Form 568 Due Date

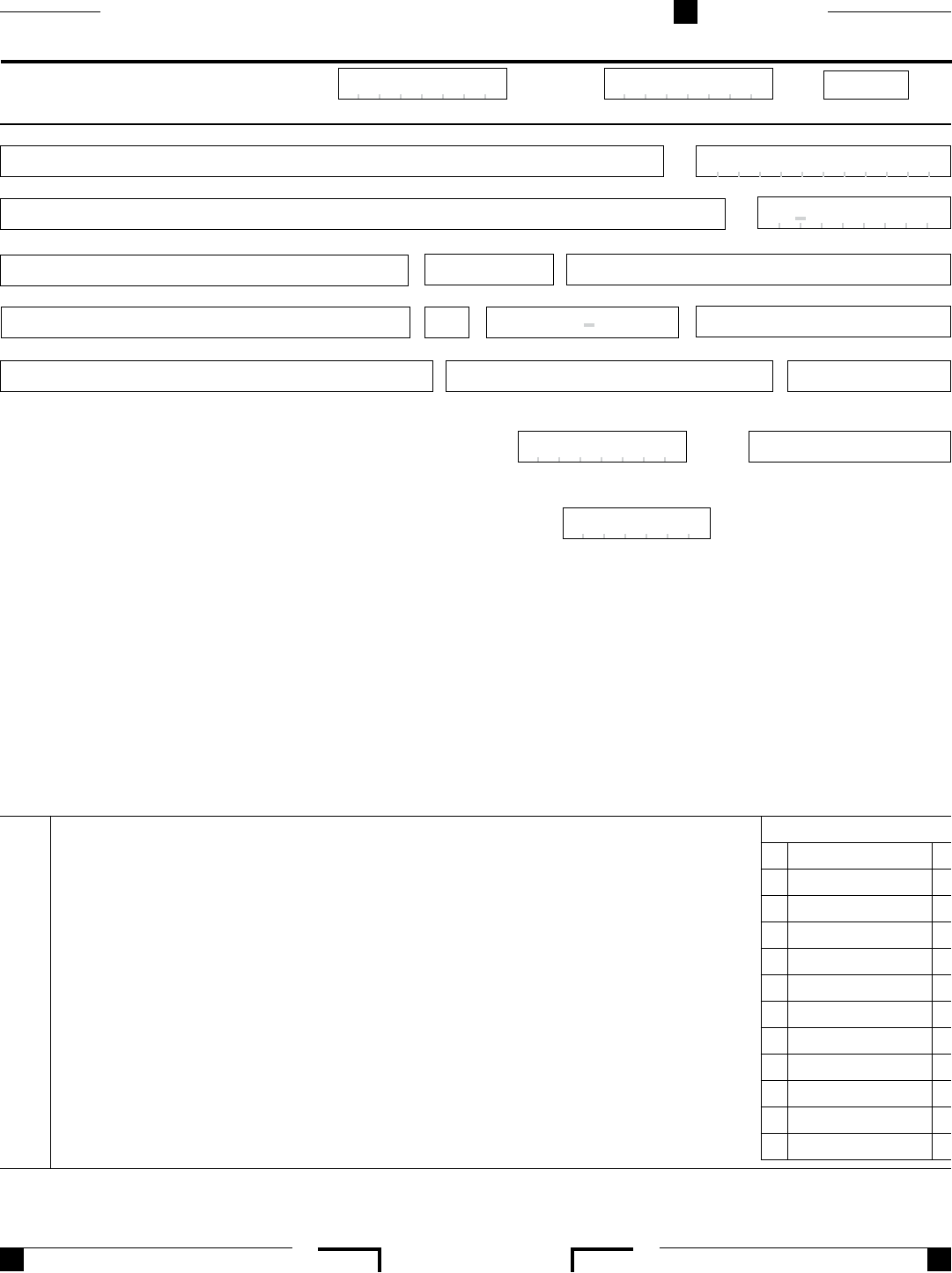

Form 568 Due Date - This form is for income earned in tax year 2022, with tax returns due in april. Web up to $40 cash back sign and date the form, and include your title if applicable. Web what is form 568? Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. All california llcs must file form 568 [ 3 ]. Web form 568 payment due date aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. If your llc files on an extension, refer to payment for automatic extension for. Web when is form 568 due? What is the california llc tax due date?

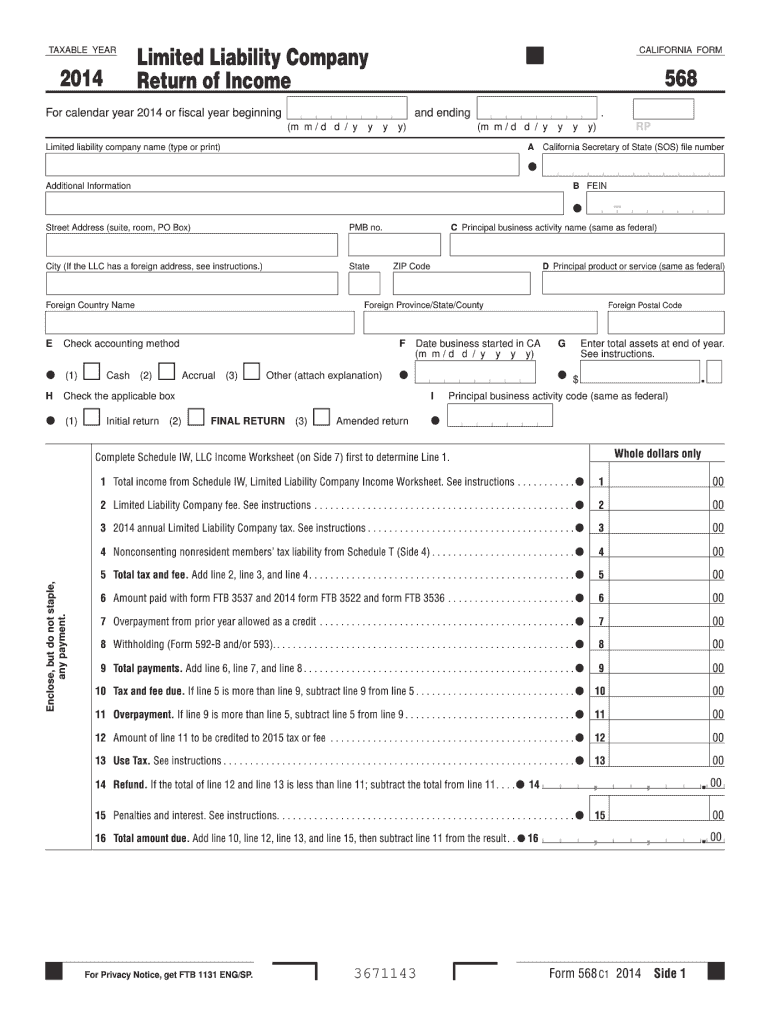

They are subject to the annual tax, llc fee and credit limitations. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. You and your clients should be aware that a disregarded smllc is required to: This form is for income earned in tax year 2022, with tax returns due in april. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. Web form 568 payment due date aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. Web up to $40 cash back sign and date the form, and include your title if applicable. You can then go back into your return and complete your federal and state. Web when is form 568 due? Web form 568 is due on march 31st following the end of the tax year.

Web yes, you will be given the option to print your form 568 to meet the earlier filing date. The california llc tax due date is when llcs in california are required to have their tax returns filed. Web up to $40 cash back sign and date the form, and include your title if applicable. 3537 (llc), payment for automatic extension for llcs. You can then go back into your return and complete your federal and state. Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web when is form 568 due? Web this tax amounts to $800 for every type of entity and is due on april 15 every year. Form 3522 consists of your llc’s franchise tax. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:.

CA Form 568 Due Dates 2022 State And Local Taxes Zrivo

While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. Web you still have to file form 568 if the llc is registered in california. If your llc files on an extension, refer to payment for automatic extension for. What is the california llc tax due date? Registration after.

Instructions For Form 568 Limited Liability Company Return Of

How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. 3537 (llc), payment for automatic extension for llcs. You can then go back into your return and complete.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. When is form 568 due? In california, it currently sits. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Registration after the year begins.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Disaster relief tax extension franchise. You and your clients should be aware that a disregarded smllc is required to: Web form 568 due dates llcs classified as partnerships use form 568, due the 15th day of the 3rd month after the close of the company’s tax year. Web when is form 568 due? Form 3522, or the llc tax voucher,.

Form 568 Limited Liability Company Return of Fill Out and Sign

What is the california llc tax due date? The california llc tax due date is when llcs in california are required to have their tax returns filed. You can find out how much you owe in state income. Disaster relief tax extension franchise. Web what is form 568?

Form 568 Instructions 2022 State And Local Taxes Zrivo

How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. You can then go back into your return and complete your federal and state. Web form 568 due dates llcs classified as partnerships use form 568, due the 15th day of the 3rd month after the close of the.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web up to $40 cash back sign and date the form, and include your title if applicable. In california, it currently sits. Ftb 3522, llc tax voucher. Web what is form 568? What is the california llc tax due date?

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web file limited liability company return of income (form 568) by the original return due date. What is the.

Form 568 Fill Out and Sign Printable PDF Template signNow

Registration after the year begins. You can find out how much you owe in state income. They are subject to the annual tax, llc fee and credit limitations. 3537 (llc), payment for automatic extension for llcs. Web form 568, limited liability company return of income ftb.

Form 568 Instructions 2022 2023 State Tax TaxUni

The california llc tax due date is when llcs in california are required to have their tax returns filed. Web form 568, limited liability company return of income ftb. What is the california llc tax due date? Web you still have to file form 568 if the llc is registered in california. Registration after the year begins.

Web When The Due Date Falls On A Weekend Or Holiday, The Deadline To File And Pay Without Penalty Is Extended To The Next Business Day.

You and your clients should be aware that a disregarded smllc is required to: 3537 (llc), payment for automatic extension for llcs. Form 3522, or the llc tax voucher, needs to be filed to pay the franchise tax. Web form 568 is due on march 31st following the end of the tax year.

Web Yes, You Will Be Given The Option To Print Your Form 568 To Meet The Earlier Filing Date.

In california, it currently sits. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web form 568 payment due date aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. When is form 568 due?

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Ftb 3522, llc tax voucher. Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. The california llc tax due date is when llcs in california are required to have their tax returns filed. You can then go back into your return and complete your federal and state.

While You Can Submit Your State Income Tax Return And Federal Income Tax Return By April 15, You Must Prepare And.

Web what is form 568? How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. If your llc files on an extension, refer to payment for automatic extension for. Web we last updated california form 568 in february 2023 from the california franchise tax board.