Form 7203 Filing Requirements

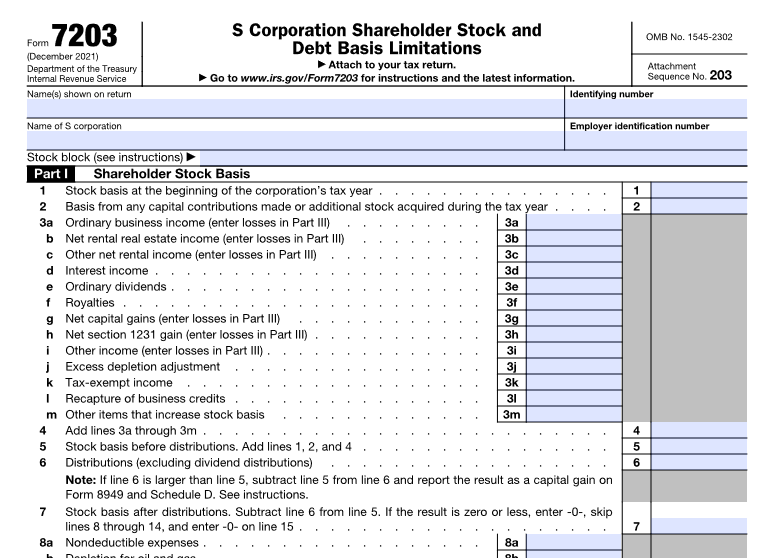

Form 7203 Filing Requirements - December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. · are claiming a deduction for their share of an aggregate loss from an. In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. Web this form is required to be attached to 2021 federal income tax returns of s corporation shareholders who: Department of treasury on september 7, 2021, the difference. Web do not file september 28, 2022 draft as of form 7203 (rev. Shareholder allowable loss and deduction items. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios:

Web who must file form 7203 is filed by s corporation shareholders who: Shareholder allowable loss and deduction items. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Received a distribution received a loan. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. · are claiming a deduction for their share of an aggregate loss from an. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other.

Web who must file form 7203 is filed by s corporation shareholders who: Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Web this form is required to be attached to 2021 federal income tax returns of s corporation shareholders who: Received a distribution received a loan. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web do not file september 28, 2022 draft as of form 7203 (rev. As of publication, form 7203 and its instructions.

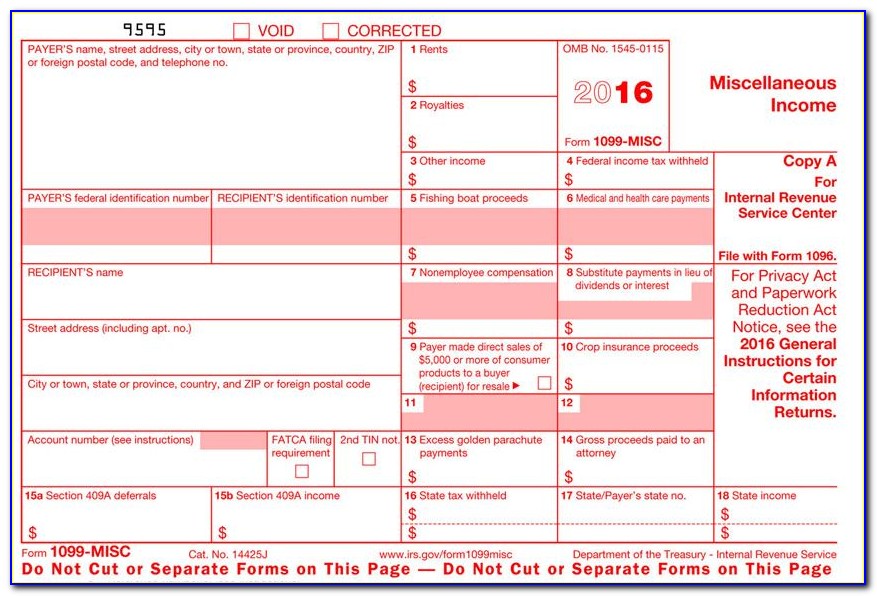

Irs Form 1099 Int Filing Requirements Form Resume Examples o85pxXq5ZJ

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web do not file september 28, 2022 draft as of form 7203 (rev. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. As of publication, form 7203 and its instructions. Web january 19, 2021.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Web who must file form 7203 is filed by s corporation shareholders who: Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203.

Form7203PartI PBMares

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. Department of treasury on september 7, 2021, the difference. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. In response to.

National Association of Tax Professionals Blog

Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. Web form 7203 is required to be attached to the 2021 federal income tax return by s.

Irs Form 1099 Int Filing Requirements Form Resume Examples o85pxXq5ZJ

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. Web who must file form 7203 is filed by s corporation shareholders who: In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain..

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Department of treasury on september 7, 2021, the difference. Are claiming.

How to complete IRS Form 720 for the PatientCentered Research

Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Department of treasury on september 7, 2021, the difference. · are claiming a deduction for their share of an aggregate loss from an. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax..

More Basis Disclosures This Year for S corporation Shareholders Need

As of publication, form 7203 and its instructions. Web who must file form 7203 is filed by s corporation shareholders who: Shareholder allowable loss and deduction items. The final form is expected to be. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Department of treasury on september 7, 2021, the difference. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. Shareholder allowable loss and deduction items. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. · are claiming a deduction for.

IRS Form 7203 Fileable PDF Version

· are claiming a deduction for their share of an aggregate loss from an. Department of treasury on september 7, 2021, the difference. Web do not file september 28, 2022 draft as of form 7203 (rev. Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due.

Web Who Must File Form 7203 Is Filed By S Corporation Shareholders Who:

In response to a renewed irs focus on s corporation shareholder basis issues, the irs has developed a new tax form 7203 that certain. Department of treasury on september 7, 2021, the difference. The final form is expected to be. Shareholder allowable loss and deduction items.

December 2022) S Corporation Shareholder Stock And Debt Basis Limitations Department Of The Treasury.

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other. Web this form is required to be attached to 2021 federal income tax returns of s corporation shareholders who: Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be.

Are Claiming A Deduction For Their Share Of An Aggregate Loss From An S Corporation (Including An.

Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Received a distribution received a loan. · are claiming a deduction for their share of an aggregate loss from an. Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft.

Web You Must Complete And File Form 7203 If You’re An S Corporation Shareholder And You:

Web form 7203 requirements claiming a deduction for their share of an aggregate loss, including one that may have been disallowed last year due to. Web form 7203 is required to be attached to the 2021 federal income tax return by s corporation shareholders who meet any one of the following four scenarios: Web do not file september 28, 2022 draft as of form 7203 (rev. As of publication, form 7203 and its instructions.