Form 540 Nr

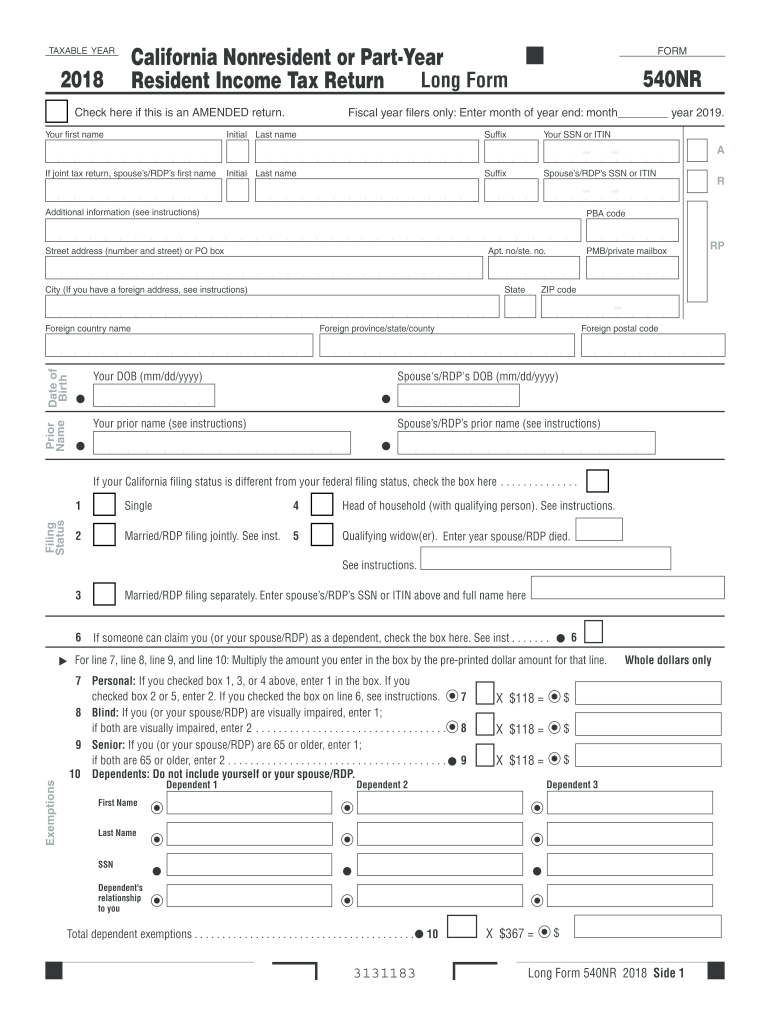

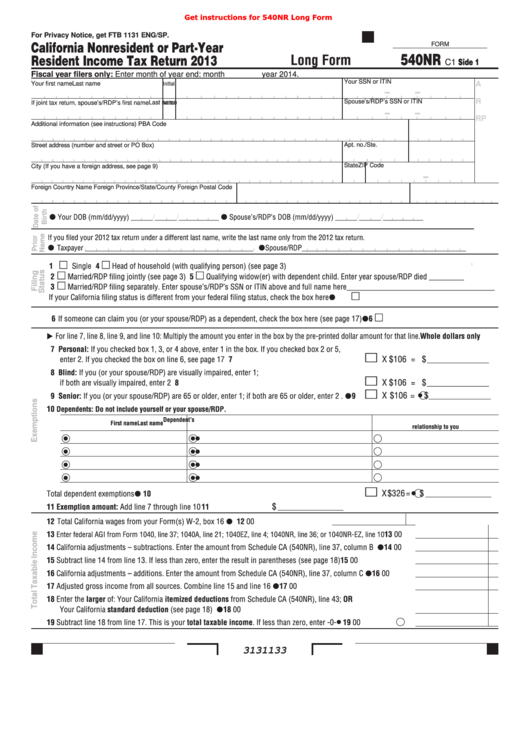

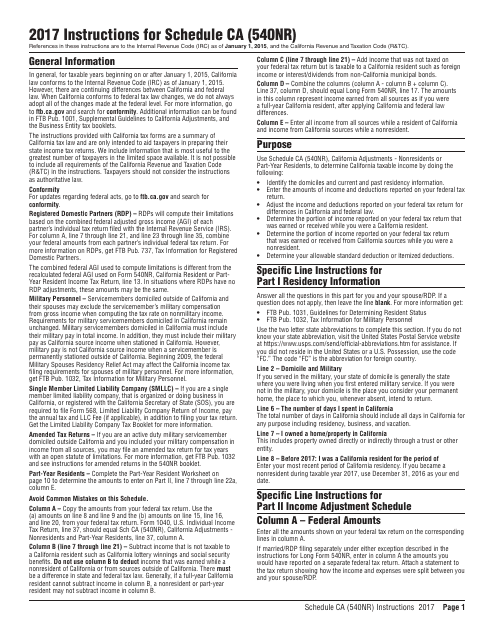

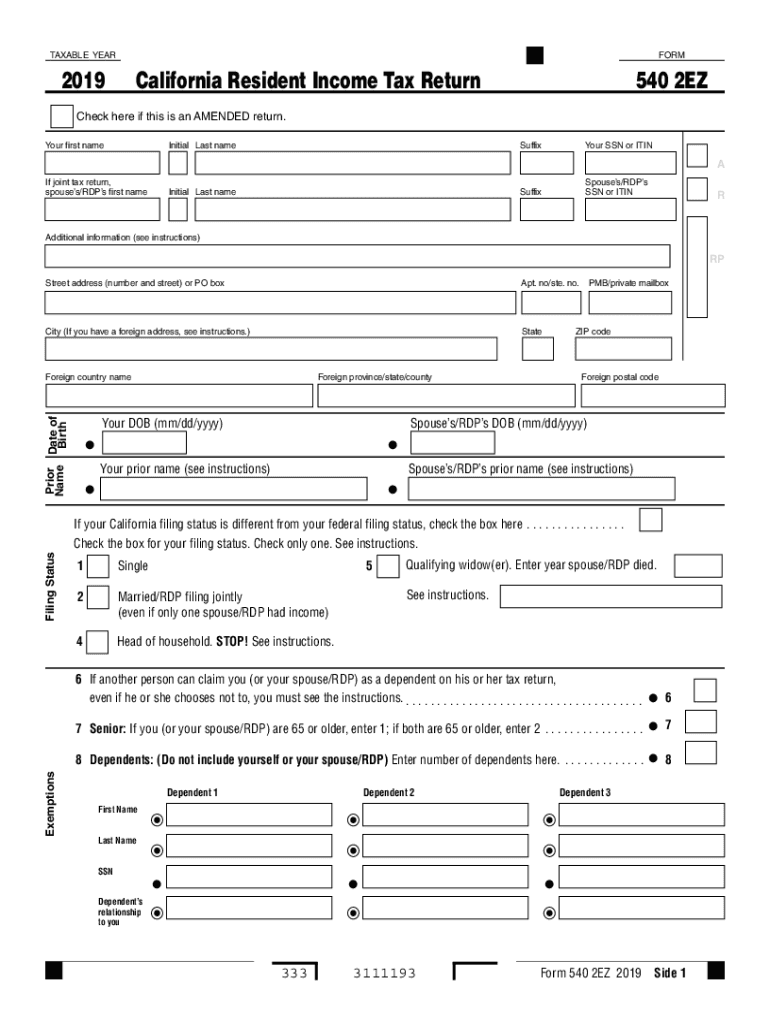

Form 540 Nr - If you and your spouse/rdp were california residents during the entire tax year 2021, use forms 540, california resident income tax return, or 540 2ez, california resident income tax return. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. See handout schedule ca (540nr) sandy eggo citizen of pandora. Enter month of year end: Web 333 3131203 form 540nr 2020 side 1 63 • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. This form is for income earned in tax year 2022, with tax returns due in april 2023. Complete all lines that apply to you and your spouse/rdp for taxable year 2021. Form ftb 3853, reporting exemption code e for the months she was a nonresident and code z for the months she had coverage. Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government.

Web schedule ca(540nr) before we can continue. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web california form 540nr fiscal year filers only: Sandy eggo 123456789 0 1,787 0 1,787. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Web (form 540nr line 17) is $42,932 or less if single or mfs. 6 exemptions for line 7, line 8, line 9, and line 10: Form ftb 3853, reporting exemption code e for the months she was a nonresident and code z for the months she had coverage. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Sandy’s agi from line 17 is $58,500.

We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. If you and your spouse/rdp were california residents during the entire tax year 2021, use forms 540, california resident income tax return, or 540 2ez, california resident income tax return. Web (form 540nr line 17) is $42,932 or less if single or mfs. See handout schedule ca (540nr) sandy eggo citizen of pandora. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Web schedule ca(540nr) before we can continue. Sandy eggo 123456789 0 1,787 0 1,787. Web 333 3131203 form 540nr 2020 side 1 63 • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. Arrived in california on 7/1/2021. Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z.

20182021 Form CA FTB 540NR Long Fill Online, Printable, Fillable

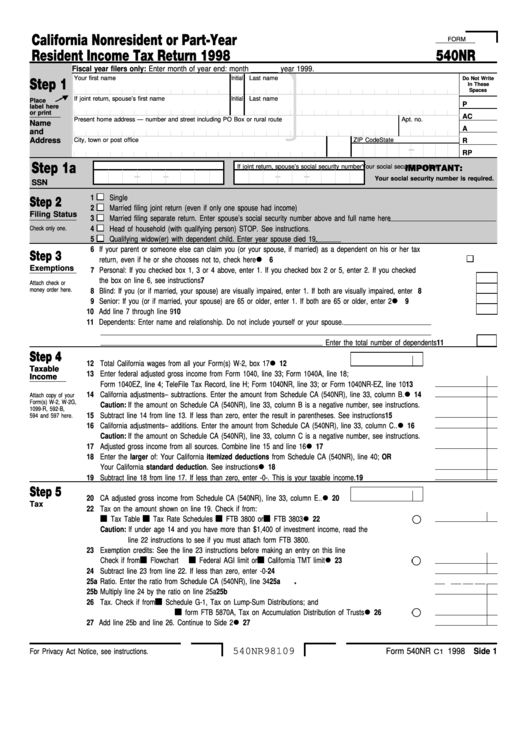

Web 333 3131203 form 540nr 2020 side 1 63 • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. Web california form 540nr fiscal year filers only: Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or.

Fillable Form 540nr California Nonresident Or PartYear Resident

Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Arrived in california on 7/1/2021. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Enter month of year end: Web schedule ca(540nr) before we can continue.

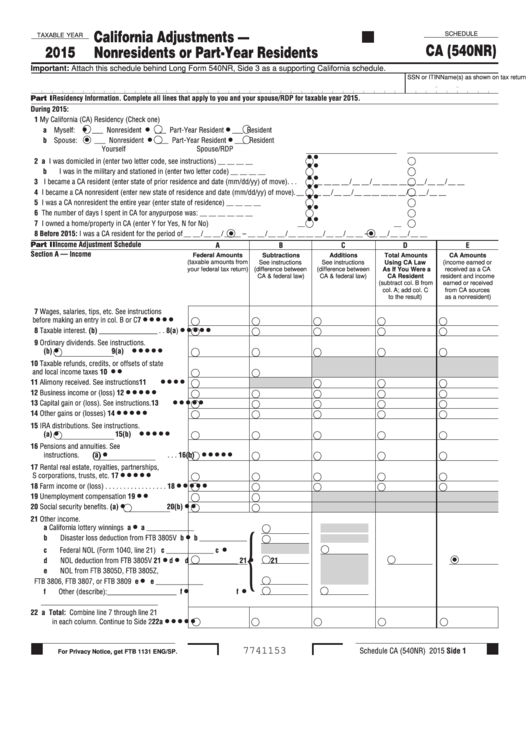

Instructions for Form 540nr Schedule Ca California Adjustments

Web california form 540nr fiscal year filers only: Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Sandy’s agi from line 17 is $58,500. See handout schedule ca (540nr) sandy eggo citizen of pandora. Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last.

Form 540 2EZ California Tax Return Form 540 2EZ California

Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. See handout schedule ca (540nr) sandy eggo citizen of pandora. Enter month of year end: Arrived in california on 7/1/2021. Attach this schedule behind form 540nr, side 5 as a supporting california schedule.

Fillable Form 540nr California Adjustments Nonresidents Or Part

Sandy’s agi from line 17 is $58,500. Enter month of year end: Form ftb 3853, reporting exemption code e for the months she was a nonresident and code z for the months she had coverage. Web california form 540nr fiscal year filers only: Web (form 540nr line 17) is $42,932 or less if single or mfs.

State of california tax form 540nr Fill out & sign online DocHub

Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. 6 exemptions for line 7, line 8, line 9, and line 10: Sandy’s agi from line 17 is $58,500. Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or itin r additional.

Fillable Form 540nr California Nonresident Or PartYear Resident

If you and your spouse/rdp were california residents during the entire tax year 2021, use forms 540, california resident income tax return, or 540 2ez, california resident income tax return. Web 333 3131203 form 540nr 2020 side 1 63 • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the.

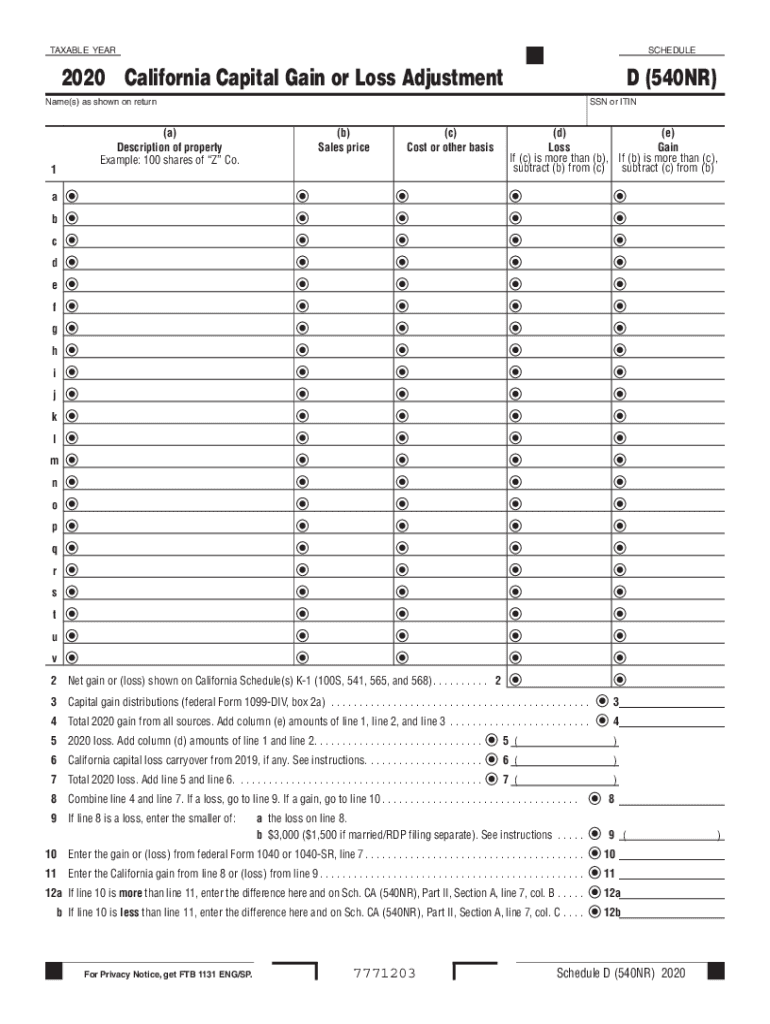

Printable California Form 540 NR Schedule D California Capital Gain or

If you and your spouse/rdp were california residents during the entire tax year 2021, use forms 540, california resident income tax return, or 540 2ez, california resident income tax return. Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or itin r additional information (see instructions) pba code Sandy eggo.

540Nr Long Form Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z. Web schedule ca(540nr) before we can continue. Form ftb 3853, reporting exemption code e for the months she was a nonresident and code z for the months she had coverage. Sandy eggo 123456789 0 1,787 0 1,787. Enter month of year end:

2016 Form 540 Fill Out and Sign Printable PDF Template signNow

If you and your spouse/rdp were california residents during the entire tax year 2021, use forms 540, california resident income tax return, or 540 2ez, california resident income tax return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sandy eggo 123456789 0 1,787 0 1,787. Enter month of year end: Web.

Web (Form 540Nr Line 17) Is $42,932 Or Less If Single Or Mfs.

Web 333 3131203 form 540nr 2020 side 1 63 • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. 6 exemptions for line 7, line 8, line 9, and line 10: Sandy eggo 123456789 0 1,787 0 1,787. Web schedule ca(540nr) before we can continue.

Web California Form 540Nr Fiscal Year Filers Only:

Enter month of year end: Form ftb 3853, reporting exemption code e for the months she was a nonresident and code z for the months she had coverage. Your first nameinitial last namesuffixyour ssn or itin a if joint tax return, spouse’s/rdp’s first nameinitial last namesuffixspouse’s/rdp’s ssn or itin r additional information (see instructions) pba code Complete all lines that apply to you and your spouse/rdp for taxable year 2021.

Sandy’s Agi From Line 17 Is $58,500.

See handout schedule ca (540nr) sandy eggo citizen of pandora. If you and your spouse/rdp were california residents during the entire tax year 2021, use forms 540, california resident income tax return, or 540 2ez, california resident income tax return. Attach this schedule behind form 540nr, side 5 as a supporting california schedule. Arrived in california on 7/1/2021.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The California Government.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web for more information, see schedule ca (540nr) specific line instructions in part ii, section b, line 8z.