Form 61A Online Filing

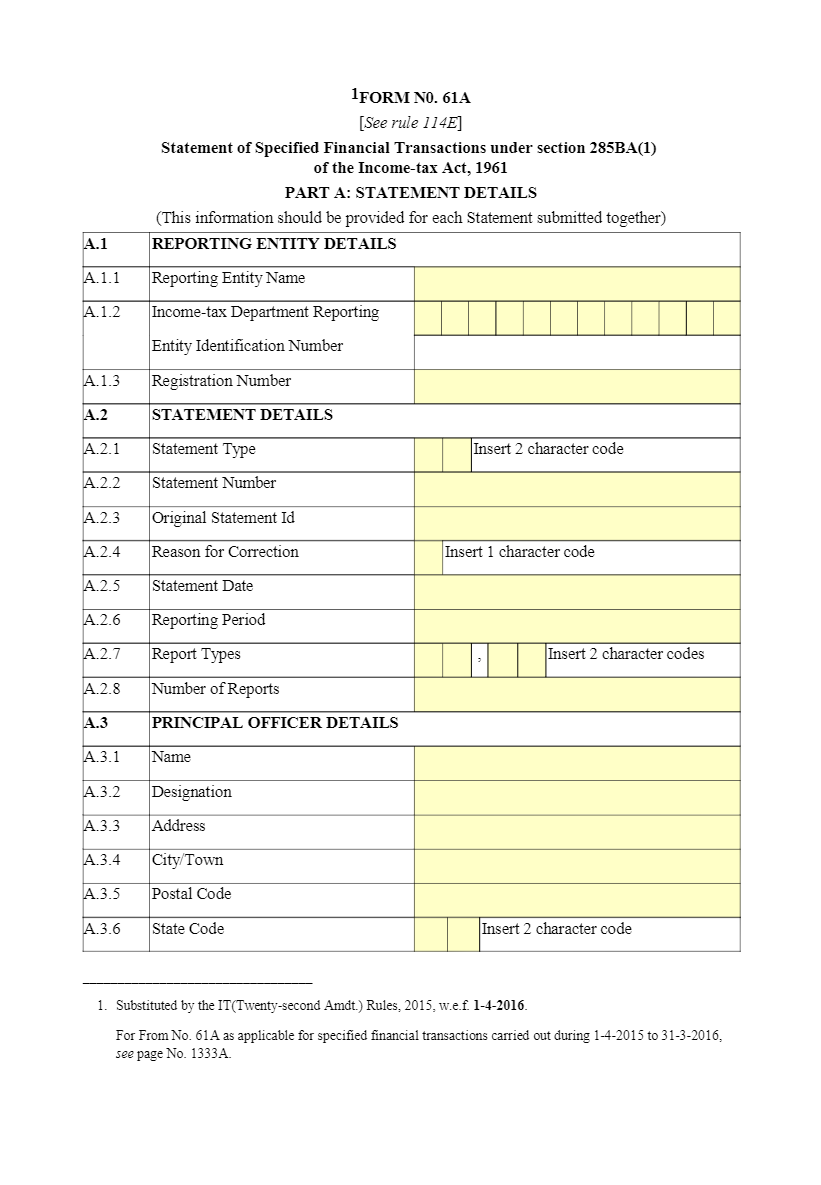

Form 61A Online Filing - Web the statement of financial transactions (online return in form no. Web how to upload form 61a? Web reporting entity or reporting person is an entity which is required to furnish a statement of financial transaction (in form 61 a) or statement of reportable account (in form 61b). Web filing of statement of financial transactions (sft) online step 1: Top 1⁄ 2”, center sides. 17” x 11” fold to. Register on the reporting portal under my account menu. Web the statement of financial transactions (online return in form no. 61a with digital signature) shall be furnished on or before 31st of may, immediately following the. Web what is the use of filing of form 61a?

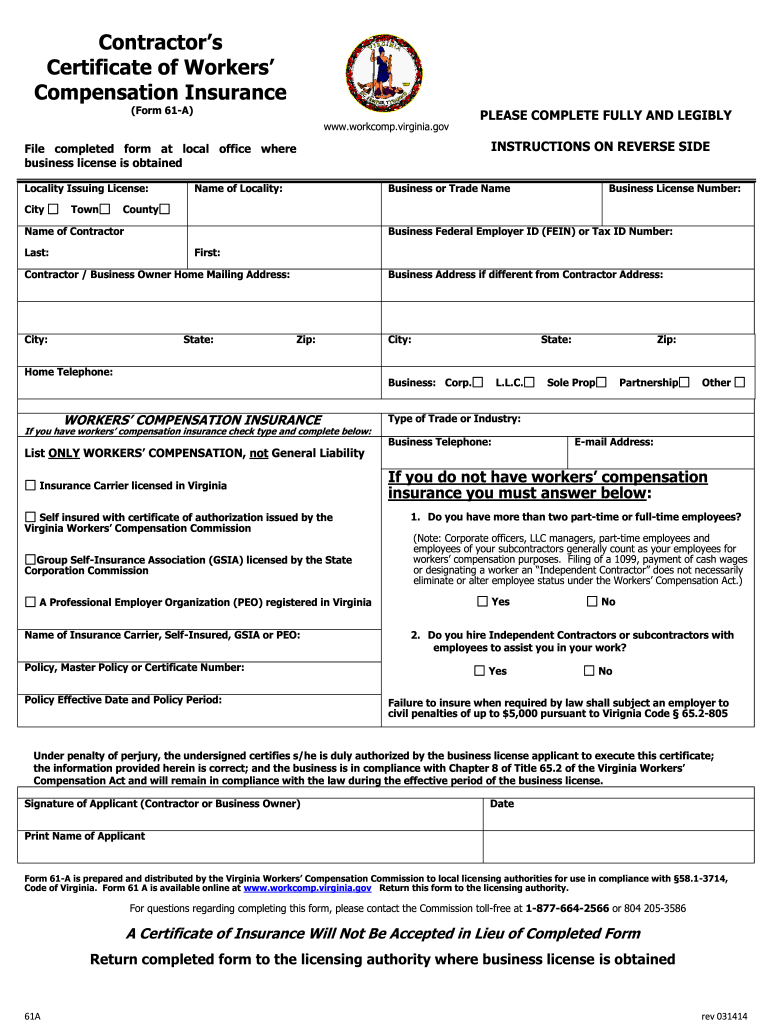

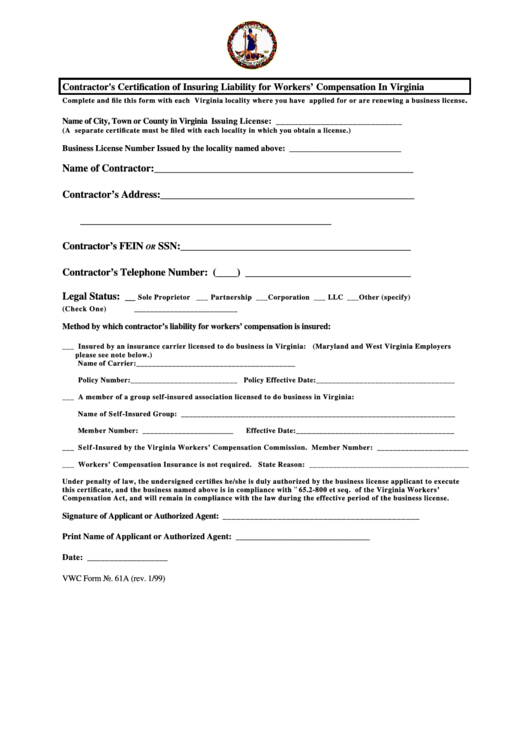

All information requested i s required. What is the due date/ time limit. What are “specified financial transactions” for filing form 61a? Web contractors, in order to secure your business license or renewal, click here to complete the contractor’s certificate of workers’ compensation (form 61a) and receive your. Web the statement of financial transactions (online return in form no. Sign it in a few clicks draw your signature, type it,. 17” x 11” fold to. Web filing of statement of financial transactions (sft) online step 1: Rejection of coverage (form 16a) notice terminating prior rejection of coverage (form 17a) forms; Web what is the use of filing of form 61a?

Top 1⁄ 2”, center sides. Web 18k views 5 years ago. Web filing of statement of financial transactions (sft) online step 1: An heir files this form to report. The completed form assists the commission in following up with uninsured contractors that. Web contractors that do not list insurance coverage are asked to provide a reason. We will reject your form if any of the following are missing: 61a with digital signature) shall be furnished on or before 31st of may, immediately following the. Web reporting entity or reporting person is an entity which is required to furnish a statement of financial transaction (in form 61 a) or statement of reportable account (in form 61b). What are “specified financial transactions” for filing form 61a?

VWC 61A 20142021 Fill and Sign Printable Template Online US Legal

What is the due date/ time limit. Web what is the use of filing of form 61a? Web the statement of financial transactions (online return in form no. Web 18k views 5 years ago. Web how to upload form 61a?

Form 61A Who is to file and under what conditions Legal Raasta

Top 1⁄ 2”, center sides. Different programs may use files with the 61a file extension for different purposes, so unless you are sure which format your 61a file is,. Sign it in a few clicks draw your signature, type it,. Who must file form 61a? Web contractors, in order to secure your business license or renewal, click here to complete.

Vwc Form 61a Contractor'S Certification Of Insuring Liability For

All information requested i s required. Here is the download link. Web for filing of form 61a, pan number is not enough, you will also need to have itdrein (income tax department reporting entity identification number). Sign it in a few clicks draw your signature, type it,. The completed form assists the commission in following up with uninsured contractors that.

Form 61A of Tax Act

Web the statement of financial transactions (online return in form no. All information requested i s required. Web the statement of financial transactions (online return in form no. Web how to open 61a files. 17” x 11” fold to.

Statement of Financial transactions Form 61A filing & Submitting "SFT

Register on the reporting portal under my account menu. Web the statement of financial transactions (online return in form no. Different programs may use files with the 61a file extension for different purposes, so unless you are sure which format your 61a file is,. Edit your va 61a form online type text, add images, blackout confidential details, add comments, highlights.

Everything about Form 61A

Web contractors that do not list insurance coverage are asked to provide a reason. Web filing of statement of financial transactions (sft) online step 1: All statements uploaded to the. Web contractors, in order to secure your business license or renewal, click here to complete the contractor’s certificate of workers’ compensation (form 61a) and receive your. Here is the download.

How to track filing status of Form 61A with TINNSDL? Learn by Quicko

Register on the reporting portal under my account menu. Different programs may use files with the 61a file extension for different purposes, so unless you are sure which format your 61a file is,. We will reject your form if any of the following are missing: What is the due date/ time limit. 61a with digital signature) shall be furnished on.

Form 61A of Tax Act (2023 Guide)

All statements uploaded to the. What is the due date/ time limit. 61a with digital signature) shall be furnished on or before 31st of may, immediately following the. We will reject your form if any of the following are missing: The completed form assists the commission in following up with uninsured contractors that.

Form 61A of the Tax Act, 1961

Web what is the use of filing of form 61a? Web filing of statement of financial transactions (sft) online step 1: Here is the download link. Who must file form 61a? Web contractors, in order to secure your business license or renewal, click here to complete the contractor’s certificate of workers’ compensation (form 61a) and receive your.

Statement of Specified Financial Transactions Form 61 A

Sign it in a few clicks draw your signature, type it,. Web the statement of financial transactions (online return in form no. 17” x 11” fold to. Web contractors, in order to secure your business license or renewal, click here to complete the contractor’s certificate of workers’ compensation (form 61a) and receive your. Web the statement of financial transactions (online.

Who Must File Form 61A?

The south carolina workers' compensation commission offers all of its forms in pdf fillable format, or that they can be printed out and completed manually. Register on the reporting portal under my account menu. All statements uploaded to the. What is the due date/ time limit.

Web Reporting Entity Or Reporting Person Is An Entity Which Is Required To Furnish A Statement Of Financial Transaction (In Form 61 A) Or Statement Of Reportable Account (In Form 61B).

Web 18k views 5 years ago. Rejection of coverage (form 16a) notice terminating prior rejection of coverage (form 17a) forms; Web contractors, in order to secure your business license or renewal, click here to complete the contractor’s certificate of workers’ compensation (form 61a) and receive your. 17” x 11” fold to.

What Are “Specified Financial Transactions” For Filing Form 61A?

An heir files this form to report. Edit your va 61a form online type text, add images, blackout confidential details, add comments, highlights and more. Web filing of statement of financial transactions (sft) online step 1: Here is the download link.

61A With Digital Signature) Shall Be Furnished On Or Before 31St Of May, Immediately Following The.

All information requested i s required. 61a with digital signature) shall be furnished on or before 31st of may, immediately following the. We will reject your form if any of the following are missing: Web for filing of form 61a, pan number is not enough, you will also need to have itdrein (income tax department reporting entity identification number).