Form 740 Ky

Form 740 Ky - Copy of 1040x, if applicable.) check if deceased: Tax return, tax amendment, change of address. Ky file users should familiarize themselves with kentucky forms by reading the instructions. We last updated the kentucky individual income tax return nonresident or. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Download, complete form 740 (residents) or. • moved into or out of kentucky during the. This form can be used to file a: Amended (enclose copy of 1040x, if applicable.) check if deceased: What you should know before you begin:

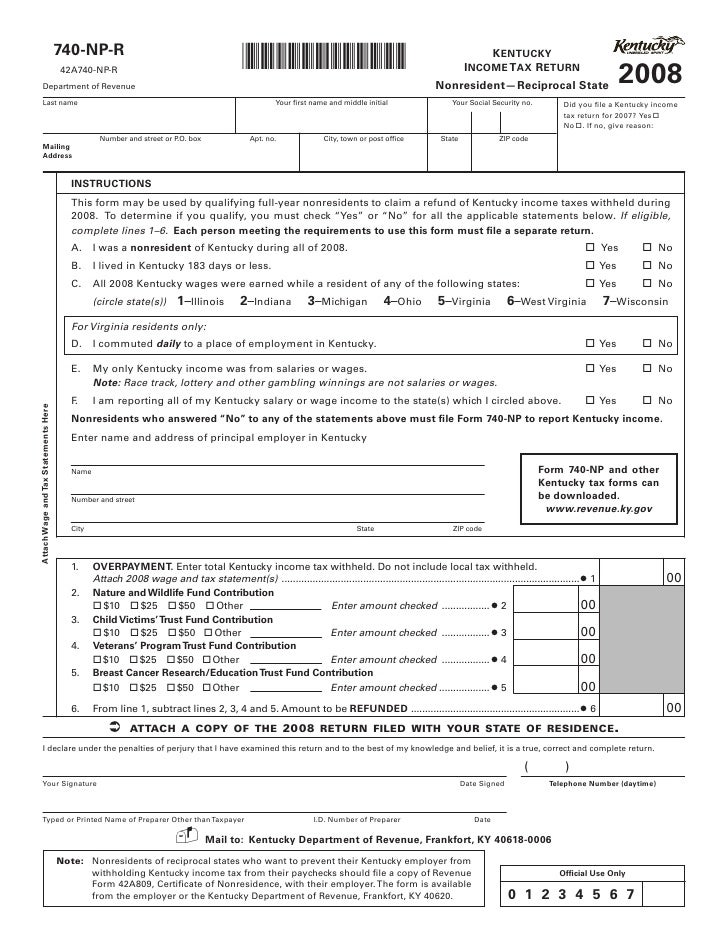

We last updated the kentucky individual income tax return nonresident or. Web form 740 is the kentucky income tax return for use by all taxpayers. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. Amended (enclose copy of 1040x, if applicable.) check if deceased: • moved into or out of kentucky during the. • had income from kentucky sources. Copy of 1040x, if applicable.) check if deceased: Download, complete form 740 (residents) or. Web dividing deductions between spouses use this schedule if married filing separately on a combined return. Commonwealth of kentucky court of justice.

Web commonwealth of kentucky petitioner vs. What you should know before you begin: This form can be used to file a: Web form 740 is the kentucky income tax return for use by all taxpayers. Ky file users should familiarize themselves with kentucky forms by reading the instructions. • moved into or out of kentucky during the. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. We last updated the kentucky individual income tax return nonresident or. Commonwealth of kentucky court of justice. Web 740 2020 commonwealth of kentucky department of revenue form check if applicable:

2013 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

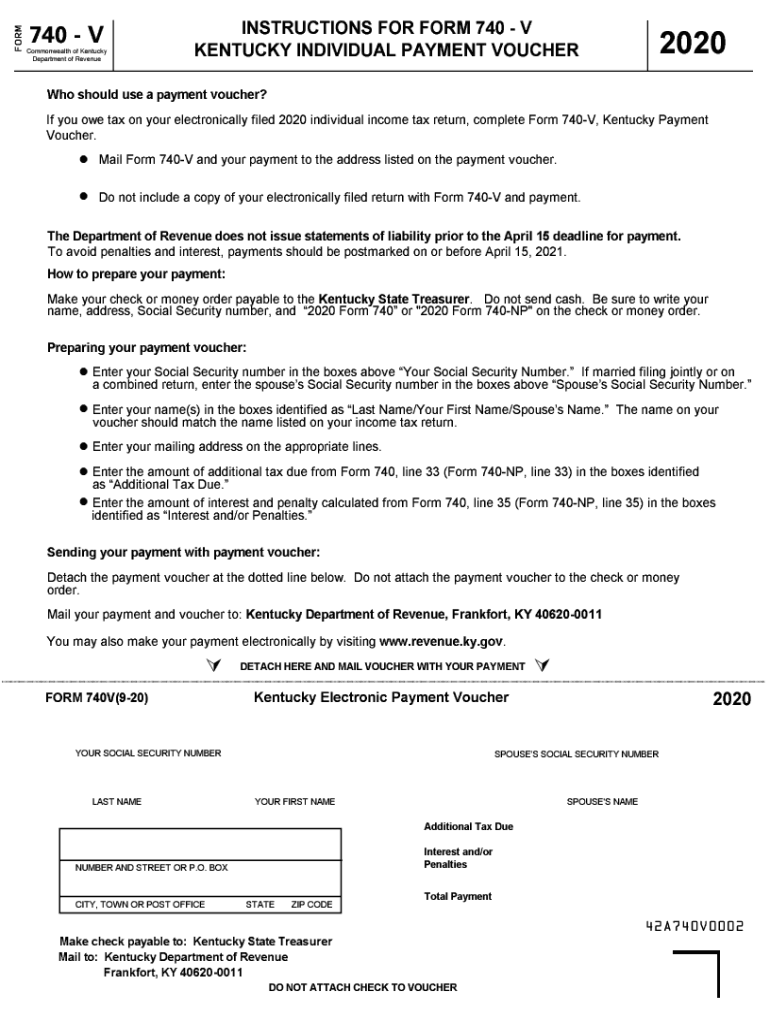

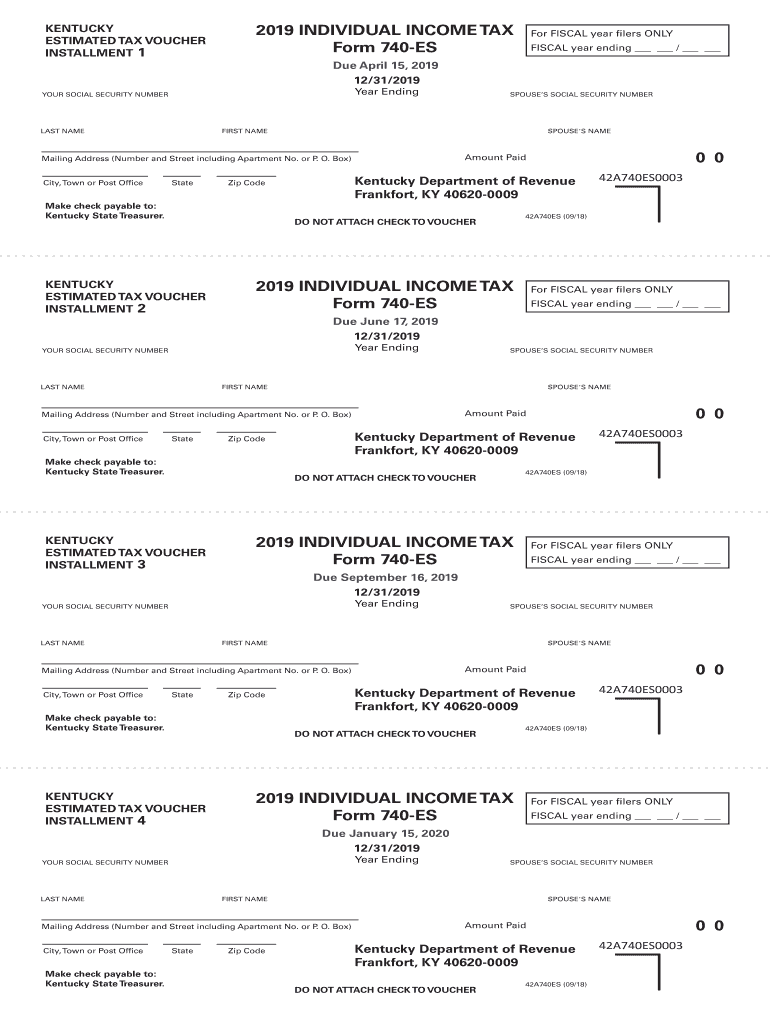

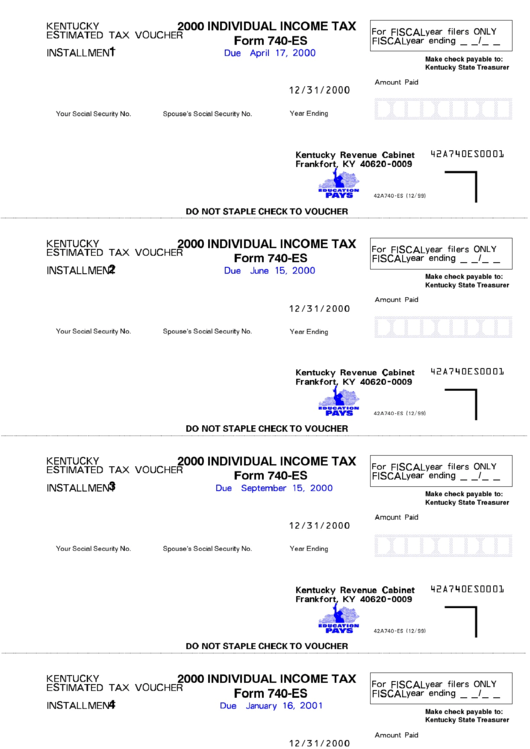

Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Copy of 1040x, if applicable.) check if deceased: Ky file users.

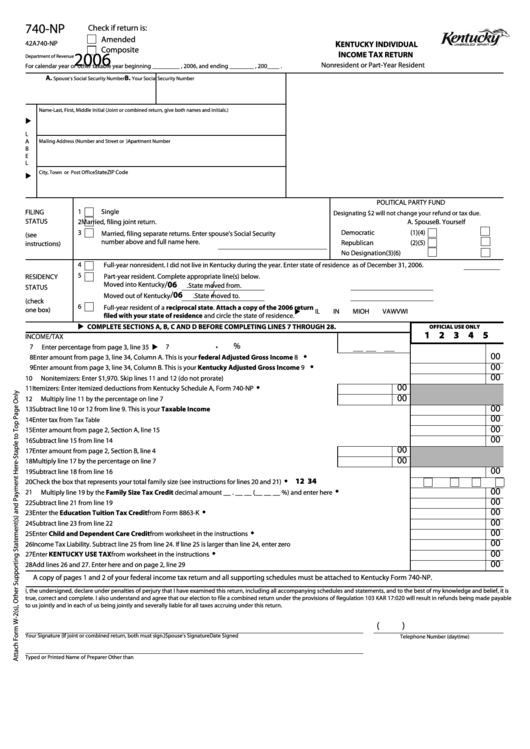

Fillable Form 740Np Kentucky Individual Tax Return

Ky file users should familiarize themselves with kentucky forms by reading the instructions. Web form 740 is the kentucky income tax return for use by all taxpayers. What you should know before you begin: Amended (enclose copy of 1040x, if applicable.) check if deceased: • moved into or out of kentucky during the.

2021 Form KY 740NPR Fill Online, Printable, Fillable, Blank pdfFiller

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web form 740 is the kentucky income tax return for use by all taxpayers. Download, complete form 740 (residents) or. Amended (enclose copy of 1040x,.

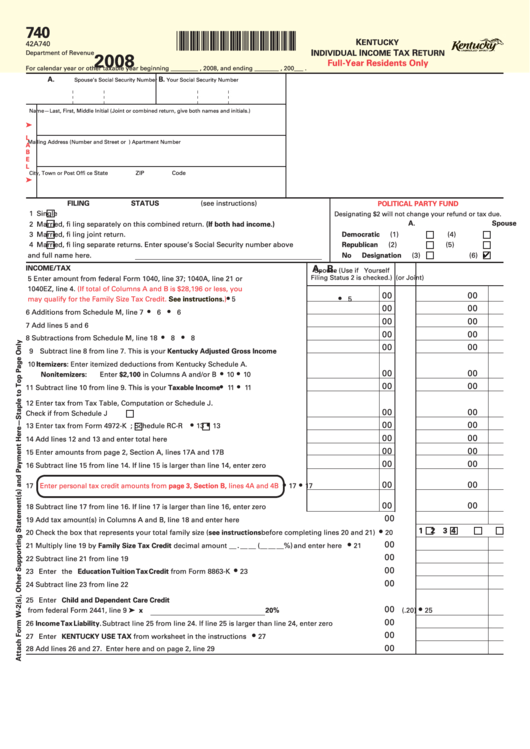

Fillable Form 740 Kentucky Individual Tax Return FullYear

This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Tax return, tax amendment, change of address. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web dividing deductions between spouses use this schedule if married filing separately on a combined return. • had income from.

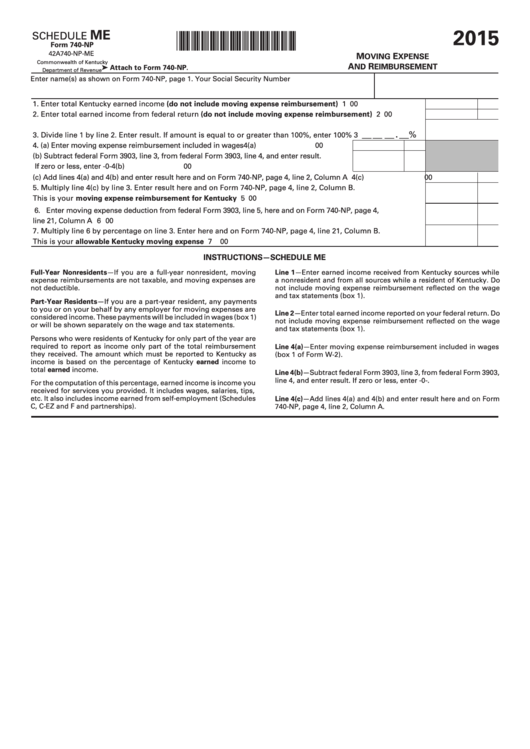

Fillable Schedule Me (Form 740Np) Kentucky Moving Expense And

Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: Download, complete form 740 (residents) or. • moved into or out of kentucky during the. • had income from kentucky sources. We last updated the kentucky individual income tax return nonresident or.

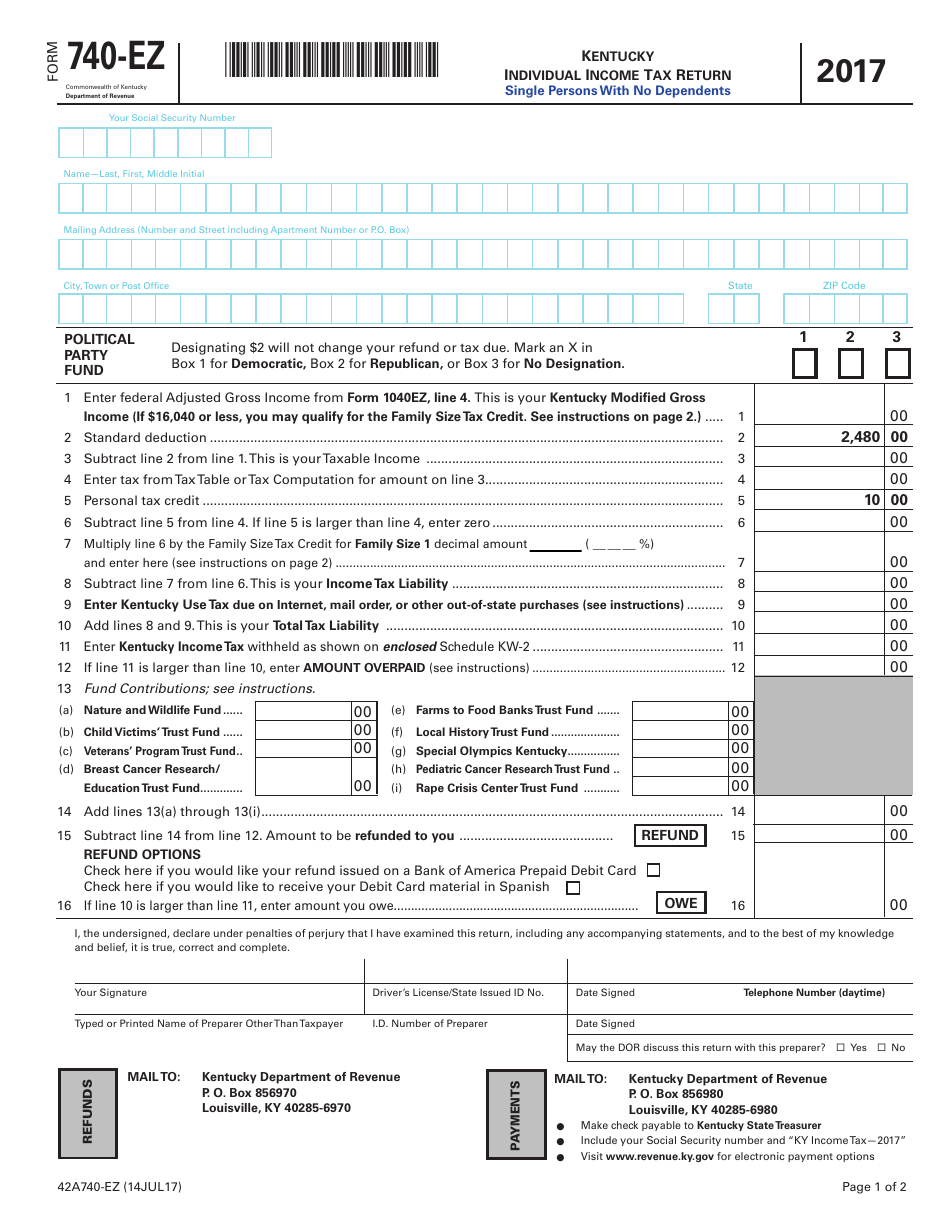

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Download, complete form 740 (residents) or. Copy of 1040x, if applicable.) check if deceased: Web commonwealth of kentucky petitioner vs. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. Commonwealth of kentucky court of justice.

KY 740V 20202022 Fill out Tax Template Online US Legal Forms

Web dividing deductions between spouses use this schedule if married filing separately on a combined return. What you should know before you begin: Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. Payment vouchers are provided to accompany checks.

Kentucky Form 740 Es Fill Out and Sign Printable PDF Template signNow

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Download, complete form 740 (residents) or. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web commonwealth of kentucky petitioner vs.

Form 740Es Individual Tax 2000 printable pdf download

Web commonwealth of kentucky petitioner vs. • moved into or out of kentucky during the. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Copy of 1040x, if applicable.) check if deceased: Amended (enclose copy of 1040x, if applicable.) check if deceased:

Kentucky Unemployment Back Pay Form NEMPLOY

What you should know before you begin: Web dividing deductions between spouses use this schedule if married filing separately on a combined return. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Download, complete form 740 (residents) or. Tax return, tax amendment, change of address.

What You Should Know Before You Begin:

• moved into or out of kentucky during the. Copy of 1040x, if applicable.) check if deceased: Web commonwealth of kentucky petitioner vs. We last updated the kentucky individual income tax return nonresident or.

Commonwealth Of Kentucky Court Of Justice.

This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web dividing deductions between spouses use this schedule if married filing separately on a combined return. Web form 740 is the kentucky income tax return for use by all taxpayers. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who.

Tax Return, Tax Amendment, Change Of Address.

• had income from kentucky sources. This form can be used to file a: Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: Amended (enclose copy of 1040x, if applicable.) check if deceased:

Download, Complete Form 740 (Residents) Or.

Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.