Form 5405 Pdf

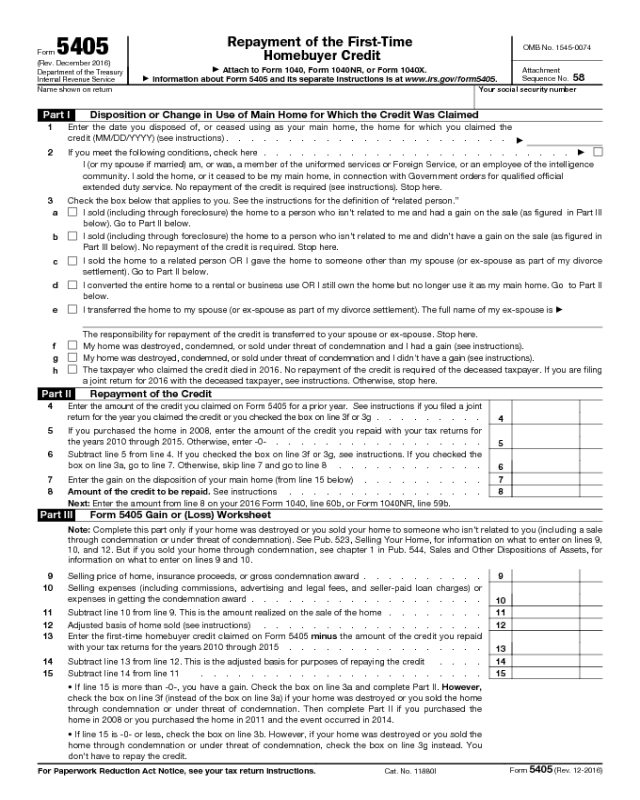

Form 5405 Pdf - Web download your fillable irs form 5405 in pdf at the end of the 2000s, residents of the united states who decided to buy a home for the first time could use a profitable. Complete, edit or print tax forms instantly. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Notice concerning fiduciary relationship 1122 11/16/2022 inst 56: Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. You disposed of it in 2022. Get ready for tax season deadlines by completing any required tax forms today. December 2010) department of the treasury internal revenue service. In the case of a sale, including through foreclosure, this is the year in which. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home.

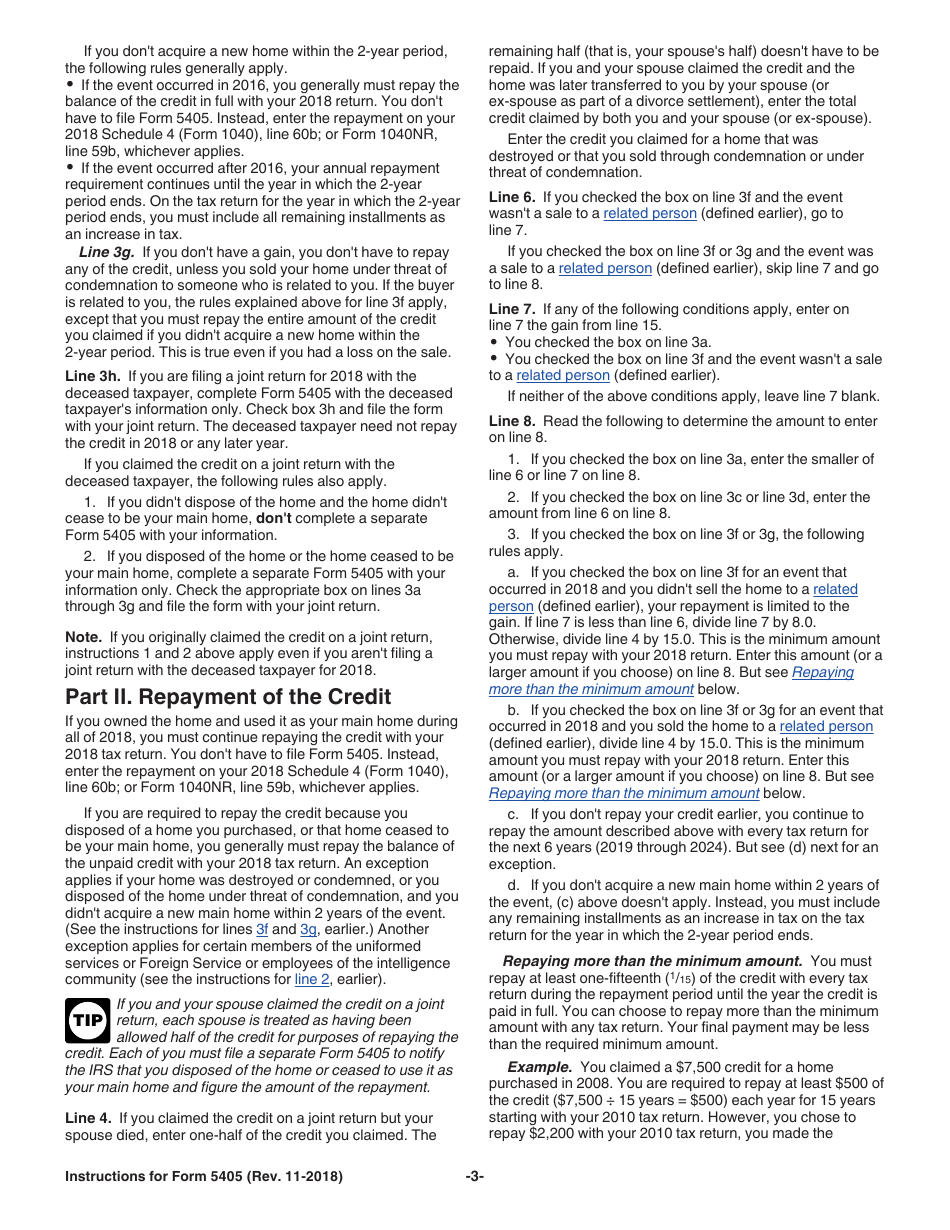

Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. In the case of a sale, including through foreclosure, this is the year in which. Web use form 5405 to do the following. Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: Web download your fillable irs form 5405 in pdf at the end of the 2000s, residents of the united states who decided to buy a home for the first time could use a profitable. Attach to your 2009 or 2010. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be. You disposed of it in 2022. December 2012) department of the treasury internal revenue service.

Complete, edit or print tax forms instantly. Attach to form 1040, form 1040nr,. December 2012) department of the treasury internal revenue service. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. You disposed of it in 2022. November 2020) department of the treasury internal revenue service. December 2010) department of the treasury internal revenue service. In the case of a sale, including through foreclosure, this is the year in which. December 2010) department of the treasury internal revenue service.

Form 5405 Edit, Fill, Sign Online Handypdf

Attach to your 2009 or 2010. November 2020) department of the treasury internal revenue service. Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: December 2012) department of the treasury internal revenue service. December 2010) department of the treasury internal revenue service.

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: Web form 5405 is a tax form used by individuals who have purchased a home for the first time or by those who have experienced a significant change in their home ownership status. Attach to form.

FIA Historic Database

You ceased using it as your. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. December 2010) department of the treasury internal revenue service. November 2020) department of the treasury internal revenue service. Web use form 5405 to do the following.

FIA Historic Database

Part iii form 5405 gain or (loss) worksheet. You disposed of it in 2022. You disposed of it in 2021. Web enter the amount of the credit you claimed on form 5405 for a prior year. You ceased using it as your.

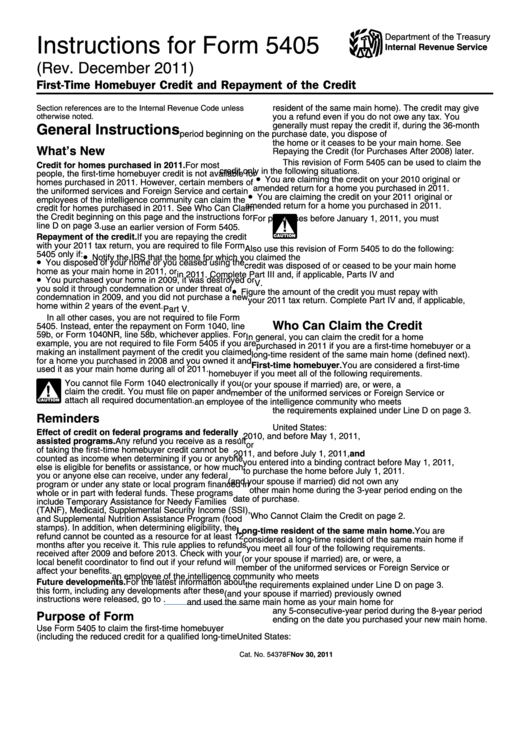

Instructions For Form 5405 FirstTime Homebuyer Credit And Repayment

Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be. Attach to your 2009 or 2010. You disposed of it in 2021. Attach to your 2009 or 2010. Complete, edit or print tax forms instantly.

Fill Free fillable Repayment of the FirstTime Homebuyer Credit Form

You disposed of it in 2022. Notice concerning fiduciary relationship 1122 11/16/2022 inst 56: Notify the irs that the home for which you claimed the credit was disposed of or. Attach to your 2009 or 2010. December 2010) department of the treasury internal revenue service.

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Web enter the amount of the credit you claimed on form 5405 for a prior year. Get ready for tax season deadlines by completing any required tax forms today. December 2010) department of the treasury internal revenue service. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home..

Popular Home Buyer Interest Form, House Plan App

Get ready for tax season deadlines by completing any required tax forms today. December 2012) department of the treasury internal revenue service. Web form 5405 is a tax form used by individuals who have purchased a home for the first time or by those who have experienced a significant change in their home ownership status. You ceased using it as.

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Notice concerning fiduciary relationship 1122 11/16/2022 inst 56: You disposed of it in 2022. December 2010) department of the treasury internal revenue service. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. You ceased using it as your.

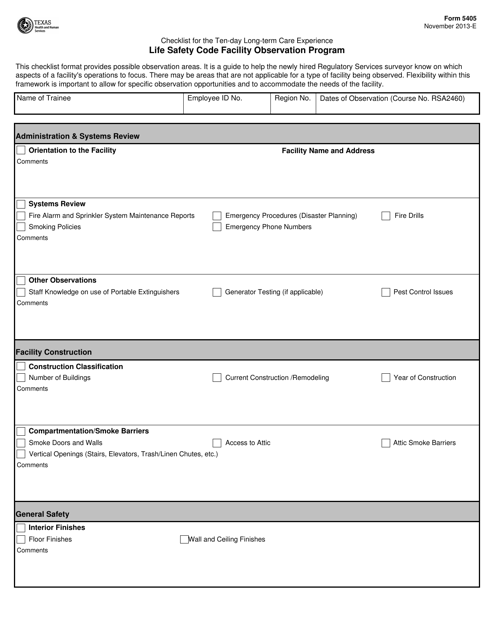

Form 5405 Download Fillable PDF or Fill Online Checklist for the Ten

Notice concerning fiduciary relationship 1122 11/16/2022 inst 56: December 2012) department of the treasury internal revenue service. December 2010) department of the treasury internal revenue service. Web the irs requires you to prepare irs form 5405 before you can claim the credit. You disposed of it in 2022.

Web Enter The Amount Of The Credit You Claimed On Form 5405 For A Prior Year.

Notify the irs that the home for which you claimed the credit was disposed of or. November 2020) department of the treasury internal revenue service. Attach to your 2009 or 2010. Web form 5405 is a tax form used by individuals who have purchased a home for the first time or by those who have experienced a significant change in their home ownership status.

Part Iii Form 5405 Gain Or (Loss) Worksheet.

Web use form 5405 to do the following. You disposed of it in 2021. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home.

The Form Is Used For The Credit Received If You Bought A.

Notice concerning fiduciary relationship 1122 11/16/2022 inst 56: December 2010) department of the treasury internal revenue service. December 2012) department of the treasury internal revenue service. In the case of a sale, including through foreclosure, this is the year in which.

You Disposed Of It In 2022.

Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: Attach to form 1040, form 1040nr,. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)