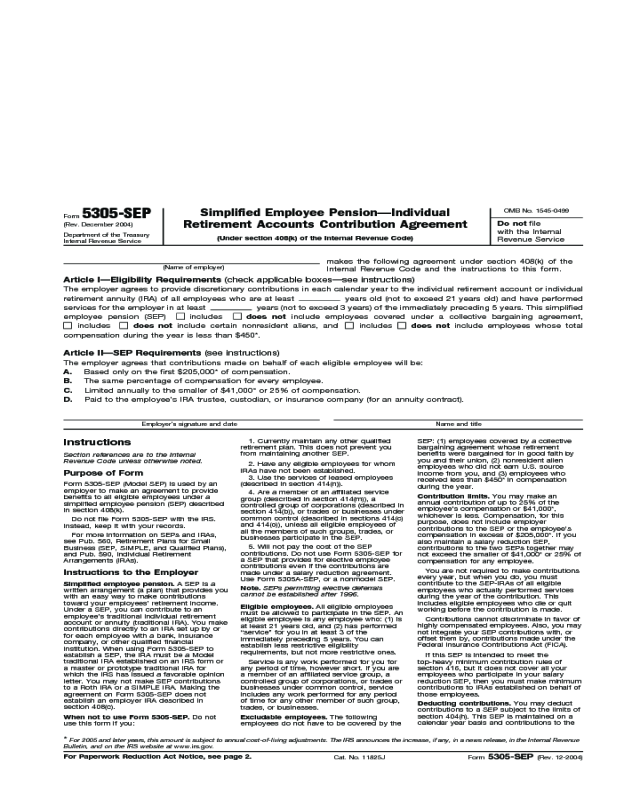

Form 5305-Sep

Form 5305-Sep - Get ready for tax season deadlines by completing any required tax forms today. Each employee must open an individual sep ira account. It cannot be a simple ira (an ira designed to. Web there are three document format options for sep plans: Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. This form is for income earned in tax year 2022, with tax returns due. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due. Web what does this mean to me? Web employers must fill out and retain form 5305 sep (pdf) in their records.

This form is for income earned in tax year 2022, with tax returns due. Get ready for tax season deadlines by completing any required tax forms today. Here is the irs faq for sep plans, which includes links to the most current form and instructions:. This form is for income earned in tax year 2022, with tax returns due. Web employers must fill out and retain form 5305 sep (pdf) in their records. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. It cannot be a simple ira (an ira designed to. Complete, edit or print tax forms instantly. Each employee must open an individual sep ira account.

Web what does this mean to me? Each employee must open an individual sep ira account. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Web employers must fill out and retain form 5305 sep (pdf) in their records. Web there are three document format options for sep plans: Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. It cannot be a simple ira (an ira designed to. This form is for income earned in tax year 2022, with tax returns due. This form is for income earned in tax year 2022, with tax returns due. No plan tax filings with irs.

Form 5305SEP Edit, Fill, Sign Online Handypdf

Web what does this mean to me? Get ready for tax season deadlines by completing any required tax forms today. Web employers must fill out and retain form 5305 sep (pdf) in their records. This form is for income earned in tax year 2022, with tax returns due. Here is the irs faq for sep plans, which includes links to.

Form 5305SEP Simplified Employee PensionIndividual Retirement

No plan tax filings with irs. Web what does this mean to me? This form is for income earned in tax year 2022, with tax returns due. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Get ready for tax season deadlines by completing any required tax forms.

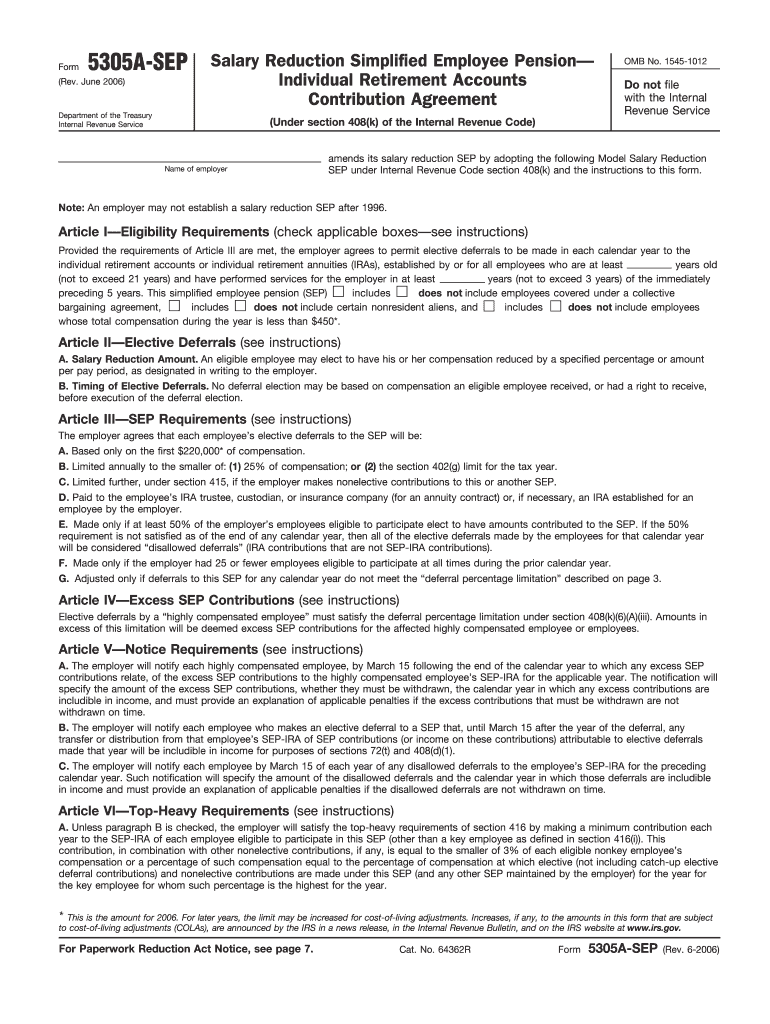

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Web there are three document format options for sep plans: Complete, edit or print tax forms instantly. Here is the irs faq for sep plans, which includes links to the most current form and instructions:. No plan tax filings with irs. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will.

Fill Free fillable Fidelity Investments PDF forms

It cannot be a simple ira (an ira designed to. Complete, edit or print tax forms instantly. No plan tax filings with irs. Get ready for tax season deadlines by completing any required tax forms today. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

This form is for income earned in tax year 2022, with tax returns due. Complete, edit or print tax forms instantly. Web there are three document format options for sep plans: Web what does this mean to me? This form is for income earned in tax year 2022, with tax returns due.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Web employers must fill out and retain form 5305 sep (pdf) in their records. Each employee must open an individual sep ira account. This form is for income earned in tax year 2022, with tax returns due. Get ready for tax season deadlines by completing any required tax forms today. It cannot be a simple ira (an ira designed to.

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

Each employee must open an individual sep ira account. Complete, edit or print tax forms instantly. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. This form is for income earned in tax year 2022, with tax returns due. Here is the irs faq for sep plans,.

20062022 Form IRS 5305ASEP Fill Online, Printable, Fillable, Blank

Here is the irs faq for sep plans, which includes links to the most current form and instructions:. Web what does this mean to me? No plan tax filings with irs. Each employee must open an individual sep ira account. Complete, edit or print tax forms instantly.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

This form is for income earned in tax year 2022, with tax returns due. It cannot be a simple ira (an ira designed to. This form is for income earned in tax year 2022, with tax returns due. Web what does this mean to me? Here is the irs faq for sep plans, which includes links to the most current.

Ea Form 2016 Pdf Latest Ea Form C P 8a Pin Technology Centre

Web what does this mean to me? Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. No plan tax filings with irs. It cannot be a simple ira (an ira designed to. Complete, edit or print tax forms instantly.

Each Employee Must Open An Individual Sep Ira Account.

This form is for income earned in tax year 2022, with tax returns due. Form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed. Web what does this mean to me? Web there are three document format options for sep plans:

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

It cannot be a simple ira (an ira designed to. Here is the irs faq for sep plans, which includes links to the most current form and instructions:. Complete, edit or print tax forms instantly. Web employers must fill out and retain form 5305 sep (pdf) in their records.

No Plan Tax Filings With Irs.

Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Get ready for tax season deadlines by completing any required tax forms today.