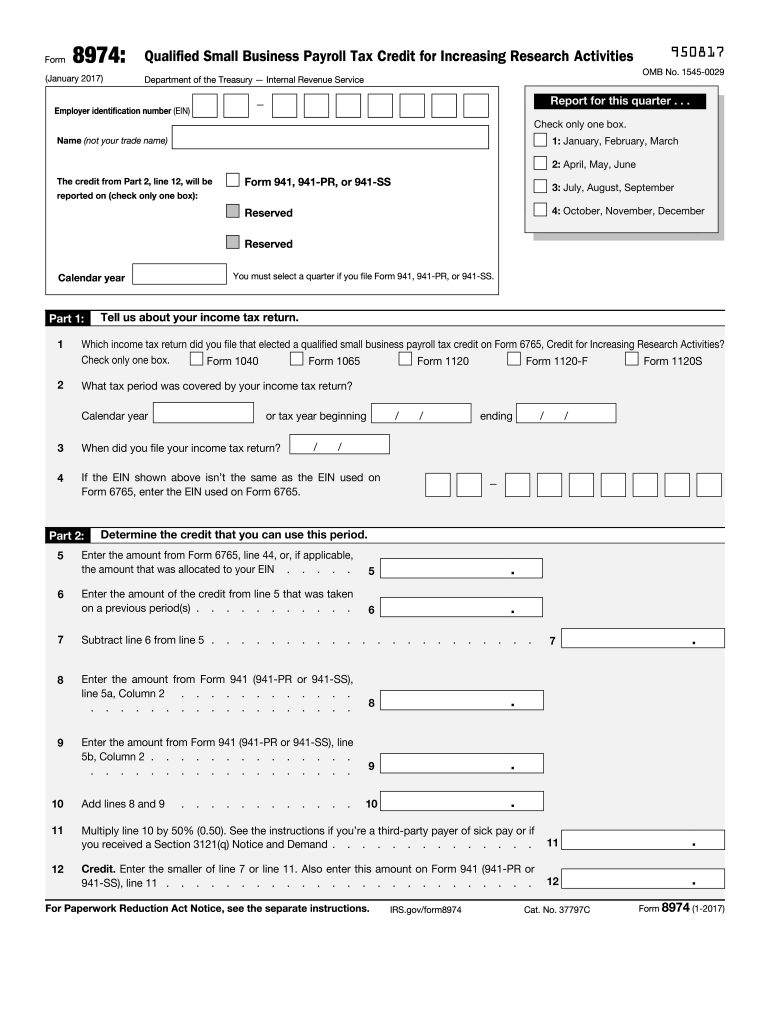

IRS 8974 2017 Fill and Sign Printable Template Online US Legal Forms

Use form 2220, underpayment of estimated tax by. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. It will explain how much you owe and how to pay it. Get everything done in minutes. Check out how easy it is to complete.

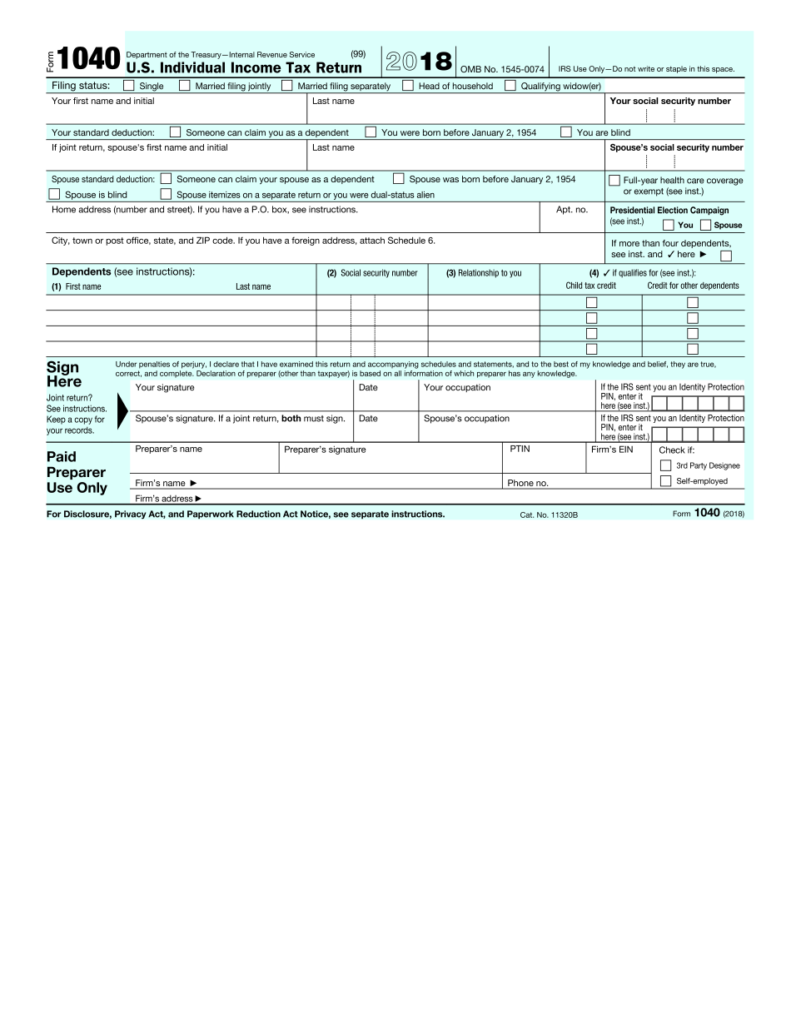

IRS 1040 Form Fillable Printable In PDF 2021 Tax Forms 1040 Printable

Get everything done in minutes. What is a form 5173? A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web read your notice carefully. Custodian in order for them to release the.

Form 5173 PDF Fill Out and Sign Printable PDF Template signNow

Get everything done in minutes. The member has no operations in or related to a boycotting country (or with the government, a company, or a national of a Pay the amount you owe by the due date on the notice. Custodian in order for them to release the. Persons having operations in or related to countries that require participation in.

LOGO

It will explain how much you owe and how to pay it. Use form 2220, underpayment of estimated tax by. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web read your notice carefully. Web form 5173 is required when a deceased.

EDGAR Filing Documents for 000119312516456864

Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states. What is a form 5173? A transfer certificate will be issued by the service when satisfied that the.

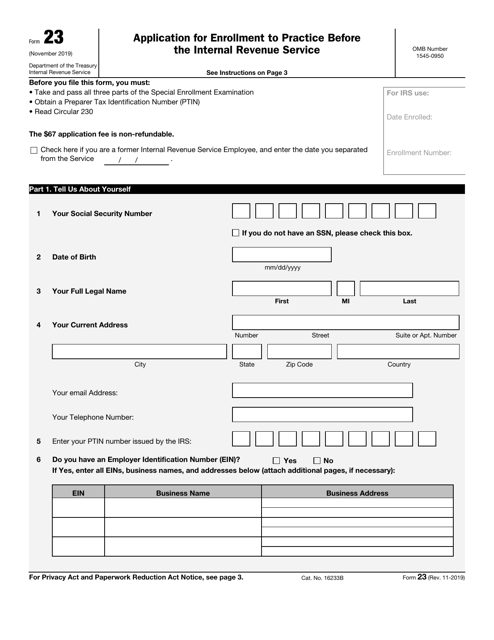

IRS Form 23 Download Fillable PDF or Fill Online Application for

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. (form 706na and form 5173) watch on in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Form 5713 is used by u.s. Use form 2220, underpayment of estimated.

form 5173 Fill Online, Printable, Fillable Blank form706

A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web form 5173 is required when a deceased nonresident has u.s. Custodian in order for them to release the. A member of a controlled group (as defined in section 993(a)(3)) is not required.

Form 5173 Transfer Certificate Form Inernal Revenue Service

Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. If you receive income unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. (form 706na and form 5173) watch on in this article, we’ll.

Web To Request A Transfer Certificate For An Estate Of A Nonresident Not A Citizen Of The United States.

A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. If you receive income unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Custodian in order for them to release the. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for.

It Will Explain How Much You Owe And How To Pay It.

Form 5713 is used by u.s. Web form 5173 is required when a deceased nonresident has u.s. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web to request a transfer certificate for an estate of a nonresident citizen of the united states.

Web Information About Form 5713, International Boycott Report, Including Recent Updates, Related Forms And Instructions On How To File.

Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. Web read your notice carefully. The executor of the person's estate must provide form 5173 to a u.s. (form 706na and form 5173) watch on in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases.

The Member Has No Operations In Or Related To A Boycotting Country (Or With The Government, A Company, Or A National Of A

A member of a controlled group (as defined in section 993(a)(3)) is not required to file form 5713 if all of the following conditions apply. Pay the amount you owe by the due date on the notice. Introduction to irs transfer certificate and form 706 na Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate?