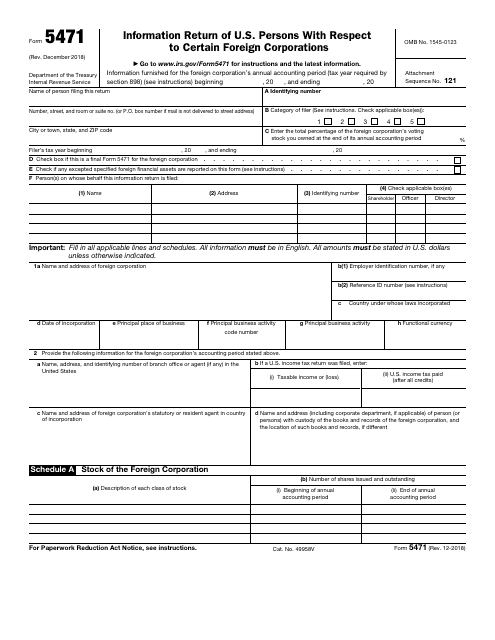

Form 5471 Instructions 2022

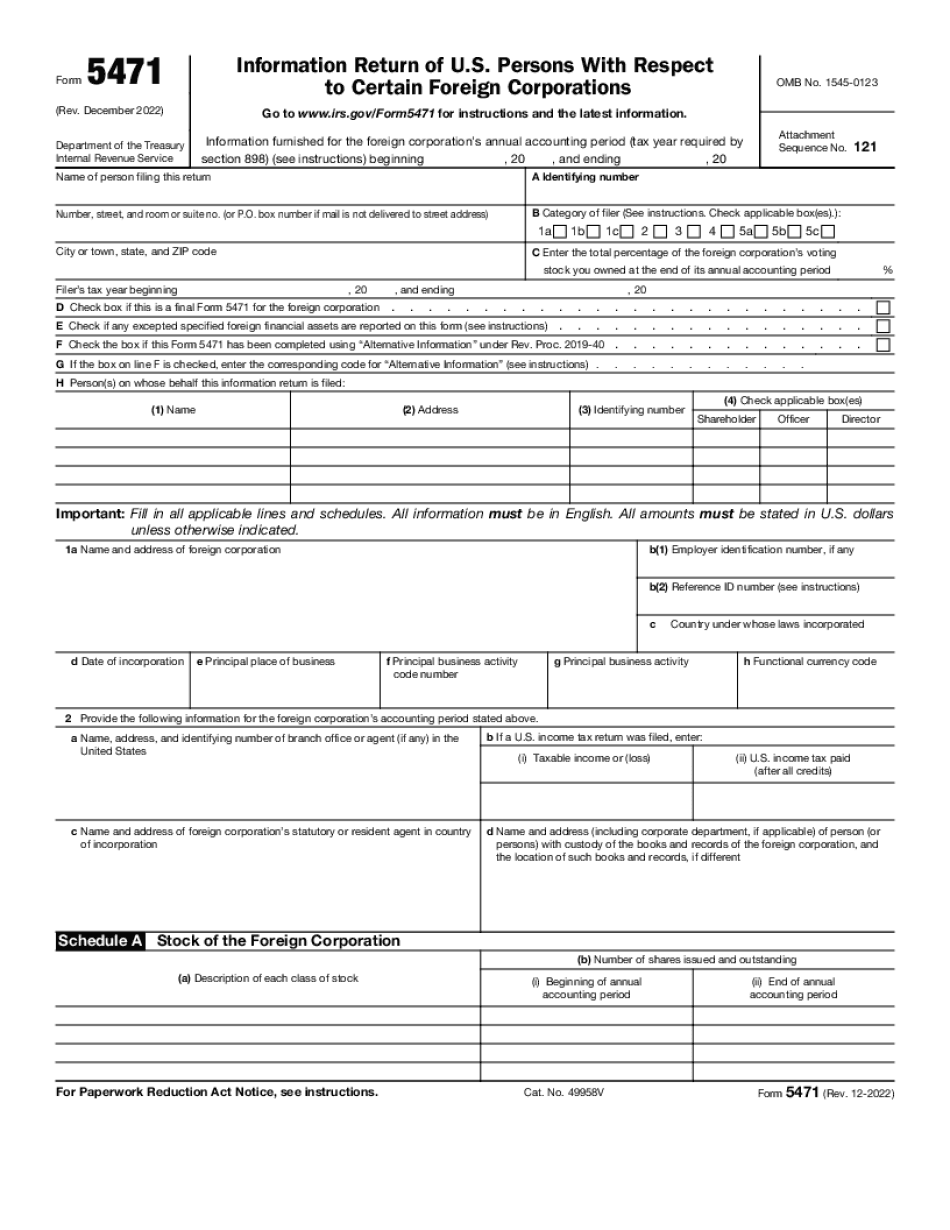

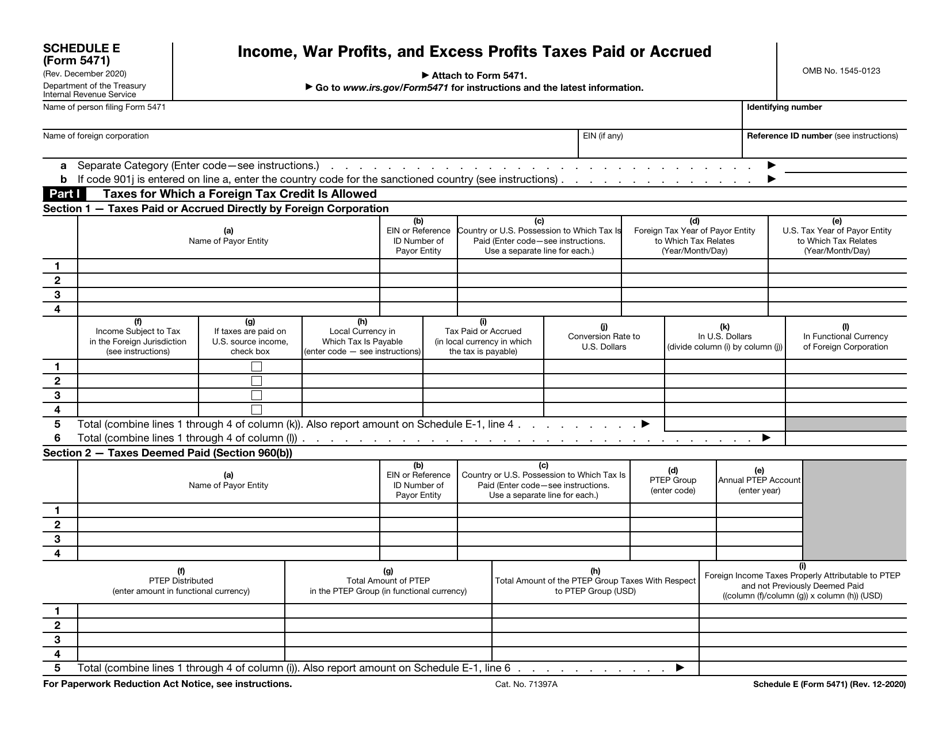

Form 5471 Instructions 2022 - File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web form 5471, schedule j, line 4, column (e) (x), as a positive number, the $40 ptep distribution. With respect to line a at the top of page 1 of. Web changes to separate schedule e (form 5471). Use the december 2019 revision. Complete a separate schedule q for each applicable separate category of income. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section Enter the appropriate code from the table below for the separate category of income with respect to. Web information about form 5471, information return of u.s. Web once finalized, these forms and instructions are intended to be applicable for a taxpayer’s 2022 tax year.

Web information about form 5471, information return of u.s. Use the december 2019 revision. Web once finalized, these forms and instructions are intended to be applicable for a taxpayer’s 2022 tax year. Web changes to separate schedule e (form 5471). If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). Enter the appropriate code from the table below for the separate category of income with respect to. December 2022) department of the treasury internal revenue service. Web form 5471, schedule j, line 4, column (e) (x), as a positive number, the $40 ptep distribution. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section

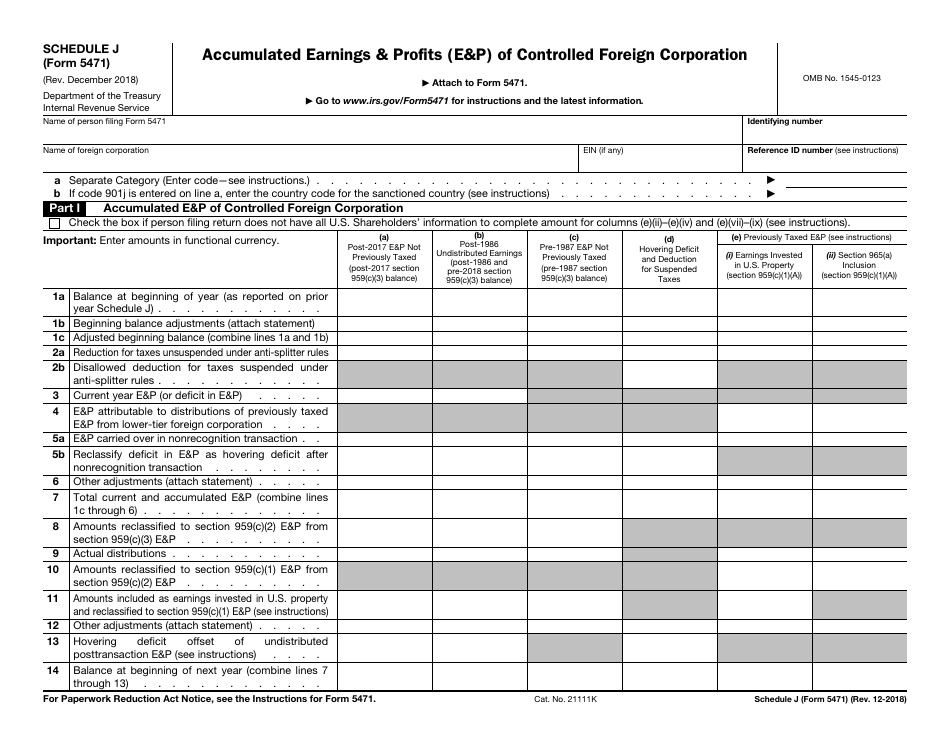

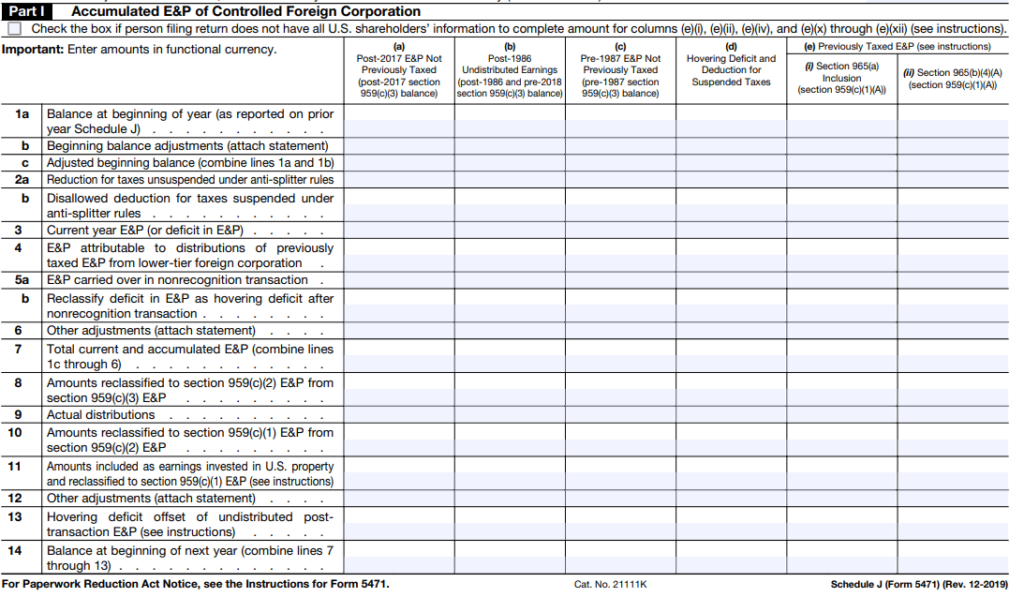

Changes to separate schedule j (form 5471). File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section Domestic corporation reports on line 6, column (e)(x), as a negative number, the $4 of tax on the ptep distribution. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Web changes to separate schedule e (form 5471). Web information about form 5471, information return of u.s. Preparing for the 2022 tax filing season with the 2022 tax filing season just a few months away, the time is now to start planning for upcoming compliance changes. Web developments related to form 5471, its schedules, and its instructions, such as legislation. Web once finalized, these forms and instructions are intended to be applicable for a taxpayer’s 2022 tax year.

Form 5471 Instructions 2016 Brilliant 1099 S Certification Exemption

With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. December 2022) department of the treasury internal revenue service. Use the december 2019 revision. Preparing for the 2022 tax filing season with the 2022 tax filing season just a few.

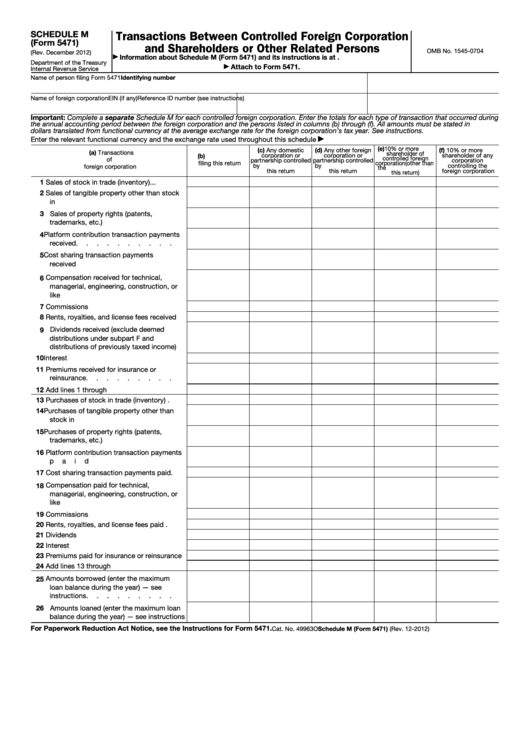

2012 form 5471 instructions Fill out & sign online DocHub

Changes to separate schedule j (form 5471). Enter the appropriate code from the table below for the separate category of income with respect to. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Form 5471 filers generally use the.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

Web changes to separate schedule e (form 5471). Web once finalized, these forms and instructions are intended to be applicable for a taxpayer’s 2022 tax year. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section Changes to separate schedule j (form 5471). Web information about form 5471, information return.

Instructions on Tax form 5471 TaxForm5471

December 2022) department of the treasury internal revenue service. Web form 5471, schedule j, line 4, column (e) (x), as a positive number, the $40 ptep distribution. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web changes to separate schedule e (form 5471). Web once finalized, these forms and instructions.

Form 5471, Page 1 YouTube

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Enter the appropriate code from the table below for the separate category of income with respect to. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section With respect to line a at.

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

With respect to line a at the top of page 1 of. Preparing for the 2022 tax filing season with the 2022 tax filing season just a few months away, the time is now to start planning for upcoming compliance changes. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web.

Fillable Form 5471 Schedule M Transactions Between Controlled

Web developments related to form 5471, its schedules, and its instructions, such as legislation. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Use the december 2019 revision. Preparing for the 2022 tax filing season with the 2022 tax.

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Web changes to separate schedule e (form 5471). Web developments related to form 5471, its schedules, and its instructions, such as legislation. With respect to line a at the top of page 1 of. Web form 5471, schedule j, line 4, column (e) (x), as a positive number, the $40 ptep distribution. Use the december 2019 revision.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Preparing for the 2022 tax filing season with the 2022 tax filing season just a few months away, the time is now to start planning for upcoming compliance changes. Domestic corporation reports on line 6, column (e)(x), as a negative number, the $4 of tax on the ptep distribution. With respect to line a at the top of page 1.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Web information about form 5471, information return of u.s. Web developments related to form 5471, its schedules, and its instructions, such as legislation. Enter the appropriate code from the table below for the separate category of income with respect to. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section.

Web Once Finalized, These Forms And Instructions Are Intended To Be Applicable For A Taxpayer’s 2022 Tax Year.

Form 5471 filers generally use the same Web form 5471, schedule j, line 4, column (e) (x), as a positive number, the $40 ptep distribution. Changes to separate schedule j (form 5471). File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

With Respect To Line A At The Top Of Page 1 Of.

Web developments related to form 5471, its schedules, and its instructions, such as legislation. Web changes to separate schedule e (form 5471). If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). Web information about form 5471, information return of u.s.

December 2022) Department Of The Treasury Internal Revenue Service.

Preparing for the 2022 tax filing season with the 2022 tax filing season just a few months away, the time is now to start planning for upcoming compliance changes. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Enter on line 7 e&p as of the close of the tax year before actual distributions or inclusions under section Enter the appropriate code from the table below for the separate category of income with respect to.

Complete A Separate Schedule Q For Each Applicable Separate Category Of Income.

Domestic corporation reports on line 6, column (e)(x), as a negative number, the $4 of tax on the ptep distribution. Use the december 2019 revision. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file.