Form 5500 Instructions 2022

Form 5500 Instructions 2022 - Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Web form 5500, line 2d. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Or use approved software, if available. Web paper forms for filing. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). Completed forms are submitted via the internet to efast2 for processing. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Erisa refers to the employee retirement income security act of 1974. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions,

Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Completed forms are submitted via the internet to efast2 for processing. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Or use approved software, if available. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, See the instructions to the form. Web paper forms for filing.

Web form 5500, line 2d. Erisa refers to the employee retirement income security act of 1974. See the instructions to the form. Or use approved software, if available. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Completed forms are submitted via the internet to efast2 for processing. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans.

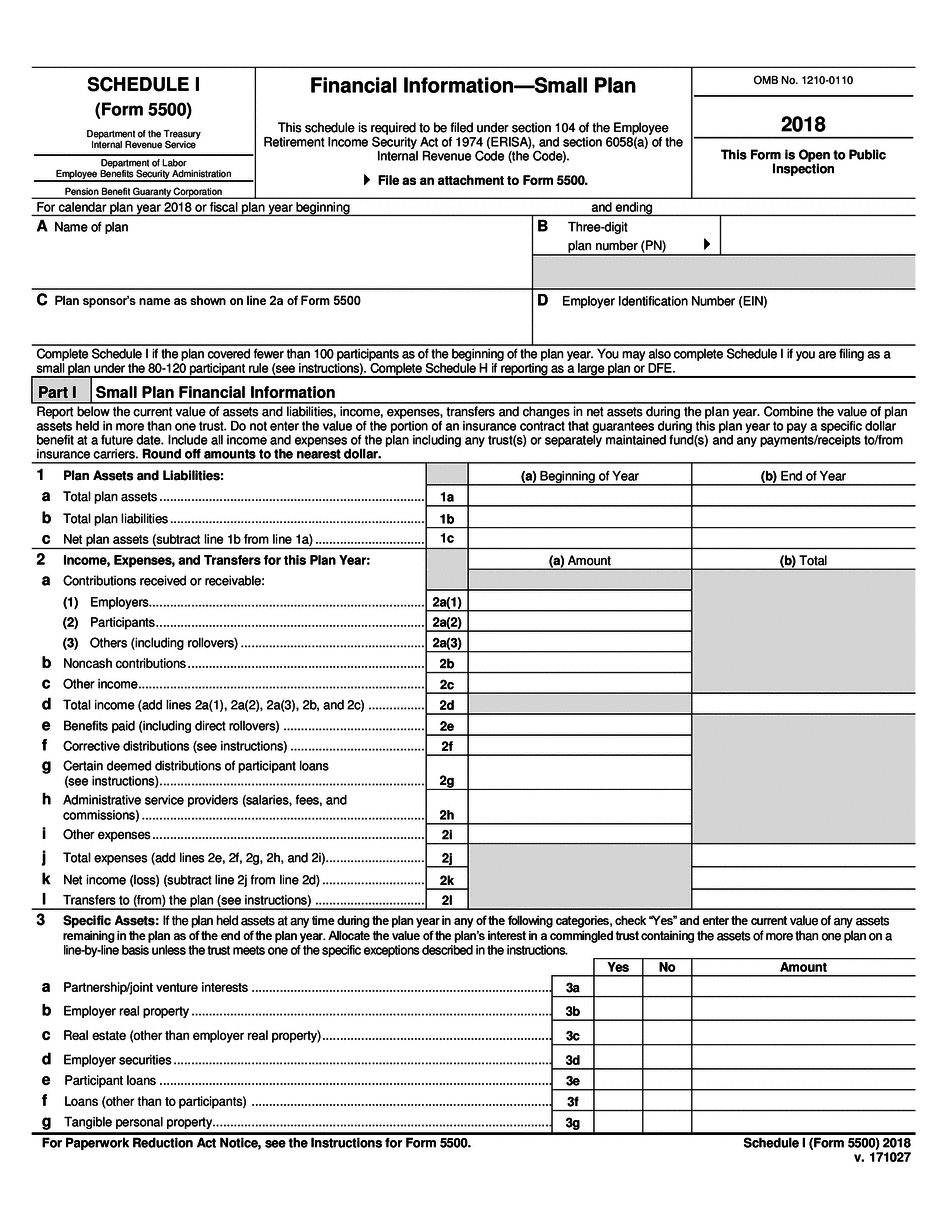

5500 Instructions 2018 Fillable and Editable PDF Template

Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). Or use approved software, if available. Erisa refers to the employee retirement income security act of 1974. Web form 5500, line 2d. Web paper forms.

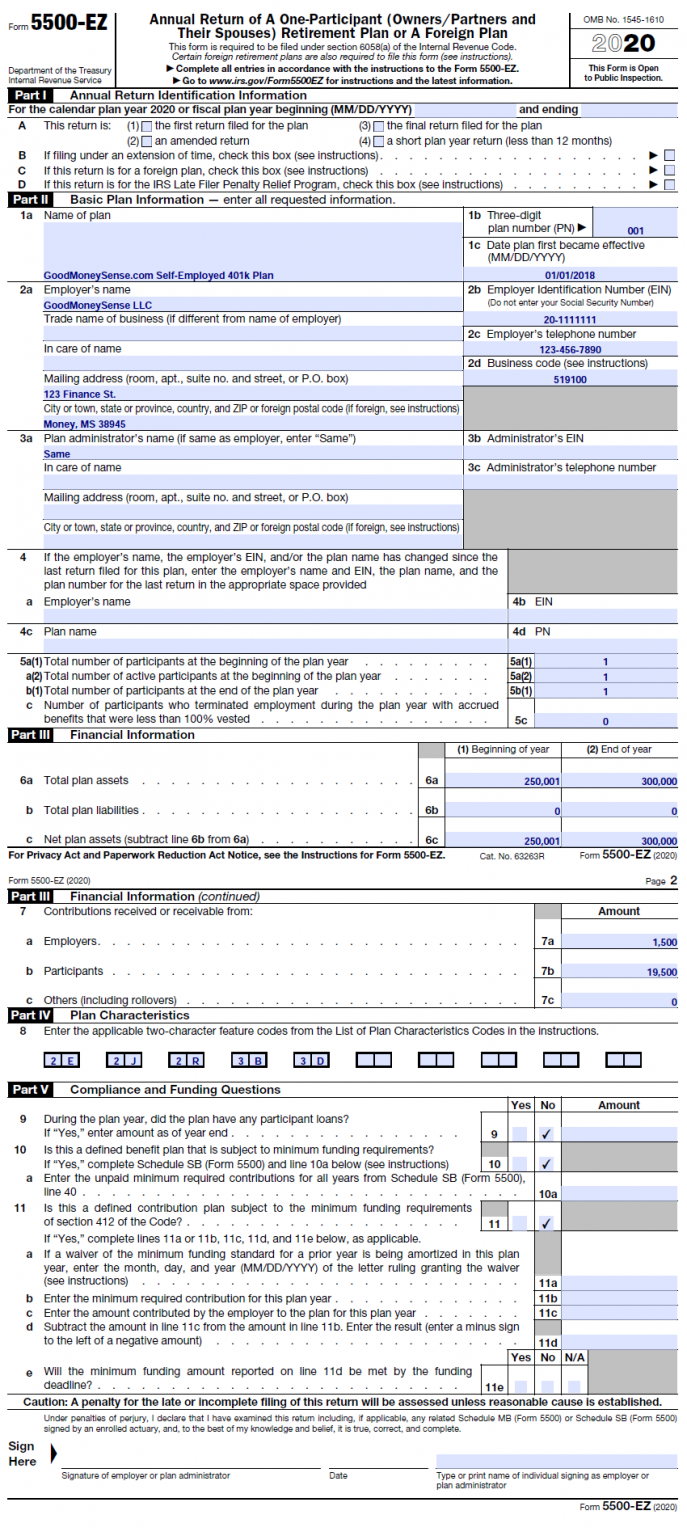

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Completed forms are submitted via the internet to efast2 for processing. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Web paper forms for filing. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2%.

How to File Form 5500EZ Solo 401k

The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Erisa refers to the employee retirement income security act of 1974. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, Web this projection shows expected benefit payments for active participants, terminated vested participants,.

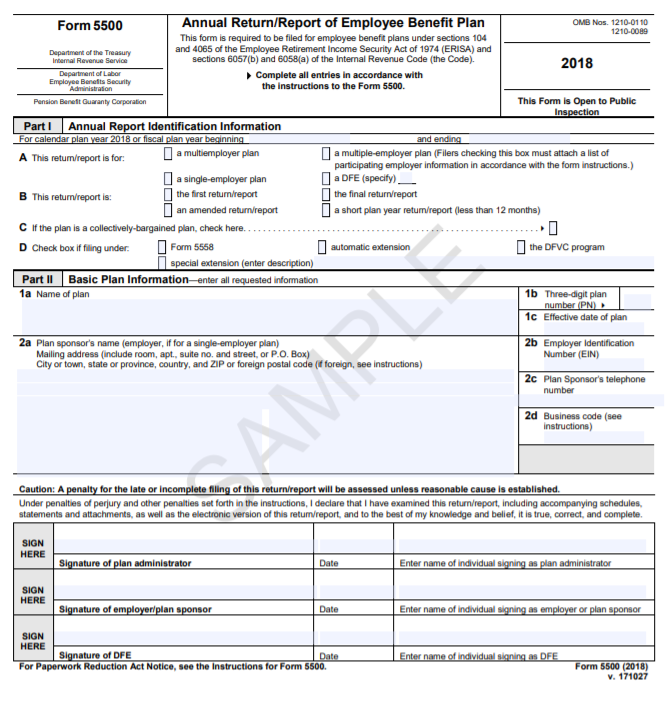

Form 5500 Fill Out and Sign Printable PDF Template signNow

Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, Web paper forms for filing. Web form 5500, line 2d. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Or use approved software, if available.

2019 2020 IRS Instructions 5500EZ Fill Out Digital PDF Sample

Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Web paper forms for filing. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) The instructions to line 2d of the form 5500 have been clarified on how to.

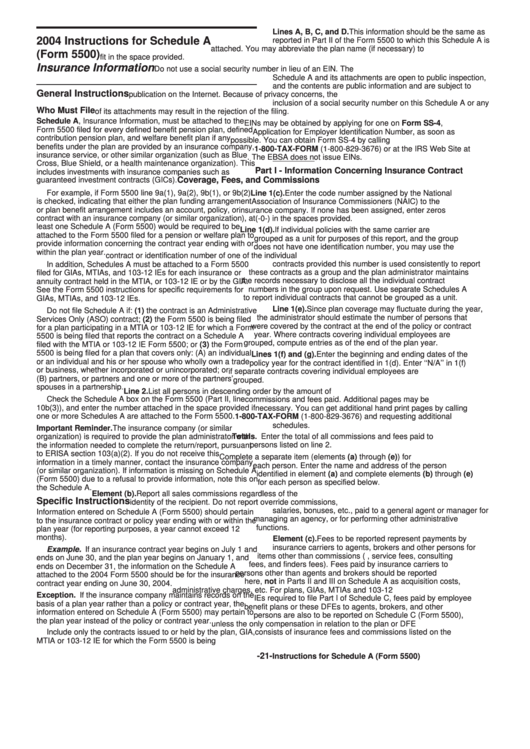

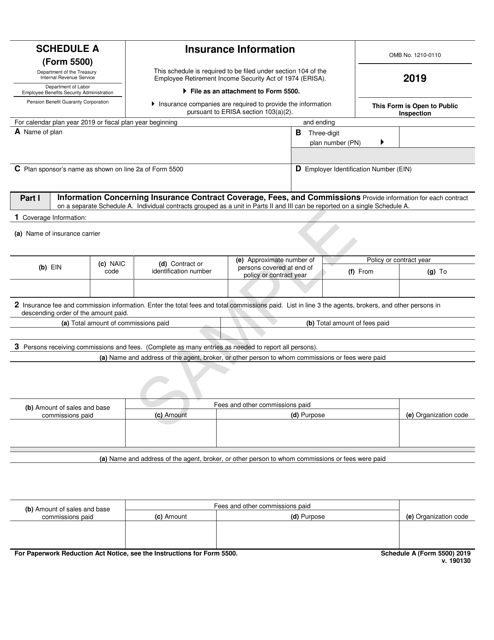

Form 5500 Schedule A Instructions Insurance Information 2004

The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Completed forms are submitted via the internet to efast2 for processing. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Erisa refers to.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

(failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Erisa refers to the employee retirement income security act of 1974. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s.

Form 5500 Is Due by July 31 for Calendar Year Plans

(failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Web paper forms for filing. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. See the instructions to the form. The instructions for line 3a(1), 3a(2), 3a(3).

Dol form 5500 Instructions Inspirational 25 6 1 Statute Of Limitations

Web paper forms for filing. Erisa refers to the employee retirement income security act of 1974. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). (failure to enter a valid receipt confirmation code will.

IRS Form 5500 Schedule A Download Fillable PDF or Fill Online Insurance

Web paper forms for filing. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, Completed forms are submitted via the internet to efast2 for processing. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b),.

(Failure To Enter A Valid Receipt Confirmation Code Will Subject The Form 5500 Filing To Rejection As Incomplete.)

Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Erisa refers to the employee retirement income security act of 1974. Or use approved software, if available. Web paper forms for filing.

The Instructions For Line 3A(1), 3A(2), 3A(3) And 3A(4) Have Been Revised To Align With The Language In The Clarified Generally Accepted.

The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, Web form 5500, line 2d. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner).

See The Instructions To The Form.

Completed forms are submitted via the internet to efast2 for processing.