Form 5471 Schedule E-1

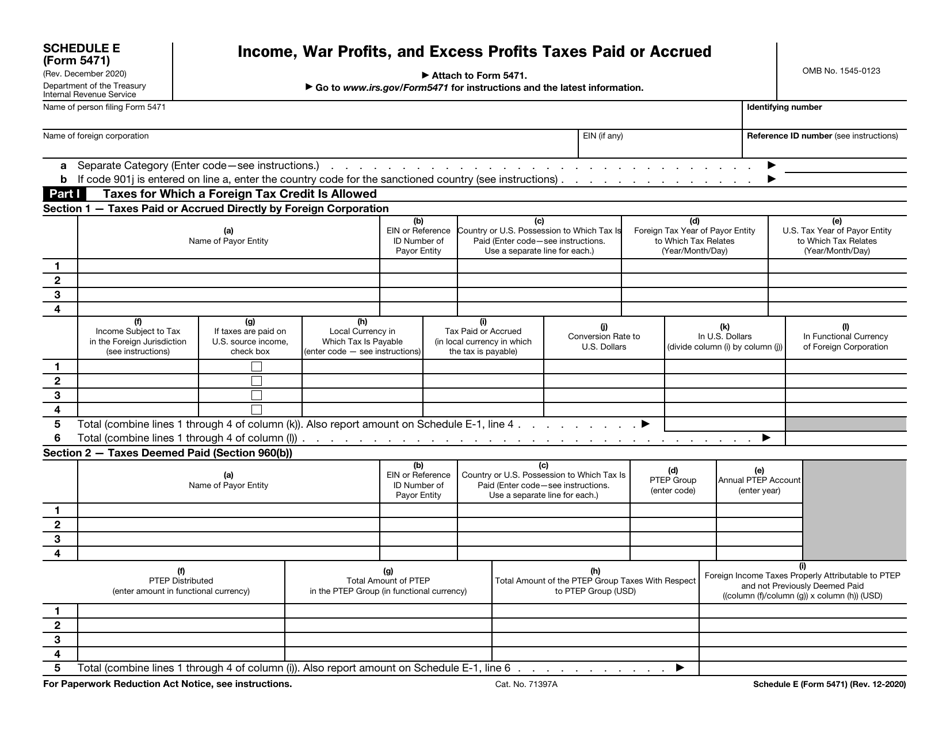

Form 5471 Schedule E-1 - Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Taxes paid, accrued, or deemed paid on accumulated earnings and profits (e&p) of foreign corporation: Go to www.irs.gov/form5471 for instructions and the latest information. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web changes to separate schedule e (form 5471). The taxes must be categorized as related to either subpart f income, tested income, residual. December 2021) income, war profits, and excess profits taxes paid or accrued department of the treasury internal revenue service attach to form 5471. Web changes to separate schedule e (form 5471). Web changes to separate schedule e (form 5471). Dollars unless otherwise noted (see instructions).

December 2021) income, war profits, and excess profits taxes paid or accrued department of the treasury internal revenue service attach to form 5471. Web changes to separate schedule e (form 5471). In new column (g), taxpayers are instructed Taxes paid, accrued, or deemed paid on accumulated earnings and profits (e&p) of foreign corporation: Dollars unless otherwise noted (see instructions). The taxes must be categorized as related to either subpart f income, tested income, residual. Form 5471 filers generally use the same category of filer codes used on form 1118. Web schedule e (form 5471) (rev. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Form 5471 filers generally use the same category of filer codes used on form 1118.

Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Dollars unless otherwise noted (see instructions). Web changes to separate schedule e (form 5471). Form 5471 filers generally use the same category of filer codes used on form 1118. Form 5471 filers generally use the same category of filer codes used on form 1118. Go to www.irs.gov/form5471 for instructions and the latest information. Taxes paid, accrued, or deemed paid on accumulated earnings and profits (e&p) of foreign corporation: Schedule e, part i, has been divided into section 1 (taxes paid or accrued directly by foreign corporation) and new section 2 (taxes deemed paid (section 960(b))). Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web schedule e (form 5471) (rev.

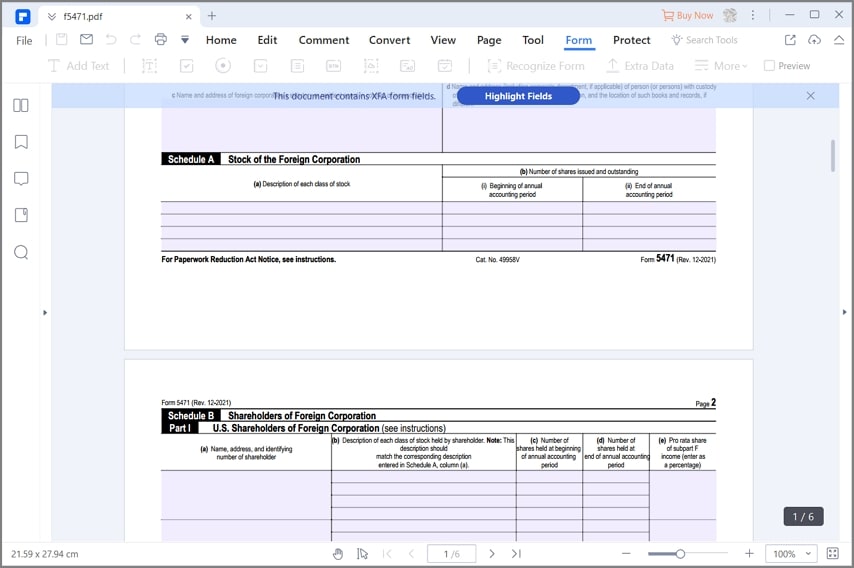

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

The taxes must be categorized as related to either subpart f income, tested income, residual. Web changes to separate schedule e (form 5471). Form 5471 filers generally use the same category of filer codes used on form 1118. Go to www.irs.gov/form5471 for instructions and the latest information. Schedule e, part i, has been divided into section 1 (taxes paid or.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web changes to separate schedule e (form 5471). Web changes to separate schedule e (form 5471). Dollars unless otherwise noted (see instructions). In schedule.

How to Fill out IRS Form 5471 (2020 Tax Season)

Web changes to separate schedule e (form 5471). Web changes to separate schedule e (form 5471). Form 5471 filers generally use the same category of filer codes used on form 1118. Web changes to separate schedule e (form 5471). In schedule e, part i, section 1, new columns (g) and (h) have been inserted.

A Deep Dive Into the IRS Form 5471 Schedule E Reporting and Tracking

Dollars unless otherwise noted (see instructions). Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Web changes to separate schedule e (form 5471). In new column (g), taxpayers are instructed The taxes must be categorized as related to either subpart f income, tested income, residual.

Form 5471 and Corresponding Schedules SDG Accountant

Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Web changes to separate schedule e (form 5471). Web schedule e (form 5471) (rev. Taxes paid, accrued, or deemed paid on accumulated earnings and profits (e&p) of foreign corporation: Form 5471 filers generally use the same.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Form 5471 filers generally use the same category of filer codes used on form 1118. Taxes paid, accrued, or deemed paid on accumulated earnings and profits (e&p) of foreign corporation: In schedule e, part i, section.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule E

Form 5471 filers generally use the same category of filer codes used on form 1118. Dollars unless otherwise noted (see instructions). Go to www.irs.gov/form5471 for instructions and the latest information. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

The taxes must be categorized as related to either subpart f income, tested income, residual. Go to www.irs.gov/form5471 for instructions and the latest information. In schedule e, part i, section 1, new columns (g) and (h) have been inserted. Schedule e, part i, has been divided into section 1 (taxes paid or accrued directly by foreign corporation) and new section.

IRS Form 5471 Schedule E and Schedule H SF Tax Counsel

Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Go to www.irs.gov/form5471 for instructions and the latest information. Form 5471 filers generally use the same category of filer codes used on form 1118. In new column (g), taxpayers are instructed Form 5471 filers generally use.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

December 2021) income, war profits, and excess profits taxes paid or accrued department of the treasury internal revenue service attach to form 5471. Schedule e, part i, has been divided into section 1 (taxes paid or accrued directly by foreign corporation) and new section 2 (taxes deemed paid (section 960(b))). Web schedule e (form 5471) (rev. Go to www.irs.gov/form5471 for.

Web Changes To Separate Schedule E (Form 5471).

December 2021) income, war profits, and excess profits taxes paid or accrued department of the treasury internal revenue service attach to form 5471. Form 5471 filers generally use the same category of filer codes used on form 1118. In schedule e, part i, section 1, new columns (g) and (h) have been inserted. Web changes to separate schedule e (form 5471).

Form 5471 Filers Generally Use The Same Category Of Filer Codes Used On Form 1118.

Web schedule e (form 5471) (rev. Schedule e, part i, has been divided into section 1 (taxes paid or accrued directly by foreign corporation) and new section 2 (taxes deemed paid (section 960(b))). Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons: Web changes to separate schedule e (form 5471).

Go To Www.irs.gov/Form5471 For Instructions And The Latest Information.

In new column (g), taxpayers are instructed Taxes paid, accrued, or deemed paid on accumulated earnings and profits (e&p) of foreign corporation: Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. The taxes must be categorized as related to either subpart f income, tested income, residual.