Form 593 Instructions 2022

Form 593 Instructions 2022 - Verify form 593 is signed if the seller. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web the organization should submit form 2553: If the organization adheres to. Inputs for ca form 593,. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. 2 months and 15 days past the start of the tax year in which the election is to be effective. The new form is a combination of the prior: Web california real estate withholding. Sign it in a few clicks draw your signature, type it,.

Form 593, real estate withholding. Web amount or see instructions for form 540, line 71. Confirm only california income tax withheld is claimed. First, complete your state return. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: If the organization adheres to. Web the organization should submit form 2553: 593 real estate withholding tax statement report withholding on real estate sales or transfers. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Web on january 1, 2020, our new form 593, real estate withholding statement went live.

Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Form 593, real estate withholding. Verify form 593 is signed if the seller. When you reach take a. Web amount or see instructions for form 540, line 71. Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. If the organization adheres to. Sign it in a few clicks draw your signature, type it,. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms.

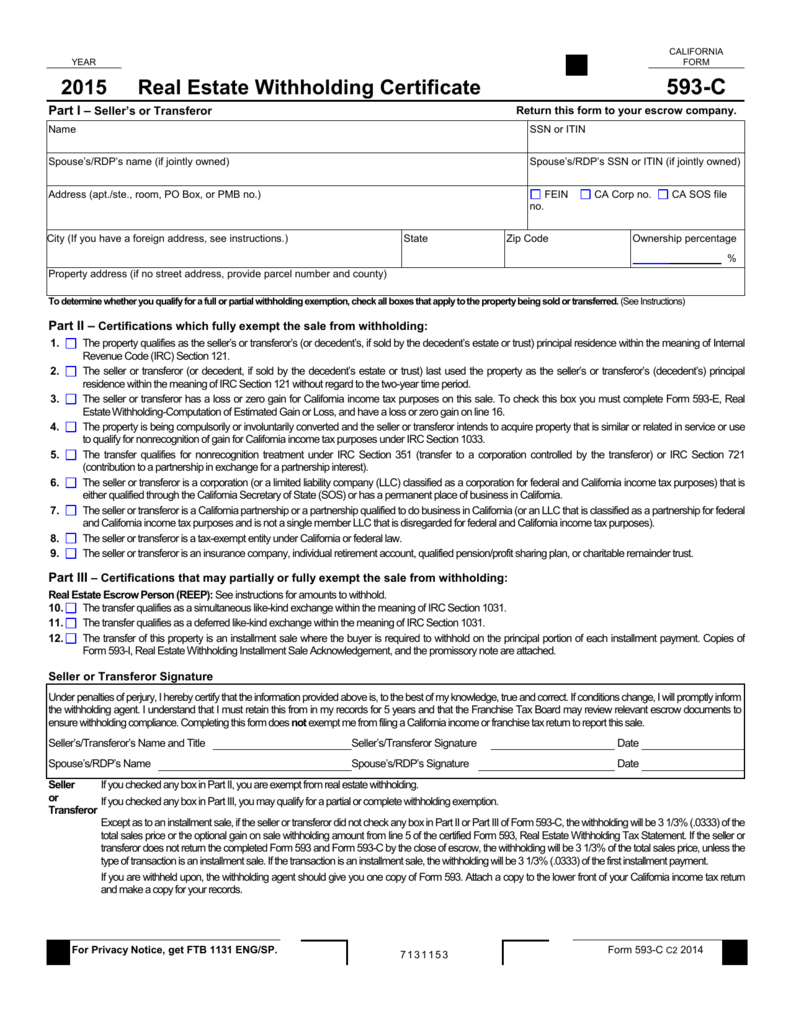

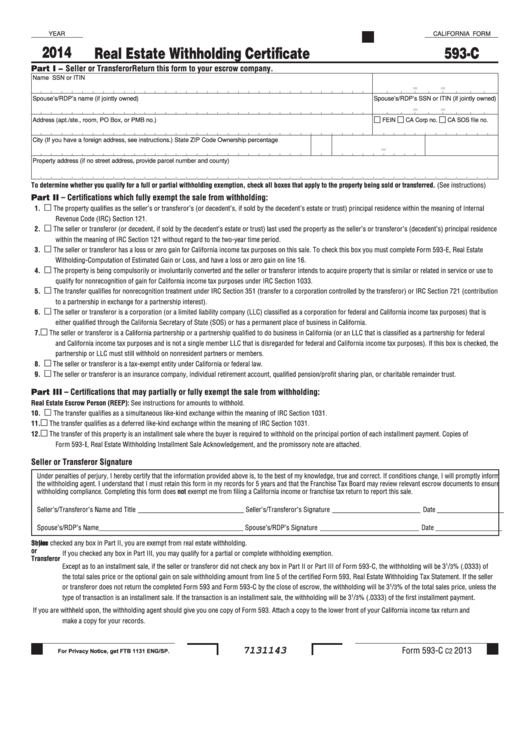

Form 593 C slidesharetrick

First, complete your state return. Web on january 1, 2020, our new form 593, real estate withholding statement went live. Payment voucher for real estate withholding. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web the ftb instructions state that the completed form 593 is to be sent to the.

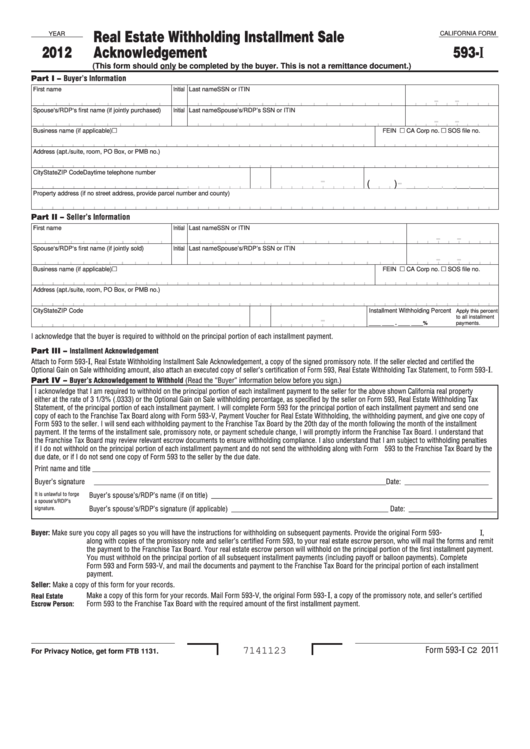

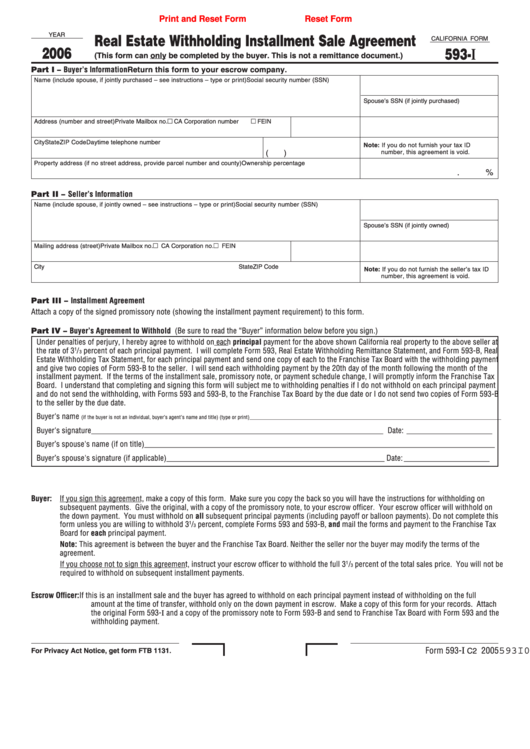

California Form 593I Real Estate Withholding Installment Sale

The new form is a combination of the prior: 2 months and 15 days past the start of the tax year in which the election is to be effective. File your california and federal tax returns online with turbotax in minutes. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web.

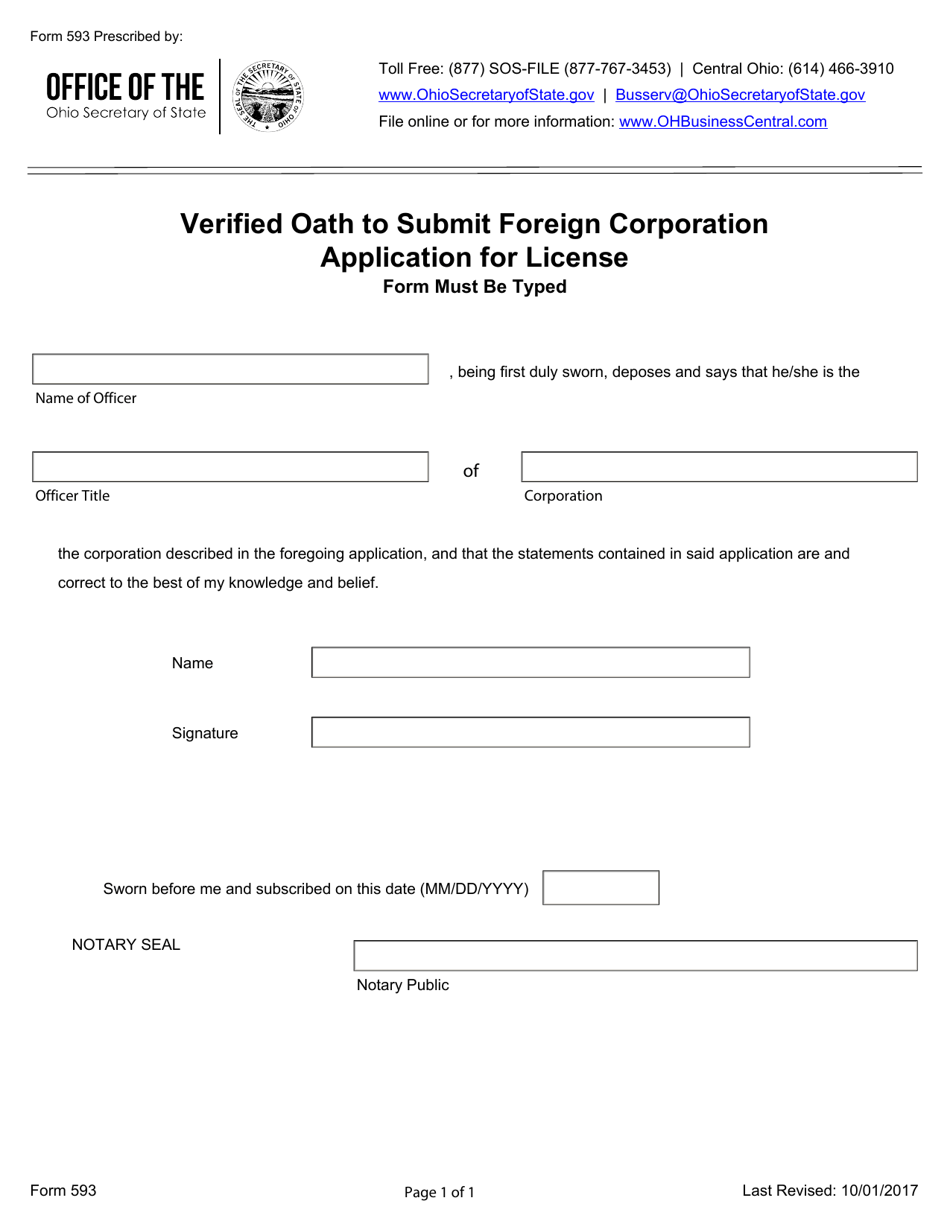

Form 593 Download Fillable PDF or Fill Online Verified Oath to Submit

Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. The new form is a combination of the prior: 593 real estate withholding tax statement report withholding on real estate sales or transfers. 2 months and 15 days past the start of the tax year in which.

Form 593 C 2020 slidesharetrick

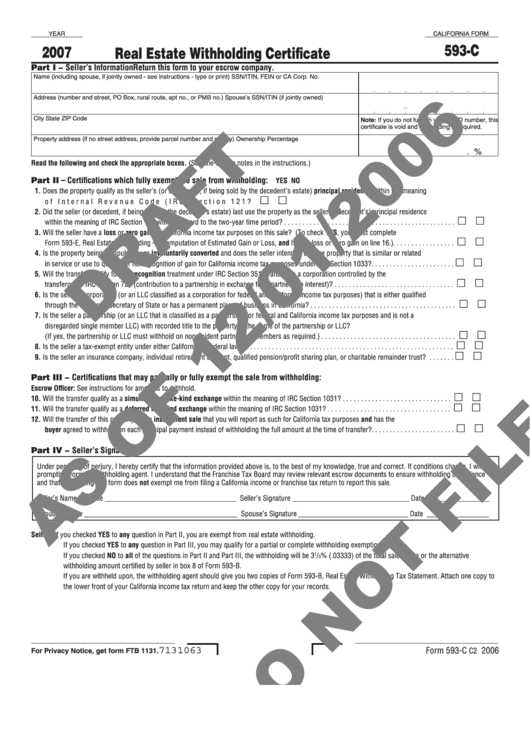

Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Sign it in a few clicks draw your signature, type it,. Web california real estate withholding. Payment voucher for real estate withholding.

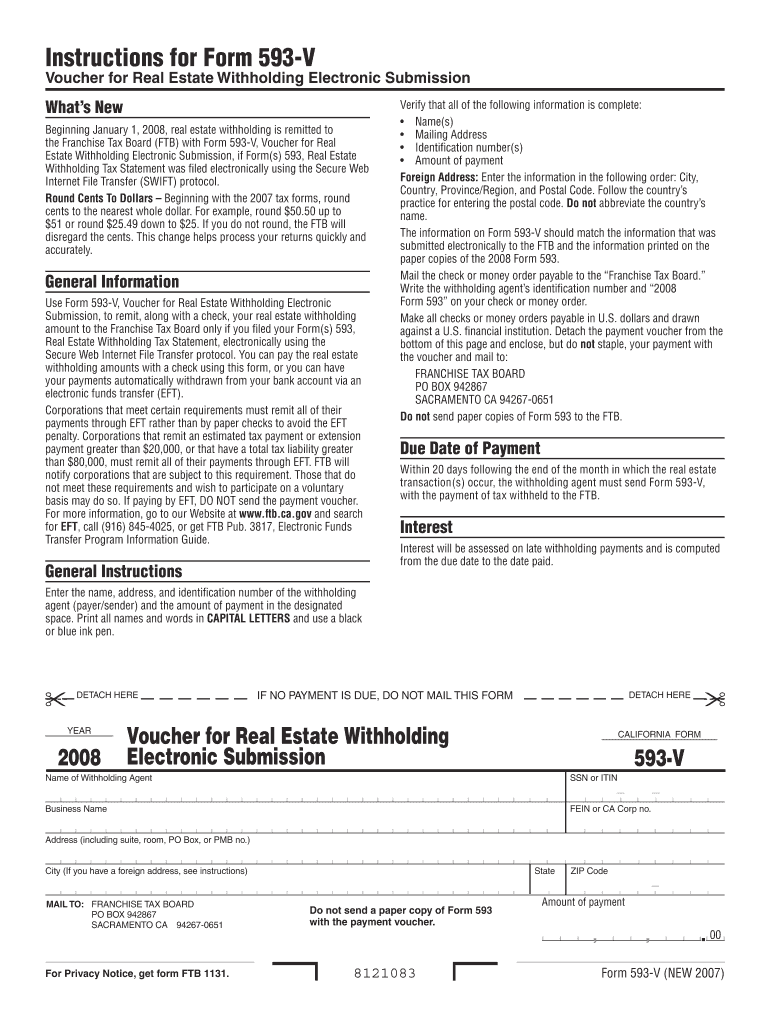

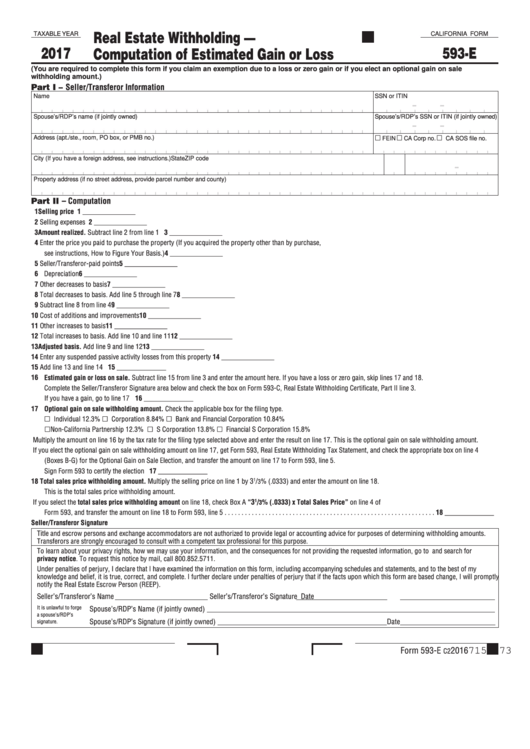

593 V Form California Franchise Tax Board Ft Ca Fill Out and Sign

Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. File your california and federal tax returns online with turbotax in minutes. Web amount or see instructions for form 540, line 71. 593 real estate withholding tax statement report withholding on.

Form 593V Franchise Tax Board Edit, Fill, Sign Online Handypdf

Payment voucher for real estate withholding. 2 months and 15 days past the start of the tax year in which the election is to be effective. File your california and federal tax returns online with turbotax in minutes. See instructions for form 593, part iv. Web for withholding on a sale, the remitter will need the original completed form 593.

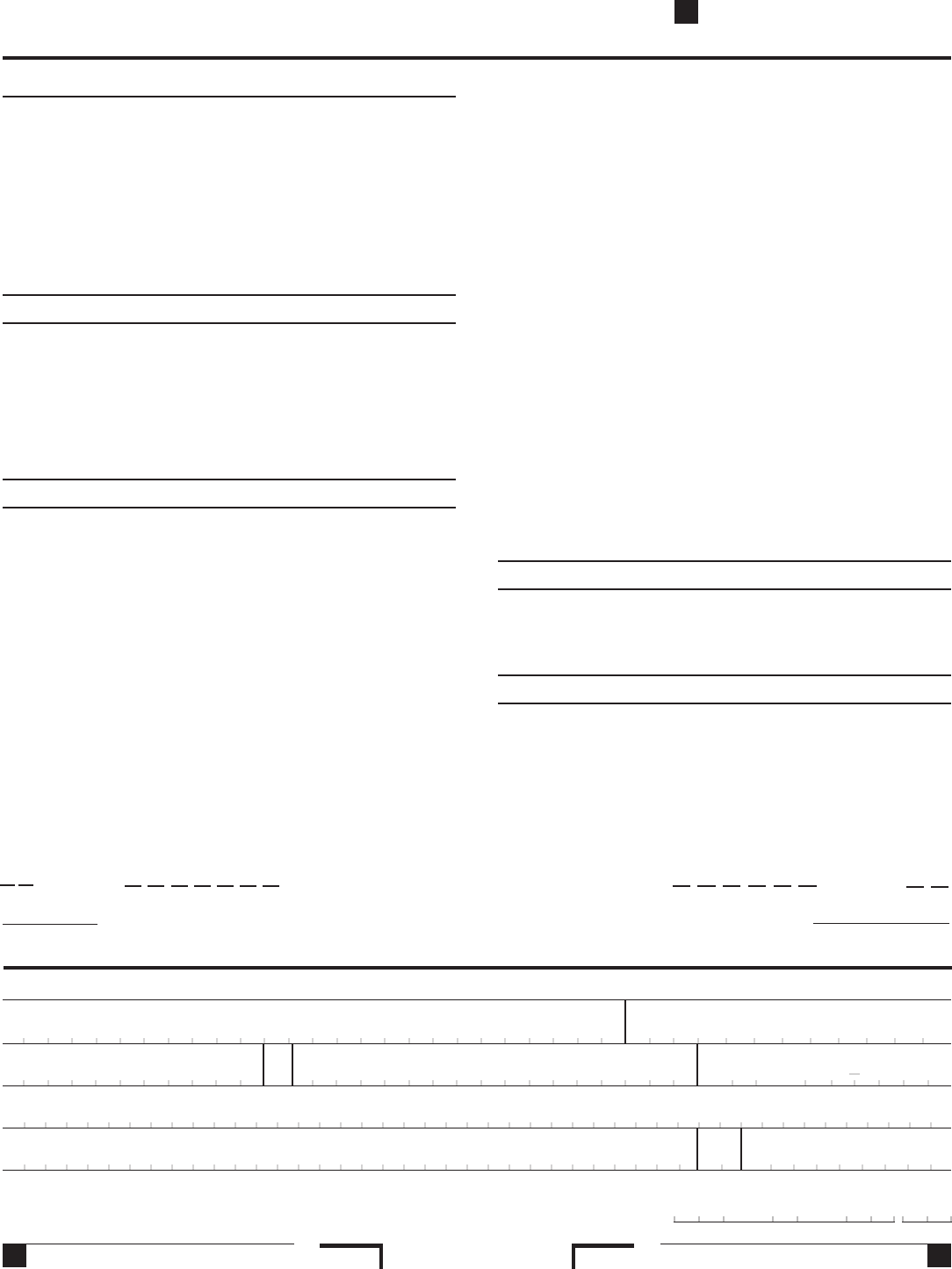

Fillable California Form 593C Real Estate Withholding Certificate

If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Inputs for ca form 593,. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. Confirm only.

California Form 593C Draft Real Estate Withholding Certificate

Web on january 1, 2020, our new form 593, real estate withholding statement went live. See instructions for form 593, part iv. Verify form 593 is signed if the seller. If the organization adheres to. Web california real estate withholding.

Fillable California Form 593E Real Estate Withholding Computation

Verify form 593 is signed if the seller. Payment voucher for real estate withholding. The new form is a combination of the prior: Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Confirm only california income tax withheld.

Fillable Form 593I Real Estate Withholding Installment Sale

File your california and federal tax returns online with turbotax in minutes. Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. Form 593, real estate withholding. • the transfer of this. Web efile your california tax return now efiling is.

If You Are A Seller, Buyer, Real Estate Escrow Person (Reep), Or Qualified Intermediary (Qi), Use This Guide To Help You Complete Form 593,.

Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web the organization should submit form 2553: Web amount or see instructions for form 540, line 71. Payment voucher for real estate withholding.

593 Real Estate Withholding Tax Statement Report Withholding On Real Estate Sales Or Transfers.

Web sellers of california real estate use form 593, real estate withholding statement, to claim an exemption from the real estate withholding requirement. File your california and federal tax returns online with turbotax in minutes. Form 593, real estate withholding. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of.

Inputs For Ca Form 593,.

Purpose use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in. Sign it in a few clicks draw your signature, type it,. See instructions for form 593, part iv. Web $100,000 or less in foreclosure seller is a bank acting as a trustee see form 593, part iii for a complete list of full exemptions, and part iv for full or partial exemptions.

Web This Article Will Assist You With Entering The California Real Estate Withholding Reported On Form 593 To Print On The Individual Return Form 540, Line 73.

Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Edit your calif form593 e online type text, add images, blackout confidential details, add comments, highlights and more. The new form is a combination of the prior: If the organization adheres to.